Good morning!

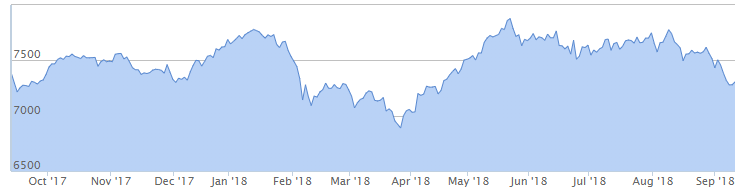

While I was away, the FTSE (UKX) dropped by 2% in a week. That will teach me!

The biggest faller was WPP (LON:WPP), which had a profit warning. Other big fallers were Ocado (LON:OCDO) and Just Eat (LON:JE.), and most of the big mining companies.

Mainstream media has been pointing out that the index is now around its five-month lows.

Taking a slightly longer timeframe, we can see that it basically hasn't gone anywhere over the past year (before dividends):

in currency terms, GBP has at last found some strength over the past few weeks. That is perhaps the most obvious headwind to explain the recent weakness. But it only partly explains the move.

Buying opportunity? This situation has certainly caught my attention. As regular readers will know, I am short FTSE puts. I am committed to buy a decent chunk of shares at 6,000 if the FTSE falls below that level by next March.

Aside from that reason, there are also a few tempting shares in the big-cap space to look at. British American Tobacco (LON:BATS) for example (where I already hold a long position) has been extremely weak and I am thinking about increasing my position size in it. I also have more highly rated companies like Unilever (LON:ULVR) and Experian (LON:EXPN) on the watchlist. Unfortunately, their share prices have remained very strong.

In some ways, it could be argued that the FTSE going flat for a while is a benign situation.

For those people who are worried about a general overvaluation, it gives the market a chance to grow into its valuation. And it does that without causing any of the panic you get with a very sharp sell-off. Instead of panic, it merely causes boredom and melancholy among the impatient.

And for people like myself who are buying equities from time to time, it means we still have lots of opportunities.

I've noticed a really mixed bag in terms of sentiment expressed on twitter and in casual conversations this year. Investors I've spoken to are happy with a flat or small gain this year, given the soggy performance of the index. It's completely different to last year, when lots of people said that investing had been made easy!

Away from the FTSE, the AIM All-Share Index (AXX) has outperformed the big-cap indices.

I do question the usefulness of this index when it comes to measuring small-cap and micro-cap performance. It includes ASOS (LON:ASC), Fevertree Drinks (LON:FEVR) and Burford Capital (LON:BUR) - these collectively are worth about £13 billion and dwarf the vast majority of other constituents.

As far as my own portfolio performance is concerned, with a mix of big-caps and small-caps, the total return year to date for my top equity holdings is as follows. They've done much better as a group than my smaller holdings:

- Burberry (LON:BRBY): 19%

- Volvere (LON:VLE): 5.5%

- H & T (LON:HAT): minus 4%

- PCF (LON:PCF): 48%

- United Carpets (LON:UCG): minus 9%

- IG Group (LON:IGG): 22%

- Creightons (LON:CRL): 20% (purchased in Feb, March & June 2018)

I don't know what the aggregate portfolio performance is at this stage, but I know I'm satisfied with how these companies are doing.

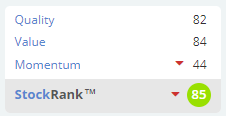

Indeed the main point of weakness among my top holdings, H & T (LON:HAT), is a stock where I've been seriously considering adding to it at current levels.

It gets a big thumbs up from the StockRanks, too:

In summary: we have a soggy main market index, which is nice for those of us who are net buyers.

As I've said before, I don't consider current valuation levels in the UK to be extreme, as long as the FTSE is within a 7000-7500 range. We have a forecast P/E ratio of 13.3x and a forecast dividend yield of 3.7%.

The thing to do then, as always, is try to drown out the noise and find some good companies.

I hate this phrase, but it's a truism, so I'll say it anyway since it applies:

"this is a stock picker's market!"

SafeCharge International (LON:SCH)

- Share price: 319.6p (+5%)

- No. of shares: 148 million

- Market cap: £473 million

This isn't one we usually cover here. It was mentioned in the comments, so I thought I'd give it a quick look.

SafeCharge (AIM: SCH), a leading payments technology company, is pleased to announce its interim results for the six months ended 30 June 2018.

One of the first things I do when I look at a company for the first time is check its historical share count. This lets me immediately categorise it as financially stable (share count is flat), mature (share count is falling) or growing/speculative (share count is rising).

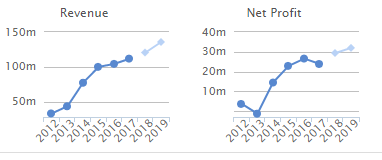

SafeCharge's share count has been flat, and its revenues have been rising every year. It has been profitable most years, though the path of profitability has been irregular.

This gives us some context with which to look at today's results.

- revenue growth +26%

- adjusted EBITDA +15% (this is framed as "excellent" but why doesn't it at least match revenue growth?)

- net income falls marginally to $11.9 million (this is after some currency effects. Profit from operations increased to $13.8 million.)

Operationally, signs are positive as processed volume is up by a whopping 59% to $6.7 billion. The CEO says "we are only at the beginning of our journey".

Outlook - it's in line with market expectations, with revenue at the top end of expectations.

Location - one curiosity is the company's location. The address is given as Guerney. Fair enough, but where are the employees (of which there are nearly 400)? I believe the management team is in Israel, and its website shows office locations around the world (London, Hong Kong, USA, etc).

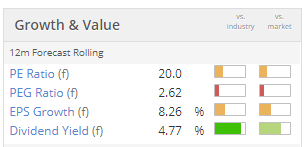

The above-average P/E rating says that investors trust the company. A hefty dividend doesn't hurt in this regard (and it's being increased by 15% today):

The core of the business is a payments platform offering a complete payments solution for merchants, and compatibility with other technologies they might like to connect to it.

This type of product is not to easy for the average Joe to test, compared with a consumer-facing product (e.g. we all have direct experience of PayPal ($PYPL), and know when we are using it).

As recommended by a reader in the comments thread, I have looked for user reviews for SafeCharge. Here is a page showing a mix of comments, including five reviews from 2018. The overall score is 7.5/10.

Scalability - this word is music to investors' ears. SafeCharge's platform can allegedly accommodate transaction volumes 10x greater than it currently processes. This could mean huge operational gearing, as increased revenues could be achieved without much additional capex.

In the short-term, however, EBITDA margin weakened and this was attributed to lower gross margins (as the company entered new markets and focused on lower-risk customers, who presumably have greater negotiating power?) and on recruitment for sales and marketing.

My view - it looks solid, it sounds promising. I wouldn't mind holding a few shares in this.

We aren't short of companies offering payment solutions, however. I wonder how we might predict which ones will win in the end, or even in the medium-term?

Though I'm a fan of the financial sector, I typically invest in lenders and other types of investors. Lending is a predictable activity with predictable returns (some of the time).

This stock falls instead into the fintech category, that hybrid category halfway between financials and technology. The rewards are huge for those who succeed (PayPal) but it's a fast-moving sector which is tough on those who fail. Reaching critical mass is key.

Besides the difficulty of predicting who will win, this sector has also been (in my opinion) the recipient of vast quantities of speculative money in recent years.

I'll keep an eye on this share, although I'm unlikely to buy it at current levels.

DP Eurasia NV (LON:DPEU)

- Share price: 89.45p (+3%)

- No. of shares: 145 million

- Market cap: £130 million

(Please note that I hold DPEU shares.)

There's not much else I want to talk about from today's RNS, so here's a story from Tuesday.

The share price for this Domino's Pizza business has approximately halved since I first covered it - in July!

It's my worst performing share. In total, it has fallen by more than 50% since I purchased it a year ago.

My July article summed things up as follows:

There's a lot that could go wrong, either with execution of its strategies or with the macro/political situation in the countries in which it operates.

A war of words between Trump and Turkey is what happened, tariffs were increased by both countries, and the Turkish lira collapsed in value.

A year ago, a British pound was worth about 4.5 Lira. Today, it is worth 8 Lira.

It's a disaster in terms of the value of DPEU's Turkey earnings. That country is where DPEU's business is considered mature.

Micro vs Macro

Leaving the macro picture to one side, DPEU is doing reasonably well. The market responded well to Tuesday's results.

The outlook for full-year adjusted EBITDA is in line with expectations.

Some highlights:

- revenues up 32%

- adjusted EBITDA up 8% to 40 million Lira, or GBP 5 million. Held back by central overhead growth and recruitment for growth in Russia (where food sales were up almost 70%)

- online sales increased from 50% to 59% of total sales

- like-for-like growth of 10.9% in Turkey and 18% in Russia (we already knew this from the trading update)

The performance in terms of operating profit is disappointing: it reduces slightly to 15 million Lira (approx £2 million).

Below that line in the income statement, foreign exchange losses and higher interest costs in Turkey contributed to a meaningful deterioration in PBT, from breakeven to a 10 million Lira loss.

Flipping back to the macro, I note that the Turkish central bank has increased interest rates today by 625 basis points (!) to 24% (!).

That means DPEU needs to avoid borrowing in Lira. It has refinanced most of its debt from Euros to Russian Roubles.

It also means we might be due for a correction in the value of the Lira. If the Lira somehow recovered to its previous levels, with the help of a 24% interest rate, and if DPEU continued to perform roughly in line with expectations, then perhaps the DPEU share price is due for recovery? A man can dream!

The CEO has reassured investors that prices are being increased to customers in Turkey, and this is not having any noticeable impact on volumes. He continued:

Historically, the business has been relatively robust in challenging economic conditions... This is my third such experience at the helm of DP Eurasia during a difficult macroeconomic environment in Turkey and on each previous occasion we have come through stronger relative to the competition due to our market leadership position, focus on value and service to the customer and resilient franchise partners.

My view

Ever since buying into this company, I've known it was my riskiest position. Not much has changed, except I guess this has been proven to be correct (sadly!)

I'm planning to hang on to it, partly out of stubbornness. But if I hadn't bought it a year ago, and was looking at it today, I think I would have the same positive reasons to buy into it now (with the discount in the share price being adequate compensation for volatility in the Lira).

It's probably beyond the risk tolerance of most investors, even for a small position. And I can easily sympathise with that perspective.

Calling it a day there. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.