Morning! Graham here.

Huge thanks to Paul for volunteering to do yesterday's report, even though I was scheduled to do it. He didn't know this, but I had just spent three days in Newcastle. I am still recovering.

For today's report, I'm tempted to wade into controversial topics with a look at the macro outlook but we also have updates from:

- SDI (LON:SDI)

- Pressure Technologies (LON:PRES)

- City of London (LON:CIN)

- Hipgnosis Songs Fund (LON:SONG)

I have to leave the office at 1pm so the report will be finished by then, whether I like it or not.

Cheers

Graham

The Boom is Back

When the din of politics gets very loud, it can overshadow company news. This most certainly happened over the last few days.

If you've been looking at the comments on the SCVR recently, then you'll know what I mean. The dreaded 'B' word, and the 'E' word, dominated the thoughts of many readers.

Most of the time, I try to stay on higher ground and focus on companies. But the macro picture truly is of great interest to me when it comes to indexes and currencies. Let me preface what I am about to say with the warning that leveraged trading is unsuitable for the majority of people.

- Indexes

Having watched the FTSE-100 for pretty much my entire career, I think I have the ability to perceive when it offers good relative value. Maybe I am overconfident, but that is my perception.

I backed up my view by taking leveraged long positions in the FTSE during the Spring/Summer this year, believing that there was plenty of value around the low 7000s. Using options, I was able to structure the trades in such a way that I wouldn't lose any money, so long as it settled somewhere above the 6300-6500 region. While I liquidated all of those positions sooner than I wanted, I'd be interested to repeat the strategy if such good value was ever offered again.

The beauty of trading and investing in a diversified index, versus specific companies, is that you can afford to take on a lot of exposure with just a small number trades. That's the beauty of diversification: you can go "big", without necessarily taking on too much risk. Two of my largest three holdings are investment companies, for this reason.

Another benefit of index trading is that it allows us to manage the overall equity risk in our portfolio.

One of the UK's best-known private investors, for example, is Pete AKA Wheeliedealer (@wheeliedealer). He uses index trading in a completely different manner than I do, but it works for him. He sometimes reduces his portfolio equity risk by shorting the FTSE. If the FTSE falls, the profits on his short offset the reduction in value in his physical portfolio.

(Incidentally, this is why I think it's a bit misleading when spread bet companies say "X% of our clients lose money", as they are required to do under ESMA regulations. For those customers who use their spread bet accounts to hedge equity risk, it is to be expected that they will lose money on average - because stock markets generally go up.

However, if the customers sized their trades properly, they actually reduced the short-term risk in their portfolios. I bet that the majority of businesses who buy currency forwards and interest rate swaps from investment banks lose money, too - but investment banks aren't required to publish those statistics!)

Personally, I never take short positions in indexes. I only go long, because:

- indexes have positive expected return, over the long-term

- timing their temporary setbacks is difficult

- I am happy to accept large short-term swings in the value of my portfolio

For these reasons, I only want to increase my exposure to indexes. And occasionally, I think that some tactical leverage can be justified.

Anyway, the FTSE has indeed proved to be good value around 7000, thanks to the election result, and is now at 7500.

It's true that the possibility of FTSE companies being nationalised appeared possible, if the election went the other way. Additionally, tax rates and many other economic variables would have changed in ways that would have been, at the very least, highly uncertain in terms of their impact on business (I don't think this is a controversial statement).

But with the election having turned out the way that it did, the political risk associated with UK stocks has receded for the foreseeable future. We can imagine that future elections might be fought closer to the centre ground, which business groups would surely be very happy with.

Perhaps I was too relaxed about the risk associated with UK regime change, but I have tried hard to soak up the optimism that appears to be associated with long-term investing success. There is a positive mindset that I think you need, in order to win as a long-term equity investor. You need to be open to the gradual process of wealth generation and economic progress, while accepting that there will be mishaps along the way.

While it is no guarantee of success, I think that if you don't have this mindset, you risk sitting in too much cash, government bonds or other low-yielding assets for too long.

Anyway, with the FTSE at 7500, I now consider it to be in the region of fair value, with fair prospects for satisfactory positive returns (dividends + capital gains).

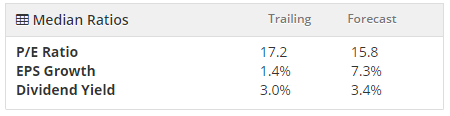

Here are the latest FTSE metrics according to Stocko:

The forward PEG ratio is 2.2x.

Here are the metrics for the S&P 500:

The forward PEG ratio for this one is 2.1x, i.e. marginally cheaper than the FTSE.

I would therefore say that the S&P 500 offers similar value to the FTSE, at current levels.

Indeed, two of the recent additions to my portfolio are top components of the S&P, and I intend to continue looking for nice opportunities in this index.

Index conclusions - while most investors will have seen some nice gains in their portfolio over the last week, it's important not to get carried away.

Firstly, if your portfolio hasn't performed particularly well, despite the index gains, it's not necessarily a sign of poor stock selection. See if there are company-specific reasons for the lack of strong performance. Check your annual and long-term performance metrics again.

If there are no company-specific reasons for a lack of strong movement this week, then it might just be a case of bad luck. It's not easy to predict which stocks will react the best to macro news such as an election result.

On the other hand, if your portfolio has performed extremely well, then celebrate by all means, but maybe think again before ploughing yet more funds into the stock market. If you weren't willing to be fully invested at 7000, due to the political risk at the time, are you sure that you want to plough money in at 7500? It might be worth reflecting on.

My stance is to remain more-or-less fully invested at all times.

Here is how my top 10 holdings have performed year to date (or in the case of Berkshire Hathaway and Northamber, since I bought them). Total return:

- Volvere (LON:VLE) (+9.6%)

- Burberry (LON:BRBY) (+24.8%)

- Berkshire Hathaway ($BRK.B) (+9.8%)

- H & T (LON:HAT) (+26.6%)

- Creightons (LON:CRL) (+42.8%)

- IG Group (LON:IGG) (+29.3%)

- PCF (LON:PCF) (-1.1%)

- Next (LON:NXT) (+84.7%)

- Northamber (LON:NAR) (+3.9%)

- B.P. Marsh & Partners (LON:BPM) (-5.7%)

I'm not unhappy about share prices going up but even more importantly than that, I think I have assembled a collection of sturdy businesses which I can have confidence in.

That said, I'll continue to remove those which don't meet my expectations or where my confidence or conviction dips too low. So far this year, I've removed Distil (LON:DIS), CMC Markets (LON:CMCX), Duke Royalty (LON:DUKE) and Record (LON:REC).

And share prices are but one element of the equation. Another key element of the macro outlook is:

- Currency exchange rates

These are hard to ignore for pretty much everyone. Even if you focus only on UK stocks, the difference between investing in an importer and an exporter can be huge, when interest rates are volatile.

For some time now, I've been saying that GPB is undervalued, particularly against the Euro. Yes, I've been talking my own book. But my rationale was:

- a belief that the purchasing power of GBP was strong, compared to European countries. I've just returned from a weekend of celebrations in Newcastle, where I used the Wetherspoons app to order more than my fair share of cheap food and drinks.

Of course people complain about the cost of living in the UK, but the UK is not really very expensive, compared to other European countries, and the job opportunities it provides are vastly better than most of its European rivals.

- a belief that the ECB would engage in permanent money-printing, with no effort at all to defend the value of its currency.

Some monetary hawks supported the creation of the ECB, thinking that it would bring German discipline to the European south.

I could never agree with that point of view. I always believed that when push came to shove, the ECB would be used to engage in far more money-printing, on the whole, than national banks would have done on their own.

In the past, a national bank in one European nation would have had some regard to the value of its exchange rate, relative to other European nations. Choosing a less inflationary policy would result in a stronger currency, attract foreign investment into the country, and allow its citizens to prosper - this is the story of the United States in the 20th century.

But with the ECB having a monopoly over the money supply in the entire Eurozone, the element of currency competition within Europe was mostly abolished, with certain exemptions such as Switzerland and the UK.

When I see Switzerland, I see proof that a country outside the EU with a strong economy can have an incredibly powerful currency. The Swiss National Bank temporarily pegged the Swiss franc against the euro a few years and bought an absurd pile of assets, which was only possible thanks to the extreme level of international demand for Swiss francs.

Therefore, while I didn't (and still don't) have much faith in the Bank of England under Mark Carney, I did believe that it would be difficult for the UK not to outperform the EU and the ECB, when it came to future inflation and money-printing.

I also believed in the fundamentals of the UK economy, that Brexit would be resolved and that its outcome would not be disastrous for the pound. In short, I did not believe that the post-referendum devaluation of the pound was justified or was permanent.

Well, if I can blow my own trumpet for a moment, my predictions are looking pretty good, although there is still a long way to go (the euro was only worth 76p in early 2016, and it's now worth 84.7p).

For this year alone, the pound is up over 6% against the Euro this year. This 6% boost has turbo-charged my returns, since my personal spending happens to be in Euros!

Is there more pound strength to come? I firmly believe so, but I could be wrong.

For now, the boom is back both in UK stocks and in the pound - and it's hard to complain about either of those two things.

I'm sorry if you were expecting company-specific analysis, but that's all I have time for today.

Paul will be with you again tomorrow, as I have a day trip to London for an AGM.

Best wishes everyone.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.