Good morning!

I hope everyone is ok out there.

As I type, FTSE futures are changing hands at 6550.

It has been an extraordinary week in the stock market.

In the immortal words of Clive Dunn, "Don't panic!"

In today's article I'll be taking a look at the newswire, as usual, and talking a little about what's going on more generally.

Some small-cap announcements today:

- Foxtons (LON:FOXT)

- Novacyt SA (LON:NCYT)

- Avation (LON:AVAP)

- Vitec (LON:VTC)

Rightmove (LON:RMV) has published results, too. I have a long position in that one, and it's relevant to OTMP, so I might say a few words on it.

Finished at 13:30. Got as far as VTC.

Carnage

I should address the fact that the FTSE is down by 800 points, or over 11%, in the space of five trading sessions.

What I've been doing - very little!

As long-time readers will know, I don't trade very often. I can go many months without buying anything new, or selling anything.

It is true that since December, I disposed of around 1/4 of my entire portfolio, to help fund a house purchase. Yesterday, I got rid of my tiny stake in Property Franchise (LON:TPFG), to help fund this purchase.

The rest of the sales took place in mid-January, long before the panic over the coronavirus.

So my share portfolio has not been reacting to this news.

If I had been more clever, I would also have sold my entire stake in Burberry (LON:BRBY) last month, when it was trading at £23 (now £16). But selling and buying back cheaper is not a game that I play.

The total returns for my largest holdings so far in 2020 are:

- Volvere (LON:VLE) (+6% YTD) (21% of portfolio)

This is a cash-rich, counter-cyclical holding which would benefit from a recession. It's been holding up as I hoped it would in these circumstances.

- Burberry (LON:BRBY) (minus 27% YTD) (12% of portfolio)

Burberry has heavy exposure to China and Chinese tourists around the world. If I had more cash lying around, I'd consider topping up on this at a PER of 18x (granted that major earnings downgrades are likely for the current year).

- H & T (LON:HAT) (minus 2% YTD) (12% of portfolio)

This issued a positive, "top-of-the-range" trading update at the end of last month, but has now given back those gains. With the gold price currently very strong and the stock sitting at possibly 7x earnings, it looks too cheap to me.

- Berkshire Hathaway ($BRK.B) (minus 8% YTD) (11% of portfolio)

Jack covered Warren Buffett's annual shareholder letter here. Like Volvere, Berkshire is cash-rich and would benefit from the buying opportunities which a market crash would present.

- IG Group (LON:IGG) (minus 4.5% YTD) (9% of portfolio)

The market volatility will throw up plenty of trading opportunities for IG's customers. Again there is an element of counter-cyclicality, since customer activity is tied to volatility rather than the economy (and volatility is especially pronounced in bear markets!).

Even if you aren't interested in my individual holdings, hopefully this helps you to see that I am not actually very worried about their share prices. I'm more worried about whether they are going to be reasonably successful companies over the long-term. I don't think that the Coronavirus changes this, even if it causes a lot of disruption in the short-term.

Buffett gave us a nice quote about this:

In investing, just as in baseball, to put runs on the scoreboard one must watch the playing field, not the scoreboard.

In other words, it's what your companies are doing that counts, not their share price. If they are doing well on the pitch, then the scoreboard will follow.

Market dislocations such as we are currently experiencing do bring harm to investors, in the following two major ways:

1. Forced sellers

Those who have used leverage are particularly vulnerable in times such as this.

If the leverage is long-term and can't be called in by the lender (e.g. mortgage debt), then leveraged investors have a better chance of survival.

If the leverage is in some form of a margin loan, then market volatility can quickly wipe out accounts, unless bets have been sized appropriately.

I actually consider this to be a cardinal sin, when it comes to investing. It might be the worst mistake that an investor can make.

What's so disastrous about it is that the losses it brings are permanent. They can't be recovered, except through starting again and investing with fresh money.

Forced sales are to be avoided at all costs, in my view.

2. Excessive trading

This is a less serious problem than forced selling, and you may disagree with me on this point. But I do consider excessive trading to be a real problem for investors, and a drag on returns.

There are some examples of investors who timed the market spectacularly well, and whose trading served them. I think Leon Boros falls into this category: selling out of the stock market before the 2008 crash.

But for every Leon Boros who sells out in advance of a market crash, I think there are far more people who sell out, and then miss the subsequent recovery.

Beating the market is very hard, and I think that beating it is even harder if you're not participating in it sometimes, and if your transaction fees are multiplying thanks to huge trading activity.

Of course this isn't advice. This is just a point of view.

"I couldn't resist"

One trade which the recent market movements did trigger me into making was a long position in the FTSE Index, using a put option.

I did this on Monday, when the FTSE was at 7180. I had good data for all my FTSE trading activity from last year, and the pricing on Monday was back around the levels which I traded before several times, and made money from each time.

So far, this trade hasn't done anything for me yet (this is an understatement). The FTSE is at 6540, so it's down by 640 points.

But the option doesn't expire until September this year, and my breakeven level is 6420, i.e. I won't lose any money from the trade unless the FTSE is below 6420 in September. And if the FTSE is below 6420 in September, I intend to fill my boots with UK equities.

What's crucial about this trade is that I again traded in very small size. Being greedy with leverage is the root of so much disaster in life and in the stock market. On the other hand, taking small regular profits over a long period of time is an honourable way to make money, in my view.

All of that having been said, I can't deny that there are real psychological reasons for people to behave the way that they do. I'd be lying if I said that I didn't get a kick out of participating in the movements of the FTSE, or taking big-sized positions in the companies I admire.

The trick is to stay in control, and stick to your plan, regardless of what the market throws at you.

Right, on with company news...

Versarien (LON:VRS)

- Share price: 39p (unch.)

- No. of shares: 154 million

- Market cap: £60 million

Paul seems to have missed Tuesday's bombshell announcement from Versarien, which is a market-leading supplier of RNS announcements to the London Stock Exchange.

Or is it?

According to Tuesday's announcement:

Going forward, the Company intends to use its interim and full year results announcements to provide updates on the status of various collaborations and will not make announcements between these unless a disclosure obligation arises.

But if it doesn't make lots of announcements, what exactly will the point of the company be?

It turns out the VRS was only teasing us. Today we are reassured that content will continue to flow, albeit in the form of web presentations and "Q&A" rather than RNS announcements:

Versarien has adopted a new communications platform called Investor Meet Company... Through live, interactive presentations, as part of the investor roadshow, all investors can now have the same opportunity for two-way engagement regardless of the number of shares they own or where they are located so they can come to an informed decision about the Company.

Alongside the published Q&A from the live presentations on the Investor Meet Company platform, the Company will seek to publish a Q&A each month addressing these shareholder questions...

My view

I was worried for a day or two, but today's announcement is very comforting. Versarien will continue to publish lots and lots of material for investors to consume. At the end of the day, that is what matters.

Foxtons (LON:FOXT)

- Share price: 74.75p (-5%)

- No. of shares: 275 million

- Market cap: £206 million

As flagged by Paul last month, Foxtons is trading "around breakeven, in lousy market conditions".

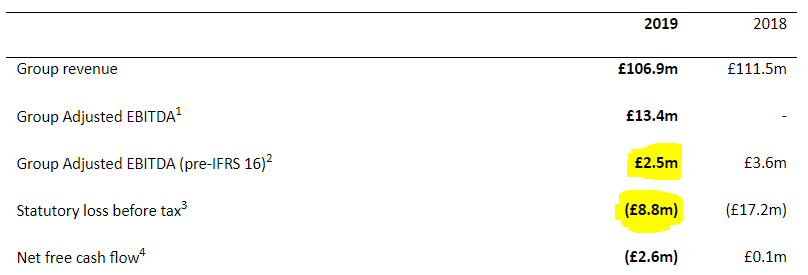

The statutory pre-tax loss for 2019 is actually £8.8 million, so there's a bit of work to do, to get back to breakeven on a statutory basis.

We are presented with a pick-n-mix of earnings measures.

I tend to look immediately for the statutory result. Companies earnings statutory profits are what I'm looking for.

If you're in a forgiving mood, the pre-IFRS 16 adjusted EBITDA might also be worth a look.

But like Paul, I can categorically rule out using adjusted EBITDA in a post-IFRS 16 world. The £13.4 million number shown above is meaningless.

In this particular instance, net free cash flow offers a halfway house between the two measures. In both 2018 and 2019, it's not too far off breakeven.

Key points:

- lettings revenue down 2% (hurt by the tenant fee ban) (£65.7 million).

- sales revenue down 10% (£32.6 million).

- cash of £15.5 million, no borrowings.

I note that the decline in sales revenue was driven by a decline in units sold and a decline in revenue per sale. It's pretty hard to put a positive spin on that.

Market share did grow in both sales and lettings - but at the expense of pricing. Competitors increased their prices to landlords, in the wake of the tenant fee ban.

Dividend is still cancelled. Seems reasonable to keep cash in the company, for now, while it waits for a recovery in the London residential property market.

CEO comment - "pleased with our resilience in this prolonged downturn".

And regarding the future:

...with the uncertainty of the general election removed, early signs are that the sales market may improve during 2020. Our sales pipeline is currently ahead of last year, however we are well prepared for further challenging conditions in the sales market in the run up to Brexit and will continue to build our lettings business and manage our cost base in line with trading conditions.

My view

It's a very reasonable statement and a reasonable strategy. Foxtons is focusing on the more stable lettings business while it waits for the sales market to pick up.

It doesn't pass my quality filters (too labour-intensive, too hard to generate a competitive advantage). On the other hand, there is clear scope for recovery when the cycle turns.

If you are close to the London property market and can time this one, it could turn out to be a winner. But for most of us (myself included), timing its recovery is likely to be too difficult.

Novacyt SA (LON:NCYT)

- Share price: 148.5p (+29%)

- No. of shares: 37.8 million

- Market cap: £56 million

This is a clinical diagnostics company, dual-listed in London and Paris. You can find the French shares on Stockopedia here.

A few weeks ago, it announced that it was in the final stages of developing a test for the coronavirus, as a "research use only test".

It then announced that it had launched a "CE-Mark" test, which it said could be used by labs and hospitals without the need for further validation.

Today it releases a gangbusters statement:

- €1.1 million of sales so far from these Coronavirus tests.

- high levels of interest, and the value of customer quotations has grown "significantly".

- "in active discussions with representatives from a number of countries".

- "major distribution agreement" with a "global life sciences company", to supply two Asian countries (not China). This is forecast to generate sales of €2.5 million in the first six months.

- agreement with US healthcare group to manufacture and sell its research use only test.

- In contact with US FDA as it reviews the test for use in the US.

Excerpt from the CEO comment:

We believe the Primerdesign test remains among the quickest and most accurate tests available for COVID-19, as well as being stable for long distance shipping without the need for specialist cold-chain shipping. It is also designed to run on multiple molecular testing platforms commonly used around the world.

My view

This is beyond my area of expertise - I can't judge whether the Novacyt tests are superior to others already available.

I do think it's interesting that there is one company set to directly benefit from responding to the Coronavirus problem.

Stock market investors may feel desperately in need of a "hedge" against the spread of this disease, and NCYT shares promise to provide it, at least in the short-term.

Avation (LON:AVAP)

- Share price: 254p (-1%)

- No. of shares: 63 million

- Market cap: £159 million

This is an aircraft leasing company, based in Singapore.

As foreign jurisdictions go, Singapore is one of the safer ones (in my humble opinion).

Avation has been around for a long time, and has a good track record of building shareholder value.

It started a "formal sale process" last month, saying that it was in talks with someone about the potential sale of the company.

Today's update:

Since the date of the announcement, a number of parties have expressed interest in the Company and certain portfolios of aircraft. The strategic review and formal sale process is being undertaken in response to an unsolicited approach to purchase the Company. The purpose of the review is to establish what path would represent best value for shareholders.

They go on to say "Avation's value is above the net asset value of the company".

That NAV, for the record, is $4.29 per share.

At latest exchange rates, that is £3.33 per share.

Results - are excellent, boosted by the once-off $37 million recognition of value in aircraft purchase rights that it no longer needs, and will sell off in due course.

Excluding those gains, PBT is up 10%. Not bad.

My view

Over the long-term, Avation has earned a decent return on equity (high single digits or low double digits) and grown its NAV while also paying dividends to shareholders (current yield 3.8%).

On that simple basis, and on the assumption that aircraft leasing is likely to remain a stable business, I would therefore tend to agree with management. A share price closer to NAV would make more sense.

Vitec (LON:VTC)

- Share price: 832.8p (-9%)

- No. of shares: 45.6 million

- Market cap: £380 million

Purchase of shares by Executive Directors

This is a new one for me. It has been listed for a long time but escaped my attention until now.

Its products "typically attach to, or support, a camera" - supports, accessories, bags, power, etc.

The results are a bit uninspiring, as expected. It issued a profit warning in November.

Net debt increases to £96 million, but it would have fallen in the absence of IFRS 16 impacts. Fair enough.

Covid-19 - Vitec has employees in China and Italy. Together, China and Italy account for 9% of turnover.

Sites in these countries are open again, but there is still some everyday disruption, supply chain issues, and a reduction in demand. The current estimated hit to operating profit is up to £5 million - no big deal for a company of this size. Of course this estimate is subject to change.

Outlook

Order visibility is "limited", and the eventual impact of the Coronavirus is unknown. Based on H1 so far, Vitec expects the financial year to be "more H2 weighted than usual".

An H2-weighting can generally be interpreted as a semi-profit warning.

My view

I'm out of time for now. For what it's worth, my initial impressions of this company are pretty good. I'm tempted to say that it's heading into value territory at a P/E multiple of 10x. But I would need to study it in more detail, to be able to say that with any conviction.

The CEO and FD have bought some shares this morning, to try to show some conviction. They have not quite done so in the sort of size that would make me sit up and take notice.

For me, a Director purchase needs to be at least a month's pay, to be of any major significance.

Going to hang up my pen there as I've covered a lot of ground already and it's time for lunch.

Have a great weekend, everyone. I think we all deserve a rest.

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.