Good morning!

Final call for Mello London & Masterclass

This is the last SCVR before Mello London, so it's my last chance to remind you of the Stockopedia discount code MLStocko25. This gets you £25 off, for one or both days.

I've also been informed that there is a Black Friday sale for the ShareSoc Masterclass event. Full members of ShareSoc can buy tickets until midnight tonight for £24.50. Non-ShareSoc members can book for £44.50 until midnight.

Three directors or CEOs from my portfolio holdings will be at Mello: Jonathan Lander of Volvere (LON:VLE), Scott Maybury of PCF (LON:PCF) and Charlie Cannon-Brookes of Duke Royalty (LON:DUKE) (you may have noticed a pattern - I like my financial stocks).

Others I would be interested in are Impax Asset Management (LON:IPX), National Milk Records (OFEX:NMRP), Bioventix (LON:BVXP), etc. The problem of having too many good choices!

One or two of you may have been looking forward to getting revenge on me for my bad beats and suckouts against you during the poker tournament at Mello Derby ealier this year.

Unfortunately, I'm going to have to skip the poker on this occasion, seeing as I'm scheduled to be on stage three times the following day, including first thing in the morning. My brain needs a rest sometimes! May the luckiest person win.

Today I intend to look at:

- Record (LON:REC)

- Caffyns (LON:CFYN)

- Fuller Smith & Turner (LON:FSTA)

- Gateley Holdings (LON:GTLY)

Record (LON:REC)

- Share price: 31p (+2.5%)

- No. of shares: 199 million

- Market cap: £62 million

(Please note that I currently hold REC shares.)

This is an investment I got into around the start of 2018. It hasn't worked out so far, as Record's currency hedging products have failed to achieve any momentum over this period.

I hold the stock for a couple of reasons - I trust that management are well-aligned and are competent, it has a super balance sheet, and it is good at converting profits to cash.

While I'm not an income investor by any means, the yield is also quite interesting, e.g. it has an 8% forecast yield, according to Stockopedia.

Today we get confirmation that the interim dividend is unchanged at 1.15p. This is more than adequately covered by H1 EPS of 1.63p.

Directors are very heavy shareholders, so the dividend works as a management bonus, too. There's also a bonus scheme allocating 30% of operating profit to staff.

If the full-year dividend turned out to be 2.3p, the yield would be 7.4% against the current share price.

There have been special dividends for two years running. So a full-year dividend of 2.3p is the minimum that I'm hoping for.

The Business

The main reason I don't own a bigger position in this (it's only about 3% of my portfolio) is that growth has been non-existent for a while. That's the magical extra ingredient which would make this a really attractive share.

In USD, Record's assets under management equivalent (AUME) declined marginally from $62.2 billion to $61.8 billion during H1. The important factor in that movement is client flows, and they were neutral over the six months. The best word I can come up with to describe the demand for Record's products is lukewarm!

Post period-end, Record lost seven clients from two currency hedging mandates. After that loss, it has c. 60 clients left. It's important to be aware of this customer concentration risk.

Results

Despite the lack of positive energy, financial results remain decent for now. Revenue is up 3% to £12.6 million, and PBT is up 5% to £4 million. Record has switched some clients from fixed management fees to lower management fees plus a performance element. So revenues could be more volatile in future.

The P/E ratio is c. 11.5x for the current year, increasing to 13.5x if results deterioriate according to the consensus forecasts.

The downside is protected by balance sheet equity of £26.4 million, virtually all of it tangible and nearly all of it liquid or near-cash. That's over 40% of the market cap!

The Products

What really matters is for the company to achieve some fresh traction with its currency hedging products.

Passive hedging is increasingly competitive and this strategy accounts for the 84% of Record's AUME. Dynamic hedging and "currency for return" pay much higher fees.

Record needs to find new, innovative ways to help customers. CEO comment:

"As financial markets and client demands evolve, opportunities continue to arise for new and enhanced services. We are working hard alongside our clients to meet such demand.

"Competition and fee pressure in Passive Hedging in particular continue to put pressure on operating margins. Our approach of investing in innovative solutions to meet client demand requires ongoing investment both in systems and people.

My view

This is a low-conviction holding for now. Good points are:

- balance sheet protection

- very heavy dividends

- competent, aligned management

Negative points are:

- margins under some competitive pressure

- customer concentration risk

- needs to innovate now to thrive in the years ahead

I hope it succeeds and I'm happy to give it more time. But I won't be adding any more to my portfolio until there is some evidence that its efforts are succeeding.

Caffyns (LON:CFYN)

- Share price: 405p (unchanged)

- No. of shares: 2.9 million*

- Market cap: £12 million

The share count for this motor dealership is a bit misleading as it has several classes of preference shares, including 2 million preference shares with voting rights. This ensures family control is maintained.

Paul said earlier this year that he wouldn't get back into this share again, as it's too illiquid.

Margins are small, as you expect for a car dealer. The underlying PBT margin is 1.1% of revenues. That's an improvement from the 0.7% underlying PBT margin recorded in the same period a year ago!

Aftersales revenues jumped 9%. These are higher-margin, and so the improved sales mix has boosted profitability. The CEO reports that used cars are also doing very well. So it's a good H1, despite a modest reduction in total revenue.

£350k in property impairment is excluded from the "underlying" result - that seems perfectly fine to me.

There is lots of detail given re: various car brands and the Caffyns property portfolio. The overall tone is positive.

Other key points:

- Pension deficit is £5.7 million, or £6.9 million pre-tax. Cash payments of c. £500k due into it each year.

- Net debt reduces a little over the six-month period, to £12.2 million. Has increased versus 12 months ago due to capex at a site in Worthing.

- Dividend unchanged. Yield is 5.6% per Stockopedia.

Outlook

...the current industry consensus for the 2018 calendar year is for no more than a single-digit fall in the UK new car market, so we are cautiously optimistic about the outlook.

However, our full year outcome will remain dependent on the success of the next bi-annual registration plate change in March 2019 as well as on the wider challenges to the UK economy from uncertainty surrounding the finalisation of the Brexit process.

My view

Superficially cheap with tangible net assets of £29 million and annual earnings of c. £1 million.

But I agree with the Stocko rating, i.e. it's a Value Trap.

The algorithms also say that it's "conservative" - I agree with that, too!

I expect that the family are conservative in how they run it, even if they have taken on an above-average level of debt.

The problem is that return on capital is so low (4.5%) and there seems little prospect of an activist shaking things up. A managed disposal could potentially return something close to book value to shareholders, but it's out of the question given that the shares are so closely held.

So I don't see a lot to go for here, aside from a reasonable dividend yield.

Gateley Holdings (LON:GTLY)

- Share price: 150p (+1%)

- No. of shares: 111 million

- Market cap: £167 million

Gateley (AIM:GTLY), the law led professional services group, is pleased to announce a trading update ahead of the release of its half year results for the six months ended 31 October 2018.

Please refer to my previous remarks on Gateley which explain my scepticism toward law firms as an investment opportunity (and professional services in general).

H1 revenue is up 20%, half of the increase being attributable to acquisitions.

Full-year revenue should be at least £102 million with an unchanged EBITDA margin.

Last year, adjusted EBITDA margin was 19.2% so that implies adjusted EBITDA this year of £19.5 million.

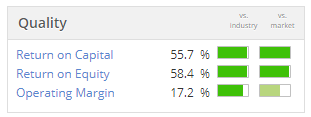

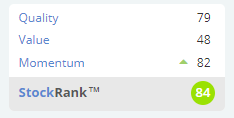

The StockRank is terrific at 85 but I think the shares should be cheap, given that it's a law firm, and the recorded quality metrics could easily deteriorate. How can it have a sustainable competitive advantage providing legal advice?

Fuller Smith & Turner (LON:FSTA)

- Share price: 917p (-2%)

- No. of shares: 55 million

- Market cap: £504 million

Key points:

- Revenues up 6%, including like-for-like sales up 4.1% from managed pubs and hotels.

- Adjusted PBT down 1% to £23.6 million, which it says is due to front-loaded capex spend (I'm not satisfied by this explanation, since capex spending doesn't appear on the income statement).

- Interim dividend up 3%.

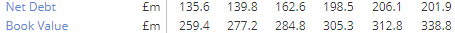

- Net debt increases to £223 million, net debt/EBITDA ratio increases to 3.1x.

My view

A good brewer and pub operator with an amazing track record of paying dividends over the last 25 years. If I had to invest in something from this sector, I'd probably choose this one.

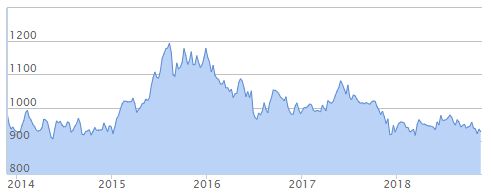

The share price has been in a range for the past five years.

During this time, its book value of equity has increased significantly but so has its debt load.

From 2013-2018:

Overall, it seems to be doing well.

Stocko likes it:

In line with the Value Rank, I suspect that it is around fair value at the current level.

That's it from me. Paul will be writing the next one from Mello.

Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.