Good morning!

Today's assortment looks a bit like this:

- DP Eurasia NV (LON:DPEU) - trading update

- Ashmore (LON:ASHM) - trading statement

- Thalassa Holdings (LON:THAL) - earn out

- Tristel (LON:TSTL) - trading update

DP Eurasia NV (LON:DPEU)

- share price: 177.5p (unch.)

- No. of shares: 145.4 million

- Market cap: £258 million

(Please note that I currently own DPEU shares.)

This is the master franchisee of Domino's Pizza in Turkey, Russia, Azerbaijan and Georgia.

It's the smallest position in my portfolio due to the fairly obvious geopolitical risks and also its speculative nature as the Dominos brand is rolled out in Russia. It remains to be seen to what extent it will catch on.

So far, the signs are pretty good. Small, speculative positions like this in my portfolio require me to make another decision at some point: to add more (when I'm more confident that it's going to succeed) or to dispose of it (when I am pretty sure that it will fail).

I haven't made that decision with DP Eurasia yet. I want to gradually learn more about the company and its progress as it produces more and more results. I also want to be careful since it has only been listed for about a year, and I am cautious about recent IPOs. We often get an accident in the first year or two.

It's worth noting that DPEU's Turkey business is already established as the #1 pizza delivery company in that country, so that part of the group is much less speculative than the rest of it.

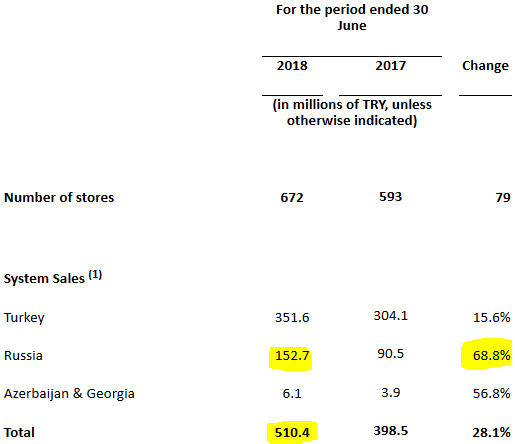

System sales - these are sales made to customers by DPEU's corporate and franchised stores. In other words, it's the revenue that DPEU would have achieved if all stores were corporate owned and none of them were franchised.

This looks satisfactory to me.

System sales in Russia are up by nearly 70% (measured in Turkish Lira). 1 Lira = 16 pence.

Russian sales are now 30% of the total, up from 23% last year.

Long-term, if the roll-out succeeds, Russia will hopefully be making a bigger contribution than Turkey. There is potential for Russia to be c. 70% larger than Turkey with respect to store count.

The growth in Turkey was very good, too. Especially when you consider that this is already a mature market for DPEU.

Azerbaijan and Georgia remain immaterial, for now.

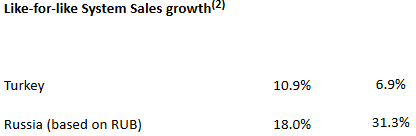

Now let's look at the like-for-like stats for mature stores only (those that have been open for over a year).

Left-hand side is 2018, right-hand side is 2017:

Turkey like-for-likes strengthen to 11%, while Russia like-for-likes reduce to 18%.

The 2018 figure for Russia is still too big to be considered a normal "like-for-like". Mature stores don't usually see their sales increase by 18% p.a. The mature stores in Russia must still be feeling the effects of extra-normal growth thanks to their newness.

Outlook for 2018 adjusted EBITDA is in line with expectations.

I can see an adjusted EBITDA estimate of TRY 118 million for the current year, or £18.6 million. Adjusted EBIT is forecast at TRY 74 million, or £11.6 million.

I think that's quite respectable (depending on how heavy the adjustments are, naturally).

Store count - it currently has 672 stores, up by 79 compared to a year ago.

Long-term, again depending on the success of the rollout, it thinks it could have 2400 stores between Turkey and Russia.

Balance sheet - It is carrying some debt, which it has refinanced from Euros to 2.2 billion Rubles (about £27 million, by my maths). This is something else which increases the risk rating of the Stock.

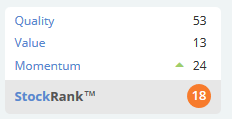

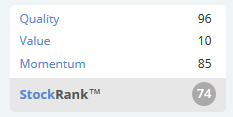

Stocko algorithms don't like it, seeing it as offering very little value (they are right!).

In summary, you can probably tell why this is the smallest position in my portfolio. There's a lot that could go wrong, either with execution of its strategies or with the macro/political situation in the countries in which it operates. The brand might not take off as is hoped in Russia.

One comforting fact is that it's listed on the Main Market of the LSE, not AIM. It's not your typical overseas AIM stock, registered in a tax haven with no corporate governance requirements. Instead, it's registered in the Netherlands and listed on the Main Market.

And of course it's a Domino's franchisee, and we know that they can be a big success for investors. DP Poland (LON:DPP) hasn't worked out particularly well for investors yet, and has been listed for 8 years, so we know that this isn't always the case. Patience is required.

Ashmore (LON:ASHM)

- Share price: 358.7p (+2%)

- No. of shares: 713 million

- Market cap: £2,556 million

This is an emerging markets asset manager I've followed for some time, and commented on here before. I like to read its updates to get an idea about conditions in emerging markets, and investor sentiment, and I think it could make for a decent investment opportunity in its own right.

Today's quarterly update shows a 3% fall in AuM, due to weakness in the underlying asset class.

Client inflows of $2.6 billion were offset by $5.2 billion of negative performance:

Asset prices weakened over the period, particularly in local currency markets, as returns were impacted by the combination of a stronger US dollar and weaker euro, risk aversion to developed world political uncertainty, and concerns about trade protectionism.

"This has left Emerging Markets valuations at levels last seen immediately after the US election in 2016, following which markets delivered a sustained rally.

Ashmore's clients sound like they are doing a pretty good job actually, sending money over in a period of cheaper valuations.

Many investors have difficulty with this: they tend to pile money in near the top, and sell out near the bottom. But Ashmore's predominantly institutional client base isn't doing that. Maybe institutional asset allocators are quite sensible, after all!

Threats - trade wars are a scary prospect for lots of export-driven EM economies, so perhaps this is a reasonable explanation for overall sentiment and valuation weakening in relation to the sector.

It's always hard to make sense of quarterly swings in the markets, because we can nearly always find reasons why a market should have gone up or down. In the short-term, I find that it's mostly just noise.

US dollar - an important factor for Ashmore. Its strength contributed about 10% of Ashmore's negative performance.

This stock could make for an interesting speculation on future USD weakness, as the value of its non-USD fixed income investments get a boost whenever USD is weak.

My view - I don't know if now is exactly the right time to be buying Ashmore, but I note that the shares are back around the levels where they spent most of 2017 and enjoy a very strong StockRank of 89.

The dividend yield is pushing 5% and assets under management are back around the very high levels the company achieved in 2013-2014, when its operating profits were in excess of £200 million. EBIT is again forecast to beat £200 million in 2019 and 2020. Not bad for a market cap of £2.6 billion. Looks a reasonable hold to me.

Thalassa Holdings (LON:THAL)

- Share price: 90p (unch.)

- No. of shares: 18.9 million

- Market cap: £17 million

Sale of WGP Group Ltd: earn out

I missed this RNS because it was announced yesterday at 11 AM. I've just been running over the numbers again to see if I can get interested enough in it to invest.

It's a deep value asset play. When I analysed it last, I suggested that in a bear case scenario it was worth 111p per share, and in a bull case scenario it was worth 176p per share.

Yesterday's announcement confirms that payments are being made to Thalassa thanks to an earn-out from the major disposal it made last year. $6 million first, with the potential for another $4 million.

By my maths, this increases the worst-case scenario for NAV by 24p to 135p per share.

If the other $4 million is received, as expected, then my worst-case NAV increases by almost 40p to 150p per share.

It's a sign of the disinterest, possibly bordering on disdain in which this stock is held by the market that the share price increased by only about 5p in response to this news.

NAV consists of cash (adjusted for the buybacks made since December), the 25% shareholding in Local Shopping Reit (LON:LSR), and the defcon payments. All very tangible assets.

There is also a robotics company thrown in "for free". It may or may not be worth anything. $7 million has been invested in it so far.

In summary, this share offers a deep discount to tangible assets: about a 32% discount, using the latest offer price and my 135p worst-case scenario.

I am still tempted to get involved, but my main point of concern remains: how will the Chairman use the new funds being made available to him? Without a clear investment policy, it's impossible to say.

There is no evidence that funds will be returned to shareholders, except to the extent that they participate in buy-backs.

So while I do think that these shares are undervalued, I haven't got the sort of conviction in the outcome that would make me want to get involved. If I bought it and still held it 5 years from now, I have no idea how the company's funds would be used by then.

At least the buy-backs are helping to shore up the demand for shares in the short-term.

Once again, I leave this opportunity for any readers who may wish to dig a little deeper into it.

Tristel (LON:TSTL)

- Share price: 307.5p (-4%)

- No. of shares: 43 million

- Market cap: £133 million

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, provides a trading update for the year ended 30 June 2018 in advance of the Shareholder Open Day to be held at its headquarters in Snailwell, Cambridgeshire on Tuesday 17 July.

It's nice that the shareholder open day has been announced in advance. Very often, this is kept secret from the general public until the day of the event!

Results are set to be in line with expectations.

Tristel will report record turnover of £22.2m (2017: £20.3m) and pre-tax profit (before share-based payments) of at least £4.4m (2017: £4.1m)

Revenue from overseas markets is growing as a percentage of the total, and the balance sheet is strong with nearly £7 million of net cash.

I can't pretend to be overly familiar with this stock - it's one that I very rarely look at.

Checking the archives, the last time I covered it was all the way back in December 2016 (share price: 165p). It was highly-rated back then, too.

Paul has covered it more recently, in February of this year.

The main source of excitement for growth is roll-out in North America, and this appears to be going according to plan so far. Various regulatory approvals are being sought.

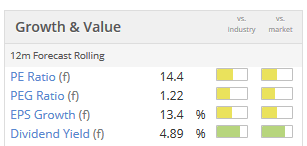

Brokers are forecasting that adjusted PBT (before share-based payments) will increase to £5.2 million for the current financial year (ending June 2019).

The Chairman announces his retirement. He focuses appropriately on the dividends paid since he took office, rather than the share price gains (which have been spectacular).

My view - not sure if there is any! I don't feel knowledgeable enough on this stock to express a view. Sorry.

The numbers suggest that it's a high-quality business, at least. If you have confidence in the expansion plans, the very high valuation might make sense:

Why I Use Reported Numbers - Intangibles

The news flow has been fairly light today, so I want to take a few minutes to talk about something that came up earlier this week in relation to my commentary on Begbies Traynor (LON:BEG).

It's 3pm on Friday, and the weather is nice, so perhaps this is not going to get as many reads as it otherwise would. But I think it's important.

In relation to Begbies Traynor (LON:BEG), it was suggested that I was being harsh on the company for using its reported operating margin, rather than using an adjusted margin which adds back a range of costs. I accept that there is room for interpretation in relation to some of these costs.

The cost that I want to focus on particularly is the amortisation of acquired intangible assets (customer relationships, customer lists, customer contracts, etc).

Adding this back can make a huge difference. For Begbies, profit before tax was £2.3 million, while the amortisation of intangibles was £1.9 million. You almost double the pre-tax profit figure if you add it back!

It is standard among many financial professionals to add back amortisation. It is also standard to use EBITDA. What is standard is not necessarily the right way to go about things in any particular circumstance.

Please note that I don't have a negative view of Begbies in particular. It is just one recent instance of this phenomenon.

Back to basics

One of the definitions I have presented to my teaching clients is the definition of income (roughly speaking, the definition of profit).

In a nutshell, income is defined as the increase in the equity of the business, excluding the effect of dividends, rights issues, and other deals with shareholders.

A company does not increase its equity, and therefore does not generate any income or profits, if it merely converts assets from one form to another, without increasing their value.

Intangibles - an example

I can use a simple example to illustrate the point.

Suppose that I have £10 million of cash in my business and no other assets or liabilities.

Now suppose that I use all of this cash to acquire another company, TargetCo. TargetCo has no tangible assets and no liabilities but it does have a customer relationship, which we think will last for another 5 years and will generate £10 million of income over its life.

Now suppose in the first year after acquiring TargetCo, my business generates £2 million of profit thanks to this customer relationship, before amortisation. We should also record an amortisation expense of £2 million (one fifth of the value of the customer relationship, since we estimated that it would last for five years, and one year has passed).

But if I present my numbers to investors excluding amortisation, then it looks like I have made a clean £2 million of profit.

What I have really done, however, is that I have converted £2 million of cash into an intangible asset, and then converted this intangible asset back into cash. My assets are changing form, and revenues are being generated, but the equity of my business is not increasing.

I'm running to stand still, basically.

- Before the deal: £10 million of cash

- After the deal: £10 million of intangible assets

- After year one: £8 million of intangible assets, £2 million of cash

It's still possible that equity will be increased in future. The customer relationship might last longer than the 5-year estimate, it might generate more revenue than expected, or it might be replaced by new customer relationships with customers who can see the quality of the work we do. All of these things are possible.

The point is, though, that there needs to be evidence that value has been created on top of the £10 million originally invested. If we are profitable only if we ignore amortisation, then it could easily be the case that we have not created any additional value.

The counter-arguments

We are often presented with the argument that it's non-cash, so it doesn't matter.

But the expense incurred to buy the intangible assets was a cash expense, and that wasn't included on the income statement, either. Surely it has to be recorded as an expense at some point in time, rather than completely ignored?

Or if we decide to take the view that amortisation is irrelevant because intangible assets are worthless, then we often find that the company has a threadbare balance sheet with minimal or even negative equity.

Cash has left the building while shareholders are left with a cupboard full of invisible assets. Doesn't sound very appealing, does it!

The bottom line

I don't blame companies for presenting their own version of events. I'm glad they do, because they often shed light on things that the official statements would leave out.

But I think investors should be cautious about excluding amortisation. It might be appropriate, or it might not. Oftentimes, it relates to something which is or was a real cash expense, and needs to be recorded on an income statement.

I'm all done for the week. Well done if you made it this far, and have a fine weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.