Good morning, it's Paul here with Tuesday's SCVR.

Please see the header above, for the list & order, of small cap trading updates/results that I'll be reviewing today. I've also included a couple of mid caps that are particularly noteworthy, and interest me (BOO and GAW).

Estimated time of completion - I'll have the bulk of the report done by 1pm, but as there is so much to report on today, I might need to carry on further into the afternoon, after lunch.

Update at 12:55 - I'm taking a break for lunch now, and will carry on writing this afternoon, as there's loads more I want to cover. the main bit's done, so the 1pm readers have got your money's worth! Look at the extra stuff this afternoon as a bonus. 5pm revised finish time.

Update at 17:24 - today's report is now finished.

Profit warnings

It seems to me that there is a potential opportunity at the moment. The fact is that 2019 was dominated by political uncertainty, and once a general election is called then it is only sensible for businesses to put investment & hiring decisions on ice, and await the result.

Therefore, it could well be the case that some businesses might have had a poor Q4, due to this factor, yet be fundamentally sound businesses which should quickly recover in 2020. There could even be a bounce back effect, with Q1 2020 being better than expected, because;

- The general election result is by far the best outcome for businesses - i.e. a business-friendly Govt with a large majority, also committed to increasing public spending (hence stimulating the economy at least in the short to medium term)

- The Deloitte survey (mentioned in yesterday's SCVR) shows a huge recent rebound in business confidence - suggesting that some investment decisions which were on ice may now be implemented

- Consumer confidence should also rebound strongly, in my opinion, because we have full employment, and good wages growth (above inflation), prolonged low interest rates, etc. Plus minimum wage is going up by c.6% soon, and it has a domino effect upwards as higher paid staff demand that pay differentials are maintained. Therefore, I'm expecting a strong recovery in consumer sentiment & spending in 2020

Put that all together, and I think shares which put out profit warnings now, caused by a soft Q4 2019, could (as always, only very selectively) make good buying opportunities. This is a bit of a one-off factor, which we can take advantage of.

Another factor to consider, is that the stock market tends to react differently to profit warnings, depending on what stage in the economic & stock markets cycles we happen to be in. Broadly speaking profit warnings work like this;

Bear markets - price plunges c.30-50% on the initial warning, and keeps falling, despite short-lived dead cat bounces. This can be because there might be forced sellers, e.g. institutions with redemptions to fund, leveraged punters on spread bets being stopped out, and other investors just capitulating. Hence selling may not be rational, and the company valuation can overshoot on the downside.

The market is gloomy, so assumes that the profit warning is the start of a continuing downward trend in performance. Catching falling knives is very costly in this environment. Shares take a long time (over a year) to recover, if at all. Markets worry about funding - will the bank withdraw support? Fresh equity raises are difficult or impossible to do, or might require a deep discount, wiping out existing shareholders.

Bull markets - price typically drops 20-30% on profit warning, and almost immediately begins recovering, as investors who like the company see the drop in price as a buying opportunity. Problems are seen as fleeting, and investors assume the company will recover quickly and give it the benefit of the doubt. Since other shares are generally expensive, profit warnings are seen as buying opportunities - grab a bargain. Banks remain supportive, and investors are happy to support re-financings on reasonable terms.

Therefore, it makes sense to steer clear of falling knives when the market is bearish, which it was for small caps in most of 2018 & 2019. However, we've seen a stunning recovery in market sentiment since autumn 2019, and especially since the general election result on 13 Dec 2019.

This means that buying carefully selected shares after profit warnings could now be potentially lucrative. But great care is needed, to check out each company properly. Every situation is different, there is no one-size-fits-all way to respond to profit warnings, in my view.

What I'm looking for, in buying opportunities after profit warnings, are shares which pass all these tests;

- Soundly financed, preferably with net cash, so no question of needing additional funding/dilution

- Strong business, with a good track record, that just happens to have had a soft Q4 2019, due to one-off factors

- No deeper, underlying problems

- A business model which I understand, and where I've monitored & researched the company over several years - i.e. companies/sectors that I understand, so I know which companies to avoid

- Strong management with a solid track record of telling it how it is, in trading updates - not companies which consistently over-promise & under-deliver (especially avoiding companies that tend to mislead investors with over-PR'd commentaries which are designed to conceal bad news)

Buying after profit warnings is dangerous, and often produces disastrous results. I've made numerous mistakes in this field over the last 20 years. Therefore, I'm being highly selective about catching any falling knives. I think it also pays to bide one's time. Jumping in immediately after a profit warning can often (usually actually) be a mistake. People anchor to the old price, and hence assume it's a bargain after a 30% drop. But often when you work through the revised forecasts, it's not cheap at all.

So, my mission now is to find shares which warn on profits due to one-off factors, and which may present good recovery plays. I'll be reporting on profit warnings in that context, over the next few weeks.

Today we have 2 profit warnings, from Flowtech Fluidpower (LON:FLO) and McBride (LON:MCB) - so I'll look at these first, and give my opinion on whether they might be buying opportunities or not.

Flowtech Fluidpower (LON:FLO)

Share price: 101.5p (down 20%, at 10:02)

No. shares: 61.2m

Market cap: £62.1m

Trading update (profit warning)

Flowtech Fluidpower plc, the UK's leading specialist supplier of technical fluid power products, provides an update on trading for the financial year to 31 December 2019.

Please bear in mind that FLO's share price is volatile this morning, so it might have changed from the level it is at the time of writing, which is 101.5p.

Graham reported on the company's Q3 2019 update here - which looked satisfactory.

Profit warning today - the announcement presents industry data from the British Fluid Power Association (yes there is such a thing!) showing that revenues dropped about 10% in Oct-Nov 2019. It strikes me that anyone owning this share should possibly monitor the BFPA's press releases, to get early warning of the likely trend in sales at FLO.

Against this backdrop, the Group experienced organic revenue decline of c.10% in Q4; as a result Group revenue is expected to be c.£112.4m which represents overall organic revenue reduction of c.1.5% (H1 growth of c.3% and H2 decline of c.6%) for FY19.

The Board now expects to report underlying profit before tax* of not less than £9.0 million.

That's quite a marked deterioration in performance, from H1 to H2.

Thumbs up to the company for setting out performance clearly. In particular, giving us guidance of not less than £9.0m for 2019 u/l profit, is very helpful. The only improvement I would have liked, is a footnote to inform us of previous market expectations for profit. More and more companies are doing that, which is immensely helpful for investors, to enable us to quickly assess the situation.

Revised forecasts - there are 2 updates today available on Research Tree. I'll just look at the house broker, which cuts EPS FY 12/2019 forecast EPS by 18.2% to 12.3p - PER of 8.3 - whilst that looks cheap, it's quite a big forecast drop coming so late in the year. The risk is that, if Q4's poor performance continues into 2020, then it could feed through to a much lower level of profit for a full year.

Or, performance could bounce back in 2020, as I was talking about in the macro preamble above.

FY 12/2020 forecast is also reduced, to 13.9p (a 16.7% reduction today). It may not necessarily be the case that 2020 improves on 2019, it could get worse, we don't know at this stage.

Outlook - I'm looking for signs of a quick bounceback in performance, but that doesn't appear to be the case here;

Expectations for FY20 have been reviewed by the Board and whilst it is confident that investments made in 2019 will lead to market outperformance, current conditions are such that achieving organic growth may prove difficult, in particular in the first half of FY20.

It is therefore possible that the positive impact of the cost saving initiatives which have now been formulated, and which will shortly be implemented, will be offset, at least in part, by market conditions remaining challenging.

I think this negative-sounding outlook rules out any possibility that I would want to buy any shares today, despite the 20% share price fall. It's probably safer to watch & wait.

Net debt - this is important, because FLO has been acquisitive, involving the use of bank debt;

Net debt** of £16.6m as at 31 December 2019 is in line with market expectations. Q4 has seen debt reduction of £2.5m in a period which paid out a £1.3m interim dividend. A combination of strong operational cash flow, no further payments of deferred consideration in respect of historic acquisition activity and the continued focus on working capital, leads to confidence that FY20 will generate significant positive cash flow.

The double asterisk footnote confirms that net debt stated excludes IFRS 16 lease "debt" - which is absolutely the right way to report it, because IFRS 16 is not bona fide interest-bearing debt, it's just a notional book entry, which shouldn't be there, in my view. Disclose it as a note to the accounts, by all means, but it needs to be removed from the balance sheet & P&L impact too, to get the numbers to make sense to me.

Is net debt a problem? - at £16.6m, it's come down since the interims, when it was reported at £18.8m as at 30 June 2019.

Assuming that trading doesn't fall off a cliff in 2020, then I don't see the debt as a particular problem, because the balance sheet overall looks sensibly structured...

Balance sheet - as at 30 June 2019 looks OK to me.

NTAV is £21.0m - that's fine for the size of the business.

Current ratio (working capital) also looks OK at 1.46

Gross bank debt of £22.6m is funding inventories of £28.1m, plus receivables of £27.0m, therefore is covered more than twice by liquid assets (plus £3.9m of offsetting cash, but that's probably window-dressed for the period end).

I don't know what the bank covenants are - it would be worth checking that out, to plan for a worst case scenario.

Dividends - with a poor end to 2019, and tough conditions expected in H1 2020, combined with the risk inherent in having bank debt, I think the company would be well advised to cut the divis for now, until trading improves.

All too often companies continue paying unaffordable divis, and end up in a (sometimes terminal) mess. It's much better to incur the wrath of investors by cutting the divis, than incurring the wrath of the bank.

My opinion - it's a straightforward situation. If you think performance will improve later in 2020, then it might be worth buying some to tuck away for recovery.

Or, if like me, you're not sure if things are going to get better or worse, then it's probably safest to watch from the sidelines.

It looks a fundamentally good business, making a quite good profit margin.

As you can see from the chart below, since it floated, there are rather a lot of large red candlesticks (big drops, for the colour-challenged readers) - meaning that the company is rather prone to warning on profits. This unnerves me. Also note that the share price has just gone sideways overall since it floated (although shareholders have received divis). Not exactly inspiring is it?

McBride (LON:MCB)

Share price: 66.6p (down 16% today, at 11:11)

No. shares: 182.8m

Market cap: £121.7m

Trading update (profit warning)

McBride plc (the "Group"), the leading European manufacturer and supplier of Contract Manufactured and Private Label products for the domestic Household and professional cleaning and hygiene markets, today provides a trading update for the six months ended 31 December 2019.

Note the year end is 30 June 2020.

This company doesn't really interest me, so I'll keep this fairly brief. Graham was uninspired by its last update - here are his comments from 22 Oct 2019. Note that update from the company contained the dreaded H2 weighting for FY 06/2020 profits - which can often be a precursor to another profit warning.

Today it says that H1 revenues are down;

The Group's first half Household revenues at constant currency were 1.4% lower compared to the prior year following a slowdown in the last two months of the period, especially in the UK. H1 UK revenues were 8.0% lower year on year...

This is expected to continue into H2, replacing previous guidance of an H2 recovery;

Reflecting the first half performance, our expectations for the rest of the year are reduced and we now expect full year Household revenues to decline by approximately 2% year on year.

What's the damage? - top marks here for complete clarity. No imprecise wording (e.g. significantly below, materially below, broadly in line with, etc) to interpret, they've just given us the actual figure, hallelujah! Why can't all companies do this?

In the absence of significant raw material cost changes, the Board now expects full year adjusted PBT to be approximately 15% lower than current market expectations(*) reflecting the impact of lower revenues.

(*)Current market expectations refer to a Group compiled consensus for FY20 of adjusted PBT £22.1m.

Even better, McBride has given us a footnote with the previous market expectations.

This is absolute gold standard reporting, and what I've been campaigning for here for years (brokers & PRs do read these reports you know). In fact, I was so thrilled, that I put in a call to McBride's PR at 07:30 today, to thank him & congratulate him on giving us the precise information we need, instead of a load of waffle that many other companies put out!

This approach seems to have worked too. By giving us the expected profit shortfall of 15%, investors have got the information they need, and the share price has gone down 16%. I reckon if a waffley, text-based profit warning had been put out instead, then the uncertainty would probably have led to a steeper fall in share price.

Net debt - looks high, but reassuring re bank covenants;

Net debt closed the period at £113.5m (30 June 2019: £120.9m) excluding the effect of IFRS 16. The Group remains comfortably within all of its banking covenants.

My opinion - this sector doesn't interest me. The customers (retailers) are under intense financial pressure, and have to squeeze their suppliers harder & harder, just to survive.

The new CEO has initiated a strategic & operational review. That sort of thing usually involves exiting low margin activities, but also usually brings exceptional costs.

With so many interesting companies out there, why on earth would anyone choose this to invest in? I suppose the upside could be if the new CEO is able to implement a lasting turnaround. From memory, I think this share has been a turnaround story for several years already.

Gateley Holdings (LON:GTLY)

Share price: 203p (down 3.8% today, at 11:59)

No. shares: 114.7m

Market cap: £232.8m

Gateley (AIM:GTLY), the legal and professional services group, is pleased to announce its unaudited results for the six months ended 31 October 2019 ("the Period"), demonstrating a strong performance with double digit growth in profitability and revenue.

It's an acquisitive group of lawyers. I see the PRs have slipped in a little upbeat comment into the opening description of the company! I can't decide whether I like these or not.

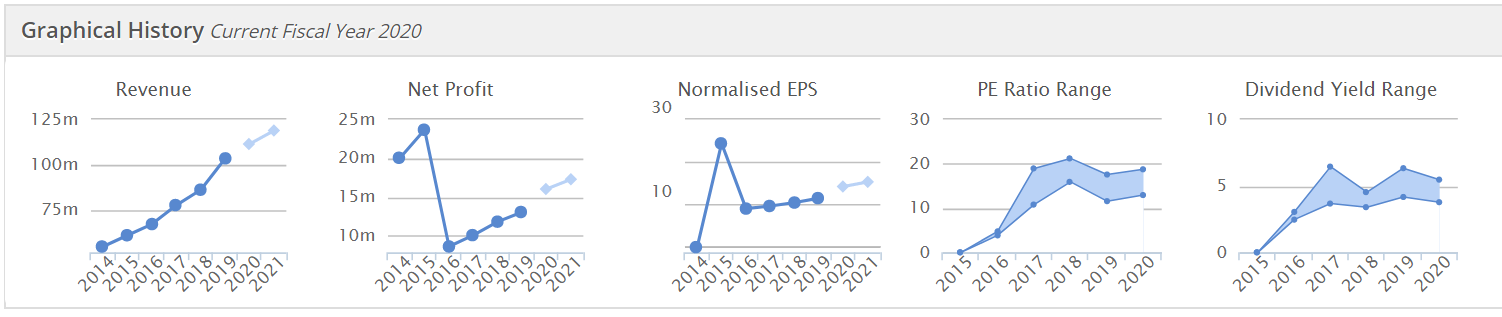

As I'm not familiar with Gateley, the Stockopedia historic graphs & Graham's previous commentary here are a good place to start.

This looks really nice actually - steadily rising earnings, no bad years, reasonable PER if you can buy near the bottom of the range, and good/reliable divis;

Interim results - key points;

- Revenue growth of 11.8% is nearly all organic (10.5%), which is positive

- Good profit margin of 10.6% (PBT of £5.5m divided by £51.8m revenues)

- Net debt down 65% to £2.1m - very good

- Interim divi up 11.5% to 2.9p

- 2 acquisitions in the period

- Outlook says confident they are well positioned to deliver full year market expectations - good

- Balance sheet looks fine to me - receivables are high, but that's par for the course with firms of lawyers - but cash collection could be improved I think

- Cashflow statement is impressive - genuinely cash generative, which it's using mainly to pay big divis

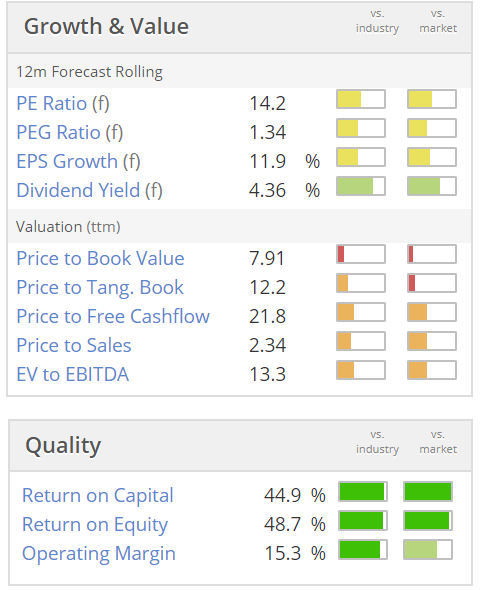

Valuation - looks sensible, I'd say this is about right, because people businesses shouldn't attract high earnings multiples. Lovely quality scores;

My opinion - I don't normally touch people businesses, so it doesn't interest me.

However, the figures look good, I can't see any issues with the numbers at all.

It's established a strong 5-year track record as a listed company, with the strategy & performance seemingly working well, so it might be worth considering.

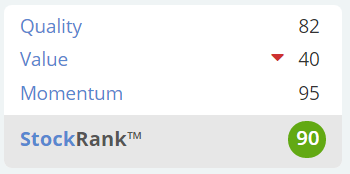

Stockopedia likes it a lot;

Like so many shares, it's had a big re-rating upwards in the last few months, so personally I wouldn't want to be buying at this point, when others might be wanting to bank their short term profits possibly. Generally at the moment, I'm seeing lots of shares that have had big rallies, running out of steam as profit-taking starts & valuations look stretched. Hence I'm more interested in companies putting out positive updates that have been overlooked in the recent market recovery.

Boohoo (LON:BOO)

Share price: 330p (up 3.7% today, at 12:59)

No. shares: 1,160.2m

Market cap: £3,828.7m

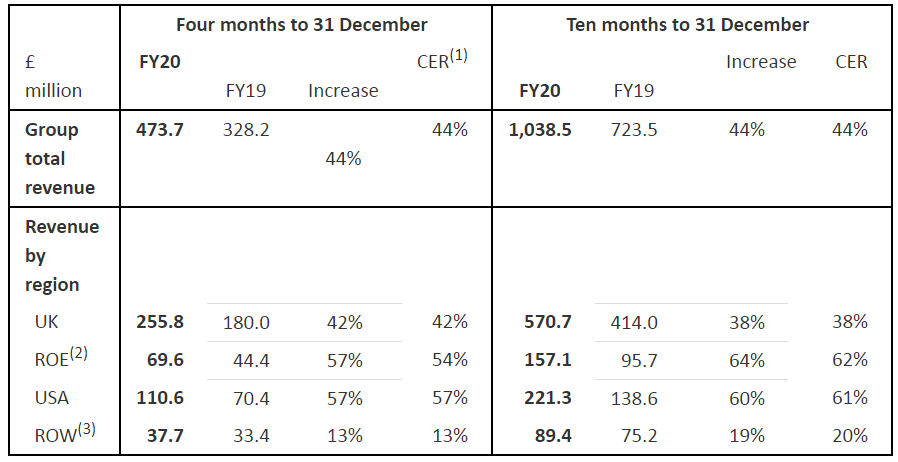

For the 4 months to 31 Dec 2019, and 10 months YTD.

Pretty stunning growth;

A brief comment to flag that there's yet another sparkling update out today from this online fashion multi-brand empire.

It now has multiple brands, which is a brilliant strategy - each one having the group expertise in design, buying, marketing, IT, logistics, etc, applied to it. So far they've all worked. Brands within the group are now: BooHoo, PrettyLittleThing (part owned by the founder's son), Nasty Gal, MissPap, Karen Millen & Coast. Note that the last 2 are targeting an older demographic from the traditional cheap & cheerful youth market.

Sales are strong internationally too.

With multiple brands (more are likely to be added), and a global market, the sky's the limit for this group, in my view. It guides that growth is expected to slow to c.25% in future, as it gets bigger. Still remarkable.

EPS for FY 02/2020 is nudged up 4% today to 5.43p - giving a PER of 61 times - expensive. Or is it? Given that FY 02/2021 is starting shortly, then we should value it on a multiple of forecast 6.75p EPS, reducing the PER to 49 times. Still expensive? Less so, but also bear in mind that BOO tends to beat forecasts. Factor that in, and the PER might be nearer say 40 in reality. That could easily drop to say 25 or 30 times the following year. Which would make it good value for a company with such strong growth & global markets.

BOO is clearly a big long term winner. I'm sorely tempted to buy back in actually, because if we think forwards say 5-10 years, then how many more failed High Street brands will BOO have hoovered up & transformed online? International sales are only scratching the surface of large markets. This could be a £10-20bn mkt cap company on that type of timescale.

I'll wait for a pullback, and then buy back in at some point in 2020.

If only I'd kept my £4,000/pt spread bet running, when it was 25p per share, that would have paid for a few sundries! Oh well, I can add this one to my list of "if onlys"! Like selling my half a million Asos shares at 9p because the PER looked too high!!

After lunch & a power-nap, let's look at some more shares.

D4T4

Share price: 216.5p (up 5.6% today, at 15:09)

No. shares: 40.2m

Market cap: £87.0m

D4t4 Solutions Plc (AIM: D4T4), the AIM-listed data solutions provider...

I don't normally comment on contract announcements, unless they're material and trigger a change in forecasts. A revised broker note came through on my email this morning, which leaves forecasts unchanged for FY 03/2020.

What's interesting though, is that H1 was very poor, with an extreme H2 bias to profits expected. Normally I'd be very sceptical about that being achieved, but in this company's case it has delivered the big upsurge in H2 required, in a previous year (I forget exactly when).

The gist of Finncap's update note today seems to be saying that forecast earnings of 14.2p this FY 03/2020 are achievable, even though only H1 was only 2.0p, leaving 12.2p to do in H2. Contract renewals, new contract wins, and a healthy pipeline are said to underpin forecasts.

Directorspeak today is effectively a trading update, hence why it's worth mentioning here;

"We are delighted with these contract successes which provide valuable underpinning to both current year and future earnings potential for D4T4, being based on consumption as well as perpetual licence models, and a pleasing endorsement of version 9.0 of the Celebrus product we launched last year. We look forward to providing further updates as the year progresses."

The contract wins today sound impressive, although no figures are given;

I like the sound of this. Although with forecasts being so H2-weighted, I could understand why investors would want to see the results actually come in on target, before chasing the share price up any higher.

My opinion - looks intriguing.

Boku Inc (LON:BOKU)

Share price: 78p (down 19% today, at 15:52)

No. shares: 255.1m

Market cap: £199.0m

Trading update (profit warning)

This one is a reader request.

Boku Inc (AIM: BOKU), the world's leading independent carrier commerce company, is pleased to provide the following unaudited trading update for the financial year ended 31 December 2019.

I can't make head nor tail of this trading update, nor the company itself. I've just spent a bit of time going through its last interim & full year accounts, and can't get my head around this at all.

Trying a different tack, the share price is down 19% today, so clearly this update has disappointed the market. There's an update note from Edison available, which is probably your best port of call if you're interested in this company.

For FY 12/2019, Stockopedia shows forecast revenues of $51.2m. Today's update says actual is slightly below, at $50.0m to $50.5m, up >42% on 2018. It mentions $3.2m of non-recurring revenue, but it's not clear from the update if forecasts included this or not. It's much better to provide a table of the breakdown of figures, rather than in text, which can be interpreted in different ways.

Ah, I think I've worked out what's going on here. Edison has massively reduced the future growth forecasts. Looking at its report from 11 Sep 2019, the old Edison forecasts are;

FY 12/2020: Revenues $68.1m EBITDA $20.1m

FY 12/2021: Revenues $78.7m EBITDA $27.7m

The latest Edison note today has these revised numbers;

FY 12/2020: Revenues $54.0m EBITDA $10.5m (down 48%)

FY 12/2021: Revenues $62.0m EBITDA $14.3m (down 48%)

As you can see, that's a near halving of forecast EBITDA between Sept 2019 and now. No wonder the share price has been weak.

My opinion - this is too complicated, and it looks as if the company doesn't have very good visibility of revenues, judging from the size of the forecast reductions today.

It seems to be an American tech company, so if it was any good, it would be on NASDAQ, surely?

Given the size of the forecast reductions, I'm surprised the share price isn't down more than 19%. Looking at the trading update, it doesn't seem to spell out that EBITDA forecasts are being slashed. Why not?

The share options charges look very high too.

Overall, I have to file this one in the too difficult tray. Today's big forecast reductions means I'm not interested in delving any deeper.

DFS Furniture (LON:DFS)

Share price: 280p (unchanged today, at market close)

No. shares: 212.3m

Market cap: £594.4m

DFS Furniture plc, the market leading retailer of living room and upholstered furniture in the United Kingdom today announces a trading update for the twenty-six week period to 29 December 2019.

It's a slightly below expectations trading update ("broadly in line")

I'm delighted to see that DFS has joined the growing number of companies which help investors by giving us the market expectations numbers in a footnote - bravo!

Based on low single digit revenue growth assumed in the second half we expect full year profit before tax and brand amortisation will be broadly in line with market expectations*.

*Consensus Profit Before Tax and Brand Amortisation forecast for the 52 weeks to 28 June 2020 of £51.2m on a pre IFRS 16 adjusted basis with a range of £50.0m to £53.6m. This is comparable to the £50.2m underlying pro forma result as reported for the 52 weeks to 30 June 2019.

More positive noises about current trading have probably saved the day;

Order intake momentum has strengthened more recently, and the key Winter Sale trading period has started satisfactorily.

My opinion - the absolutely diabolical balance sheet rules this out for me.

NTAV is hugely negative, at -£287.2m

Watkin Jones (LON:WJG)

Share price: 242p (unchanged today, at 15:04)

No. shares: 255.7m

Market cap: £618.8m

Watkin Jones plc (AIM:WJG), the UK's leading developer and manager of residential for rent, with a focus on the student accommodation and Build to Rent sectors, announces its annual results for the year ended 30 September 2019 ('FY19').

This is such an interesting property developer, with a great niche. It builds student accommodation blocks, and other "build to rent" accommodation (i.e. apartments, studio flats, etc), and its clever niche is that these are pre-sold to institutional investors. Therefore WJG doesn't need to tie up much of its own capital. Providing it project manages each development well (on time, on budget), the it has a low risk model and banks guaranteed profits when ownership transfers to the institutional investor(s) at the pre-agreed price.

I won't go into all the detail, as it's late now, but I recommend subscribers read this announcement, as it's full of interesting industry stats about student accommodation, etc.

Key numbers;

- Adj EPS of 16.7p is up 4.6% on prior year, and looks a beat against forecast of 16.3p - good

- Divis up nearly 10%, giving a yield of about 3.74% - better than cash in the bank!

- Net cash of £76.8m - good

- Build to Rent pipeline is building strongly

- Lucrative contracts to look after day-to-day management of some properties after they are built

Management are really good here, I remember meeting them a few years ago and being impressed. Although note that they have been selling down on a large scale (c. £65m Director sells in last 2 years) - no wonder they were wearing very expensive-looking suits when we met!

How to value it? This is the tricky bit. Normally I like to pay not much over NTAV. In this case though, NTAV is £162m, but the market cap is £618m - a very large premium.

On a PER basis, it's valued at around 14.5 - that sounds OK, but I don't think property developers should necessarily be valued on an earnings multiple, since large projects would dry up in a recession, and you'd be left with nothing potentially, or very little anyway, until the economic cycle improves. So this should probably be seen as an extremely cyclical share - so we should run for the hills if a serious recession loomed.

My opinion - I really like the niche that WJG operates in, and it reeks of good management.

It's difficult to value though. The pipeline looks good, and I could see this share doing well over the next few years, if we avoid a recession.

Games Workshop (LON:GAW) - this extraordinary phenomenon continues, up 9% to 6960p today. Well done to those who took the time to properly understand the business model, and the remarkable opportunity here.

I have to leave it there for today. Thank you very much for all the lovely thumbs ups! I'm a complete baby when it comes to this issue, but there we go, we all have human foibles!

See you tomorrow, where I'm braced for hopefully a positive update from Revolution Bars, one of my Big Four holdings. Fingers crossed!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.