Good morning!

While the main article is being written, feel free to comment and share your thoughts on whichever small-caps you think are most interesting today.

Incidentally, this is my last SCVR for a while. Britain's top share blogger makes his return next week, while I head south by 24° of latitude to enjoy some late summer sunshine. Cheers!

Graham

Our interesting stories today include some big-caps:

- Restaurant (LON:RTN) - interim results

- Whitbread (LON:WTB) - sale of Costa to The Coca Cola Company

- FFI Holdings (LON:FFI) - annual results

- Eservglobal (LON:ESG) - half year results

- The collapse of Wonga has provoked some commentary on the implications for H & T (LON:HAT) (where I have a long position) and other lenders.

Restaurant (LON:RTN)

- Share price: 287.6p (+4.5%)

- No. of shares: 201 million

- Market cap: £578 million

The market is pleased with these numbers despite use of the phrase "broadly in line" with respect to adjusted PBT expectations for the full-year.

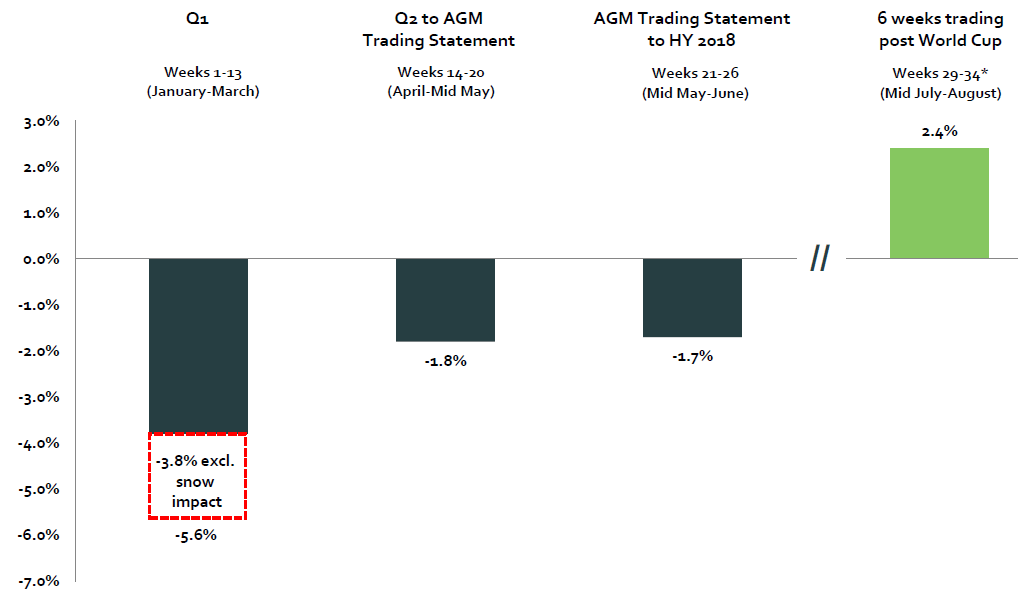

Rather than focusing on a potentially minor PBT downgrade, investors are instead focusing on a sturdy like-for-like sales performance (+2.4%) over the past six weeks, since the World Cup ended.

As a reminder, RTN operates Frankie and Benny's, Chiquito and other restaurant brands, pubs and concessions.

The results presentation includes a chart illustrating the progress in like-for-like sales. It excludes the World Cup period:

So we do have evidence that the company has been making improvements to the customer experience, compared to last year, e.g. by upgrading menus and increasing options.

One of the big disclaimers we must attach is that margins have been getting worse. Price cuts are a big factor in this.

The H1 performance itself is nothing to shout about: like-for-like sales down 3.7%, EBITDA margin down by 1.6 percentage points, and EBIT down 21%.

The company deserves credit for the clarity of its disclosures. This is one of the advantages of big-caps: they often give you really detailed information, so you don't have to guess as much compared to small-caps.

For example, cost pressures are broken down visually so that we can see exactly what happened. The main drivers were:

- Purchase costs: £5 million.

- Living Wage/Minimum Wage/etc: £5 million

- Rents, rates, utilities: £7 million

We are guided for more of the same in 2019.

The company also breaks down maintenance vs. development capex. This means we can get an accurate reading of free cash flow, before voluntary growth capex. By this measure, FCF was £14 million (vs. £35 million last year).

Exceptional charges - we have that old chestnut of "exceptional" items which aren't really all that exceptional. There is an £8.4 million hit from onerous lease provisions and impairments, vs. £12.9 million last year.

My view - To be honest, I've mentally written off this entire sector. That could be a mistake but I just can't visualise restaurants (or pubs) as quality compounding businesses over time.

I could only see that happening if their brand names were so compelling to customers that competition somehow became less intense. For as long as they are competing on price against anyone with a little bit of capital, a work ethic, and an idea, I don't want to participate.

For example, I do have a positive view of McDonalds ($MCD) and Starbucks ($SBUX) as investments, because their instantly recognisable brands give them sustainable pricing power around the world.

Conventional restaurant meals, on the other hand, work differently.

It's a bit like the difference between wine and beer/spirits. Wine is a fragmented market, whereas strong brand names dominate the beer industry. Vineyards make for fairly average agricultural investments, whereas Diageo (LON:DGE) and other drinks brands have been excellent investments.

For right or wrong, this is why I don't plan to own any restaurant or pub shares.

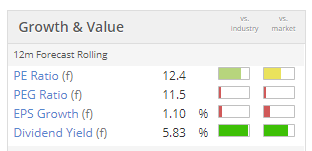

RTN's results aren't that bad, so if you are happier investing in this sector than I am and you are interested in a "value" opportunity, it could be worth looking into.

The dividend is being maintained for now, and is generous.

Whitbread (LON:WTB)

- Share price: 4700p (+17%)

- No. of shares: 184 million

- Market cap: £8,629 million

Proposed Sale of Costa to The Coca-Cola Company

This is a great follow-up to RTN.

Rather than de-merging Costa, Whitbread is selling it to Coke ($KO) for the princely sum of £3.9 billion (net cash proceeds will be a little lower than this).

That will leave Whitbread to focus on Premier Inn. Sounds good - I like it when a PLC decides what it wants to concentrate on! It usually works out well for PLCs too, because they get higher valuations.

As WTB says today regarding Costa's sale price:

the valuation is significantly higher than is currently reflected for Costa in Whitbread's market value

Most of the money will go back to shareholders, "unless more value creating opportunities arise". That's reasonable.

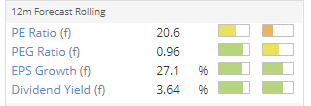

Brand power - it's a super valuation, 16.4x EV/EBITDA.

Coca-Cola aren't amateurs so we can assume that they have done the maths to justify this price.

While there may be some bull market froth in the price, there is no harm in doing a comparison with RTN's valuation today (in the same bull market conditions).

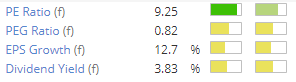

By my calculations, RTN is currently trading at an EV/FY18 EBITDA multiple of only 6x. Stocko, using trailing twelve month figures, puts it at 10x.

Either way, we can see the power of a brand like Costa versus a collection of restaurant chains, as it's reflected in the valuation multiples.

My view - the deal looks like a good move for WTB and its shareholders, though it could be argued that Costa was the more interesting part of the group, rather than Premier Inn.

This idea is a bit off-the-cuff, but perhaps the best course of action today is to sell into the WTB rally and switch immediately into Coke ($KO)?

Coke has been significantly under-performing the S&P500 over the past five years, and now sits at a PE multiple of about 21x. Definitely worth a look, if you are fishing in the US markets!

Ok, let's get back to the UK small-cap arena!

FFI Holdings (LON:FFI)

- Share price: 43.4p (-37%)

- No. of shares: 158 million

- Market cap: £68 million

Preliminary announcement of annual results

New investors must wonder about the difference between "preliminary", "final", and "annual" results. They're all the same for practical purposes!

FFI Holdings PLC (AIM: FFI), a world-leading provider in the provision of diversified services across the entertainment industry, is pleased to present its full year results for the year ended 31 March 2018.

A bit late, surely?

One of my top holdings, Burberry (LON:BRBY), has the same year-end as FFI, and it released its preliminary results three and a half months ago.

It's my first time looking at this LA-headquartered business.

It has made six acquisitions since IPO and moved into a range of different activities, beyond its traditional focus on completion contracts. It now also covers "pre and post-production services, general risk insurance, content investment and content distribution".

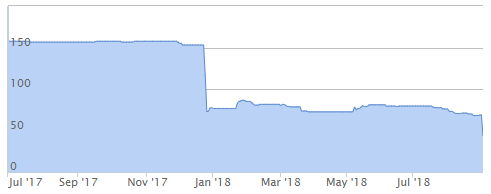

Share price performance has been abysmal:

It turns out that the US movie industry just happened to fall into disarray in Q3 2018 (i.e. October - December 2017), and FFI's results were hammered as a result.

It's amazing how unlucky fresh IPOs often turn out to be!

Outlook - doesn't sound great.

FFI's corporate overhead expenses are expected to be ahead of the board's previous expectations for FY 2019. These additional overhead expenses are related to an expansion of the Company's legal, accounting and IT infrastructure to support acquisitions and future growth as well public company and compliance expenses being ahead of budget.

I'm suffering from "acquisition fatigue". I just want to find some simple businesses that do something very well and grow because they are good at what they do.

The market's reaction to this statement, despite guidance for an improved underlying EBIT result in FY 2019, suggests to me that other investors might also be getting a bit fed up with the promise of adjusted earnings. We want real earnings!

Eservglobal (LON:ESG)

- Share price: 7.9p (+1%)

- No. of shares: 907 million

- Market cap: £72 million

eServGlobal (LSE: ESG.L & ASX: ESV.AX), a pioneering digital transactions technology company, today presents its results for the six-month period ending 30 June 2018.

It has been a while since we looked at this one.

In October, it raised £24 million at 9p. This was done to continue funding its joint venture with Mastercard, called "Homesend".

I've been catching up on the story with the help of a very useful interview published today by Tamzin of piworld.co.uk. Here's the link.

It has a loss-making, core software business in addition to Homesend.

The results are in Aussie dollars (AUD) and in accordance with Australian accounting dollars:

- We have an EBITDA loss of AUD $5 million (c. £3 million), including a $2.5 million loss from the stake in Homesend.

- Software revenues are a little lower than last time at $5.6 million, though the company is keen to point out that it received lots of orders which will be recognised in future periods.

- The software business might be sold - conversations are ongoing.

My view

Homesend could be huge, and most of the value of this share seems to rest on it succeeding. It says a lot that ESG is happy to discuss offloading its core business.

There were some post-period events which boosted the balance sheet a bit, but as of June 2018 the company's net assets amounted to $29 million (£16 million), of which $24.6 million (£14 million) was accounted for by Homesend.

So on that basis, the valuation of £70 million still feels a bit speculative to me.

Stockopedia is even more harsh, rating it highly speculative and calling it a Sucker Stock.

Feels safe to say that it's not a "value" stock!

Wonga

Wonga collapses into administration

It's not so long ago that this collapse would have been unimaginable. At its peak, Wonga was taking the payday loan market by storm and producing terrible TV ads.

But then the payday loan market was crushed by government caps on interest rates and other restrictions on high-cost short-term credit. Customer compensation claims in relation to how it collected its debts were the final nail in the coffin.

Does this have any relevance for H & T (LON:HAT) (I own), Ramsdens Holdings (LON:RFX) and other lenders? This is how I see it:

- HAT, RFX and others will benefit from slightly reduced competition. Not much though, because Wonga isn't directly competing with them. For example, H&T's personal loan product has a minimum loan term of 3 months. This isn't a "payday" type of loan.

- Lenders will be reminded of the regulatory threat in high-cost credit and will be motivated to limit their exposure to it. Most of H&T's personal lending does not meet the FCA's definition of "high-cost short-term credit".

That's about it, really.

From the consumer's point of view, they will have slightly fewer options.

The benefit of this is that they are less likely to get sucked into a debt trap that they can't get out of.

On the other hand, they are also more likely to miss bill payments or find another way to borrow, which might not be any better.

From an investment point, I don't see Wonga's demise as big news.

I do think that H & T (LON:HAT) is cheap at current levels, and would be adding to it, were it not already my third-largest equity position!

Ok, that's a wrap. It has been a busy summer taking care of these reports by myself.

I'd like to thank you all for your comments and for your "thumbs up".

It's not just your kind wishes today, but your intelligent and high-quality comments throughout the year, which make this such an interesting report for everyone, and a friendly, fun, online environment.

For the next week, I'm going to try not to check my emails or twitter. It's not that I'm being rude, promise!

You'll be in very safe hands here.

See you soon,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.