Morning folks,

Today we have a profit warning from Shoe Zone (LON:SHOE) and an update from Gear4music that is in line with expectations. We also have results from Clipper Logistics (LON:CLG)

After that, I may look at a few stories that I missed earlier in the week.

Cheers

Graham

Shoe Zone (LON:SHOE)

- Share price: 134p (-30%)

- No. of shares: 50 million

- Market cap: £67 million

Board changes and trading update

The 30% fall in share price today looks reasonable after a dire update.

The CEO has tendered his resignation, "in order to leave Shoe Zone and pursue other business interests". He leaves immediately.

I always hate seeing an abrupt departure like this. To me, it suggests that there was a falling out or some other sort of conflict at the top of the company. If you're leaving a company you care about, and if you've done a good job as CEO, why wouldn't some form of transition be arranged, some period of time in which the company can think about finding a replacement?

The two brothers who have managed Shoe Zone together for the past 20 years clearly feel that they are up to the task, and won't be seeking a replacement. Instead, one of the brothers returns to his original role as CEO, and the other will remain as COO.

Trading update - it's hardly a coincidence that the CEO is leaving on the same day as a nasty profit warning.

This year will be below expectations (not quantified).

The "tough high street trading environment" is blamed.

Shoe Zone stood out as a share which was seemingly immune to high street conditions. As a provider of very cheap footwear, some of us thought that its business would stay firm even as other retailers struggled. Now we know that this isn't quite true. Perhaps the declining footfall has finally started to take its toll?

There is a property writedown of £3.1 million, to £5.3 million. Freehold properties on the high street simply aren't worth what they used to be. The flipside of declining property values is that Shoe Zone is able to negotiate rent reductions at many stores.

Finally, there will be no special dividend this year. The special was worth 8p last year, 8p in 2016 and 6p in 2015.

The update ends on a positive note:

"While we therefore face a short-term impact on our balance sheet [due to the freehold property writedowns], we do not anticipate any change to our dividend policy, reflecting our confidence and excitement in the long-term growth opportunities through the Big Box roll-out, continued operational improvements and our multi-channel proposition."

My view

I summed up my views on this share back in October 2018 and to be honest, nothing has really changed since then.

It still looks like a clothes retailer that is capable of generating lots of cash (and paying it out to shareholders). The historical track record is excellent.

On the other hand, it probably still has little by way of an economic moat around it. It competes primarily on price, not on quality. As I said before, I doubt that the brand has any value.

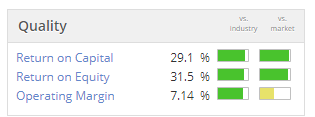

So this share is primarily a bet on management, and they have done a good job in recent years. Dividends have been very healthy and impressive quality metrics have been achieved:

So where does it go from here? If forced to go long or short, I would go long of this one.

The two brothers at the top of the company own a huge chunk of the shares between them, and are highly motivated to make it work. So I would be inclined to bet that they will figure out a way to preserve value and restore earnings, over time. But of course this is not easy to predict. All I can say for sure is that they are highly incentivised to succeed!

Updated forecasts

It's a shame that the company didn't include any updated forecasts in this RNS - I don't see why it can't do this.

The broker Finncap has published a note on Research Tree, cutting this year's PBT forecast by 14% to £9.5 million.

And FY 2020 forecasts have been withdrawn, leaving investors without any official guidance for next year.

With a 14% cut in the official PBT forecast for the current year and suspension of next year's forecast, combined with the abrupt CEO change, a share price fall of 30% today seems fair.

Summary

Last night, Shoe Zone passed two stock screens for value on Stocko, and enjoyed a high Value Rank. It is even more "value" now, probably.

It doesn't tick enough of the qualitative boxes for me but I think this one should survive and could do well for patient shareholders.

Gear4music (LON:G4M)

- Share price: 199p (+6%)

- No. of shares: 21 million

- Market cap: £42 million

AGM Statement and Trading update

Very little info given in the AGM statement, but trading is in line with expectations.

"The specific actions that we have undertaken to improve gross margins and ensure that the Group is operationally robust ahead of our peak trading period continue to yield positive results. As such, we remain confident that the Group is well-positioned to grow revenue and improve profitability."

The share price rising 6% in response says that investors were braced for more bad news, in advance of this statement. Since there wasn't any bad news, we get a small relief rally.

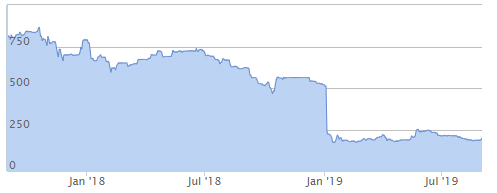

The G4M chart has been a disaster on a 12-month view, down from 620p a year ago.

The two-year picture is also very rough for shareholders:

It's amazing what a change in sentiment can do.

Looking forward, the company is forecast to make EPS next year (FY March 2021) of about 11.7p. So we could see G4M "growing into" its valuation over the next two years, if all goes to plan. And if the market gets excited again, perhaps the shares can return to their former peaks?

My view

The StockRanks are cautious, giving it a score of just 35, and that's in the ballpark of where I would rate it, too. After producing a loss in FY 2019 and seeing its gross margin crumble, it still has a lot to prove.

Personally, I need to see G4M's own brand of instruments gain real traction.

Until then, it falls into the same category for me as AO World (LON:AO.), which is a share that I'd want to strongly avoid (though I acknowledge that G4M's gross margins are better than AO's).

Clipper Logistics (LON:CLG)

- Share price: 220p (+3%)

- No. of shares: 102 million

- Market cap: £224 million

Final results for year ended April 2019

We knew this was coming out, thanks to a trading update on Tuesday.

By the way, this was Clipper's deadline day for the results, wasn't it? Companies on the main market have four months to publish their annual report, and Clipper has done it in the nick of time.

Profit from logistics activities (i.e. excluding Clipper's property-related profits) increased by 18% to £17.1 million.

It mentions new contracts with PrettyLittleThing (owned by £BOO) and other "major multinational customers".

And among many other operational highlights, I see that it's doing a robotic trial for Superdry (LON:SDRY).

The outlook sounds good:

Recent contract wins, together with a strong pipeline of new business activity and the further evolution of our Click and Collect proposition, place the Group in an excellent position to achieve further growth both in the UK and internationally. Indeed, Clipper's approach of adopting a hands-on, long-term and pro-active relationship with its retail clients allows it to continue to support its clients during these changing retail market conditions, and the uncertain political and economic landscape.

The reference to an "uncertain political and economic landscape" is echoed here:

"We are conscious of the challenging market conditions facing UK retailers and the macroeconomic uncertainty within the UK economy; this may well have some impact in the year ahead, but we remain confident in our ability to continue the momentum in the business and are well-positioned to continue to deliver strong returns to our shareholders."

Fresh macroeconomic data was released this morning on consumer confidence, suggesting that the consumer is currently very weak.

What I find interesting is that it's not just physical retailers (e.g. Shoe Zone (LON:SHOE) ) who are finding it tough right now. The dour sentiment has spread to such an extent that even online retailers are potentially vulnerable.

Since Clipper is at the heart of the online trade, its performance might be a useful measure of activity in the sector. It reports today "some organic revenue decline with certain of our customers", but predicts organic growth in the current financial year "particularly with those customers in e-commerce who will benefit from market growth".

Overall, Clipper's positioning seems ok. E-commerce is still growing and taking market share from the high street, and that's where Clipper's services are key.

Net debt was £46 million at year end, driven primarily by "assets acquired on HP and finance contracts".

The overall result for the year was net income of £13.4 million, down from £14.3 million the prior year.

My view - no change to my stance on this one. It looks and sounds like a decent logistics company that is performing well. With net income forecast to increase to £21 million in the current financial year, it might offer value at current levels.

Loungers (LON:LGRS)

- Share price: 200p (-2%)

- No. of shares: 92.5 million

- Market cap: £185 milion

Final Results for the 52 weeks ended 21 April 2019

Two days ago, Lounders confirmed that it is trading in line with expectations and is "outperforming the wider hospitality market".

Eight new sites are open with the target being 25 for the full year.

The total number of sites now is 150+.

Adjusted EBITDA rolled in at £20.6 million, after excluding £8 million+ in depreciation expense.

My view

As Paul noted on Wednesday, many people focus on EBITDA for a stock like this.

While that is true, it's also true that a company isn't worth anything unless it generates positive free cash flow. EBITDA doesn't help us to understand cash generation.

For example, Loungers spent £18.6 million on capex in FY 2018, and then spent £22.6 million on capex in FY 2019.

This expenditure (i.e. cash outflow) was higher than its adjusted EBITDA in each respective year. Adjusted EBITDA was £16.6 million in FY 2018, and £20.6 million in FY 2019.

This doesn't prove that the company is a poor cash generator. To examine that, we need to think about how much of the capex spend in recent years was "maintenance" and how much of it was "growth".

The number of sites increased by something like 22% in FY 2018, and then increased by a further 21% in FY 2019.

It's safe to assume (and it's probably not too hard to find the precise answer) that several million pounds of capex in each of the last two years was growth capex. So on an underlying basis, looking at the core estate in each year, I don't doubt that the company is cash-generative.

But is it sufficiently cash-generative to deserve a valuation of nearly £200 million? I don't know. Each site is currently being valued at over £1 million.

A more fundamental question that I have over Loungers is its competitive positioning. It says that it offers "something for everyone regardless of age, demographic or gender". In other words, it wants everybody to visit. It's open all day. It competes with all other establishments for all types of business. To me, this sounds like a difficult way to make money - we shall see!

Signing off there for the week, but thank you for dropping by. Paul makes his return on Monday.

Have a fine weekend.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.