Good morning!

There is no shortage of company announcements today, so I'm going through them personally at the moment. As usual, I'm happy to take requests in terms of which ones to cover here.

My final list is as follows:

- Conviviality (LON:CVR)

- Safestyle UK (LON:SFE)

- Strix (LON:KETL)

- Cambridge Cognition Holdings (LON:COG)

- Venture Life (LON:VLG)

Also, Paul updated yesterday's report with more sections. You can read that here.

Cheers,

Graham

Conviviality (LON:CVR) (suspended)

Update on progress and potential equity fundraise - Conviviality, the alcohol wholesaler and retailer produced an update at 6pm last night.

In short, it looks like a horror show for existing shareholders. The only ray of hope is that we still don't know at what price the new money will be raised, so there is still a chance that the forthcoming dilution will not be too severe. But it is now inevitable that those who take part in the forthcoming fundraise will end up owning the majority of the company.

If you remember the recent timeline, Conviviality discovered a £30 million tax payment coming due shortly and that it hadn't made provision for. This came after an error had led to the company miscalculating its profit forecasts, and trading margins had weakened. The shares were suspended and the CEO stood down, though staying on to help with the transition.

Originally, I thought that the company might only need to raise £30 million, plus a little bit more for extra comfort. After all, there was no clue up until recently that it had any short-term funding requirement. The balance sheet wasn't pretty and its lending facilities were maxed out, but it was thought to be profitable.

It turns out that the company needs to raise far more than £30 million. It is looking for £125 million, for the following purposes:

· "Resolve overdue payments with its creditors and return them to normalised trading terms;

· Settle payments with HMRC;

· Repay the Company's £30.0 million revolving credit facility in its entirety; and

· Provide working capital headroom and fund costs associated with the work undertaken to recapitalise the business."

So perhaps the funding requirement looks something like this:

- £30 million HMRC payment

- £30 million to pay back the RCF (I'm assuming the bank has indicated it is withdrawing this facility)

- About £6 million in fees associated with the funding (this remains to be seen)

That leaves £59 million to normalise relationships with creditors and its working capital position.

The company is also trying to raise another €5 million on top (the maximum allowed under EU rules) in an Open Offer. This is a token gesture to private shareholders and others who find themselves shut out of the Placing.

I also wonder about trading losses which might need to be funded.

Let's review the EBITDA timeline:

- 8 March: "Following a review of current year projections, the Company now expects that adjusted EBITDA for the current year will be approximately 20% below current market expectations." (forecasting error and weaker wholesaling margins)

- 13 March: "Further to the Announcement, the Company can confirm that the prevailing market expectations for adjusted EBITDA at the time of the Announcement were a range of £69.1 million to £70.5 million. Based on the guidance provided that the Company expects adjusted EBITDA for the current year to be approximately 20% below market expectations, the Company confirms an expected range of adjusted EBITDA of £55.3 million - £56.4 million."

- 14 March: "The Company's announcement on 13 March 2018 confirmed an expected range of adjusted EBITDA of between £55.3 million and £56.4 million. To the extent that the current situation creates operational difficulties, this may negatively impact the adjusted EBITDA range."

- 22 March: "Assuming the Placing is successful, the Board would expect that the adjusted EBITDA* for the year ending 29 April 2018 to be in the range of £45.5 million to £46.0 million and net debt to be below £100.0 million."

This means that it has taken just 16 days for the current year's expected financial result to worsen by £10 million, having already reduced by £15 million against previous expectations. It sounds like the company is making big sacrifices with customers and suppliers, to keep their business during this period.

With a much lower adjusted EBITDA, the net profit result will be that much lower.

The final sentence is no surprise:

If the Company is unable to raise funds by way of the Placing or otherwise, it is unlikely to be able to trade on a going concern basis.

My opinion

Those who take part in the Placing, presuming that it goes ahead, will end up owning most if not the vast majority of the company. The market cap closed at £185 million on the day before suspension, i.e. before market participants knew about the problem with the tax payment, and before EBITDA was downgraded again.

The Evening Standard (external link) reported 2nd-hand information that brokers were talking about a 10p placing price. That would produce 1.25 billion new shares and reduce the existing shares to a 13% ownership interest.

I'm glad to have covered this stock over the last couple of years - it has been a useful exercise. On my twitter feed, you'll find links to the original articles I wrote about it back in 2016.

If the Placing does go ahead, and if it returns from suspension, I will probably remain sceptical in the short-term. One reason for this is that we will need clarity on new management and a new strategy.

Another much simpler reason is that it will remain debt-laden: the £125 million placing will reduce covenant debt by just £30 million. As of a week ago, the company was forecasting covenant debt of £113 million and total net debt (including its invoice discounting facility) of £150 million by the end of April.

As in the case of Accrol Group (LON:ACRL), I think the initial placing won't be enough to produce a very sound balance sheet, and more funding rounds might be required in due course.

Alternatively, it's possible that new managers and shareholders might decide to reverse out of the previous strategy and start disposing of some subsidiaries, and break up the group. That might be the most sensible thing to do.

Safestyle UK (LON:SFE)

- Share price: 92.4p (+3%)

- No. of shares: 83 million

- Market cap: £77 million

This is a manufacturer and retailer of double-glazed windows and doors.

Its share price was around 300p this time last year, as it has suffered a series of nasty profit warnings over the past 12 months. Competitive forces and fragile consumer confidence have combined to produce a continuously deteriorating outlook. You can find our coverage of Safestyle's profit warnings in the archives.

Paul covered it again in some detail last month (link), and reckoned that earnings would be permanently lower from now on, due to the difficulty of maintaining a competitive advantage in double-glazing. He has been consistently cautious towards the stock, so all credit to him for that.

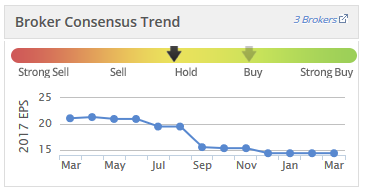

This Stockopedia graphic helpfully shows the effect of new entrants and weakening demand on Safestyle's earnings forecasts:

Thankfully, it's not all doom-and-gloom. The company is still profitable, even if this is at a lower level. And it has historically had a very strong balance sheet. Net cash sat at £11 million at December 2017.

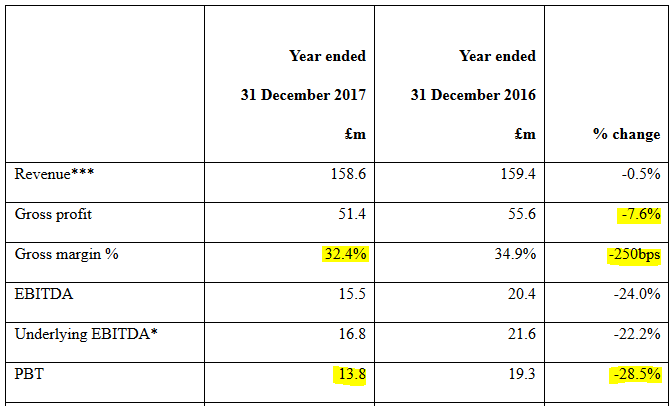

I've added my own market to the financial highlights below:

As you can see, revenue is about flat but the gross profit takes the hit with a lower gross margin. That would be consistent with lower pricing power in a more crowded industry. The company has made generous consumer finance offers to keep business flowing.

The effect of operational leverage then produces a much larger % fall in EBITDA and PBT as compared with the % fall in gross profit.

Scrolling down to the operational highlights, the company interestingly claims to have increased market share by 50bps to 10.7%. I guess there most likely has been been a big sacrifice in terms of pricing in order to achieve this.

Consumers haven't exactly been benefiting either, though. Sales prices have actually risen due to, among other things, raw material prices increasing. A combination of higher prices per unit sold and lower volumes has resulted in the flat revenue result.

Volumes are probably still falling, and were falling at a rate of c. 10% for the market as a whole during the latter part of 2017.

Dividend - the company is ploughing ahead with the same final dividend as last year (7.5p), even though this means that annual dividend cover falls to just 1.2x. I suppose this is one of the benefits of the strong balance sheet - it can afford to pay all profits as dividends, if it wants to.

If earnings fall again this year, as they are forecast to, I wonder if it will plough ahead with the same dividend? Analyst forecasts currently forecast that it will.

Outlook - not good. But the company has extended its factory in South Yorkshire and is determined to keep competing:

As a result of the deteriorating market conditions and the activities of the aggressive new competitor, the Group's order intake in 2018 to date has been weak and our market share is under pressure...

We are well invested in our manufacturing facilities and are focused on enhancing our operations, particularly through the effective deployment and utilisation of technology. Although 2018 is likely to be a year of significant challenge for all market participants, with our leading market position we are determined to participate strongly in a smaller more competitive marketplace.

My opinion

The stock has some positive characteristics - good cash flow generation, financial strength and a strong chunk of market share.

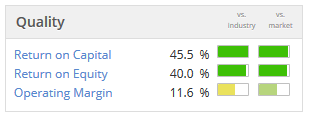

The algorithms are picking up on its positive characteristics, and give it a Quality Rank of 94.

But it sounds like the competition is increasingly eager (or desperate), using aggressive door canvassing operations to snap up leads and heap the pressure on Safestyle.

My personal view is that this is getting into a broad range where I'd consider the shares to be reasonable value. While dividends shouldn't be chased for the sake of it, it's probably worth mentioning that this dividend yield is approaching 13%.

My approach to stocks in highly cyclical and competitive markets such as this is that if I do start snapping them up, I want the market to be experiencing peak gloom when I do.

Some people might believe that we are already at peak gloom now, but I would respectfully disagree. We aren't even in a recession yet!

Strix (LON:KETL)

- Share price: 128p (-1%)

- No. of shares: 190 million

- Market cap: £243 million

This is still a fairly recent float (August 2017). It develops and produces commonly used safety controls in kettles, for which it owns the patents. HQ is on the Isle of Man, and manufacturing takes place in China.

It's numbers are in the billions. Today it reports that it sold its two billionth product late last year. Previously, it reported that its products were being used around the world over a billion times each day.

Its valuation has seemed pretty reasonable and I've been kept back from buying the shares only because 1) it has a modest debt load (probably no big deal); 2) the expectation that something will "go wrong" as it sometimes does for recent flotations; and 3) not yet having an annual report for it, as a publicly listed company.

The third of these worries will soon be out of the way, as we now have preliminary results.

And apart from those concerns, the business model is hard to fault. The main ongoing risk is that copycats, particularly from China, take a bite out of its 38% market share.

Today's numbers are in line with expectations. Revenue increased by nearly 3% and gross margin was up 120 bps to 40.7%.

Market share in "regulated" markets, i.e. those markets which protect intellectual property in the way that a western country might do, is flat at 61%.

In the "less regulated" markets, market share grew to 19%.

In both segments, the overall size of each market is growing and this growth is particularly strong in the less regulated markets, which increased by c. 12% (Strix grew by 16%).

The company does not appear to be resting on its laurels, either. A new range of controls was launched last year, which will therefore be included within a wide spread of new appliances this year.

A table illustrating Strix's controls can be seen here (external link).

Dividend - final divi declared. 2.9p is being paid for the first five months since flotation, and brokers have apparently penciled in 7p for next year.

Balance sheet - net debt is now at £46 million. The financial review says this is set to decline during 2018.

My opinion

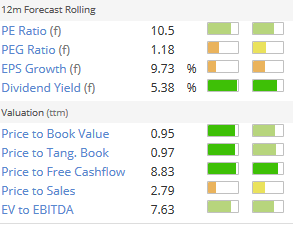

As you might have guessed, I'm increasingly warm towards this share. Stockopedia also reckons its above-average, giving it a StockRank of 73. Check out these value stats:

Having said that, I'm not sure I agree with the price to book value calculations above. The company has been reorganised, so the stats might need be updated with these latest figures. One of the advantages of looking at newly-listed companies is that there can be a delay before the computers figure out exactly what is going on!

I'm tempted to buy a small, starter position in this to get my feet wet, as I build my familiarity with its operations.

Cambridge Cognition Holdings (LON:COG)

- Share price: 97.5p (-14%)

- No. of shares: 21 million

- Market cap: £20 million

This stock is new to me, so I can't pretend to have any prior knowledge of it whatsoever.

It is a "neuroscience digital health company specialising in improving brain health by developing & marketing near-patient cognitive testing technologies for pharmaceutical and healthcare industries worldwide." Simples!

Paul has occasionally covered it in the past. He first covered it in late 2013. He said:

The company is currently loss-making, so is really a punt on their product taking off. It's a computerised testing system for early detection of dementia, so sounds an interesting product. The outlook doesn't sound immediately exciting.

The share price has risen in the four+ years since he wrote that, but not by an exciting amount (from 61p to 97.5p).

Also from that 2013 report was a management quote:

I believe that following our review of the business, and a refocused commercialisation strategy, we are far better positioned to deliver significant revenue growth and to move the Company towards a breakeven position in the next financial year, with significant future successes thereafter.

Unfortunately, profits have been infrequent and small so far.

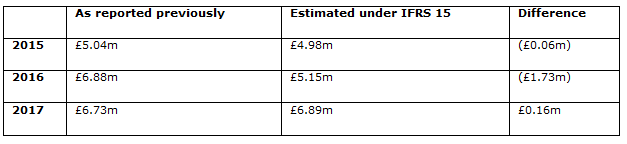

Today's results for 2017 show that revenue declined marginally to £6.73 million and the company made a pre-tax loss of £284k (last year: £116k pre-tax profit).

I don't feel qualified to judge the potential for Cambridge Cognition's products and services, but I do see that reported profits might be less lumpy from now on.

The new accounting standard IAS 15 requires companies to allocate contract revenue to particular performance obligations associated with each contract. As a result, software revenue will recognised over the period of time during which a customer uses the company's software, not at the start of the contract. This does not affect cash flow.

In the company's words:

In previous years, there have been fluctuations in results from one year to the next dependent on whether a year includes a large contract win or not. We believe this new standard will result in a smoother spread of revenue over the life of a contract.

And here's how the change would have affected previous years. While there would have been less revenue from 2015-2017, the missing amounts would gradually show up in future years.

This is to be welcomed, I think. It's a more conservative revenue recognition policy, with less revenue recognised up-front but with more of the company's total revenue being recurring in nature.

Outlook - in Paul's words, the outlook comment is not "immediately exciting". Growth is signaled, naturally. Brokers, for their part, are forecasting an 18% increase in revenue this year to £7.9 million, and a modest profit result of £0.5 million.

The products and technologies developed by the Group over the past five years to supplement the core technology have seen a gradual progression of our offering in line with customer needs. With a clear focus on the needs of patients and healthcare providers in our four core disease states, we have driven testing closer to the patient using wearable and voice activated technologies. This provides a data rich assessment of brain health and provides a detailed assessment of pharmaceutical and non-pharmaceutical intervention in these complex disease areas.

Balance sheet - looks ok. No borrowings.

My opinion - I don't know enough to give a sensible view on whether this might be a good investment or not. I will say that I've seen plenty of early-stage companies which I've felt were almost certainly going to result in wipeout for investors, and this isn't one of those.

It has a particular focus on supporting drug development companies in their search for treatments for Alzheimer's disease, Parkinson's disease, schizophrenia and depression.If you have some money to spare, and want to do something which might improve general mental health, maybe that's enough reason to support this company, regardless of the investment merits?

Venture Life (LON:VLG)

- Share price: 45.5p (+6%)

- No. of shares: 37 million

- Market cap: £17 million

This is another company which is usually unprofitable, as you can see from this chart showing negative EPS:

Today's results show that the company made another loss in 2017, but this was rather unlucky. It actually made a pre-tax profit of £63, but then got clobbered by a £430k tax charge.

Higher revenues and margins resulted in an 18% in gross profits to £6.5 million, which sounds encouraging to me.

I have looked at this company once or twice before. It owns UltraDEX (external link), whose flagship product is a mouthwash that's supposed to be exceptionally effective. I've tried it myself, and had no complaints about it at all, but ended up going back to the more well-known brands.

Venture Life is an active developer of its own products while also being a contract manufacturer for various customers. Contracted products are sold either under the customer's brand name or under a Venture Life name.

The nice thing about owning UltraDEX is that it puts Venture Life in contact with a lot of major retailers, both in the UK and internationally. That gives it a platform from which it can try to sell its complete range of products (food supplements, cosmetics, etc.)

And UltraDEX sounds as if its doing really well, with the "widest distribution in the UK for over 5 years", and "new listings in UK market with important pharmacy chains, to take effect in 2018." Its revenues increased 24% in 2017, and profitability multiplied four-fold.

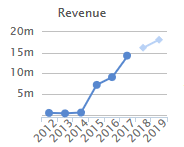

In terms of the big-picture view, Venture Life's revenue line has made great progress:

The CEO's comments are what I would hope for, based on my initial skimming of these results. He thinks the company will be "sustainably profitable going forward", as larger revenues will feed through the income statement and produce a positive net income result from now, thanks to operating leverage.

Total manufacturing capacity has increased and is now double 2017 output, so the company is ready for its next growth phase.

Dividend - it pays a very small, flat dividend, which is unchanged this year.

Balance sheet - the investment case weakens a little when you look at the balance sheet. Net tangible assets are minus £2 million, and net debt finished the year at £6.3 million. The company thinks net debt/EBITDA will fall to 2x this year, as revenues grow.

Some of this debt is quite expensive, in the form of a convertible bond with a 9% coupon attached, and needs to be refinanced next year.

My opinion - overall, I have a positive impression of the company and its prospects. There are still at least a few years to wait until the share starts to look "value" relative to earnings, but my view at this time is that the company has a bright future ahead.

The algorithms remain sceptical, only awarding it a StockRank of 17.

That's it for today! If tomorrow is quieter, I will circle back to some of today's results that I missed.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.