Morning folks!

There's a huge quantity of updates out today.

Final list:

- CMC Markets (LON:CMCX)

- Gear4Music (LON:G4M)

- Strix (LON:KETL)

- ECSC (LON:ECSC)

- Mothercare (LON:MTC)

Timings: finished at 4.30pm.

CMC Markets (LON:CMCX)

- Share price: 160.6p (unch.)

- No. of shares: 289 million

- Market cap: £464 million

I'm experiencing some regret this morning, when I see that that the share price for CFD provider CMC has nearly doubled since I sold out of it last August.

At least CMC was only ever a tiny shareholding. I've maintained a larger position (currently 8% of the portfolio) in the lower-risk IG Group (LON:IGG), which has also been performing well - although not nearly as well as CMC, in recent months.

CMC issued a blow-out interim report in November - net revenue increased from £63 million to £85 million. Thanks to operational leverage, this translates to a big percentage increase in the bottom line!

Digging into the presentation slides for that report, we learned that the company was using technology "to make better informed hedging decisions".

It admitted that it was hedging less frequently, and I was left with a question mark hanging over whether CMC was as safe as it was before, or whether it was moving into risky territory (the sort of territory which Plus500 (LON:PLUS) inhabits).

It would be surprising if CMC has started to act irresponsibly - in their next annual report, I'd like to see a clear statement regarding how much market risk they are exposed to, i.e. what percentage of total client trades is hedged (internally or externally), and what is the percentage of residual exposure.

Update

Today's update implies that hedging costs and hedging losses continue to reduce in Q3, having already reduced dramatically in H1:

Net operating income continued to outperform expectations in Q3 2020. The strong performance was driven by higher retention of client income in comparison to H1 2020.

Also worth noting:

This resulted in higher revenue per active client despite lower client income due to the weaker market conditions throughout much of the quarter.

Checking the chart for the Volatility Index (VIX), I note that it was indeed depressed for much of the Q3 period (October - December).

Spread betting companies thrive in times of volatility - i.e. when market movements are making headlines, and lots of people are trading.

In contrast, periods such as the October to December period which we just witnessed can be challenging. Well done to CMC for outperforming expectations, despite the quietness.

Outlook is good:

Q4 2020 has started well and in conjunction with the Q3 2020 performance, the Board remains confident in the ongoing strong revenue performance for the full year, with net operating income expected to be ahead of the upper end of the current range of analyst forecasts1.

And another big well done to CMC for putting the analyst forecasts at the bottom of this RNS. All good companies should do this.

The range of forecasts for net operating income (as compiled by CMC) are £184.1 - £189.3 million.

The range of forecasts for pre-tax profit are £38.6 - £45.5 million.

My view

In my November analysis, I suggested that CMC might earn operating profit of c. £40 million this year. Instead, it looks headed for c. £48 million.

Since the official forecasts are wrong, the numbers on the StockReport will need to be updated. The true P/E multiple is in the region of 12x.

Therefore, despite doubling in price, these shares might still not be expensive - and they could have a lot more to run.

You also have to factor in the risks:

- regulators have demonstrated a strong willingness to clamp down on retail trading activity, and gambling-related activity in general (this applies to all operators, not just CMC).

- I think it's fair to wonder what exactly CMC has done to its hedging strategy, that has allowed it to dramatically reduce hedging costs and hedging losses. Internalising more risk, leaving more positions unhedged and relying on correlations between instruments (for example) could mean that the company is more vulnerable to swings in market-related P&L. This needs to be cleared up, in my view.

On balance, I am more comfortable not owning shares in CMC at present. But there's a lot to admire here. Worth keeping an eye on!

Gear4Music (LON:G4M)

- Share price: 272.23p (+12%)

- No. of shares: 21 million

- Market cap: £57 million

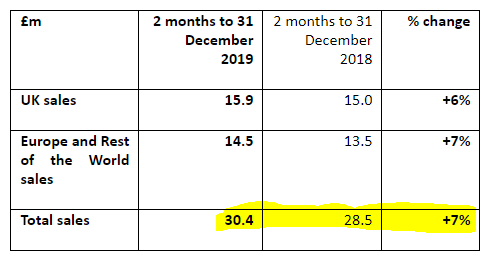

This online retailer of musical equipment has issued a decent update for November/December.

Obviously Christmas is a key period in the calendar, so it's good to see that it went well:

Sales is vanity, so how about profitability:

- gross margin +260bps to 26.5%

- gross profit +18%, growing from £6.8 million to £8.0 million

FY March 2020 profits to be at least in line with expectations.

There is a long CEO comment talking about how the company's infrastructure is working well, Black Friday was a big success, and the existing three distribution centres are big enough for G4M to keep growing, without needing new investments.

My view

A new sell-side research note has been published this morning (commissioned by the company). It gives an EPS forecast of 9.3p for FY March 2021. This is slightly higher than what you'll find on Stockopedia's StockReport.

Since EPS of 9.3p would still leave us with a racey P/E multiple, the market is clearly pricing in further growth in FY March 2022 and beyond. This is not unreasonable, on the basis that the company is adamant that its medium-term plans can be achieved without significant capex.

You might remember that G4M revealed a shift of emphasis in strategy last year, when it decided to prioritise profitability over market share growth.

Thanks to that shift, I do consider G4M to be much more investable than it was before. I've never been comfortable with growth for the sake of growth - I want to see good margins and a positive bottom line!

Anyway, the strategy has been executed - top line growth rates are more modest (7%), but we do get a few pennies in EPS.

And hopefully we will get continued profitable growth in FY 2021. CEO comment:

We remain confident in the medium to long term growth opportunity, whilst continuing our focus on improving gross margins and sustainable profitability.

Overall, G4M strikes me as being of medium-quality, as far as distributors go:

- It sells gear under its own brand, even if this brand would not be considered prestigious.

- Gross margins are not impressive, but have improved over the past 12 months

In the final analysis, it doesn't pass enough of my quality characteristics for me to get involved, and I do think that the current share price is quite optimistic about the company's ability to hit EPS forecasts over the next two years.

The sell-side analyst has put a price target of 450p on G4M, on the basis of its EV/Sales ratio being cheaper than ASOS (LON:ASC), Boohoo (LON:BOO) and Ocado (LON:OCDO). It's a reasonable perspective but the obvious counterarguments are that 1) these other companies might be overvalued, too; and 2) chasing sales is not a very robust investment strategy.

Strix (LON:KETL)

- Share price: 194.93p (+4%)

- No. of shares: 190 million

- Market cap: £370 million

Strix Group Plc (AIM: KETL), the AIM listed global leader in the design, manufacture and supply of kettle safety controls and other complementary water products used in temperature control, steam management and water filtration, is pleased to announce the following trading update for the year ended 31 December 2019.

It's unusual that an AIM company is a real global leader in its field.

That appears to be the case at Strix, which says that it has a 38% global share of the kettle control market. This is the power of owning valuable patents.

Full-year update

Today's update is in line with expectations.

Business is broken down between "Regulated markets" (where intellectual property is a thing), "Less regulated markets" and "China". Very diplomatic!

Key highlights of the RNS:

- market share being maintained in regulated markets

- market share also being maintained in China. KETL's Share in China is growing for "healthy eating appliances", which are replacing traditional kettles.

- the construction of new manufacturing operations in China is on schedule, and costs are in line with expectations.

Dividend for the full year is 7.7p (versus 7p last year).

My view

This continues to look like a really smart company, doing what it says it is going to do and generating plenty of cash.

And while I'm wary of M&A, I'm a big fan of what KETL did last year in the water filtration category: it bought certain assets from AIM-listed Halosource (HALO), when that company ran out of money.

It was only a small deal, but I like the opportunism of buying assets from a distressed seller, rather than rushing to pay a big premium for them. KETL confirms today that the Halosource products have been assisting in the growth of its water division.

KETL's primary water brand is Aqua Optima - you can check out related products on Amazon.

Overall, I continue to have a positive impression of this stock. I can't invest in it for the simple reason that I don't know how long until the expiry of its most valuable patents. If I was reassured on this point (i.e. that they will be around for decades to come), then I would be interested.

(PS: thanks to the Strix PR team for clearing up a misunderstanding I had about the RNS.)

ECSC (LON:ECSC)

- Share price: 120p (-9%)

- No. of shares: 9 million

- Market cap: £11 million

This provides outsourced cyber security services - here is its website. So it's a small support services company in a growing niche.

Profits have been hard to come by, but revenues are at an all-time high (£5.9 million) and the company says that it was cash-generative in H2.

CEO comment:

"We are very pleased that the record trading in H2 resulted in double digit organic annual revenue growth, and a return to adjusted EBITDA profitability. Growth in recurring revenue of over 25% shows the effectiveness of our strategy of winning consulting clients and converting them into long-term managed services clients. The acceleration of new client acquisitions in 2019 should help to build a solid foundation for future growth."

My view

I don't doubt the importance of the work done by ECSC, and the shares may be of interest to readers. Personally, I can't shake off the impression that the business must be very labour-intensive (similar to an IT managed services provider). It is therefore outside my investable universe.

Quantatively, it fails to impress Stocko on Quality or Value metrics, and is classified as a Momentum Trap.

Mothercare (LON:MTC)

- Share price: 15.5p (-7%)

- No. of shares: 171 million

- Market cap: £26 million

An interesting situation: "we remain of the view that we need no more than £25m of additional financing capacity in order to refinance our residual financial debt and future working capital requirements".

That additional £25 million could be in the form of equity or debt. The company says it wants to have "the minimum possible further dilution for shareholders", but I guess the decision is not entirely up to the company - it depends on the terms on which debt might offered.

Looking ahead, it wants to be an international franchisor, instead of the retailer it was before. Very sensible.

It's a special situation. It might turn out to be cheap at these levels, but I would want to wait until funding is resolved before doing anything with it. Until then, the risk of severe dilution can't be discounted.

Out of time for today - thanks everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.