Good morning!

I'd like to thank you all for staying with us through the recent changes.

Let's see what's going on in the RNS:

- Angling Direct (LON:ANG) - trading update. New store opened in Nottingham on Friday, Like-for-like sales growth very strong.

- Franchise Brands (LON:FRAN) - AGM statement. "Overall, the group is trading well."

- Keywords Studios (LON:KWS) - acquisition in Japan for JPY 120 million (£800k).

- Totally (LON:TLY) - healthcare contract worth £13.5 million in Newcastle (not sure what the margins are).

- Fastjet (LON:FJET) - small underlying loss in Q1. Might make a small underlying profit in FY 2019. Severe currency issues in Zimbabwe.

- Hipgnosis Songs Fund (LON:SONG) - buys a major music catalogue including "Havana" (1.5 billion hits on YouTube). Price not given.

ZIRP Absurdity

I was thinking about putting an update out on the general state of the markets, and have been prodded into doing so by a comment in the thread below.

These two words sum up my thoughts: ZIRP Absurdity.

For those who aren't economics nerds, ZIRP stands for the "Zero Interest Rate Policy" favoured by so many central banks since the global financial crisis.

If the interest rate is close enough to zero that it makes it makes little difference, we can still refer to it as ZIRP. The Bank of England, for example, has inched up the Bank Rate only to 0.75%, and I would say that is close enough to zero that it makes little difference.

From the 1950s until the financial crisis, Bank Rate was in a range of 4% to 16%.

The USA recently escaped from ZIRP: the US interest rate is now within a 2.25% - 2.5% range.

With US government debt ballooning to $22 trillion, however (more than 100% of GDP), the prospect of much higher rates appears unlikely. Indeed, the Federal Reserve stopped increasing rates at the end of last year, and might even start cutting rates again over the next 12 months.

The Eurozone remains mired in ZIRP and only a few months ago finally halted its QE programme.

What it means

All of this easy monetary policy means an excess supply of funds flowing into risky assets and an intense competition for yield.

And as investors have realised that interest rates aren't going to normalise any time soon, there has been a squeeze higher in global equity markets.

The NASDAQ has surged by 30% since Christmas Eve and is back around its all-time highs. I believe that this index is most representative of the risk-taking fervour that has taken hold of investors.

It has been 11 years since Western economies had "normal" interest rates. It has been 11 years since a major crash in our asset prices. A new generation of investors and financial professionals has no living memory of these things, and will be uncomfortable if they experience normal rates or a market crash at some point in the future (which they surely will).

I do think there is still some relative value to be found in the UK, if we can avoid the many poor-quality companies which litter the LSE, both of the small-cap and large-cap variety.

The FTSE-100 Index is more firmly priced now, at 7500. You may remember that I was enthusiastic and had my " buying boots" on a couple of months ago, but I have to be a little bit more tactical at this level.

According to Stocko, this index currently offers a median forecast P/E ratio of 14.1x and a median forecast dividend yield of 4.1%: not bad. I wouldn't say that I'm priced out at this valuation, but I'm more balanced.

For example, I'm no longer an enthusiastic seller of puts on the FTSE, and might even end up buying some more bonds with spare cash. My portfolio is currently 92% in equities, and 8% in bonds.

The S&P 500 might also offer pockets of value, with a median P/E ratio of 17.5x according to Stockopedia (the average P/E ratio is much higher at 22x).

The Danger Areas

The global tech sector (including the NASDAQ) is where the froth is heaviest and valuations are at their most dangerous.

For example, the loss-making Lyft ($LYFT) has IPO'd, and Uber wants to follow soon. Pinterest ($PINS) (also loss-making) has listed, as of last week. Airbnb wants to join the party. There are plenty of others keen to IPO over the summer.

While they might be great companies, you can be sure that valuations are heavy when they all rush to sell stock to the public at the same time.

I call this "late bubble investing".

Yesterday, Tesla ($TSLA) (where I have a short position) gave a presentation in which Elon Musk declared that there will be 1 million Tesla "robo-taxis" next year, i.e. cars fully capable of driving themselves with nobody in them (pending regulatory approval), and will be able to compete with Uber and Lyft. He has claimed that the net present value of a single "robo-taxi" vehicle will be c. $200,000.

I believe that this is a fantasy and I agree with the Twitter user "TeslaCharts" who describes the company as "the poster child of ZIRP absurdity". Tesla is just the most prominent and most absurd example of a company which would not exist in its current form in a sober economic environment.

There is one key difference between the present environment and the dot-com boom of the late 1990s. In the 1990s, there were plenty of pre-revenue companies enjoying rich stock market valuations. They merely needed to promise that they had a large "addressable market".

In the present environment (perhaps because of the growth of the venture capital industry?), loss-making high-tech companies are achieving huge growth and huge valuations while still unlisted, and only several years later are they foisted upon the public markets. So they are at least generating revenues when they list and should therefore be less speculative, though profits remain elusive.

If we only stick to UK small-cap stock-picking, then perhaps we don't need to worry about these macro issues. Personally, I favour the risk reduction that can be achieved when I own some bonds and have some international exposure, so I find it helpful to track these topics. I hope you've found it helpful, too. Let me know if you disagree with anything I've said!

Angling Direct (LON:ANG)

- Share price: 73p (+8%)

- No. of shares: 65 million

- Market cap: £47 million

Replacement - New Store Opening and Trading Update

Slightly embarrassing mix-up at Angling Direct this morning - the original RNS has been replaced.

Some great news for investors:

- 27th store opened.

- Like-for-like sales up 28.5%, overall sales up 50.7% (in February and March).

- UK store roll out programme "on track".

I've just opened up a broker note from February. It has an FY January 2019 revenue forecast of £44 million, and an FY 2020 revenue forecast of £54 million (an increase of 23%).

So trading in February and March appears significantly ahead of expectations. It would have been helpful if the trading update had made some reference to this!

Note that there was a small acquisition in late February, and this will have boosted total revenues in March.

My view

Usually macro factors are blamed when things go wrong at a retail company, even though management might bear most of the blame.

But when things are going well, it's only right to congratulate management for getting things right. The CEO of Angling Direct attributes the company's strong progress to "our strategic focus on customer experience and service, as well as positioning our stores in the correct locations".

Perhaps it's not more complicated than that: the management at Angling Direct have done a good job at picking the right locations, and have made some other correct decisions.

As noted previously, the most recent Angling Direct broker forecasts indicate that the company will remain loss-making this year.

If it crossed the threshold to profitability, that might help the shares to re-rate higher but they already look rather expensive to me: the market cap is worth more than £1 million per store, using the future store count.

E-commerce sales are growing strongly, so you might be able to make an argument for the market cap using that side of the business. Online sales were more than half of the company's total sales in FY January 2019. Online sales are growing in Germany, France and the Netherlands.

I would buy this at a lower level, but I'm priced out of it currently.

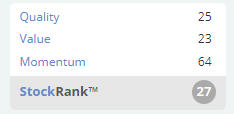

StockRanks agree with me:

Franchise Brands (LON:FRAN)

- Share price: 87.5p (+3.5%)

- No. of shares: 77 million

- Market cap: £68 million

AGM Statement and Q1 Trading Update

Another update without reference to prior expectations, but the market is happy with it and the numbers are positive:

- Q1 system sales at Metro Rod +12.9%

- B2C brands (ChipsAway, Ovenclean and Barking Mad) have all had "a positive start to the year".

My view

It's only a short update, so I won't dwell on it.

According to a note published today on Research Tree, Franchise Brands is forecast to make adjusted PBT of £3.5 million this year, followed by £4.2 million next year.

Unfortunately, I am priced out of it at the current market cap.

In its favour, I would point out that Nigel Wray is a 28% shareholder at Franchise Brands (LON:FRAN). He enjoyed huge success with Domino's Pizza (LON:DOM) and understands the profitability that a franchising business model can achieve. I wonder how large he thinks this one could eventually grow to!

Keywords Studios (LON:KWS)

- Share price: £14.72 (+0.1%)

- No. of shares: 64 million

- Market cap: £942 million

Keywords, the video game support services provider, makes a fresh acquisition - the latest in a long line of deals for this industry consolidator. This deal looks small in the grand scheme of things and is not the company's first play in Japan.

My view - Keywords doesn't fit with my preference for organic growth and my avoidance of "buy-and-build" (when looking at non-financial companies), so it's not on my radar or watchlist for a potential purchase.

I do admire its track record of successful integration so far - when it is at more normal P/E rating (e.g. a couple of months ago), I think I can understand why people find it attractive. Congrats to those who have held it for a few years and enjoyed huge capital gains!

Please see my comments from earlier this month for a more detailed review of the company.

Totally (LON:TLY)

- Share price: 11.8p (+1%)

- No. of shares: 60 million

- Market cap: £7 million

Vocare awarded new contract worth up to £13.5 million

A large contract in revenue terms: £1.94 million p.a. to provide urgent care services for Newcastle Gateshead. Services include an Urgent Treatment Centre and GP Visiting Services.

This follows a range of contract extensions won a couple of weeks ago.

I have no idea what the margins on these contracts are (probably v. small) or if this company is worth anything, but I'm happy to pass the idea along to others who may wish to research it in greater detail.

Fastjet (LON:FJET)

- Share price: 1.475p (+3.5%)

- No. of shares: 3,800 million

- Market cap: £56 million

I've been making fun of analysing this company for several years now, and have been astonished that a well-known, reputable UK fund manager continues to throw good money after bad in support of it.

This fund manager participated in yet another equity fundraising in November 2018, many years after the original idea to invest in Fastjet should have been abandoned.

Despite the company avoiding a technical administration, the equity base has effectively been restructured with its wet-lease supplier, Solenta Aviation, now owning 60% of Fastjet's shares.

Solenta appears to be a proper commercial outfit, and I guess its involvement should be considered a positive.

Fastjet's CEO since 2016 is also a much better choice of CEO compared to his predecessor, having strong experience in the aviation industry in Africa.

So I am pleased to see that the company is making progress towards breakeven: it suffered a small underlying operating loss in Q1 2019, and is looking for a "marginal" underlying operating profit in the current financial year.

My view

Despite these positives, it remains uninvestable to me and off the scales in terms of where it lies on the risk spectrum.

After restructuring and divestment, Zimbabwe now accounts for 74% of Fastjet's revenue. The Zimbabwe unit recorded a profitable Q1. But it's still much too soon for shareholders to celebrate.

Readers of this report will have some awareness of the problems in Zimbabwe, given Paul's coverage. The country is a mess as far as monetary policy is concerned (even worse than the West), and the government has tried to introduce a new currency. Fastjet and its Zimbabwean customers need to manage volatile inflation, a shortage of "hard currency" (i.e. US dollars), and restrictions on the ability to move money across borders.

I continue to believe that this company is worthless. Or if it does have some equity value, I suspect that Solenta will control all of that value at some point in the future.

Hipgnosis Songs Fund (LON:SONG)

- Share price: 103.3p (-0.7%)

- No. of shares: 341 million

- Market cap: £352 million

Acquisition of Music Catalogue

This unusual fund - focusing on songs - picks up the catalogue from Brittany Hazzard, known as Starrah. Her songs include Havana and Girls Like You. Starrah and her manager are also joining the fund's Advisory Board.

Hipgnosis has raised a gross total of £350 million from investors since IPO last year, with placings at 100p and 102p.

The original placing was used to purchase music catalogues at a historic P/E multiple of 12.6x, so there is potentially some value to be had. Might be worth researching in greater detail.

That's it for today, thanks everyone for your input!

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.