Morning folks,

The assortment of updates today looks like this:

- Trakm8 Holdings (LON:TRAK) - final results (shares down 18%)

- Xaar (LON:XAR) - trading statement ( shares up 5%)

- ATTRAQT (LON:ATQT) - trading update

- Frontier Smart Technologies (LON:FST) - statement by Science (LON:SAG) on 35p bid

Trakm8 Holdings (LON:TRAK)

- Share price: 18.5p (-18%)

- No. of shares: 50 million

- Market cap: £9 million

Trakm8 Holdings plc (AIM: TRAK), the global telematics and data insight provider, announces its final results for the year ended 31 March 2019 (FY-2019).

I've never invested in Trakm8 Holdings (LON:TRAK) or in the "good" telematics company, Quartix Holdings (LON:QTX). But I've analysed both of them in some detail before - see my review of Trakm8's results last year, when the share price was 94p.

Trakm8 shares once enjoyed an enormous valuation, at 400p. But the reality of poor cash generation and volatile performance has squeezed the life out of the shares. It is now below our £10 million market cap requirement for coverage, so this could be the last time I look at it.

Today's results are predictably bad: everything is going the wrong way. The company is loss-making and net debt has increased to £5.6 million.

What's gone wrong?

"Sales related challenges and contract delays" - the products aren't required urgently enough by customers, in other words.

Outlook

Trakm8 is looking for a low double digit (i.e. 10%-12%) increase in revenue and "small adjusted profitability" in the current financial year.

It again says that great things are expected in the second half of the year.

FY 2020 is "more significantly second half loaded than ideal", due to the launch of the AA Smart Breakdown service and some contract wins.

Jam is always just around the corner! Investors should note that H2 last year produced no jam, despite the company's expectations.

The Chairman acknowledges that previous expectations were set too high, and promises that things will be different this time around:

Given the disappointing failure to predict the outcome last year, it is prudent to be tempered in our outlook but current market expectations are for a relatively modest recovery (low double digit growth) in our revenues and very modest adjusted profitability for the financial year as a whole. The Board is confident that this will be achieved.

My view

I remain deeply cautious in relation to this company, for similar reasons to last year. Let's update my analysis under the same headings as last time:

Balance sheet

Equity has increased slightly to £22.1 million, thanks to investors putting more money in - good.

However, tangible equity has halved to £1 million.

Net debt has increased to £5.6 million and I note that the company says it has drawn £4.4 million from a £5 million facility with HSBC. It confirms that it had cash of £1.2 million and undrawn facilities of £650k at year-end, i.e. spending power of £1.85 million.

That doesn't sound like a lot of headroom to me, but Trakm8 says it "has sufficient cash resources and ample headroom for the foreseeable future", even in adverse trading conditions.

I'm not convinced. Maybe for 12 months, but surely another year of heavy losses and cash burn would leave it in a precarious situation? Trakm8 also discloses:

On 27 June 2019 the Group entered into an Amendment and Restatement Agreement with HSBC that amended the covenants on both the term loan and revolving credit facility, following the waiver of existing covenants during the year.

I doubt that HSBC is very pleased about waiving and amending covenants. Raising more equity might be a good idea, to prevent financial distress.

Cash flow

Cash generation was disastrous this year. Net cash from operations was negative, and then large development costs sucked even more cash out of the business than last year.

I noticed before that the company makes very heavy use of R&D tax credits. Without these tax credits, cash flow would have been even worse by another £1 million this year.

Creating and amortising intangible assets

The pile of intangible assets continues to grow. I admitted last year that this is a key point of uncertainty: if you think that Trakm8's intellectual property is valuable, then you might see the current share price as a huge buying opporunity. The company itself says:

Trakm8 continues to focus on owning the intellectual property ('IP') we use in our solutions, and we see this as one of our key competitive advantages. Telematics systems are complex; but because we own all the elements that encompass a solution (with the exception of the mobile networks) we have the ability to understand and resolve problems more easily than our competitors.

From the point of view of a simple financial analyst, what I can see is cash going out the door every year, and I can't see much evidence that the IP is worth a lot.

In FY 2019, Trakm8 once again capitalised more development costs than it amortised. In other words, it claims that the IP on its balance sheet is getting more valuable, thanks to all of its development spending.

£3.4 million was spent (£2.8 million internally and £600k on an external purchase), while only £1.5 million was written off.

Exceptional items

The company again makes heavy use of exceptional items to massage the adjusted numbers.

It has added two new categories of exceptions: "new product component refit costs" and "exceptional communication correction costs" - what on earth?

Reading the details, it sounds like the company messed up in a couple of different ways, and then decided to put the costs down as "exceptional". But what assurances do we have that costly mistakes won't be made in future - not much, I reckon!

(I've had to delete the picture here due to formatting difficulties.)

So we have a small, loss-making business, with a market cap of £9 million, which says that it had more than £3 million of exceptional costs over the past two years. It paid out nearly half a million pounds worth of share-based bonuses over this period, and these are also excluded from "adjusted" operating profits. Total adjustments to operating profit over the past two years add up to nearly £4 million.

For what it's worth, director remuneration has been running at around £1 million/year, too.

Put it all together, and you get a picture of a very poor-quality business. It might turn around, but there are many reasons to think that it might not.

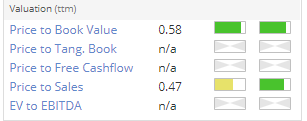

Stockopedia calls it a Value Trap, with "Value" being its only redeeming characteristic:

Personally, I don't even see it as having much "value" to speak of, since its intangible assets could be written down at the stroke of a pen.

Xaar (LON:XAR)

- Share price: 94.2p (+6%)

- No. of shares: 78 million

- Market cap: £74 million

Xaar plc ("Xaar" or the "Group"), a world leader in industrial inkjet technology, provides its scheduled trading update for the six months ended 30 June 2019

This is another share which used to have a mighty valuation. Xaar was a FTSE-250 member at one point!

Trading in H1 is in line with expectations.

Revenue is expected to come in at £23 milliion. This includes a £4 million reduction from some inventory being sent back to the business to be reworked, due to age.

H1 revenue last year was £35 million, including £10 million of "one-time royalties".

So if you exclude the inventory reversal and the one-time royalties, you can get to an "underlying" revenue increase this year (from £25 million last year to £27 million this year). Maybe that's reasonable?

Xaar makes industrial printheads, which I think is fair to say is an unglamorous industry. I've kept just half on eye on this story, believing that valuation might overshoot to the downside as it goes deeper into small-cap territory, due to lack of interest among investors.

It reports today that underlying trading has stabilised in printheads. New products are performing extremely well in terms of year-on-year sales growth, though we need to balance this against sales declines in older products.

In addition to printheads, there are a Systems business doing very well and partnership activities to develop 3d printing.

Cash sits at £21.6 million, almost 30% of the market cap.

My view - I continue to believe that this could make a nice purchase at the right price. However, it is forecast to remain loss-making until at least 2021 and so I am looking for more evidence of underlying growth and a restoration of profitability before swinging the bat at this one.

ATTRAQT (LON:ATQT)

- Share price: 35p (+3%)

- No. of shares: 180 million

- Market cap: £63 million

This makes "SaaS solutions that power exceptional online shopping experiences". Clients have included ASOS (LON:ASC) and Boohoo (LON:BOO). See the Customer section of its website.

Trading is in line with expectations and the integration of acquired businesses is proceeding in accordance with plans.

And more good news: it's getting multi-year contract renewal from customers, i.e. revenue should be more predictable for future periods.

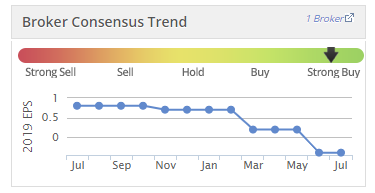

My view - valued at 3x this year's sales and with EPS forecasts having nudged down over time, I'd be cautious about this.

On the other hand, if it does hit next year's forecasts then it will make it to breakeven. Maybe there is a case to be made for it?

Frontier Smart Technologies (LON:FST)

- Share price: 35p (-1.4%)

- No. of shares: 40.7 million

- Market cap: £14 million

Science (LON:SAG) restates its case and says it does not anticipate increasing its 35p offer for FST.

As I said last week, FST looks vulnerable to this 35p offer. The statement by FST on Friday made no particular promises and provided no details in terms of the alternative joint venture plan, and Science is unimpressed:

"...in the opinion of Science Group, Frontier has repeatedly taken actions which have had the effect of frustrating the proposed acquisition of Frontier by Science Group. This latest "concept" of a non-specific strategy being proposed by the Frontier Board can only be regarded similarly"

I can't disagree with this and am leaning heavily in favour of the idea that the 35p bid would be a reasonable outcome for FST shareholders.

I can't see anything else that is of interest today, so will leave the report there. Mondays can be quiet sometimes - oh well!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.