Good morning, it's Paul here.

Yes, I'm delighted to be back! Graham is having a well-deserved holiday this week. I'd like to thank him for his terrific work in writing these reports during my 3-month sabbatical. I've been an avid reader over the summer, and have occasionally submitted sections for inclusion in Graham's reports.

On my first day back today, with legendary efficiency and organisational skills intact, I forgot to put up a placeholder article last night. Sorry about that. So here it is. I'll get to work on today's profit warning from Footasylum (LON:FOOT) next. Please feel free to add any comments below.

Footasylum (LON:FOOT)

Share price: 43p (down 48.8% today, at 09:31)

No. shares: 104.5m

Market cap: £44.9m

Trading statement (profit warning)

This company is a specialist retailer of trainers, focused on young customers. It was floated at 164p per share, in Nov 2017 by GCA Altium (financial adviser & NOMAD), and Liberum Capital (broker). So far the shares have been a disaster - currently down 74% on the price at flotation. I imagine those that bought in the float must be feeling that they've been mugged.

Checking back through our archive here, both Graham and I reviewed FOOT before it floated, here in Oct 2017, with us both having reservations, and wariness of new issues. Although I thought the historic growth looked good. Both Graham & I were worried about problems emerging after the float, as seems to happen quite often, sadly.

Although I decided to have a bit of a punt on it, but my application at the float was scaled back to zero - a stroke of good luck as it turned out. Although there would have been a 46% profit to be banked for flippers, 2 months after the float. It was, at least initially, apparently a successful float.

The share price then drifted down in the spring of 2018. The first bombshell occurred on 19 June 2018, with a nasty profit warning, which Graham reported on here. I'm reading that now, to refresh my memory. A dramatic deceleration in growth, and a cautious outlook, saw the share price halve on the day.

Here we are today, with another profit warning, and the share price halving again.

Profit warning today - this is an H1 update, for the 6 months ended 25 Aug 2018, plus guidance for the year ending 23 Feb 2019.

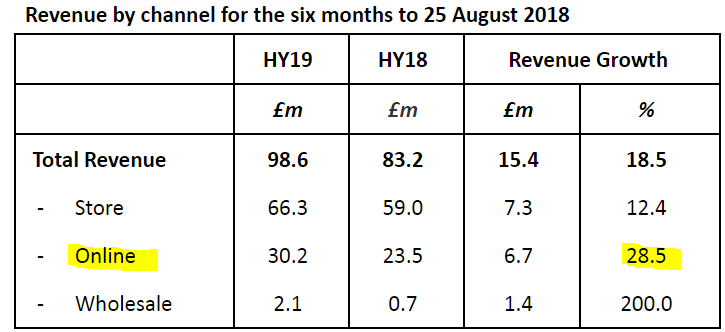

A table for revenue growth is given. However, bear in mind that the company has been opening new stores, so in isolation this data is meaningless. Although I am quite impressed with the online revenue growth of 28.5%. I'm already starting to wonder whether this might be an interesting eCommerce business, with some stores attached (66 stores at period end)?

It's profits that matter, not revenues, and H1 is set to be loss-making;

Footasylum expects to report a small adjusted EBITDA loss for the Period reflecting a lower gross margin and higher costs from investment in the Company's operations.

That sounds pretty bad to me. This is a retailer, which is spending a lot of cash on capex, to expand its retail estate. So they can't just ignore the depreciation charge. If you cannot generate a positive EBITDA, then you shouldn't be opening any more shops - unless landlords offer amazingly low rents on new sites. This really calls into question whether this business is viable, long term? Although I'm not sure what the seasonality is like - perhaps H2 might be profitable?

There's a £2m windfall (excluded from the above comments) from surrendering a lease in Birmingham - helpful for cashflow, but a one-off.

Outlook - I'll summarise this;

- Weak consumer sentiment on High Street

- May & June performance was positive

- July & August "more challenging"

- Unforeseen delays in new store openings

- Online & wholesale positive

Overall;

Despite an ongoing programme of investment to drive sales, Footasylum's revenue growth for FY19 is now expected to be below current market expectations. As a result of this, and a lower overall gross margin from a higher amount of clearance activity in stores, the Board now expects adjusted EBITDA for the full year to be significantly lower than previous guidance, at less than half of the FY18 adjusted EBITDA of £12.5 million.

Less than half, at the adjusted EBITDA level, combined with an increased depreciation charge due to new store openings, means that it looks to me as if profits are going to be all but wiped out this year.

Looking back at last year's (52 weeks ended 24 Feb 2018) numbers;

Adjusted EBITDA: £12.5m

Adjusted PBT: £8.4m

The difference between those numbers is £4.1m, which is mainly due to the £3.8m depreciation charge (easy to find, near the top of the cashflow statement). Note that the prior year saw a £2.8m depreciation charge, so it increased by £1.0m.

If we assume that, due to new store openings, the depreciation charge might increase by a similar amount of £1m this year, to £4.8m (my estimate), then combine that with a "less than half" estimate for EBITDA this year, of say (my estimate) £5m, then I reckon the company is indirectly telling us that it's only likely to achieve breakeven this year. Clearly that's a horrendous performance.

Broker update - helpfully, there's an update on Research Tree today from the house broker.

You probably think that I looked at the broker note first, before writing the above, but in fact I didn't. So it's a coincidence that the broker has lowered its adjusted EBITDA forecast for this year to the identical figure I came up with, of £5m.

Although rather than breakeven, the broker update suggests that the business will actually be loss-making this year, with forecast adjusted PBT negative at -£1.9m. This is worse than I thought. Small losses are also forecast for the following 2 years.

Expansion & capex - this is what really worries me. When a retailer is performing badly, and moves into losses, as is happening here, the sensible thing to do is to stop opening new stores.

FOOT is doing the precise opposite;

The strategy to deliver additional store upsizes alongside new store openings is also progressing, with six new store openings and further upsizes expected to be completed by December.

It could be that the leases have already been signed (hence not possible to reverse the decision to expand)? Also, without knowing the details of each individual site, it's impossible to make an accurate judgement on whether the expansion makes commercial sense or not.

I recoiled at the scale of the capex being undertaken by a business that is now loss-making. How on earth does this make sense? I would want to see management conserving cash, and fixing the performance of the existing stores, before opening any new ones. But again, that depends on the lease terms being negotiated - if landlords are throwing them amazing deals, then expansion could make sense. The trouble is, this vital information is not given to us.

The Board believes that upsizing certain stores will materially improve Footasylum's existing strong brand relationships while enhancing the consumer experience in store.

Reflecting this investment, capital expenditure and associated depreciation is expected to increase in the medium-term, with capital expenditure peaking at around £16 million in FY19.

Balance sheet - The problem is this. Last year's balance sheet looked really good, with £26.8m of net current assets. Capex this year of £16m is likely to eliminate the cash pile (£11.4m last year), and hence £16m of net current assets will shift upwards into fixed assets. Plus, store expansion means that inventories will need to increase further - although probably offset by an increase in trade creditors.

Therefore, I reckon the arguably reckless rate of store expansion is now turning a strong balance sheet into a weaker one. I wonder how much support the bank will be prepared to give, as I reckon the company will now be needing an overdraft to cover troughs in the cashflow.

The company hints at cash starting to become strained;

Overall the Company's year end cash position is expected to remain in line with market expectations as a result of the exceptional income and working capital management.

It's not stated what market expectations are for cash. Looking back to an old research note, the forecast was for only £1.1m year end cash. For the size of business, that's not enough, so it would definitely need an overdraft facility for day-to-day volatility in cashflow. Or maybe longer payment terms could be negotiated with suppliers?

I've had a quick look through the last Annual Report, by doing CTRL+F and searching for the word "bank". Note 19 indicates that the company has an (unused) £30m overdraft facility, expiring on 6 July 2021. The problem with that, is with adjusted EBITDA now forecast at only £5m for this year, the existing facility would now be about 6 times. That's way above what banks are usually comfortable with (usually 2-3 times). Therefore I imagine bank facilities are likely to be reduced at some point.

Bank covenants - I've searched the last Annual Report for figures, but the word "covenant" is only mentioned twice. So, yes the company does have bank covenants, but I don't know what they are. The usual key ones are Net debt:EBITDA, and interest cover.

In my view, the situation doesn't look desperate, but I would take it as a given that the company would not be able to (nor would be wise to) fund any further expansion from bank facilities, due to the risk of them being withdrawn.

Looking at the worst case scenario, of a further deterioration in trading, and the bank withdrawing borrowing facilities, then a placing would be needed in that scenario. What price though? In a really negative situation, we could be looking at existing shareholders being heavily diluted. So why take that risk?

My opinion - I always try to establish whether a profit warning is something temporary & fixable (a good profit warning, which might be a buying opportunity), or whether there's something more serious, and structural, going wrong.

It seems obvious to me that FOOT's problems are in the latter category.

We all know that retailing is brutal at the moment. Costs are rising, and business is leaking away online. Meanwhile property leases are like dead weights - with rents fixed too high, there's no way out from a loss-making shop, other than a CVA or pre-pack Admin.

The High Street is entering a period of massive change. Rents have to come down drastically, in order to allow existing retailers to compete & survive. I don't know what lease liabilities FOOT has already signed up to. It appears that management have been wildly over-optimistic in assessing market conditions to date.

Is this business viable? Possibly not, unless it can get its rents down, or somehow stimulate demand & improve margins.

Overall, I think this share is now uninvestable. Things seem to be going badly wrong, and it's difficult to see what will change for the better. Therefore this is one falling knife that I'm keeping well away from.

The bull case is basically hoping that management can turn it around. That may happen, but it's not a very sound basis for investing in anything, unless there's some clear evidence that a turnaround strategy is actually working. The opposite seems to be the case here, at least for now.

I wonder if the business expanded too fast? It's very difficult to manage rapid growth, and lots of new store openings. Systems & people often fall over in rapid roll-outs, and there's some evidence of this here. It looks a bit of a mess overall, with the original bull case of a fast-growing, profitable competitor to JD Sports, now long gone. It's important not to anchor to the old share price, and imagine that it's now cheap.

The fundamentals have deteriorated so badly, that the 74% fall from the float price still doesn't make it cheap in my view. I'm even asking the question whether this share is worth anything? If it could jettison the shops, and operate online only, it might be worth a look. Trouble is, I'm worried that younger people in particular (FOOT's clear target market) are doing things on their smartphones increasingly, so why would the down-trend in High Street performance change for the better?

I'm taking a leaf out of Graham's book, and just adding brief comments on companies that don't particularly interest me at the moment, as follows;

Vertu Motors (LON:VTU)

Share price: 50.25p (up 2% today, at 14:07)

No. shares: 379.3m

Market cap: £190.6m

There's a brief update today, from this chain of car dealerships.

It's trading in line with expectations.

Whilst I like this company, due to its strong balance sheet with loads of freeholds, and modest P/NTAV of only 1.1, it's difficult to see what upside potential there is for the sector whilst we have all this Brexit uncertainty.

My opinion - I suppose this might be a good share to grab quickly if a deal on Brexit is announced. There again, the forward PER of 8.75 doesn't look especially cheap. There might be a better opportunity to grab a bargain if/when everyone's really panicking about Brexit. Longer term, any trade hiccups are obviously going to get resolved - they always are. If both sides want free trade, then that is the most likely outcome. For now though, I'd rather just sit on the sidelines with shares like this, that have a lot of exposure to UK/EU trade.

Tax Systems (LON:TAX)

Share price: 97.5p (up 3.7% today, at 11:51)

No. shares: 80.7m

Market cap: £78.7m

Interim results are out today. It's a small software company, providing specialist tax software for accountants & companies.

It looks vaguely interesting. I've looked at it before, and decided it's not really my type of thing. However, here are a few brief comments;

Positives

- Upbeat commentary on expansion - e.g. developing new software for VAT

- Organic revenue growth of 9%, plus acquisition-led growth

- Recurring revenues of 89% of total - so an annuity type share perhaps?

- Very low customer churn, with 95% customer retention

- Tax is becoming increasingly complex, driving demand

Negative

- Horrible balance sheet with massive acquired intangibles

- Too much debt for me (net debt of £17.5m). Although net debt has reduced £3m over the last 6 months

- No divis

- Forward PER of 21.5 looks aggressive, considering there's also a fair bit of debt

My opinion - it's not for me, but readers who like niche software businesses might want to take a closer look.

Gamma Communications (LON:GAMA)

Share price: 901.5p (up 5.6% today, at 13:23)

No. shares: 93.87m

Market cap: £846.2m

Readers have asked me to look at results today from this provider of cloud communications services. This is not a sector I understand, nor have I ever looked at the company before. So I can only give a very rough review of the figures out today.

The numbers look good (this is for H1, 6m to 30 June 2018);

- Revenues up 18.3% to £137.6m

- Gross margin up from 44.4% last time to 45.3% - I like a combination of growing revenues and growing gross margin, due to the leveraged benefit to the bottom line

- Adjusted PBT up 28.1% to £15.5m

- High recurring revenues

- Balance sheet & cashflow statements look OK to me, I don't see any nasties in either

There's only one problem - it has a market cap of about £840m at the time of writing, with the shares up 5.6% to 902p.

So in a nutshell, the company's performing well, but the shares are expensive.

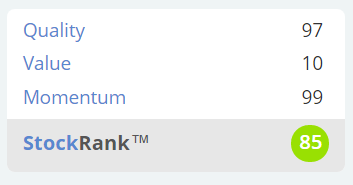

This is neatly encapsulated with our StockRank system, where it comes out with a high overall score, despite the lofty valuation;

My opinion - I'm neutral, as it's not a company or a sector that I understand.

The results look very good, and the high valuation reflects that.

I've had a quick look at the update today from WANdisco (LON:WAND) - although this is a share that I've covered before, I really have no idea how to value it, so have decided to drop coverage of it.

There's nothing much I can add, other than that it's still jam tomorrow, loss-making, and hugely expensive. It claims to have some unique software for data replication.

Future (LON:FUTR)

Share price: 450p (up 6.0% today, at 13:53)

No. shares: 81.4m

Market cap: £366.3m

There's a positive update today from this specialist magazines & media company.

... full year EBITDA is expected to be ahead of current market expectations.

The Group continues to show good revenue growth in all our core areas and our cash conversion continues to be excellent.

This is an acquisitive group, and I've had some concern over its balance sheet in the past. That doesn't necessarily mean it will make a bad investment of course.

This share has been an excellent performer since early 2017, rising 4.5 times.

It looks potentially interesting. Not my cup of tea, but possibly worth a closer look, especially since the update today sounds positive.

Right, that's me done for today! See you in the morning.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.