Plus500 (LON:PLUS) - Correction

In response to my article on Monday, Plus500's PR agent, and indeed readers in the comments section, corrected me that Plus does not make money directly from client losses.

I am only human, and I get things wrong. So I am happy to accept correction on this point, and retract my statement that Plus500 directly profits from client losses.

My belief that it did was based on my understanding that the company rarely uses an external hedge to protect itself against the net position of clients.

How Plus500 manages risk

I still believe that the company rarely uses an external hedge.

According to the presentation forwarded to me by the company's PR agent, under Risk Management, the company says "hedging would be undertaken if market movement breach the Group's risk appetite limits".

In other words, Plus500 does have risk appetite when it comes to taking on client net positions. It would hedge if client net positions became too extreme.

Profit from client net positions is listed explicitly as a source of revenue by the company, though it claims to have generated no revenues from this source for the past three financial years.

The company presentation also refers to "monitoring of instrument level correlations and volatility".

What that says to me is that the company is willing to take on a net long position in one instrument, so long as it also has a net short position in a correlated instrument.

For any single instrument, ignoring its correlations with other instruments, the only way that Plus500 could have a zero exposure in the absence of an external hedge is if the client book perfectly balanced itself. Needless to say, this is unlikely.

At a normal CFD provider, the external hedge is how the broker protects itself from an imbalanced client book.

At Plus500, it is doing two things to balance its client book, whose importance I did not appreciate:

- Using correlations of instruments to manage its overall exposure

- Blocking client trades when the net position gets too large

Consequences of using these techniques

The first technique relies on correlations remaining within some kind of normal range in order for it to work.

The second technique risks creating unhappy clients. The company presentation says "when limits are reached, no further trades accepted."

This chimes with certain comments by customers and indeed with the company's own FAQs.

For example:

This means: we can prevent you from trading for any reason.

Another example:

This means: we can prevent you from closing a trade for any reason.

Other CFD providers reserve the right to block trades too, of course.

But Plus500's need to block trades can be expected to be much more severe than its rivals.

Professional and sophisticated traders tend to be intolerant when it comes to being prevented from trading without a good explanation. Plus500's customers probably aren't too excited about it either.

In March, the following was reported (the bolding is mine):

A lawsuit filed Sunday in Israel alleges that Plus500 Ltd., a London-listed financial trading company, selectively paused service customers in order to prevent them from selling options they had purchased...

Mr. Torgeman’s lawsuit claims that in the correspondence from Plus500, the company admitted to having deliberately paused trading in his account and in that of other users...

If the court accepts Mr.Torgmen’s claim, the case will come to include all Plus500 customers whose trading was deliberately halted in the past seven years.

There is also an EU law firm seeking to file a class action law suit against Plus500. It alleges the following (the bolding is mine):

Plus500 engaged in an intensive advertising campaign aimed at delivering misinformation to new clients, exaggerating the size and reputation of its platform, publishing fake testimonials boosting the company and paying affiliate marketers to create websites with fake reviews.

...Novice investors are deliberately targeted to ensure that the individual is unaware of normal practice in the markets and therefore will not challenge the unreliable broker when using the platform results in losses.

In summary, I am happy to retract my statement that Plus500 profits from client losses. It claims not to have made any revenues from principal gains on customers' trading positions from FY 2015 to FY 2017, and I am happy to take it at its word.

Instead of profiting from client losses, Plus500 profits primarily from the spread it applies to the prices offered to customers.

Risk control is achieved by monitoring the correlations of clients' net positioning, and by occasionally preventing them from trading.

Is it a bucket shop?

Some people feel that it is unfair to refer to the second largest CFD provider in the UK as a bucket shop.

I do not mean to say that the company is small or unregulated. It is big and regulated.

The definition of a bucket shop refers to how it works, not how large it is:

...an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in

Except for those unusual cases when Plus500 might occasionally hedge, when its risk appetite is breached, there is no transfer or delivery of the underlying assets nominally being traded.

That makes it a bucket shop, albeit probably the largest bucket shop in the history of finance.

Let's take a look at today's news:

- MJ Gleeson (LON:GLE) - trading update

- Purplebricks (LON:PURP) - final results

- Superdry (LON:SDRY) - final results

Modern Water (LON:MWG) has also issued a couple of updates over the past few days. I have no opinion on this stock but am happy to recommend comment #14 in the thread below.

MJ Gleeson (LON:GLE)

- Share price: 782p (-2%)

- No. of shares: 54.6 million

- Market cap: £427 million

MJ Gleeson plc (GLE.L), the urban regeneration and strategic land specialist, is today issuing a trading update following the end of its financial year on 30 June 2018....

I last covered this Northern house builder in February, at its half-year report.

Looking at it again today, I am struck again by the big premium to book value in the share price. Evidently, it is being valued on its earnings prospects and not on existing value.

Its volumes have grown strongly. Home unit sales for the year are up 21% versus FY 2017.

It looks like growth in H2 this year was a bit calmer than the growth in H2 last year.

I calculate unit sales as follows:

- 2017 H1: 435, H2: 562

- 2018 H1: 593, H2: 632

There was a big jump in H2 last year. The growth since then has been at a smoother pace.

Progress is in line with Gleeson's strategic plans:

The division is comfortably on track towards achieving its 2017 stated target of doubling housebuilding volumes to 2,000 new homes per year within 5 years.

Still a long way to go to achieve this, but it is going in the right direction. Owned and conditionally purchased plots are up almost 11% to 12,852.

Potential plots in the Strategic Land division (the division that seeks planning consent for land) are up too, from 21,400 plots at December 2017 to 22,838 plots at June 2018. It also has land that could be used commercially.

Valuation: The shares are priced beyond the levels where I could consider buying them, seeing as NAV was last reported for December 2017 at 318p. Note that the shares traded below NAV during the 2008-2013 period.

That said, the company is executing well and making hay while the sun shines. NAV is increasing and dividends are being paid.

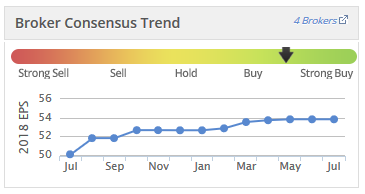

Earnings momentum has been strong:

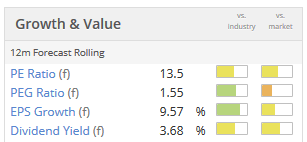

And the P/E multiple isn't too stretching, so if you think that earnings are sustainable through the medium-term then the shares don't look too expensive:

Purplebricks (LON:PURP)

- Share price: 311.3p (-2%)

- No. of shares: 302 million

- Market cap: £940 million

This hybrid estate agent is another stock which doesn't fit within our normal limits for small-cap coverage. It remains an interesting story, and has received plenty of commentary on this website, including from myself. See the archives.

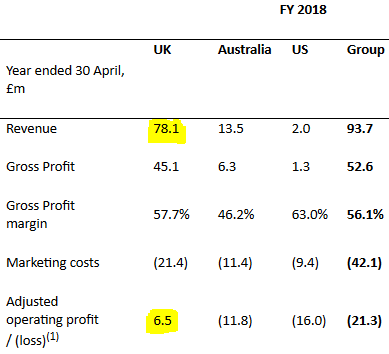

Today's results show the UK breaking into meaningful profitability, converting £78 million of revenue to £6.5 million of adjusted operating profit:

Key employees received £2.4 million of share-based payments in relation to the UK operation, so the operating profit achieved before adjustment was £4.2 million.

Worth noting that £1.7 million of costs slipped from cost of sales to interest payable, for technical reasons. If they hadn't, then I'm guessing that the operating profit for the UK would have been £2.5 million.

Of course, this is a rather small number in the context of Purplebricks' market cap - investors are anticipating serious growth, both in the UK and overseas.

H1 UK revenues (for the six months to October 2017) had been £39.9 million, so the H2 revenues are slightly reduced in comparison.

People don't like to move house around Christmas, so seasonality might be a reasonable excuse for this reduction.

The loss for the year is enormous, at £27 million.

Or if we ignore issuance of £102 million of shares, the cash outflow was about £20 million.

Thanks to share issuance, the company was left with a vast cash balance of £153 million as of April 2018.

As a result, I wouldn't consider shorting Purplebricks. The balance sheet is too strong - it will take at least a few years for it to work its way through that cash, I think. And the share price could go anywhere in the meanwhile.

With regards to operational performance, the company commissioned some analysis which concluded that it had "the highest level of conversion to sale of the top 10 estate agency brands in the UK", sells properties faster than this group and completes faster.

I do think that the Purplebricks approach is probably suitable for some properties, but I don't know if it's as high as the 10% market share being sought by the company in the medium term.

In the meanwhile, profitability in the core UK market is dwarfed by its market cap, and the international expansion is speculative. So I agree with its classification as a Sucker Stock. It might work out well for investors at this valuation, but probably not:

Superdry (LON:SDRY) issued results today, and might be worth a look a forward P/E ratio of c. 11.5x.

It has traditionally had a very strong balance sheet, and flexes its financial muscle by declaring a 25p special dividend, on top of the full-year ordinary dividend of 21.9p. Just thought I would mention it in passing.

I'm going to call it a day there - thank you for dropping by.

Kind regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.