Good morning, it's Paul here. I have a lunchtime meeting in London, so will only be able to rattle out a few sections early. I'm hoping that Graham might then be able to add a bit more this afternoon.

I added more sections to yesterday's report last night, so here's the link to that.

Let's start with a profit warning;

Image Scan Holdings (LON:IGE)

Share price: 4.25p (down 38.2% today, at 08:21)

No. shares: 136.0m

Market cap: £5.8m

(at the time of writing, I hold a long position in this share)

Trading update (profit warning)

Image Scan (AIM:IGE), the specialist supplier of X-ray screening systems to the security and industrial inspection markets provides a trading update for the year to 30 September 2018 ("FY18").

This is a tiny company, below our usual market cap size. However, 2 readers have already mentioned it this morning, and I hold personally (more's the pity), so I naturally want to look at it, and see what's gone wrong.

The company made a series of positive updates over the summer, which drove the share price up substantially. This also allowed a big holder to exit, via a discounted secondary placing done through the house broker. I took part in that placing, thinking I was getting a bargain. They tried first to sell at 10p, then reduced the price to 8p, when the market price had been around 11-12p. So an apparent bargain. Since then, the share price has dropped by almost two thirds.

There was the first sign of trouble, which I mentioned here on 6 Dec 2017, with the company referring to delivery dates not yet being finalised on a proportion (not stated) of the order book. A reader mentions in the comments that he sold out at the time, sensing trouble ahead. That was a great move. Sadly I didn't have that option, due to my having a position size that's too big to sell in the open market. So I'm in for the duration here.

Profit warning - today the company drops a bombshell, that a £1m order is likely to be cancelled (on unknown terms). That's a material figure - the company did £5.0m revenues last year, and £3.3m in 2016.

Here's the key bit in today's announcement;

The order was made up of largely standard portable X-ray products and, though the Board is confident these units can be sold to other customers, this may not occur in FY18.

Whilst the Board expects FY18 sales to be weighted towards the second half and the Company to remain profitable for the financial year, given this development the Company now expects its trading performance for FY18 will be materially below current market expectations.

The dreaded H2 weighting - so that means interim results are probably likely to be poor. Although remaining profitable for the whole year suggests that this is a setback, but not a disaster.

In terms of financial impact, this means inventories are likely to be increased, and that's bound to put a strain on cashflow.

Balance sheet - is quite strong. By my reckoning, I don't think this issue is likely to trigger a financial meltdown. Inventories were already quite big (probably including some or all of the disputed order), and the company had £1.25m in net cash as at 30 Sep 2017. The current ratio was 1.81, with a working capital surplus of £1.8m (i.e. current assets exceed current liabilities by this amount).

Therefore it looks to me as if today's setback probably won't trigger any financial problems. The balance sheet looks strong enough to absorb the loss of this contract.

My opinion - incredibly disappointing. I thought it was strange that the company did a series of positive updates in the summer. It's difficult to shake off the feeling that those of us who took part in the 8p secondary placing were stitched up!

That said, the share price has fallen so much now, that I think risk:reward is looking favourable again. It expects to remain profitable this year, and has interesting new products which had been selling well until today's bombshell. At this price, I certainly won't be selling, and could even be tempted to top-up.

That said, the lack of liquidity means that anyone holding more than a small scrap of shares is locked in for the duration, whether they want to be or not. I very much dislike tiny, illiquid shares, for this reason. You buy them in the hope that the odd one will be a multi-bagger, but given that you can't exit when something goes wrong, risk:reward can actually be very poor with the smallest shares on the market.

Comptoir (LON:COM)

Share price: 19.5p (up 2.6% today, at 08:52)

No. shares: 122.7m

Market cap: £23.9m

Comptoir Group plc, the owner and/or operator of Lebanese and Eastern Mediterranean restaurants, is pleased to today announce a pre-close update for the 52 week period ending 31stDecember 2017.

I'm not a fan of this small restaurant group. The format seems to me like a glorified kebab shop. There's one at Gatwick Airport, and the rest are mainly in London.

I was expecting another profit warning, given how dire the casual dining sector is at the moment - due to over-supply, and cost pressures. However, this is surprisingly good;

Despite a difficult market backdrop, the Directors are pleased to report that trading for the 52 weeks to 31st December 2017 was above market expectations. The Company had a strong trading performance during the second half of 2017, ending in a busy December.

As announced within the interim results of the Company, published in September 2017, the Company has focused on controlling its costs and improving its operational efficiencies and margins where possible. The Directors expect this focus to continue throughout 2018.

Now the difficult bit - what are market expectations?! Since the regulators (may their headphones snag on every door handle) imposed MiFID II, we can't get hold of much broker research. For this reason, I implore companies and their advisers to clearly state in every trading update what they believe market expectations are (in a footnote). Some companies already do this, and there's no valid reason why it cannot be done. Without this crucial information, many investors are left in the dark, and are therefore not likely to buy the shares.

Stockopedia (whose data comes from Thomson Reuters) shows a forecast net (i.e. after corporation tax) loss for 2017 of -£0.7m. So beating that number (by how much, we're not told) doesn't necessarily mean the company is profitable.

Still, at least things haven't got any worse.

New sites - 3 more were opened in H2 of 2017. Given that the company is struggling to reach profitability, is it wise to roll out a format that isn't really working very well? If they're getting amazingly low rent deals, then maybe, but we're not told rental terms. It now operates 26 restaurants, with another 3 franchised sites. Two more new sites are planned for 2018.

Sale of CPU - I think they mean a building, not a computer chip. Central processing unit, is my guess for the meaning of CPU in this context. Companies & advisers should avoid abbreviations in announcements, since not all readers will necessarily know what they mean. This has raised cash of £2.6m.

EDIT: I've just looked back at the announcement of 19 Oct 2017 which says that;

Completion of the sale is expected before the end of the current calendar year.

Therefore it looks likely that the £4.5m net cash below includes the proceeds from this disposal.

Net cash was £4.5m at 31 Dec 2017. It is not stated whether this includes the £2.6m from the CPU sale, or not. Why introduce such an ambiguity? Does nobody sense-check these announcements before they're published? (see edit above)

My opinion - if you fancy buying into a small restaurant chain that's struggling to operate at breakeven, then this could be your chance! Valuations in the sector have come down to more reasonable levels, although the £23.9m market cap here values the business at about £824k per site. This seems way too high to me, given that the business doesn't make a profit overall. Maybe things will improve in future, and its financial position looks fairly sound. I'm not interested.

Not a very successful float, since June 2016;

Spectra Systems (LON:SPSY)

Share price: 123p (up 18.8% today, at 09:40)

No. shares: 45.4m

Market cap: £55.8m

Spectra Systems Corporation, a leader in machine-readable high-speed banknote authentication and brand protection technologies...

There's more good news for shareholders here, this company seems to be on a roll;

... announces that it received confirmation yesterday from its licensee for covert materials supplied to 18 central banks that the royalty component of the licensee's payments will be higher than previously expected for 2017.

As a result, Spectra estimates that its profits for the year ended 31 December 2017 will exceed market expectations.

No indication of the amount is given, so we're left in the dark, to guess at the financial benefit of this good news.

Broker update - thankfully the house broker is on hand to give us some guidance. House broker notes are treated as commissioned research, hence can still be distributed under MiFID II (may the regulators' socks rotate just enough to be uncomfortable)

Estimated profit for 2017 is increased by 18% to $4.0m, 8.6 US cents EPS. That's 6.0p EPS for 2017, and the same forecast for 2018. At 123p that looks like a PER of 20.5. To determine whether that's a reasonable price or not, we would have to find out whether earnings are sustainable, and likely to increase further, or not? I haven't looked at the company closely enough to form a view on its future prospects.

Balance sheet - is excellent, with plenty of cash.

Dividends - nothing as yet, but I see that quite generous divis are forecast to start shortly.

My opinion - this looks an interesting company, worth a closer look. The key issue is understanding its products & markets, and determining how well they are likely to sell in future. Although reading that back to myself, that's the key issue with every share!

Spectra seems to be generating out-performance at the moment from one key customer, which is obviously more risky if something were to go wrong. It sounds like a big customer too, supplying 18 central banks. I wonder if it's De La Rue (LON:DLAR) ? Major customers like that can act as very good references for selling to other customers. All in all, it looks intriguing.

T Clarke (LON:CTO)

Share price: 78.4p (down 6.0% today, at 10:11)

No. shares: 41.8m

Market cap: £32.8m

TClarke plc ("TClarke" or the "Group"), the Building Services Group, announces a year end trading update for the financial year ended 31st December 2017.

This business specialises in complex electrical & IT installations, e.g. for office blocks under construction or refurbishment.

This is how trading updates should be done by all comapnies:

The Board is pleased to report that the expected outcome for the year is in line with current market expectations, which are an underlying profit before taxation of circa 6.5m and revenues in the region of 310m.

It's so simple, why can't all companies do this? I wish they would. Tell us how you've performed versus market expectations, and then tell us what those expectations are. Simple, clear, everyone can understand it, and we don't have to struggle to find broker forecasts, which are often now unavailable.

Cash position looks good;

After an aggregate 3m investment in the ETON acquisition and at our manufacturing facility at Stansted, the Group's cash generation remains robust with the year end net cash position improving by 27% to 11.7m, the strongest closing balance recorded since 2009 (31st December 2016: 9.2m).

Order book - down slightly, but I like the comments about tendering sensibly. We don't want the company to "do a Carillion" and get into bother from under-pricing contracts;

Our forward order book as at 31st December 2017 has strengthened to 337m compared to 330m at 31st December 2016. This has eased back from the record high reported during the course of 2017, a reflection of our selective approach to tendering rather than lack of opportunities.

My opinion - I don't touch any contracting businesses any more, so it's not for me.

Right, I have to dash, for a lunchtime meeting in London. Hopefully Graham might be able to add some extra section(s) this afternoon.

Regards, Paul.

Hi, Graham here picking up the baton to add to Paul's article.

Alumasc (LON:ALU)

- Share price: 159p (-8%)

- No. of shares: 36 million

- Market cap: £57 million

We've occasionally written on this supplier of premium buildings products before.

The operations are split in the following categories: Solar Shading & Architectural Screening, Roofing & Walling, Water Management, Housebuilding.

A year ago, at 175p per share, I said the stock was in value territory at a PE ratio of c. 9x.

Offsetting this was a £33 million pension deficit, requiring annual payments of £3.2 million - quite a lot of forecast earnings.

Overall, I was reasonably impressed with the company's performance.

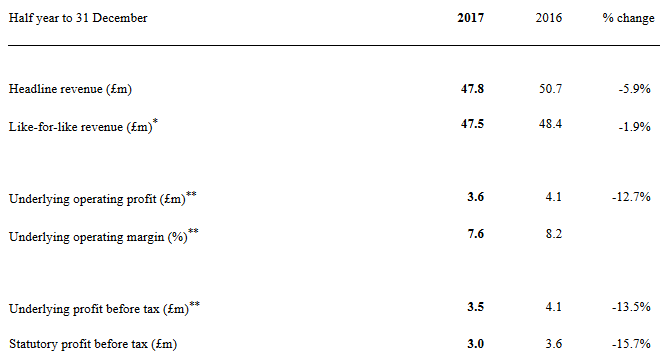

Fast-forward a year, and the numbers have deteriorated a bit:

Like-for-like revenue excludes revenue from a division which was sold in July 2017 - fair enough.

Underling profit excludes some "one-off" costs and gains - these seem like reasonable adjustments to look at the underlying business, but you'll see from the above table that they amounted to negative £0.5 million both this year and last year. They were negative £0.6 million the year before that. Perhaps we should just leave them in, since they tend to crop up most years?

Alumasc describes the performance as "satisfactory" versus a flat UK construction market and input cost inflation.

We are guided for a second half weighting. Checking last year's interim results, this was promised last year too!

Checking what happened last year, the promised second-half weighting did indeed materialise:

- H1 underlying EPS 9.1, PBT £3.6 million.

- Full-year underlying EPS 20.1, PBT £8.1 million.

So when Alumasc guides for a better second half this time around, due to "large project phasing", I'd say this is quite credible.

On that basis, maybe PBT will again approach £8 million for the full-year?

Brokers were previously forecasting PBT of £9.5 million, which looks a bit aggressive to me at this stage.

UK revenues are up 1% versus a flat market, so maybe there has been a small increase in market share. Revenues are a bit lumpy, so we can't expect market share to go up strongly every period.

In terms of the operating divisions, the biggest contributor to profit is water management

This division's revenue are up 4% year-on-year, with slightly reduced operating profit thanks to lower sales of its higher-margin drainage products and higher input costs.

Order book is down by a few million to £25 million.

Acquisition

There's an £8 million acquisition of a drainage business, paid from existing banking facilities (Alumasc is actually paying £14 million, but will benefit from the target's £6 million in net cash).

The target made £1.4 million in PBT from capital invested of £3.2 million. Not only does this sound like a good deal in terms of the earnings multiple, it also sounds like a high-quality business - check out that ROIC!

Outlook - the outlook is in line with previous expectations. Which suggests that £9.5 million in PBT is still on the cards.

My opinion

I had a positive impression of Alumasc the first time I covered it, and I still do.

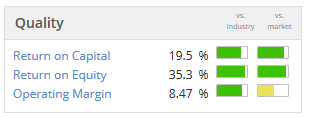

I like its intense focus on margins. Though margins aren't very high, it has nevertheless achieved good returns:

With this acquisition, it has found a productive way to use its cash balance. The new company also earns great returns on capital, and hopefully the combination with Alumasc can be even better than the sum of its parts!

You have to add about £30 million to the market cap to account for the pension deficit, so the valuation is not that cheap. And revenues are bit lumpy, leading to this last reduction in half-year sales. But it looks like a decent company all the same, so maybe there is room for it re-rate higher over time.

I'm not seeing too much other news to comment on, so I'll call it a day there.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.