Good morning!

Graham here. Paul is taking a long weekend for his birthday.

Markets continue to act in all sorts of surprising ways - the NASDAQ has returned to all-time highs and the FTSE climbed back to 6500 as of Monday before retreating 300 points (6200 in the futures as I type).

Reflecting the uncertainty, the Volatility Index (VIX) has found strength again and is now around 30 - a historically very high level, although we've been much higher than that in 2020.

I hope you are all managing to navigate these conditions - it's not easy! I have taken the 'easy' option of trading virtually not at all, and simply watching the value of my accounts gyrate.

Today I'm looking at:

- CMC Markets (LON:CMCX)

- Onthemarket (LON:OTMP)

- Churchill China (LON:CHH)

- Mind Gym (LON:MIND)

Finished c. 2pm.

CMC Markets (LON:CMCX)

- Share price: 217.5p (+9%)

- No. of shares: 289.1 million

- Market cap: £628 million

Spread betting companies are a very lazy way to invest - compared to having an active spread bet account.

Why bother with all that trading, when you can sit back and make money from everybody else's trading?

Why bother trying to make money in blackjack and poker, when you can simply own the casino?

I should have held on to the CMC shares I bought last year. The share price has more than doubled since.

Instead, I focused on my shareholding in IG Group (LON:IGG) - one of my top 5 holdings. IG is in my view likely to be the lowest-risk share in the spreadbet industry, with CMC coming in at second place.

This entire industry has enjoyed a bizarre windfall from the Covid-19 pandemic. Government lockdown policies crashed the Western economies which in turn sparked stock market chaos and drove traders (both old and young) to churn their accounts like never before.

Let's see how CMC did for FY March 2021:

- net operating income +93% to £252 million

- PBT explodes to £98.7 million

- EPS explodes to 30p

It almost sounds too good to be true, and I am nervous that it is.

Last year, as flagged in my analysis of CMC's interim results, the company changed its risk management strategy.

Risk management at spread bet companies should be simple, in my view: client trades should be hedged by default, except where the exposure is so small as to be immaterial.

IG Group (LON:IGG) does that, and it publishes a chart every year showing the residual market risk (almost zero).

Plus500 (LON:PLUS) doesn't do that. That's why, a few days ago, it reported that its customers had made $150 million at its expense.

In November, CMC announced that it was now hedging less often, leaving only a "significant" amount of risk hedged with its prime brokers.

This decision was made, according to CMC itself, because of the collapse in trading activity after strict leverage limits on retail traders were imposed by the EU regulator, ESMA.

The November report disclosed that retail client trading activity had reduced to just 30%-40% of previous levels.

My fear is that CMC decided to take on a somewhat riskier business model, as a way to make up for the business that was crushed by the leverage limits.

From today's update. I have added the bold:

Following implementation of ESMA regulations, which resulted in a material change in client trade duration, the Group refined its risk management strategies in the final months of our prior financial year. As a consequence, this year the Group internalised more client flow than previously, particularly in the more highly traded and liquid instruments, which resulted in lower hedge costs.

The change increased the daily revenue ranges and market risk exposure, which was supported by the Group's strong regulatory capital ratio, and yielded higher net trading revenue

It's there in black and white: increased market risk exposure. It would help if it quantified this (e.g. by telling us what percentage of risk is unhedged, or gave us the daily revenue range).

But investors can't complain that they haven't been warned.

CMC has been honest. It is hedging less, it has more market risk, and it now has a wider daily revenue range.

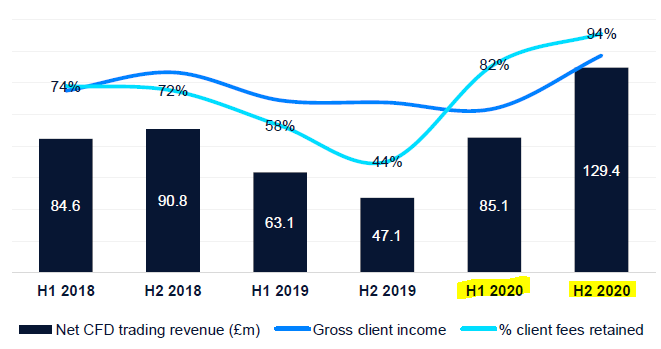

This is the context in which we need to understand the near doubling of CFD net trading revenue (to £214.5 million), despite CFD gross client income increasing by only 11% (to £240.6 million).

Net trading revenue includes "risk management gains and losses", while gross client income does not.

CMC describes this result as "greater retention of client income".

You can see it in this chart from the Analyst Presentation. You can see net trading revenue jump sharply, despite only a modest increase in gross income:

In this presentation, we learn that Hedging costs declined from £35.6 million in 2019 to just £23.3 million in 2020.

And "Risk Management Gains/Losses" swung from a £49.5 million loss to a £13.7 million profit.

That's a good thing. But what I really want to know is what sort of a loss CMC could face, if its customers made winning bets? I think it's safe to presume they could win a lot more, at the expense of CMC, than they could before.

To me, there are only two possible explanations. Either CMC's previous hedging strategy was very expensive and wasteful, or its current hedging strategy is very risky.

I really, really hope that it's the former, not the latter.

In the Risk Management section, CMC says that its team runs stress scenarios on their "residual portfolio", modelling various market movements and how they would affect the company. Why not simply hedge?

Balance sheet - taking a leaf out of Plus500's book, CMC points to its strong balance sheet as a justification for taking on market risk exposure.

Equity is £382 million, of which cash and broker balances add up to nearly £220 million.

Similarly, the company's "own funds" (its primary liquidity source) have bounced sharply higher to £238 million.

Client moneys are segregated and held separately.

The minimum capital requirement is £81 million, so there is indeed plenty of headroom above that.

My view

There are very impressive results but I am now firmer in my belief that CMC is appreciably riskier than IG.

I would still doubt that CMC's riskiness has reached the level of Plus500 - CEO Peter Cruddas, owning 57% of CMC, has too much to lose.

OnTheMarket

- Share price: 57p (+8.6%)

- No. of shares: 71.2 million

- Market cap: £40.5 million

Final Results to 31 January 2020

It's not often that myself and Paul end up on opposite sides of the exact same trade. But Paul has been short of Rightmove (LON:RMV) in recent months (I'm long) and had a long position on OTMP (I've been sceptical about this one for years).

See the comments thread, the last time OTMP was discussed.

OnTheMarket IPO'd at 165p in early 2018, and I've been consistently worried about the business model.

The basic idea is to bribe estate agents to use the portal, by giving them lots of free OTMP shares.

Great for the estate agents, but not so great for other OTMP shareholders.

In the end, it's the general public who will determine the winner. As of FY January 2020, Rightmove's market share of viewing time was 75% (2019: 76%, 2020: 73%).

Long-term, I imagine that there will continue to be space for two profitable property portals. If anybody should be worried about OnTheMarket, perhaps it is Zoopla.

FY January 2020

OnTheMarket has generated a 32% revenue increase and reduced losses:

As you can see, the cash balance has dwindled to £8.7 million, down £7 million on the year despite equity issuance during the period. A further equity raise appears likely.

KPIs

- Traffic (measured by site visits) up 49% to 237 million.

- Average monthly leads per advertiser up 75% to 96

- Branches on paid contracts are now 9,000 as of May, up from 8,000 as of January.

There should be good scope for further revenue growth this year, from contracts signed during the previous year.

The consensus forecast is that revenue will hit £27 - £28 million in FY January 2020, but I don't think this reflects the impact of the pandemic.

Trading update

February and early March was in line with expectations, pre-lockdown. The property market was then effectively suspended.

From May 11th, there was some recovery in traffic and instructions.

The good news is that traffic in the first week of June was up 15% versus the first week of March. And new instructions are now back at early March levels.

The key takeaway is that we have a quick recovery to pre-Covid activity levels.

Outlook

There is no guidance - not very helpful, but this is a common stance taken by companies.

Agent recruitment has been slowed down by the pandemic, and revenues have been hit by a 33% discount offered to agents from April (for three months).

Finishing on an optimistic note:

"...the recent uplift in activity, which reflects increased brand awareness, is encouraging and we remain confident that we have the right strategy to support our longer-term vision to become the portal of choice for agent customers and property-seekers alike,"

CEO

Remember that the CEO got the boot in March, very abruptly, without any proper explanation being given.

The acting CEO (formerly CFO) remains in charge.

My view

I don't see any reason to change my view on this today.

There is some improvement in the financial performance, and I do expect that it will continue to improve, but at the end of the day, I'm not sure if there is space for a third mass market property portal.

If there isn't, then it will have to topple Rightmove or Zoopla - not exactly an easy task.

And from a shareholder perspective, I think that dilution could be heavy - not just on an ongoing basis to get agents to sign up, but also because the existing cash balance looks a bit thin, relative to recent losses and its growth ambitions. It might not immediately be forced to raise, but it might want to raise. Pedestrian growth using its now rather limited resources will hardly satisfy anyone.

Churchill China

- Share price: 1068p (-3.3%)

- No. of shares: 11 million

- Market cap: £117 million

This is a "manufacturer of innovative performance ceramic products serving hospitality markets worldwide".

Its customers have been smashed by the lockdown policies, and its share price has duly halved (vs. February levels).

It confirms today that trading in April and May was "well below normal levels".

Furthermore, CHH guides that monthly revenues will "remain below 2019 levels for some time as hospitality market activity re-adjusts".

This is despite European markets re-opening (with restrictions) and the UK beginning its exit from lockdown.

There will be an unknown number of redundancies (you can find the number of employees on the StockReport - at CHH there are over 600).

We have commenced a process to adjust costs across our business consistent with these lower levels of activity and as such we have entered into a consultation period with our employees in relation to the potential reduction in the size of our workforce.

There is not much else of interest in this statement.

My view

It's rare that a good company becomes a bad company overnight. I doubt that it has happened, in this case.

Net cash at year-end (Dec 2019) was an encouraging £15.6 million, and cash generation was healthy.

Unfortunately, the company hasn't quantified the impact on trading so far, there is no guidance, and forecasting is pretty much impossible.

Gross margins

I wanted to look into the company's operating leverage, to hazard a guess at possible outcomes, but neither Churchill nor Portmeirion (LON:PMP) publishes gross margins. Which makes it even trickier to do the operating leverage calculation.

At least we know that the final operating profit margin was very good last year, at 17%. This does provide a baseline margin of safety, so that small revenue declines won't automatically lead to large losses.

The revenue decline is unlikely to be small, of course.

I'm inclined to think that by cutting costs (e.g. via the redundancies, and elsewhere), and using its cash balance if necessary, Churchill will be able to navigate this difficult period and come through in good shape on the other side.

It's just very hard to do any calculations right now. At times like this, we are left with guesswork and instincts.

Mind Gym

- Share price: 105p (-8.7%)

- No. of shares: 99 million

- Market cap: £104 million

Full year results for the year ended 31 March 2020

This training business joined AIM in 2018.

Pre-pandemic, the shares were around 200. So it's another one whose valuation has roughly halved.

Today's results show revenue of £48 million (up 15%), of which "digitally enabled revenue" (yuk!) is £14.5 million.

That means 70% of revenue wasn't digital, and therefore I guess has complications in a socially-distanced world.

The company discloses that 40% of pre-Covid revenues were from live, face-to-face sessions.

Pre-tax profit for the year came in at £7.4 million (+44%).

Covid-19 impact:

Mind Gym's clients were thrown into crisis mode as entire industries slowed down and like so many others we were confronted with a sudden drop in revenue.

Staff have accepted reduced hours, salary cuts, and a few have been furloughed.

"People-related overheads" have been reduced by 19%.

The company notes that some salaries for the digital development team will be capitalised, not expensed - this will require monitoring.

Dividend - not happening. But balance sheet cash is impressive at £16 million.

Outlook:

Despite the short-term impact of COVID-19 and an unsurprisingly slow start to the year, the Group is well positioned to respond to the new market needs.

My view

This probably suffers from many of the same uncertainties afflicting the hospitality/leisure industry.

But unlike a rollercoaster ride or a relaxing hotel stay, at least it is possible to get training online. Mind Gym has other ways to sell and deliver its expertise.

This one could be worth researching in greater detail.

I'm out of time there, thanks everyone. See you tomorrow!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.