Good morning!

A slow start this morning.

I was out last night in Carluccio's in Dublin.

This restaurant chain has been in the news in recent months, as creditors agreed to a CVA. 30% of UK sites are closing while the rest will benefit from an investment programme. I have read that £10 million is being ploughed in by its majority owner, the Dubai-based Landmark Group.

Nothing was out of place last night, however - apart from a very loud fire alarm, which caused patrons to run for their lives (just kidding, nobody panicked).

It was a great value menu, very flavourful and authentic, reflecting well on this medium-sized chain sticking to its roots. I had olives, calamari and chicken saltimbocca. A large photograph of a romantic Italian town served as the backdrop to our seating.

It's a shame that so many restaurant chains are struggling, even those providing such an excellent service to customers. Reading around some commentary on Carluccio's closures, it's clear that the pain is also being keenly felt by smaller chains and independent restaurants who lack the resources of the larger groups.

Things will remain desperate until supply matches demand. There is no other solution that I can think of, apart from fewer restaurants. There are still too many empty chairs at empty tables.

The RNS wire is a bit quiet today.

I am planning to take a look at:

- FairFX (LON:FFX) - Half-Year Trading Statement

- Impax Asset Management (LON:IPX) - AUM Update

- Hipgnosis Songs Fund - Result of Issue

FairFX (LON:FFX)

- Share price: 129p (+13%)

- No. of shares: 155 million

- Market cap: £200 million

This is an international payments group, serving both retail and corporate customers. I last covered it at its full year results in April.

Foreign exchange is a gigantic industry and an exciting place for new entrants at the moment, due to the complacency of high street banks.

Banks know that most people won't shop around, so their rates tend to be uncompetitive.

More and more people are shopping around, however. Consider the increasing popularity of the services provided by pawnbrokers Ramsdens Holdings (LON:RFX) and H & T (LON:HAT) (in which I own shares), for example.

Targeting the both the consumer and the SME/corporate segments, FairFX has plenty of business to compete for.

Its pre-tax profit (PBT) was negligible last year. The hope for investors is that this year, top-line growth combined with fixed costs can lead to some scale efficiencies. Broker forecasts suggest that PBT could surge to £7.7 million.

Today's update is in line with expectations:

The strong first half gives the Board confidence that the Company will achieve market expectations for the full financial year.

Organic turnover growth comes in at 23%, led by growth in international payments (39%).

Including acquisitions, growth is 146%.

FairFX is combining its pre-existing FX capabilities with the digital banking offer from CardOne (which it acquired last year) to launch a range of new products for SMEs.

I continue to think that this looks interesting.

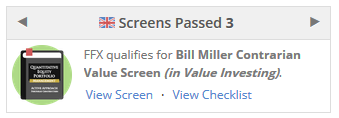

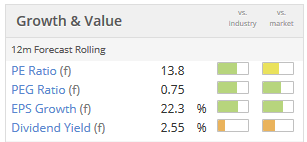

It passes a couple of momentum screens, including the Value Momentum Screen, while also passing Bill Miller's Contrarian Value Screen (you can find these below the chart on the StockReport).

So there looks to be a healthy dose of both value and momentum with this stock. A nice combination.

This section is written by Paul Scott (in response to reader requests). Paul owns shares in Intercede (IGP)

Intercede is "the leading specialist in digital identity, credential management and secure mobility."

Intercede (LON:IGP)

- Share price: 28p (unch.)

- No. of shares: 50.5 million

- Market cap: £14 million

Intercede (LON:IGP) is rather speculative, but the reasons I've picked up some shares personally are;

Quality of customers - outstandingly good, e.g. Governmental bodies around the world, major defence & healthcare companies, etc, including USA & M.East. If you can sell encryption technology to organisations like that, then these tend to act as reference sites, and can sometimes result in a snowballing effect on future sales. Clearly the company has an outstanding product, or it would not have won all these contracts.

New CEO - with a background in sales/marketing in IT. The company's focus seems to have previously been on product development. If the new CEO can turn that into rising revenues, then the operational gearing here could be exciting (as gross margin is 99.6%)

Cost-cutting - the recent results statement indicated that overheads had been slashed by £3m p.a. When you take into account R&D tax credits, I reckon this means the company is probably now at or near breakeven. Hence cash burn should (hopefully) no longer be a problem - but that's dependent on sales being maintained at a minimum of previous levels of around £9m. This excerpt from the 7 June 2018 results statement is the key bit, which is what induced me to buy the shares;

A cost-cutting exercise removed significant costs from the business without impacting operational capability. Intercede started the new financial year with an operating cost run rate that is more than 20% lower (approximately £3m per annum) than at this point last year.

Takeover potential - with a world-class product, and a market cap of only £15m, a larger IT group might decide to buy Intercede.

Cash - looked tight at £2.3m at last year-end of 31 Mar 2018, but rose to £4.7m as at 30 Apr 2018, after significant orders received.

Convertible loan notes - this is a bit of a nuisance. The company has c.£5m convertible loan notes in issue, which carry interest at 8%, so costly, at c.£400k p.a.. Interest is payable quarterly, so £100k per quarter cash outflow. The conversion price is 68.8125p, which is well above the current share price of 28.3p, so dilution on conversion doesn't look a problem. Final redemption date is 29 Dec 2021 - so not a problem for the time-being - the company has 3 years to come up with the money to redeem these loan notes (if they're not converted beforehand), and actually it currently has roughly that amount of cash on hand anyway. So this doesn't look like a problem to me - unless trading deteriorates, when it would become a problem.

Paul's opinion - the company has been a serial disappointer in the past, which is why the market cap is so low, at only £14m. However, the way I look at things, risk:reward looks asymmetric - in that the upside, if sales accelerate, could be very considerable - after all, this is a very sexy sector, and this company clearly has an outstanding product (evidenced by its major customers). It's possible to imagine that this could be a 5-10 bagger (£75-150m market cap) if sales accelerate (which has happened before - look at the chart), and drop through into decent profits. Obviously that upside case may not materialise though, and there have been false dawns in the past.

If the company does even half well, then a £14m market cap could potentially double or triple. There are lots of other far more speculative companies around, with nothing like this company's quality of customers, on higher market caps.

It all hinges on what progress (if any) is made on new contract wins. The recent newsflow has been good - with major contracts secured just after the 31 Mar 2018 year-end.

I'm inclined to sit tight for a year or two, and wait to see what newsflow emerges. It may work, or it may not, I don't know. It might have been more sensible to wait and see, then buy shares if & only if the newsflow is positive, and a chart breakout occurs (which would be the Minervini approach). Personally though, I tend to prefer buying ahead of the crowd, because that way there's plenty of liquidity, and I can get into a micro cap in decent size. The risk of my approach is that the company continues to under-perform, and it becomes difficult to impossible to exit, even at a lower price.

This one won't appeal to most people, as it's rather speculative.

Impax Asset Management (LON:IPX)

- Share price: 202.5p (-1%)

- No. of shares: 130 million

- Market cap: £264 million

A standard quarterly update from this environmentally-focused asset manager.

AuM are up 7% quarter-on-quarter for Q2 2018, to another all-time high.

The share price might be a little soft today as group net inflows fell to £200 million, not helped by a £100 million net outflow at its acquired US-based business.

It's the smallest inflow for Impax since Q3 2016, when AuM was only about a third of its present level.

So this update could be seen by some as a slight loss of momentum and raise a yellow flag about US progress.

On the other hand, it's only one quarter and inflows remained positive, so it's hardly the end of the world. The CEO refers to "a healthy pipeline of new business".

Market movements picked up the slack, raising AuM by over half a billion pounds. The overall AUM movement was from £11.0 billion to £11.75 billion.

As regular readers will now, I like the fund management sector and have written favourably about this company on many occasions. I remain open to the possibility of adding shares in this to my portfolio at some point in the future.

Hipgnosis Songs Fund

This fund has released a string of announcements since last year, when it first attempted to float. After several delays, the IPO was aborted.

Today, it announces that it has successfully raised just over £200 million in gross proceeds.

I am keen to figure out if this might be worth buying shares in, when it finally lists.

It plans to buy catalogues of songs containing "proven, evergreen Songs from award winning songwriters". It is hoping to get "more than 10 number 1 hit songs in the UK and US", from at least 8 songwriters.

Collecting royalties is not entirely straightforward these days, given the proliferation of illegal downloading.

The fund is obviously bullish on this point, seeing improved monetisation from legal streaming services (e.g. Spotify) and less piracy in emerging markets.

Compound returns

The basic concept sounds attractive to me. It comes down to the yields achieved and the safety of its portfolio in terms of its diversification.

Copyright lasts for 70 years after the death of the artist (in the UK). I suppose that's another important consideration - how long will be left on the catalogues of songs it purchases?

Not all of the fund's earnings will be distributed as dividend, so there is the potential for compound returns. Hipgnosis is targeting 10% per annum total return on NAV over the medium term, net of fees. That would be a fine result

There is a 182-page prospectus on its website, if you are at a loss for things to do this weekend!

Cake Box Holdings (LON:CBOX)

- Share price: 164p (+2%)

- No. of shares: 40 million

- Market cap: £66 million

This is a new issue, only listing on June 27. See announcement. Thanks to Edinburgh Investor for suggesting that we take a look. It's still too early for it to have any Stocko metrics.

No new money was raised at IPO. Existing shareholders sold about 3/8ths of the company at 108p.

It has generated a bit of a buzz, and its share price is now more than 50% higher than that Placing price.

What it does: egg-free cake shops! Some people don't want to eat eggs for religious reasons, while others are still free to enjoy and appreciate the taste of egg-free cakes.

It has a franchise model. Most revenues are derived from cake and sponge sales to franchisees. I like this model, as it is often associated with very high returns on capital.

I've been reading some research which suggests that Cake Box might earn about £3 million in net income during the current financial year. If that's true, the corresponding P/E ratio at the current share price is c. 22x. Not cheap, but understandable in the context of the rating attached to Patisserie Holdings (LON:CAKE).

All done for today, and for the week.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.