Good morning!

Today we have interim results from H & T (LON:HAT), so that's top of my agenda seeing as it remains one of the larger positions in my portfolio.

On the list today we have:

- Castings (LON:CGS)

- MBL (LON:MUBL)

- H & T (LON:HAT)

- Marshall Motor Holdings (LON:MMH)

- French Connection (LON:FCCN) (comment by Paul Scott)

- D4t4 Solutions (LON: D4T4)

Castings (LON:CGS)

- Share price: 402.5p (-5%)

- No. of shares: 44 million

- Market cap: £175 million

This heavy industrial stock reports continuing strong demand from its main customers, but the machining part of the business needs more time to recover to profitability. It's going to move into the company's main headquarters, rather than having is own location. Shares are down 5%.

My view -I'm worried that machining is never going to fully recover from the loss of a big contract in 2017. Return on capital for the group as a whole has deteriorated and may only be restored through some shrinkage as part of the restructuring process.

All of that having been said, the company remains profitable and financially sound. The foundry business is still doing well. This could be worth a look.

MBL (LON:MUBL)

- Share price: 3.75p (-17%)

- No. of shares: 17 million

- Market cap: 650k

AIM Notice and Update on Proposed Cancellation

Thanks to MrC for pointing this one out. I would probably have missed it, as the RNS was published after 6pm yesterday evening. MBL is being fined £125k (reduced to £75k for early settlement) for breaches of the AIM rules by previous members of the Board.

MBL is now a cash shell after its last operating subsidiary appointed administrators (from Begbies Traynor (LON:BEG) ) in June. It proposes to delist and then, as a private company, return cash to shareholders via an orderly winding up.

I dabbled in these shares about five years ago, when I was doing the "deep value" strategy.

I'm glad I quit the stock, as it has achieved very little for shareholders since then.

It reported balance sheet cash of £1.35 million as of September 2017, and disposed of its other operating subsidiary in March 2018 for cash consideration of £0.8 million. I have no real insight into what the current cash balance might be.

I think the market cap at the current offer price of 4p is something like £0.7 million.

That could be very cheap compared to its cash balance, but you have to be willing to go through a delisting and then hope to get paid out from a private company - lots of hassle.

H & T (LON:HAT)

- Share price: 319p (+3%)

- No. of shares: 38 million

- Market cap: £120 million

(Please note I currently own HAT shares.)

I have held shares in this continuously since 2013. So far, so good.

H&T is Britain's largest pawnbroking group, operating 182 stores.

It has much in common with Ramsdens Holdings (LON:RFX), a popular holding among readers of this column. Their differences are mostly around geographic concentration (the two firms rarely compete with each other over the same turf) and product emphasis.

H&T, despite growing its other products, remains at its core a traditional pawnbroker. I am keen for this part of the business to remain strong, because it's what sets it apart from other alternative credit providers. It's the platform from which it can engage in other services: jewellery retail, personal loans, etc.

So it's pleasing to read that the pawnbroking pledge book continues to make steady headway, up by almost 9% to £48 million. There are certain periods when it is necessary to shrink the book - thankfully, this does not appear to be one of those times.

The main driver of growth, however, is the personal loans segment. These have increased by 78% since June 2017, or 19% since December 2017.

One nice little factoid in today's results is that only half of H&T's personal loans now fall under the FCA's definition of high-cost credit. Customers who pay back their high-cost loans may be able to access the lower-cost loans.

Its nice to see this improvement in the mix of credit quality. Loans with longer maturities to customers with better creditworthiness make for sturdier business. And the regulatory threat should be lower for these loans, too.

The overall performance of the personal loan book during these six months didn't achieve quite the same margin as it did last year: risk-adjusted margin falls to 37.5% from 44.5%.

That's still a very strong margin, in my book. I'll make sure to keep a watchful eye on this indicator in future periods.

Balance sheet - net debt increases from £11.5 million to £16.8 million. The covenant test says that net debt/EBITDA must remain below 3x. The actual value for this ratio at June 2018 is 0.97x.

It has happened before that people think an increase in debt at H&T is bad thing. It's actually a very good thing, when it is the result of increased lending (assume that credit risk has not deteriorated).

Growing the personal loan book and the pledge book means more debt is needed to fund these loans. There is nothing wrong with this in principle!

Gold purchasing - a relatively minor operation, it also sees a little bit of growth, thanks to increased volumes.

Fx/Other - H&T hasn't made huge headway into FX yet, but it is improving and it made £1.6 million of gross profit from this service. Other services were flat or lower.

Regulation

This might be the primary risk faced by shareholders, since I think that management and the company's reputation are both extremely strong. Regulation is the thing that could come out of nowhere to dent profits.

The FCA is consulting with the industry at the moment, seeking clarification on various matters. It sounds like H&T are closely monitoring the situation and are well-placed to respond proactively.

Outlook - there is good demand for loan and trading is in line with expectations.

Dividend - the interim dividend increases from 4.3p to 4.4p.

In summary, we have continued progress at H&T.

I've been thinking about topping up recently, in fact. The share price has been a bit soft, perhaps due to weakness in the Sterling gold price.

I like to have some long gold exposure in my portfolio, and that's one of the reasons I've been holding H&T for so long. So it would make sense for me to top up when the gold price is weak.

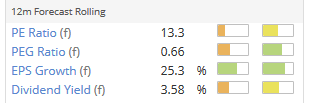

And the valuation does look unduly pessimistic to me. A cheap rating is one of the reasons H&T has a huge StockRank of 97:

The one thing holding me back from buying more shares is that H&T's return on capital is not overly high.

It's much higher than a high street bank, naturally, and is not bad for a financial stock, but it has only very rarely achieved ROCE of 20%+ (and that was when the gold price was enjoying a bull market).

So in the absence of further news I have no plans to buy or sell. A happy holder!

Marshall Motor Holdings (LON:MMH)

- Share price: 156p (-1%)

- No. of shares: 78 million

- Market cap: £122 million

I've only covered this car dealer once before (in March 2017). At the time, the share price was 170p and I said that value investors should be taking a look.

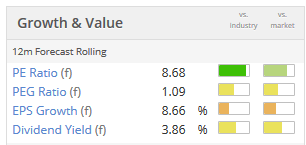

Not much has changed! I can see why readers have been taking an interest in it. The StockRank is 97 and the forecast P/E ratio is only 6.5x (Stocko data).

Checking back to my previous article, I noted that it had completed a very large acquisition and was carrying a big debt load as a result.

But since then, MMH has made a big disposal. It got rid of its leasing division for £42.5 million, making a handsome profit in accounting terms. The rationale was to focus on its retailing activities, strengthen its balance sheet and reduce its indebtedness. Sounds great - I like it when companies are focused on their core activities, without distractions.

So let's take a look at MMH's highlights for the latest period, now that we've caught up with where the company is! All numbers relate to continuing operations:

- underlying PBT up 1.2% to £16.4 million on slightly reduced revenues. The closure of six underperforming sites has played a big role in this.

- like-for-like new unit sales to retail customers down 5.9%.

We would expect the trend for new vehicle sales to be downwards. Compare with Pendragon (LON:PDG).

- like-for-like used unit sales down marginally but revenues up 5.2%. Gross margin improvement. This is attributed to a better management information system and the support of PCP financing, which accounts for most of the company's sales.

PCPs (personal contract plans) may bear some regulatory risk, as they remain somewhat controversial. According to this legal analysis published in April, there is the chance of a fresh mis-selling scandal around how car dealerships and finance companies have sold PCPs to customers. Just something to bear in mind.

- aftersales revenue up 3.2%. This is by far the most high-margin activity, so it's good to see it having a robust performance.

Balance sheet

This is much less complicated than it was when I looked at it last year. We nowhave equity of £200 million, of which tangible equity is £80 million.

There is a small net cash position, rather than a huge debt load.

But MMH has retained its £120 million revolving credit facility until June 2021.

So we could have more acquisitions before too long.

Outlook

The outlook for the rest of the year remains unchanged.

The BoD expresses caution while also arguing that the group is well-positioned for the future.

My view

I can see the attractions to this stock in quantitative terms. It's a straightforward value play: the earnings multiple is exceptionally cheap, and yet the outlook does not immediately appear to be disastrous.

And the balance sheet is sound so there is no reason to use that as an excuse to shy away from it. Although more acquisitions may see debt levels rising again soon.

Personally, I find it hard to differentiate between car dealerships. I have difficulty finding reasons why a customer would prefer to use one over another, apart from price.

For that reason, I am not terribly comfortable investing in the sector. It's sort of the same as with recruitment companies. They are providing a service that many other companies can offer, too.

On the other hand, there is no doubt that MMH's earnings are real and it does throw up an interesting value opportunity.

I think in the end it comes down to economics. A rising tide will lift all boats in the sector, and it's possible that investors are being unnecessarily gloomy about prospects for car sales. I do have a financial interest in the vehicle market through my holding in PCF (LON:PCF).

Even if car sales do keep trending downwards, there is still plenty of aftersales revenue for MMH to generate.

It will be interesting to see what transpires over the next 12-24 months.

Comment by Paul Scott, who owns FCCN shares.

French Connection (LON:FCCN)

- Share price: 48.1p (+0.4%)

- No. of shares: 96 million

- Market cap: £46 million

A brief comment from me on the situation re French Connection (LON:FCCN) and its exposure to House of Fraser. This has been a known issue for some time, for people who understand the business.

FCCN has concessions (a store within a store) in department stores, including House of Fraser. These are typically small operations, with minimal staff and little stock. The way concessions work is that all sales are "banked" through House of Fraser's EPoS system. HoF then sits on the money for, I am told, about 2.5 months.

As HoF has been on the brink of going bust for some time, it was worth working out the potential liability to FCCN. Thankfully, a retail FD friend of mine worked out the figures some time ago. He reckoned there was a potential bad debt to FCCN of about £2m (probably less), if/when HoF went bust.

Since HoF went into Administration, then that crystallises the loss for FCCN and other concessions. Mike Ashley would not be paying those debts as part of his acquisition, as pre-Administration trade payables are unsecured creditors, hence usually are paid nothing in this type of insolvency.

How is the £2m estimated bad debt for FCCN worked out?

Estimated 40 concession sites within HoF stores.

Estimated annual turnover per concession of £200k

Giving £8m estimated annual revenues for FCCN from its HoF concessions.

Assume the bad debt is perhaps 3 months takings, arriving at an estimate of £2m bad debt for FCCN.

That's not material, since FCCN has a market cap about £46m, and has substantial net cash - so it can afford to write off a £2m bad debt without any consequences.

FCCN will also have to write-off fixtures & fittings related to its HoF concessions, or at least the ones that are to be closed. This again will not be material, and is non-cash, so not a problem.

The inventories within HoF stores remain FCCN's property, and if necessary can be moved to other FCCN sites, so there should not be any write-offs relating to inventories.

Going forwards, this might prove a nice opportunity for FCCN to accelerate the reduction of its heavily loss-making retail division. So I feel that, once the dust has settled, the market might actually see this as a positive.

To reiterate, the sooner the FCCN retail stores are closed, the better, as they lose money hand over fist! The value in the business is the profitable wholesale & brand licensing divisions. It amazes me that this is so obvious, yet "the market" seems oblivious to it.

There was a takeover approach last year, which must have been serious, since the board apparently spent several months assessing it & allowed the potential acquirer to do due diligence. It's only a matter of time before the business is sold, because the founder/chairman is into his 70's now, and must be looking for an eventual exit (otherwise he wouldn't have engaged with the potential acquirer last year).

I've worked out that FCCN has several stores which are literally black holes for cash, in terms of losses. The leases on these should soon expire. That means that profitability should make a step change upwards. That's what's interesting about this cash-rich company. The brand is still very valuable, and I'm hoping for an eventual payout here of 100-200p, on a trade sale.

This special situation is certainly one for patient investors only! I'll be insufferable when the payday does finally come, lol!

The recent share price softness, presumably on worries over HoF, looks overdone to me, so if it goes much lower, I'll be topping up. But it's already one of my biggest long positions, so maybe it's not wise to tie up too much cash in this one?

I imagine there is likely to be an RNS from FCCN very soon, detailing the cash losses due to HoF insolvency. It should also give us some detail on the non-cash write-offs (e.g. F&F), plus an update on what's happening going forwards. I imagine this is likely to say that some HoF concessions will continue, but some will be closed. They'll obviously only keep the profitable ones, and this is a nice opportunity for FCCN to re-negotiate terms with Mike Ashley, on a take it or leave it basis (giving him a taste of his own medicine!). Therefore FCCN should emerge with a more profitable concessions operation after this process has been completed. Hence I'm rather looking at this as glass half full, rather than glass half empty.

This section written by Graham.

D4t4 Solutions (LON: D4T4)

- Share price: 168p (+13%)

- No. of shares: 38 million

- Market cap: £64 million

Five contracts announced by this data analytics company.

Numbers aren't given. They sound impressive. The word "global" is used four times!

In addition, we learn that a £19.5 million debtor balance has been paid off.

CEO comment:

In the year to date, and in line with management's expectations, we have been successful in converting a number of significant opportunities from our strong pipeline. This puts us on track to return to more normalised levels of business weighting for the first half of this financial year, against the comparable period last year."

Results have been a bit lumpy thanks to the contract-oriented nature of sales.

I tend to steer clear of anything too lumpy/order-driven these days, preferring a simpler life.

Also, having skimmed D4t4's website a couple of times, I think it would take me a lot of effort to properly understand what it does. I only have time to analyse so many companies.

So I wish everyone the best with this one, but I don't think I'll cover it again. It's in my personal "too difficult" tray.

It does have a good track record of profitability, dividends, etc so it could be worth looking into if you are confident enough to analyse it.

Calling it a day there. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.