Happy Friday 13th everyone!

I see very few updates on the RNS this morning that are of relevance to usual coverage here, so I thought I'd throw open the comments thread straight away for suggestions. Maybe there are stocks which could have been covered earlier in the week, which you'd like me to catch up on now? Let me know.

Best wishes,

Graham

Provident Financial (LON:PFG)

- Share price: 869p (+10%)

- No. of shares: 148 million

- Market cap: £1,288 million

One of the interesting stories which did come out today was this trading statement from Provident Financial.

Provident is a Yorkshire-based "doorstop lender" which also offers subprime credit cards, subprime vehicle finance, and short-term loans.

The share price crashed in August when it was revealed that changes it made to its sales force had effectively resulted in chaos, with both employees and customers jumping ship as a result.

Today's update has been well-received. I'll quickly summarise what it says:

- Consumer credit division is still heading for an £80 million - £120 million loss before exceptions.

This is the problem division. A former MD has returned to head up this division, the operating model has been fixed to give back some of the flexibility which it had before the changes this, and headcount has been significantly increased again to help customers.

These are the key numbers:

Collections performance in September was 65%, up from 57% in August, whilst sales were approximately £6m per week lower than the prior year compared with £9m during August. Home credit receivables ended September at £316.3m, down 33% from June 2017 (June 2017: £471.7m, September 2016: £489.2m).

As you can see, it's a much smaller business now than it was last year: more than a third smaller!

While losses this year can be taken for granted, the question is whether and how long it might take to return to profitability. I would assume that returning to its former size is impossible in the short-term, but I would expect it to return to core profitability quickly, once the exceptional costs associated with hiring and firing staff, and the recent poor collections experience, are out of the way.

- Satsuma (short-term loans) are up 28% over three months, and more than doubled compared to last year. Expected to produce a small loss this year, but the trajectory is encouraging.

- Vanquis Bank (suprime credit cards) are up 14% in terms of the receivables book year-on-year, which is reasonable to me. An up-and-coming credit card provider.

- Moneybarn (subprime vehicle finance) has receivables up over 25% year-on-year to £362 million.

My opinion

I haven't bought any of this, but I did consider it. Total funding capacity is £236 million which consists of £74 million in cash, £70 million in debt headroom, and £92 million which could potentially arise from the Bank division.

That total amount looks big enough to to cover any further losses, although of course that cannot be guaranteed. The credit rating is BBB- and it's on negative watch from Fitch, so it's on the cusp of falling out of the broad "investment grade" category, and into the "speculative grade" category.

For your reference, this is how Fitch describes the BBB rating:

'BBB' ratings indicate that expectations of default risk are currently low. The capacity for payment of financial commitments is considered adequate, but adverse business or economic conditions are more likely to impair this capacity.

That appears to summarise Provident's position quite well.

There is also an FCA investigation into some of Provident's activities at its Bank (the "repayment option plan" so the possibility of a fine can't be ruled out.

On balance, I'd be inclined to think that the outlook here is better than average, so it's something I'll be keeping an eye on. Recovery situations are always a bit uncomfortable and this is no different. I don't think the CCD is going to as profitable as it once was any time soon.

On the other hand, the other parts of the business are doing fine and the CCD itself will hopefully be back at least at breakeven before long.

I think buying this could make good sense for the patient and the risk-tolerant.

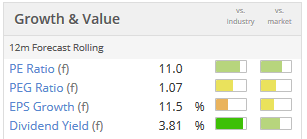

Stockopedia sums up the situation in its own way: Speculative and Contrarian!

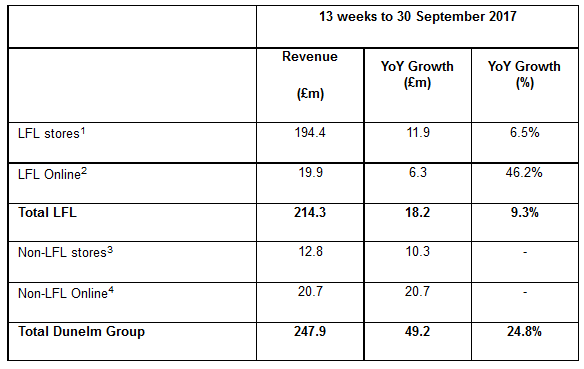

The Quality statistics show that it was quite a good business before the prior management inflicted unnecessary and heavy changes on it:

Dunelm (LON:DNLM)

- Share price: 748.25p (+1%)

- No. of shares: 202 million

- Market cap: £1,509 million

Another big cap, and this one quite heavily requested in the comments.

It's a homeware retailer with 165 superstores across the country, and at least another four due to open by the end of 2017.

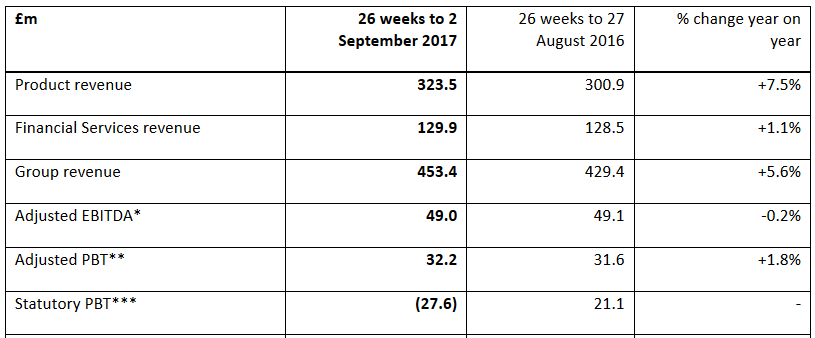

Wednesday's trading update gave us the following stats:

LFL stores are the most important metric for me. It is of course a good thing that LFL Online is growing at such a healthy clip, and if it keeps up then we can give it more emphasis, but for now Online is still relatively small.

Checking the archives, I last covered this share back in January, when it reported LFL Stores declining by 3.1% for H1 2017.

So the context for these Q1 2018 figures is that they are against weak comparatives.

If you're willing to put the question of LFL sales to one side, the overall picture is fine: sales up almost 25% year-on-year.

Gross margin is not too exciting, at 48.9% last year, and is down 220bps in Q1, although the company expects this to recover (if you exclude some lower-margin acquired stores from the calculation).

My opinion

I'm hard-pushed to say that there is anything particularly attractive to me about this share right now.

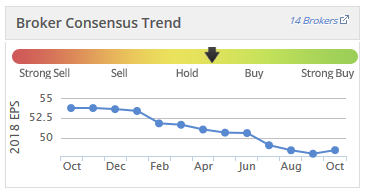

The share price has risen c. 30-35% from its range prior to the earnings forecasts for this year finally stabilising:

For the share price to have risen by such an amount without the earnings outlook increasing so very much, says to me that it is fully up with events now.

Admittedly I might have missed it, but does this company enjoy any sort of competitive moat? Is there anything that makes it stand out from the crowd? Maybe not? Bear in mind that value for money is its primary selling point within a fragmented homeware market.

It's also currently without a CEO, as the previous one stepped down in August and has yet to be replaced

The middling valuation seems more than fair to me!

Flowtech Fluidpower (LON:FLO)

- Share price: 158p (-0.6%)

- No. of shares: 52.2 million

- Market cap: £82 million

Acquisition of Group HES, New Division Established

This is a nice little industrial company which provides spare parts related to hydraulic and pneumatic power production.

I've written cautiously about its acquisition strategy while acknowledging its high StockRank and therefore the statistical likelihood of it outperforming.

Yesterday, Flowtech announced a fairly small acquisition, just a £4 million deal (of which £3 million is to be paid in cash). The target produced EBIT of £0.7 million on sales of £10 million - nothing extraordinary about this valuation.

The potential synergies are obvious. You can see for yourself by browsing the target's website here.

It looks to me as if it was a small, direct competitor. The announcement says that it has "a mix of wider technical applications", and adds aerospace coverage. So it may have a few differences in offering to Flowtech. My impression is that the two companies were probably competing head-on against each other.

The Managing Director will stay on to build a new division within Flowtech. Always positive to hear that kind of news.

We also have a brief trading update:

The Board of Flowtech remain very encouraged about the future and remain confident that the Group's current performance will deliver another year of solid progress. As a business, it is confident in its strategy, commercial opportunities and the prospects of the Group.

My opinion

This particular acquisition sounds good. Although I am strongly biased in favour of organic growth whenever possible, it's a positive step to take out a decent little competitor at a modest valuation. Of course there is an element of execution risk, as always. But it's not a very big transaction so the risks are limited.

I'm warming up to this share. StockRank remains elevated. Valuation remains cheap. Maybe there's not much to worry about after all?

N Brown (LON:BWNG)

- Share price: 347.1p (+5)

- No. of shares: 284.5 million

- Market cap: £987 million

This specialist fashion retailer announced its interims yesterday. It specifically caters to size 20+ and age 45+.

Our Paul has dabbled in these shares, getting a bit nervous over the summer when it was announced there were problems with historic insurance products sold to customers.

Customer redress costs associated with these products have dragged on into H1:

It's a rare instance when I would put significant emphasis on the adjusted number, since the customer redress costs are truly unusual in nature. Though we might also bear in mind that historic profits were inflated by selling these poor-value, third-party products.

The adjusted figures exclude customer redress, store closure costs and unrealised FX movements.

Outlook sounds ok:

"At this early stage in the second half, current trading is on track with our plan and we are focused and well prepared for the peak trading period ahead. We are confident in our ability to deliver sustainable long-term growth and achieve our international ambitions."

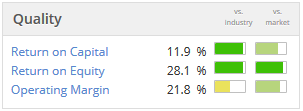

Product revenue growth was up 7.5% in H1, while financial services revenue (lending to customers) grew by just 1.1%. Product margin has suffered due to the Sterling devaluation, while Financial Services margin has improved thanks to "continued improvement in the quality of the loan book".

Future plans are based on growing UK market share, expanding in the US and other markets, and selling through other retailers' websites.

It provides clear updates to FY18 guidance, which is so helpful. Though when you deal with larger companies such as this, they tend to be a lot more forthcoming compared to small-caps!

Credit: Some readers were wondering about my wider thoughts on consumer credit. As a holder of H & T (LON:HAT), it's a category which I'm personally exposed to.

My approach is to think very carefully about the type of credit which I'm buying into. Some of the key factors for me are: 1) how is the credit being used? 2) what is the collateral, if any? 3) does management have credibility in financial risk management?

So for example, credit extended by H & T (LON:HAT) might potentially be used to pay rents or other necessary bills. That type of credit is unlikely to move the same way in a recession as the credit extended by N Brown (LON:BWNG), where the credit is being used to buy fashion items. The more discretionary the spend, the more vulnerable it is to retrenchment.

My opinion: I don't see any red flags in terms of how N Brown is managing its loan book. The main risk is that profits would reduce if customers were able to lower their rate of time preference and avoid borrowing so frequently, or if a recession forced them to do that. It's important to note that lending ("Financial Services") is responsible for £130 million out of the entire H1 Group revenue of £453 million.

Taking a look at the quality statistics, the size of the loan book, and the £300 million net debt outstanding, it strikes me that overall returns are actually quite poor.

I don't normally advocate for more debt but the customer loan book is £550 million, almost twice as large as the debt outstanding.

If it's possible to borrow more, I think perhaps they should be strongly considering it. That could give a big boost to return on assets (especially return on intangible assets) and allow the payment of a special dividend. As things stand, the returns aren't quite exciting enough for me.

.

I finally made it to the end!

Have a great weekend and see you next time.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.