Good morning!

Today we have updates from:

- Joules (LON:JOUL)

- Time Out (LON:TMO)

- MySale (LON:MYSL)

- Clipper Logistics (LON:CLG)

- Porvair (LON:PRV)

And in the world of big-caps, IG Group (LON:IGG) has issued an update. And the executives at Boohoo (LON:BOO) have sold shares (thanks for alerting me to this with your comments).

Timings: finished at 13.40.

Joules (LON:JOUL)

- Share price: 225p (+0.5%)

- No. of shares: 89.4 million

- Market cap: £201 million

Joules, the premium British lifestyle brand, today provides a trading update for the first half of the financial year to31 May 2020 ('H1').

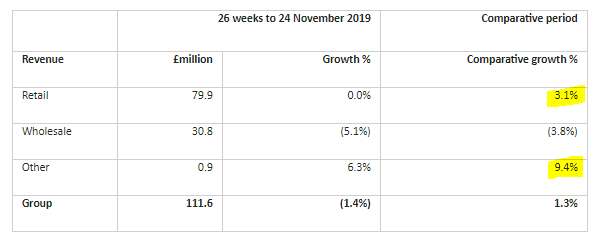

These H1 sales figures are adjusted to include Black Friday, since it was included in last year's H1.

I quite like the overall message here:

As you can see, retail and "other" (licensing) both achieved growth.

The only category to fall was wholesale. Wholesale partners have been converting to the retail concession model, so there is a shift in revenue from one category to the other.

But that only partially explains the 3.8% decline in wholesale - Joules cites the "continued challenging UK trading environment".

As for retail, it will have been boosted by the conversion from Wholesale but other factors given are "strong e-commerce growth", "enhancements to the customer proposition" and "growth in our active customer base". There has also been some store growth.

Store growth - after a tough September, Joules reports that October and November were much better (retail revenue up 9%). As a consequence, Joules plans to open four new stores before Christmas. For context, it had 125 stores at the most recent year-end.

I'm not entirely sure about this - surely the justification for opening new stores is a lot stronger than just a couple of months of good trading?

Either way, it's encouraging that management see continued store growth opportunities, despite the difficult general environment.

But note that the 3.1% growth rate in retail revenue includes e-commerce revenue and is not adjusted for floor space or the number of established stores, i.e. it is not a "store like-for-like" figure.

As far as I can make out, Joules didn't open any stores in H1 this year, but it did open a net six new stores in the previous financial year. As they matured, they will have helped to boost retail sales in H1. So the 3.1% growth rate is not a good indicator of like-for-like growth (the number that really matters).

Outlook is confident:

Whilst the UK trading environment is anticipated to continue to remain challenging, the performance and momentum of our retail channels and our clean inventory position as we approach the important Christmas trading period give us confidence that we will continue to deliver growth through the second half of the year.

My view

Unless you are Mike Ashley, I think the best strategy is to be extremely selective in this sector.

There are so many things that can go wrong (a dodgy seasonal collection, unfavourable weather, competition from larger companies, rising wages, etc.) that the best thing to do, in my opinion, is to simply avoid the vast majority of retailers.

But in the hierarchy of retailers, Joules is certainly (in my opinion) closer to the top end rather than the bottom, even if I am unsure about its like-for-like retail figures.

Over the last few years, it has developed a nice track record of profitable growth. The founder, Tom Joule (owning 32%) is still a Board Member and Chief Brand Officer. Stocko awards it a QualityRank of 86, testifying to its very good returns in recent years. These are all very good things.

So I can appreciate that there are arguments in favour of owning this share. But personally, I'm electing to sit on the fence for this one.

Time Out (LON:TMO)

- Share price: 123.5p (-2%)

- No. of shares: 148.5 million

- Market cap: £183 million

Capital Markets Event and Trading Update

This company manages local websites and food/culture markets in various cities.

I've not studied it before, because the history of large losses was a turn-off.

Today it says:

The Company is encouraged by the early trading of the five sites opened in 2019. New Markets in Miami, New York, Boston, Montréal and Chicago, have replicated - with a strong local focus - the concept first launched in Lisbon, which is now Portugal's most popular attraction with c. 4 million visitors a year. In combination, the six Time Out Markets offer food from 120 of the world's best chefs, occupy 185,000 square feet and accommodate almost 4,000 seats. The global roll-out is set to continue with planned launches in Dubai (2020), London (2021) and Prague (2023).

Despite this positivity, the company will miss EBITDA forecasts this year, due to some delays and additional spending.

But the comany says it is still on track to make a profit in 2020.

My view - I was sceptical about the claim to run "Portugal's most popular attraction", but in fact Time Out Market Lisboa is the #1 Food & Drink venue in Lisbon, according to TripAdvisor. It achieved a score of 4.5/5 from over 20,000 reviews.

Recent reviews say things like "Great experience, highly recommended", "A must visit for all foodies", "Great place to stop", "Seriously delicious food!".

Here's a YouTube video about it (fast forward to about six minutes in).

I can't claim to understand the investment thesis, but clearly something is going right here.

MySale (LON:MYSL)

- Share price: 3.5p (-0.6%)

- No. of shares: 795 million

- Market cap: £28 million

This Australian e-commerce business has been a disaster for shareholders.

In August (as discussed by Paul), it issued 500 million new shares at the derisory level of 2p. It additionally issued share options over 10% of the company to management. There is a separate RNS today about equity issuance for management.

So if you like getting diluted, it has been a wonderful share.

Today's results show a loss of (Australian Dollars) $50.8 million at the EBITDA level, or $18.8 million at an underlying level.

Revenue is down by almost 30% to $209 million. The underlying EBITDA margin was therefore minus 9%.

Strategy

The company is now organised as an "Inventory Light Marketplace Platform", and will not buy inventory for its own account.

In plain English, it provides a place where Northern Hemisphere brands can sell their goods to the Southern Hemisphere, out of season. Mysale will provide distribution, a warehouse, and a website to take orders. It says that this will be a negative working capital business (i.e. funded by its customers).

Non-core activities and assets have been sold off, and a huge writedown of existing inventory has taken place.

Staff count has more than halved (measured by full-time equivalents).

Outlook - trading to date in the current financial year is in line with expectations.

Net cash was $6.8 million at the end of October, after the fundraising effort.

My view

It's a brave effort at turnaround and I can see the logic in what management are trying to do. The old business model didn't work, so they are going to try something with less financial risk and which might work.

Accumulated losses are now an amazing $179 million, but who knows - maybe this new platform has a chance?

You can browse its Australian consumer website here ("Ozsale"). Trustpilot reviews are poor.

Much too speculative for me. Might be worth keeping an eye on for signs of financial improvement.

Clipper Logistics (LON:CLG)

- Share price: 296.5p (-1%)

- No. of shares: 102 million

- Market cap: £301 million

To enable comparison with last year, Clipper discusses these results on the basis of the old accounting standard (IAS 17) rather than the new one (IFRS 16).

- Revenue +11.7%.

- EBIT +13.5%, helped by e-fulfilment and returns management (e.g. from the likes of Sosandar (LON:SOS) ).

E-fulfilment and returns management EBIT increased by 34% and is now about two-thirds of the total EBIT (£8.4 million out of £12.1 million). Clipper is one of the beneficiaries of online retail!

- PBT up 9.5%.

Net debt (pre-IFRS 16) is £64 million, a significant increase due to "working capital outflow, capital expenditure and dividends".

The company has significant leasehold assets, and the present value of lease liabilities now recognised on the balance sheet is £183 million.

Outlook is for a slight earnings miss:

"Trading has continued to be positive post-period end, with the key Black Friday trading weekend seeing record daily volumes in certain sites, and we expect full year earnings to be broadly in line with the board's expectations.

Notwithstanding the difficulties facing the UK high street and the uncertainties of the UK political environment in the current year, Clipper remains positive about the longer-term outlook and believe the Group is well positioned to achieve further growth in both the UK and internationally."

There's an interesting snippet in the review about where the growth is coming from: PrettyLittleThing (by £BOO) is explicitly mentioned.

Other names mentioned as contributing to Clipper's growth during the period are Shop Direct (i.e. Very & Littlewoods), Hope & Ivy (women's dresses), Simba Sleep and Amara. An impressive collection of different brands.

My view

This appears to be a good logistics company, exposed to growing parts of the economy and performing well.

I suspect that it is fairly valued at current levels and Stocko agrees (ValueRank 42).

Porvair (LON:PRV)

- Share price: 601.3p (+4%)

- No. of shares: 46 million

- Market cap: £275 million

Porvair plc ("Porvair", "the Group" or "the Company"), the specialist filtration and environmental technologies group, announces the following trading update ahead of its close period for the year ended 30 November 2019.

This is a quality company, as discussed by Paul in June and by me in January.

Today it reports that revenue for FY Nov 2019 will be up 13%, or 10% at constant currency exchange rates.

This sounds like a sales beat to me. The forecasts I can see (e.g. on the StockReport) suggested that sales growth would be around 9%.

Indeed, earnings will be slightly ahead of expectations.

Paul raised a concern about cash generation during the summer, and today's update confirms that net cash is almost unchanged since the end of H1, at £3.9 million. That's only a marginal increase since May.

So the company is reporting good profits but this isn't flowing through to cash yet, due to £14 million spent on capex and acquisitions.

I have a positive impression of management, who emphasise a strong ROCE among their KPI targets. So I am inclined to give them the benefit of the doubt, that they are using the cash wisely.

You won't be surprised to learn that this is categorised as a High Flyer by the algorithms at Stocko. It's a nice company, that is usually very expensive!

That'll do it for today, thanks everyone.

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.