Good morning!

In case you missed it ("ICYMI" - which I keep seeing on Twitter, but have only just realised what it means) - I wrote 4 more sections in yesterday's report last night. So yesterday's report now covers;

LoopUp (LON:LOOP)

MySale (LON:MYSL)

Quartix Holdings (LON:QTX)

Vertu Motors (LON:VTU)

Joules (LON:JOUL)

You might like to revisit that report whilst I'm busy writing today's.

Bonmarche Holdings (LON:BON)

Share price: 101.7p (up 13.7% today)

No. shares: 50.0m

Market cap: £50.9m

Trading update - the market clearly likes today's update, judging by the share price rising 13.7% at the time of writing. This company is a value ladieswear retailer, operating from 322 sites, and online.

This update covers the 13 weeks to 1 Jul 2017, being Q1 in its financial year.

The numbers look good;

- Total Q1 sales up 7.6% vs last year.

- LFL stores sales up 4.2% - I'm impressed, as many retailers are struggling to achieve any significant LFL sales growth.

- Online sales are up an impressive 39%, but bear in mind that is from a low base.

- Overall, trading is in line with expectations for the full year.

You could argue that, as it's only an in line update, then the share price shouldn't really have moved very much, if at all. However, in this case I think there might be an element of relief that things are not getting any worse, after a period of considerable disappointment after the Dec 2015 profit warning. The share price has dropped by two thirds since then, from c.300p to c.100p.

Also the PER, and divi yield, are deep into value share territory. So a positive update should reinforce the market's perception that very generous divis may be sustainable after all.

BON has a solid balance sheet, with net cash.

My opinion - I mentioned in a recent report here, that the Q2 retail sales data from the ONS was actually very good. The total amount spent for Q2 was up 5.6% on the same period last year. For that reason, I'm more bullish on retail shares than previously.

The rule of thumb seems to be that retailers need to achieve c.3% LFL sales growth, at constant margins, to soak up the increased cost pressures, especially wages. BON has beaten that in its Q1 trading. The Directorspeak sounds positive, and all in all shareholders must be feeling considerably encouraged by this update.

My main problem with BON is that its operating profit margin is so low. Therefore it has to be seen as a lowish quality business, that would probably struggle to survive in a recession.

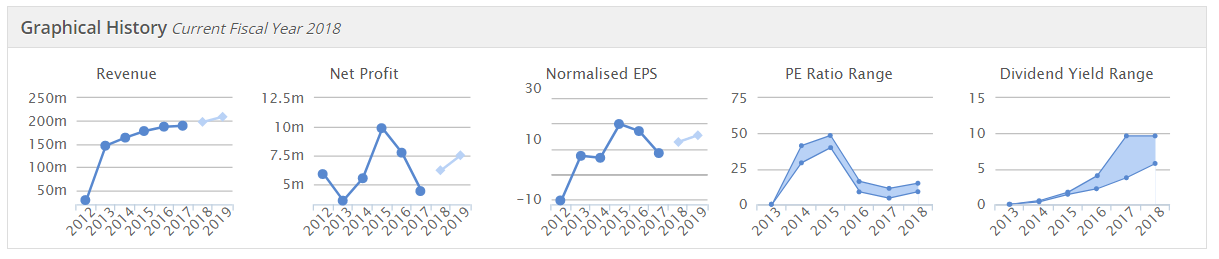

As you can see from the Stockopedia graphs below, profitability is erratic. Although note the divis have become very attractive (assuming they are maintained);

Overall, it's not a company that I would want to invest in. However, after today's update, things are looking better than they have done for a while. With a stonking dividend yield of over 7%, and decent signs of improving trading, I can see that this share might appeal to some investors.

Audioboom (LON:BOOM)

Share price: 2.1p (down 7.7% today)

No. shares: 930.6m

Market cap: £19.5m

CFO leaves - it's not clear from this announcement whether the CFO was sacked or resigned.

It's a red flag in either case. I am very nervous when a CFO leaves a company with immediate effect, as in this case. It tends to suggest (at the least) that there's been a major disagreement over something in the board room. Or maybe the now former CFO just couldn't face yet another fundraising round? I think this company will need to raise more money from shareholders in 2018, despite its protestations to the contrary.

The Stockopedia algorithms are screaming warnings at us - a StockRank of just 1, and a classification of "Sucker Stock". I add my own qualitative warnings to that - this company is nowhere near being a viable business, as I reported here, a week ago.

So, based on current information, I think this one is definitely best avoided. IF it does turn things around, we can always buy in at a later date. There's no sign of it being a viable business as things stand now though. Maybe the departed CFO came to the same conclusion?

Norcros (LON:NXR)

Share price: 174p (up 4.2% today)

No. shares: 61.7m

Market cap: £107.4m

AGM trading statement - this group describes itself as;

the market leading supplier of innovative branded showers, taps, bathroom accessories, tiles and adhesives

It has a 31 Mar year end. So today is an update on Q1, being the 13 weeks to 2 Jul 2017.

Overall, it's in line;

The Group's overall trading for the first quarter was in line with the Board's expectations.

Jolly good. There's been a positive forex influence;

Group revenue for the 13 week period was 8.2% higher on a constant currency basis compared to the same period last year and 16.8% higher in Sterling terms reflecting a stronger South African Rand.

I was worried that weaker sterling might impact its profit margins (since production is outsourced to China). It seems that the group has coped well with this issue;

"This performance demonstrates the benefits of our diversified operating model with revenue growth in all UK sectors and in each of our UK businesses, with good growth in exports and sustained progress in South Africa.

As a result of a series of management initiatives to protect the Group's profitability following the weakening of sterling last year and the continuing focus on organic and acquisition led growth the Board remains confident that the Group will continue to make progress in line with its expectations for the current year."

This seems a more upbeat message than in previous updates. In the past there has always seemed to be some part of the group that was struggling, but there's no mention of anything like that today.

Valuation - consensus is shown as 27.7p EPS for this year. At 174p, this translates into a PER of 6.3. That seems astonishingly low. However, the elephant in the room is the enormous pension fund, with a deficit which has proven very volatile in the past.

However, to date the group has proven adept at servicing the pension fund, paying decent divis (yielding about 4.5%), and financing sensible bolt on acquisitions.

My opinion - it looks very cheap. However, it's always looked cheap. There seems no appetite from the stock market to take the shares higher. When they do put on a spurt, there always seems an inexhaustible supply of shares to sell, from stale bulls.

For that reason, I'm reluctant to buy back in. That said, it is looking tempting, at such a lowly valuation. The business seems to be performing well, despite various headwinds. So worth considering, I'd say. If you're prepared to be patient.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.