Good morning!

Please see the header above for the shares that have caught my eye this morning.

CEO interview - Best Of The Best (LON:BOTB)

In case you missed it yesterday, here is the link to my audio interview with William Hindmarch, CEO of BOTB (in which I have a long position).

Sorry if this project rather curtailed yesterday's report. I've decided that it's too much to write a SCVR and do an interview on the same day. So in future, I'll only do interviews when Graham is writing that day's SCVR.

FinnCap research

Excellent news for private investors. FinnCap tweeted me last night, to say that all investors, including PIs, can now access their research. The website is here. I've just registered, and it works! So that's a very handy initiative to widen the distribution of research notes - something that I'm very keen to encourage.

Ab Dynamics (LON:ABDP)

Share price: 1472p (up 14.8% today, at 11:08)

No. shares: 19.5m

Market cap: £287.0m

AB Dynamics plc (AIM: ABDP), the designer, manufacturer and supplier of advanced testing systems and measurement products to the global automotive industry, is pleased to provide a trading update in advance of the publication of its final results for the twelve months ended 31 August 2018.

A very nice update today;

The Group has performed well through the year and the Board expects both revenue and profit before tax to significantly exceed market expectations.

Most of the growth has come from track testing products, used for autonomous vehicle development.

My opinion - I'm not sure how to value this share, as I don't have any updated forecasts. So I'll have to use some guesswork.

Stockopedia shows broker consensus of 34.0p EPS for y/e 31 Aug 2018. What does "significantly exceed" mean? Maybe c.40p EPS? At 1472p per share, that would be a PER of 36.8 - expensive.

Maybe the market thinks the company will achieve more than 40p then? And/or that the new year might deliver say 50p EPS? That would move the PER down to a still expensive 29.4.

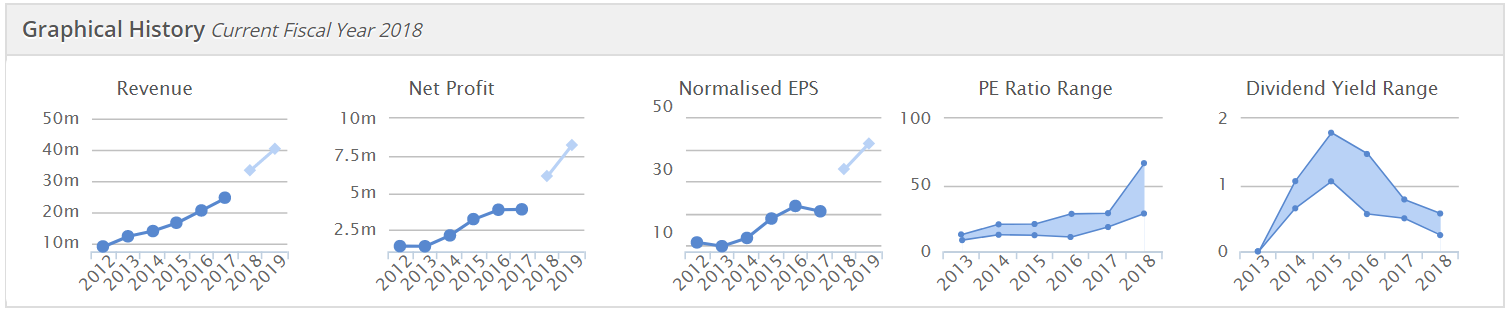

As you can see from the Stockopedia graphs, this company has an outstanding track record, and the light blue forecast blobs & lines below are based on forecasts that we now know are too low. Once the data has updated then, these graphs will look even better.

Overall, this is a terrific little company, performing very well indeed. The share price reflects that, so it can't afford to put a foot wrong.

Elegant Hotels (LON:EHG)

Share price: 68p (up 3.7% today, at 11:30)

No. shares: 88.8m

Market cap: £60.4m

Elegant Hotels Group plc ("Elegant Hotels", the "Company" or the "Group"), the owner and operator of seven upscale freehold hotels and a beachfront restaurant on the island of Barbados, issues the following trading update in relation to the year ended 30 September 2018.

H2 trading is in line;

Trading since the interim results in May has remained in line with market expectations.

Current trading - up;

In addition, bookings for the year ended 30 September 2019 are currently tracking ahead of the same period last year.

Barbados tax changes - sounds like there isn't a problem as yet, but there might be in future? That's how I read this anyway;

The Group notes the recent changes to taxation implemented by the newly elected Government of Barbados and, in line with its initial assessment, can confirm that it has not seen a material resulting impact on the results for the year ended 30 September 2018.

Moreover, while the Board continues to monitor the matter closely, at this point it does not expect these changes to materially affect expectations for the year ended 30 September 2019.

More generally, the Group welcomes the Government's plans to invest both in the Barbados tourism industry and in the wider infrastructure of the island.

My opinion - I've reported favourably on this share before. I like the asset backing of freehold properties. Although the big discount to NTAV suggests that the stock market thinks the property valuations are too high.

The shares have slipped down in the last year, like many other small caps, so could be worth a fresh look perhaps, especially that we now know that current trading is up on last year. Quite interesting. It pays out decent divis too, with a yield of over 4%.

With solid current trading, and the chart showing we're near 2-year lows, then this could be an interesting entry point perhaps? Obviously your research process would need to include doing some googling on the tax changes in Barbados.

Luke Johnson is a NED here, and owns 12.5% of the company - a (probably) bullish sign.

Intercede (LON:IGP)

Share price: 31.5p (up 5% today, 11:50)

No. shares: 50.5m

Market cap: £15.9m

(at the time of writing, I hold a long position in this share)

Intercede, the leading specialist in digital identity, credential management and secure mobility....

H1 revenues (6m to 30 Sep 2018) are up over 10% to £4.1m - in line with expectations. This is a useful improvement, but still very small numbers. A strong end to H1 is noted.

Cost-cutting - deep cost cuts were announced some time ago, which combined with a more sales-focused new management, is what prompted me to buy some shares here. So the operating losses have been substantially reduced;

Coupled with action taken to reduce the cost base prior to the start of the financial year, operating losses for HY2018 are substantially reduced to less than £1.0m (2017: £3.1m).

That's really good news, in my view. With a much lower cost base, sales growth (at very high gross margins) should have a dramatically geared impact on the bottom line. The tricky bit is actually delivering much higher sales.

Cash - this (below) is also good news, and it confirms my view that the company should hopefully be able to avoid tapping shareholders for more funds;

Cash balances as at 30 September 2018 totalled £3.6m, compared to £2.3m as at 31 March 2018 and reflect a positive operating cashflow during the period, plus the receipt of £1.0m from HMRC in respect of the 2017/18 Research & Development Claim.

Convertible loans - opinions differ on this issue. Here's what I wrote about them on 6 July 2018;

Convertible loan notes - this is a bit of a nuisance. The company has c.£5m convertible loan notes in issue, which carry interest at 8%, so costly, at c.£400k p.a.. Interest is payable quarterly, so £100k per quarter cash outflow. The conversion price is 68.8125p, which is well above the current share price of 28.3p, so dilution on conversion doesn't look a problem. Final redemption date is 29 Dec 2021 - so not a problem for the time-being - the company has 3 years to come up with the money to redeem these loan notes (if they're not converted beforehand), and actually it currently has roughly that amount of cash on hand anyway. So this doesn't look like a problem to me - unless trading deteriorates, when it would become a problem.

My opinion - I was drawn to this company by the amazing quality of its client base, which include Governments, other large public sector organisations (worldwide), and major corporations. So clearly it has an excellent product (secure ID software).

If sales can be driven strongly upwards, then this share would in all likelihood become a multibagger, as the growth feeds through to a move into profits. The market cap is peanuts right now, so clearly sentiment is still very much against the company.

That's no wonder, when you look at its historic track record, which is lamentable.

I completely understand why the stock market is sceptical about this share. The company has promised jam tomorrow over many years, and simply didn't deliver on the potential. However, it has new management now, which have stripped out costs, and focused on driving sales.

The jury is out on whether this turnaround will work or not. However, I'm encouraged by today's announcement that risk:reward is looking quite good. I.e. big upside if it works, and probably not much downside if the company continues trundling along at the £8-10m p.a. level of revenues that it has done over the last 5 years.

Stockopedia hates it, with a StockRank of 6, and "Sucker Stock" classification - a reminder that this is high risk. There again, the Stockopedia computers don't know that it has new management, and that cash burn has been slashed! So they're not necessarily right.

Note that a fund connected with one of the NEDs bought 1.5m shares this year, and now holds 26.4% of the company, which I see as a bullish sign.

The chart seems well underpinned at c.30p

DFS Furniture (LON:DFS)

Share price: 201.5p (down 4.1% today, at 12:44)

No. shares: 211.7m

Market cap: £426.6m

DFS Furniture plc (the "Group"), the market leading retailer of living room and upholstered furniture in the United Kingdom today announces its preliminary results for the 52 weeks ended 28 July 2018 (prior year: 52 weeks ended 29 July 2017).

A few brief points;

Underlying EPS down 25% to 14.0p - this seems to be a miss, against the 14.4p consensus forecast shown on Stockopedia

DFS blames exceptionally hot weather in Q4 - strange, as that didn't seem to affect competitor SCS (LON:SCS) which reported strong results earlier this week, see my comments here in this Tuesday's SCVR

Dividends - the yield here is attractive, at over 5%. Final divi maintained at 7.5p, giving total divis for the year of 11.2p (same as last year)

Outlook - more positive, with positive (no figure given) LFL sales in the first 9 weeks of the new financial year

Balance sheet - ridiculous, with large negative NTAV. This is only possible because customers pay up-front

My opinion - SCS looks a far better investment proposition than DFS, in my view. I'm basing that on the fact that SCS has a strong balance sheet with pots of cash, whereas DFS has a debt-laden, weak balance sheet. SCS pays a higher divi yield. Finally, SCS is trading well (earnings rising), whilst DFS is trading poorly.

So if I wanted to hold shares in a furniture retailer, then right now SCS would be the obvious pick.

Audioboom (LON:BOOM) - another poor update. Sales have risen quite a lot since I last looked at it, but the cash burn & losses continue. Looks like it will need to refinance again. I don't see a viable business here.

Volvere (LON:VLE) - an interesting special situation, where the largest investment is being sold for a huge profit. This leave cash above the market cap. Management have an excellent track record. I had this on my watchlist after Graham mentioned it, but the stock was too illiquid for me to buy a meaningful position, so I didn't. Well done to holders.

That's it for now. Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.