Good morning!

I'll start today's report with Duke Royalty (LON:DUKE) and Haynes Publishing (LON:HYNS). and then will see where to go from there.

Duke Royalty (LON:DUKE)

- Share price: 48p (+0.7%)

- No. of shares: 240 million

- Market cap: £115 million

Many of you will be familiar with this one: it provides investments to private companies in the form of royalties.

We can think of it as a type of corporate mortgage: the investee pays flat payments to Duke over a very long period of time (e.g. 30 years). There is no final maturity date on which the principal is paid back - the principal is considered to be paid back over the course of the agreement.

Except there is one major difference, namely, that the payments aren't flat. They increase or decrease (subject to a floor and a cap) in line with revenue changes at the investee.

It's a bit like if the bank increased your mortgage payments by 5%, whenever your income increased by 5% (or reduced them if your income declined).

It's an innovative structure, and I was a shareholder here for a while (not currently).

These interim results appear to be in line with expectations. In terms of net income, the company earned £3.3 million, versus forecasts in the market for full-year net income of £6.9 million.

EPS is 1.65p, versus full-year forecasts for 3.3p.

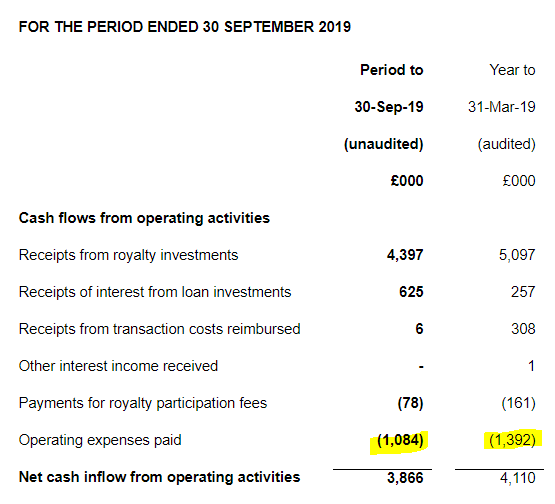

The Chairman would like people to focus on "net cash inflow from operating activities", a simple measure of cash generation. By this measure, Duke generated cash of £3.9 million. This consists of:

- £4.4 million received in royalty payments

- £600k in interest received

- £1.1 million in operating expenses paid

Some quibbles

I have a few minor qualms about this, which would make me want to focus on the income statement more than cash flow.

Firstly, Duke's payments to its suppliers, i.e. operating expenses paid, don't happen exactly in line with when these costs are incurred.

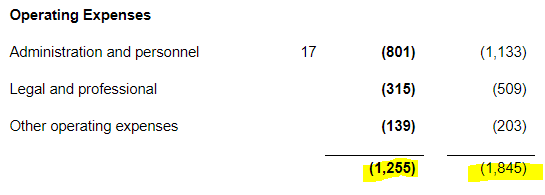

For example: in FY 2019, Duke incurred operating expenses of £1.845 million. In H1 2020 (the period reported today), these were £1.255 million. From the income statement:

But Duke didn't pay these amounts in cash to its suppliers, as you can see on the cash flow statement. It paid only c. £1.4 million last year, and only £1.1 million in H1 (as I mentioned above):

So you miss out on the real costs incurred if you're only watching the cash flow statement.

Secondly, taxes don't appear to get a mention when it comes to cash flow.

Taxation expense of £400k was incurred in H1, and the total (current and non-current) tax liability on Duke's balance sheet increased by this amount, implying that no tax payments were made by Duke. This would help to explain why tax payments can't be found on the cash flow statement!

That £400k expense is worth noticing for Duke's shareholders. Duke is headquartered in Guernsey and is tax-free in that jurisdiction, but it still has to pay some tax in the UK. Depending on the timing of tax payments, you could miss it if you only look at the cash flow statement

Thirdly, the cash flow statement conceals the fact that most of the royalty investments are amortising and will abruptly come to a halt at some point in the future.

I grant that this problem is very far away. And royalty payments could and should increase over time, due to revenue growth at the investees. But I think it's an important point to understand. Most of the royalties are not perpetuities, i.e. the payments will not last forever. So treating these payments as a measure of ongoing earnings could be a little aggressive.

The income statement doesn't suffer from this problem, since it should reflect the changing value of the royalties, in line with their projected performance until expiry.

Of course the income statement isn't perfect, either. It is more subjective, since it require inputs such as a discount rate to value the portfolio, and there is no objectively correct discount rate to apply.

Even so, I think the £3.3 million net income figure is worthy of shareholder attention, since it includes all of the operating and taxation expenses incurred.

Dividend - Duke has been heavily supported by a number of institutional investors, who I suspect are using it to help their equity income strategies. The dividend has been a major priority from the start. The quarterly payment is currently 0.75p, for a yield of 6.25% against the current share price. Forecasts suggests that these payments will be increased again, soon.

Debt facility - as noted previously, Duke can borrow up to £50 million from Honeycomb Investment Trust (LON:HONY), at 7.25% plus one-month LIBOR. The borrowings shown on today's interim balance sheet were paid off by a £17.5 million equity fundraise in October.

Outlook - there is no information given on the financial performance by individual investees in this report, but the outlook statement is confident.

My view - I think these are good results. As many of you will know, I sold out of Duke in August. But I acknowledge that the company's performance thus far is faultless, in the sense that none of the investees have defaulted and that a rising stream of quarterly dividends has been paid on time.

Long may it continue!

If you find this company interesting, I'd recommend that you take a look at the investees and see what you think. Some of the big ones include Lynx Equity (UK), SijfaCruises and Trimite.

How would you expect these businesses to hold up in a recession? Would you be happy holding most of their enterprise value (on the assumption that the equity value left after Duke's refinancing is not too large)? Are you comfortable with the notion of lending to them using borrowed funds? Ask yourself the tough questions. Or ask the company - they are very open to communicating with their shareholders.

I'll continue to watch this one from the sidelines, for the time being.

Haynes Publishing (LON:HYNS)

- Share price: 438p (+3%)

- No. of shares: 15 million

- Market cap: £66 million

This interesting little business put itself up for sale last month, following the death of its founder. It said that it wanted to be part of a larger organisation with more financial resources.

It is known for making manuals for cars, motorcycles and more. It also has impressive data services in the form of HaynesPro and Oats.

Many formal sale processes happen during a period of disaster but that is not the case for Haynes. Today's update confirms that H1 PBT is up by 37%.

Chairman comment:

"I am pleased to report another strong period of trading for Haynes, driven entirely by organic growth, with both revenue and underlying profit tracking ahead of the prior year.

Our strong performance is underpinned through our sustained investment in product innovation, content integration and growing data coverage, which continues to generate value for all stakeholders of the Group."

My view

There's not much to analyse in this update. For what it's worth, I do have a positive impression of Haynes and find the decision to sell a little perplexing, since the company appears to be capable of making nice profits on its own.

A son of the founder is the CEO, and the Haynes family still owns the majority of the shares. I'm sure they thought long and hard about what would be in the best interests of all stakeholders in the busihess.

There is no word of any bid for the business yet, and predicting the eventual sale price is not exactly easy. Stocko gives it a ValueRank of only 29 but the digital nature of the current business could allow for it to be sold at a hefty multiple.

The forecast P/E multiple according to Stocko is in the region of 16x.

Northamber (LON:NAR)

- Share price: 47.75p (+6.1%) (not the real price, wide spread)

- No. of shares: 27 million

- Market cap: £13 million

Statement regarding David Phillips

Please note that I have a long position in this share.

This is very sad news regarding Mr David Phillips.

Mr Phillips founded Northamber in 1980, and had a long and illustrious career at the helm of this tech "distie".

I met him at a few Northamber AGMs, and he was a generous host at every meeting. My condolences to his friends and family.

From an investment point of view, Northamber has fascinated me for a long time. It was one of my original "value" investments, but the value never properly emerged during my original holding period.

I held it from 2013 to 2016, selling it for a small profit not far from where I had originally bought it, c. 31p.

The experience taught me that pure value wasn't necessarily a very good strategy. Deep value investments could drift along for many years, achieving little.

I noted last month that Northamber's reported net assets were £16.6 million, but that this was before the sale of its warehouse for £10 million more than its book value.

Having looked at the numbers again today, I couldn't resist buying back into this company. To fund the purchase, I sold Record (LON:REC).

Even adding on the cash from the warehouse sale doesn't fully describe the value opportunity here, in my view.

The company also owns an 18,000 square foot office building, Namber house, in Chessington. It was originally bought for around £3 million, in 2001, when it was newly built. But Northamber's "land and buildings" on its balance sheet are now only considered to be worth £1.6 million.

I don't know what this building is worth, but the freehold of a similar-looking office in Leatherhead which also has plenty of parking spaces is currently for sale at £318/sqare foot.

If the Northamber office was worth that, it would fetch £5.7 million, raising the value of the balance sheet by another £4 million. That would bring total balance sheet value to over £30 million, when you include the proceeds from the warehouse sale (but before taking operating losses into account).

That value estimate for Namber House as an office could be completely wrong, but there is an alternative. In 2014, Kingston Council granted prior approval for a change of use of the building to 28 residential units: 20 one-beds, 6 two-beds, and 2 three-beds with parking.

And that's not all. According to the most recent annual report, the company had tax losses of £4.7 million. But these can't be found on the balance sheet, "due to the uncertainty there will be sufficient taxable profits in future to absorb them".

These tax losses should be more than enough to avoid corporation tax on the sale of the warehouse and the office (if indeed the office is sold), with plenty of surplus tax assets left over that.

As for the core distribution business, it has been loss-making for nearly a decade but the losses aren't huge in comparison to revenues and maybe there is a rival who would pay something for it, if that's the direction the Board decided to take. I wonder what they might do.

I swore off deep value investing a few years ago but having looked at these numbers today, I couldn't resist trying one more time.

Appropriately, Northamber passes the "Ben Graham NCAV Bargain Screen" according to Stocko. And that's before taking into account the sale of the warehouse, the potential value of the office, and the tax losses.

Ok, that's it for the week. Thanks everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.