Good morning!

A few things to look at today:

- Record (LON:REC)

- Taptica International (LON:TAP)

- Volvere (LON:VLE)

- Sopheon (LON:SPE)

- Majestic Wine (LON:WINE)

Record (LON:REC)

- Share price: 33.4p (+15%)

- No. of shares: 199 million

- Market cap: £66 million

(Please note that I have a long position in REC.)

After a period of what feels like relentless decline, it's nice to finally see some positive results at Record.

I've described this as a low-conviction holding - see my discussions at the last trading update and in more detail at the interim results.

It's a currency manager, helping dozens of institutional clients to deal with their currency exposures.

In recent years, it has suffered from competitive pressures on pricing and overall growth has been very limited, particularly when it comes to client numbers. Performance fees have withered.

However, I took the view that downside risk was limited by Record's fortress-like balance sheet, and that its highly-invested managers and motivated staff might come up with ways to reinvigorate it. But it was impossible for me to have a strong belief in this!

Results

Today's results show almost everything moving in the right direction.

Fees - The company's pricing model has changed, so that certain products which used to charge a management fee only, now charge a reduced management fee but also come with a performance fee.

It turns out that this has increased the total fees charged, at least for FY 2019.

Record's long-term track record of outperforming its benchmark (in the "Enhanced Passive Hedging" product) suggests to me that there is scope for the performance fee element to increase in future years. It outperformed its benchmark by 5bps in 2019, but the 5-year average is 12bps per annum.

On a big-picture view, "Average management fee rates for most product lines have remained broadly constant throughout the year ended 31 March 2019" - it's hard to deny that there is still some pressure on fees.

Clients - This number of clients is unchanged since the recent Q1 update. 65 clients is encouraging vs. 60 at the previous year-end. Three commercial relationships were lost, but seven commercial relationships were gained.

Note that Assets Under Management fell 8% when measured in USD, or 1% when measured in GBP.

Revenues - with the help of performance fees, revenue improves to £25 million (2018: £23.8 million). With cost control and operational leverage, operating margin improves to 32%.

Profits - after paying out the profit share to staff, operating profit for shareholders improves 8% to £7.9 million. Net cash generated from operations was £7 million.

70% of Record employees are also shareholders, so the employee alignment is very high. You will struggle to find a similar metric at other companies!

Balance sheet - super strong, with net assets of £27.4 million. Intangibles and PPE only add up to about £1 million, so it's liquid.

Outlook - confident. I tend to share their optimism that future political developments (Brexit, more globalisation, etc.) will throw up plenty of opportunities for currency managers. Hopefully, Record can capitalise on them.

Dividend - Ordinary dividend is unchanged, but the special dividend is increased. Total dividend is 2.99p.

My view - I'm starting to feel like my faith in Record might have been justified, after all. It's still not a high-conviction holding and I could sell out of it at any time. But I think these results do provide plenty of ammunition for the argument that it remains on track to provide solid results for shareholders in the years ahead.

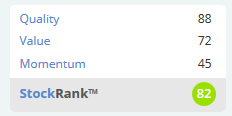

The Stockopedia algorithms share my views on its Quality and Value. Perhaps the Momentum can pick up soon?

Taptica International (LON:TAP)

- Share price: 98.5p (+0.5%)

- No. of shares: 127.6 million

- Market cap: £126 million

Trading is mixed at Taptica. I guess investors already knew this, given the P/E multiple of less than 3x.

Some bright points:

- Integration of RhythmOne is rapid, with $20 million of "cost savings and synergy benefits" this year, and a meaningful contribution to the bottom line expected next year.

- Looking to do another buyback. Spending another $15 million at the current share price would take out up to another 12 million shares.

- The cash position is $70 million (£55 million).

My view - I don't have a view! Happy on the sidelines.

Volvere (LON:VLE)

A quick note on Volvere, which published the result of its tender offer last night.

In the end, I didn't tender any of my shares, so my percentage ownership of this vehicle has seen its biggest uplift to date.

The number of shares outstanding is reducing to 1.9 million, for a market cap of £24.5 million at the current share price.

The Landers are selling most of their shares, taking out more than £7 million between them. Their percentage interest in the vehicle remains material, however, at 19% (down from 30%).

I'll be at the AGM in 11 days, and look forward to gaining more insights into their view on future opportunities.

This remains by far my largest holding, and I consider it to be a defensive and counter-cylical play. It's mostly cash, after all.

While of course I hope they find some new investments, the preservation of capital remains the top priority and I believe that they share that philosophy with me.

Sopheon (LON:SPE)

- Share price: 1180p (+3.5%)

- No. of shares: 10 million

- Market cap: £119 million

This innovative software group provides an update on trading.

It is right to highlight that its growth has been generated organically. This is much more impressive and valuable than the growth by acquisition which we so regularly come across. Though it also remains open to the possibility of doing some M&A, if it makes sense to do so.

It has widened the scope of its products from Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) to the much wider goal of helping organisations "to achieve their strategic goals". An ambitious and broad target.

The sentence I've pasted below won't win any awards for Plain English. But I think I understand what it's saying:

We continued to focus on and refine our three core growth strategies − to extend our footprint in existing customers by expanding our enterprise platform, to target new business acquisition with a clear vertical focus, and to develop a partnership ecosystem.

Recurring revenue - most of its software sales are on a permanent basis ("perpetual license"), but it's exploring how to move towards a recurring revenue model, which customers seem to have a preference for. Sounds good.

Outlook - confident of meeting full year expectations.

In a separate announcement, Sopheon releases some information about the last version of its flagship Accolade software.

My view - I maintain my positive impression of this group.

It should be noted that paid-for research released today has said there is an increase in "forecast risk" (analyst-speak for the risk of failing to meet forecasts).

This is because full-year revenue visibility at this time is currently flat, versus forecast revenue growth of 7%-8%. The company will be relying on its traditionally strong H2 to meet forecasts.

Given the flat revenue visibility, I am a little surprised that the share price increased today.

Overall, though, I haven't come across anything that I particularly dislike about this company. It likely deserves its above-market P/E multiple. The StockRanks classify it as as a High Flyer.

Majestic Wine (LON:WINE)

- Share price: 295.5p (-7%)

- No. of shares: 72 million

- Market cap: £213 million

I've never covered this wine retailer before, but if you check the archives you'll see that Paul has discussed it from time to time.

He covered it in January of this year, ultimately putting it in his "too difficult" tray.

Today's announcement is exuberant about the potential at Naked Wines. So it's going to focus on that from now on, and sell the activities using the Majestic Wine name. Sale proceeds will be used to pay down debt, grow the remaining business, and any surplus will go back to shareholders.

In the context of these plans, the historic group numbers don't seem terribly relevant.

I will note that there is an eye-watering £20 million of adjustments, or 10% of the market cap. Impairments, acquisition expenses, amortisations, share-based payments, etc.

From my point of view, adjustments of that scale call into question the credibility of the results. But good luck to the company and its investors as it embarks on its new strategy.

I must hang up my pen now, as I have been forced to go to a spa this afternoon for a trip to the jacuzzi, thermal suites, etc. It's a hard life but someone has to do it!

See you tomorrow morning.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.