Good morning everyone!

First up, I'd like to mention that there are a few spaces left in the "StockSlam" coming up this Thursday, July 26th. It's an opportunity to meet other investors, and (while there are still a few spaces left) to present the case for your favourite stock. Here's the link.

In terms of company news today, we have:

- IG Group (LON:IGG) - final results

- Fevertree Drinks (LON:FEVR) - interim results

- Fulham Shore (LON:FUL) - final results

There are lots of trading updates, including from:

3.30pm: Putting in some quick comments now, as I'm running out of time.

- Cenkos Securities (LON:CNKS) (-13%) - full year revenue for 2018 is set to be materially below 2017, due to tough comparatives and a difficult start to the year. I don't intend to buy back into this labour-intensive company but I can't deny that its shares are exceedingly cheap for a business which has never made a loss and has been very generous to shareholders in the good times. At the end of last year, it had net assets of £30 million and cash of £37 million. The market cap is now £48 million.

- Motorpoint (LON:MOTR) - trading in line with expectations, no change.

- Charles Stanley (LON:CAY) - trading in line with expectations. As you were.

IG Group (LON:IGG)

- Share price: 860p (-0.6%)

- No. of shares: 368 million

- Market cap: £3,164 million

Results for the Year ended 31 May 2018

(Please note that I currently own IGG shares.)

These results from IG are in line with expectations.

The company has performed very well, yet again. Operating profit is up 32% thanks to improvement both in net revenue (+16%) and in the operating margin.

Cash flow generation remains excellent. Net cash of £228 million is generated from operating activities, about the same as reported net income of £226 million. Of this, less than 10% is reinvested in PPE and intangible assets.

The dividend gets a big boost, offering investors a yield of c. 5% at the current share price. It is likely to be held at this current level until earnings start to increase again.

Outlook

Earnings will be under pressure in FY 2019, thanks to ESMA (European Securities and Markets Authority) rules coming into force on 1 August 2018.

We've discussed these rules before in this report. IG and its competitors have had time to prepare for them to come into effect.

It's comforting to see reiteration that the reduction in historic revenue from these rules would have been 10%, before any mitigating actions.

3pm: fixed this for an error. IG continues to guide that 50% of UK/EU revenue will be generated by clients categorised as professional (compare this to Plus500 (LON:PLUS), which estimated that 12% of its EEA clients generating 75% of its EEA revenues would be eligible to be categorised as professional). All of these companies generate the majority of their revenues from a minority of their clients.

To mitigate the effects of the new rules, IG says it allows retail clients to apply to use its non-EU entities to trade with - interesting. It is also developing new products for retail customers that will comply with the regulations.

Earnings per share will fall from 61.7p in FY 2018 to an estimated 51.2p in FY 2019, before hopefully resuming growth.

My view

I'm very happy to continue holding this one. I agree with the company's statement that it differentiates itself through its good conduct - it treats customers fairly.

Most of the revenue from FY 2018 relates to customers who have been with IG for over 3 years, and you will find plenty of customers who have been using them for 5 or 10 years.

Something I've noticed not just from the numbers (e.g. the reduction in IG's client pool), but also from IG's communications with clients on its own message board, is that it has become increasingly explicit about not wanting business from clients who don't understand its products or who can't afford to trade.

Forgive me for quoting this below section in full, but I think it's important to get a feel for the company's approach:

The number of client 'first trades' is significantly lower than the number of clients who applied for an account. There is huge demand for the OTC leveraged derivative product, but IG seeks to ensure that it only accepts appropriate clients who understand the products and the associated risk. The rigorous processes the business employs to assess applicants to ensure that they have sufficient knowledge and experience, and sufficient wealth, reflects IG's belief that leveraged derivative products are not suitable for the vast majority of individuals.

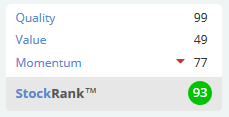

The shares are loved by Stocko algorithms when it comes to quality and momentum, but they aren't overly cheap right now, at c. 17x earnings.

In terms of future growth opportunities, I don't see any reason why the company can't continue to grow into new geographies and to develop innovative new products in the years ahead. It will launch a new US business (for FX trading) in the next few months, and plans to launch a new exchange for European retail clients in the second half of the year.

I suppose the major threat is that ESMA or another regulator would impose more regulation and threaten the business model again at some point.

I'm willing to take that chance. IG serves many other markets rather than just the EU, and I suspect that regulation has other beneficial effects in reducing the threat of competition, thereby ultimately making life easier for established players like IG.

Fevertree Drinks (LON:FEVR)

- Share price: 3861p (+12%)

- No. of shares: 115.5 million

- Market cap: £4,459 million

This supplier of tonic water is obviously far too big for this report. I'd like to keep tabs on it, though.

Some of the highlights:

- revenue +45% to £104 million. Gross margin 53.2%.

- agreement signed with the largest North American wine and spirits distribution company. 29 states covered.

- agreement signed for distribution in Spain.

- full-year outcome to be comfortably ahead of expectations.

The share price has reached a fresh all-time high today, and has approximately doubled compared to where it was trading at as recently as December.

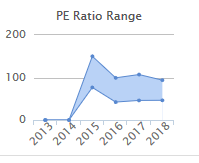

Whenever the P/E ratio has been in the low 40s over the past few years, it has been a bargain:

Key trends driving growth: "the well-established premiumisation trend across the wider beverage sector as well as the movement to long mixed drinks".

It's fortunate that this premiumisation occurred while Schweppes was complacent, and had allowed its own brand image to cheapen. Schweppes started fighting back last year. But Fevertree had arguably already stolen its thunder. Fevertree today points to statistics indicating that that it is now the category leader in UK mixers, with 40% value share.

The USA operation is gearing up. 32 employees have been hired to directly manage expansion over there.

Cash balance is healthy (£56 million).

My view - I'm happy to keep an eye on this.

In terms of valuation, the share price indicates that investors are expecting Fevertree to achieve a good level of success in the USA and several other parts of the world, too. Based on progress so far, you would have to say that this is quite likely.

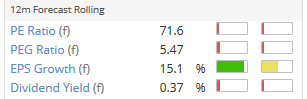

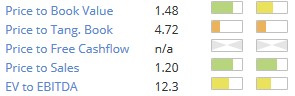

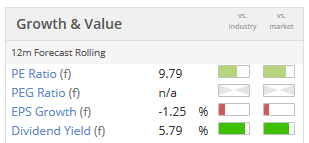

Not much value on offer relative to current earnings, of course:

Fulham Shore (LON:FUL)

- Share price: 10p (-1.5%)

- No. of shares: 571 million

- Market cap: £57 million

Apologies for not covering any small-caps until now. We are back in regular territory with this medium-sized restaurant group.

I've tried out the sourdough pizzas at Fulham Shore's Franco Manca. No complaints in terms of taste, quality or price. The menu is rather limited, though - that's one of the ways it keeps costs down. It also chooses slightly off-beat locations.

It's common knowledge that there are too many restaurants, and capacity needs to be removed from the marketplace to restore profitability. Landlords who have seen their retailing tenants struggle will now see their restaurateur clients in the same boat. It's good news for anyone who wants to rent some commercial property, I guess!

Latest numbers

These results show revenues up thanks to expansion, but profits down.

We don't get like-for-like numbers from Fulham Shore but it does report that sales at Franco Manca's original branches (prior to the 2015-2017 expansion) have stabilised.

Headline EBITDA improves slightly to £7.4 million. Headline operating profit, a more meaningful number in my view, comes in at £3.7 million.

When you take all statutory costs into account, you are left with an operating profit only marginally above breakeven. Finance costs then eat away at that, so the company makes a small pre-tax loss.

Outlook

Q1 trading at Franco Manca and The Real Greek (its other brand) are said to be "encouraging", achieving like-for-like revenue growth.

Growth expectations have previously been reset lower for this stock. Management says it plans to open "a limited number of new restaurants this year", and will "approach expansion with caution". Sounds very sensible to me.

Despite good trading in Q1 and overall confidence in the future, there is an admission that visibility is not great:

... the remainder of the financial year is difficult to predict. Costs will, in all likelihood, continue to rise but maybe not as much as they did during the past financial year.

My view

Management appear to be doing the best they can in the circumstances. It's tough out there.

If I had to make a single guess as to what the fair value for this stock is, I would probably say book value (6.6p per share). If it could surprise me by earning above-average returns on capital, then I could raise my estimate.

IQE (LON:IQE)

- Share price: 105.9p (+4.5%)

- No. of shares: 761 million

- Market cap: £806 million

H1 2018 Post-close trading update

IQE plc (AIM: IQE; "IQE", the “Company” or the "Group"), the leading global supplier of advanced wafer products and wafer services to the semiconductor industry, provides a trading statement for the six months ended 30 June 2018.

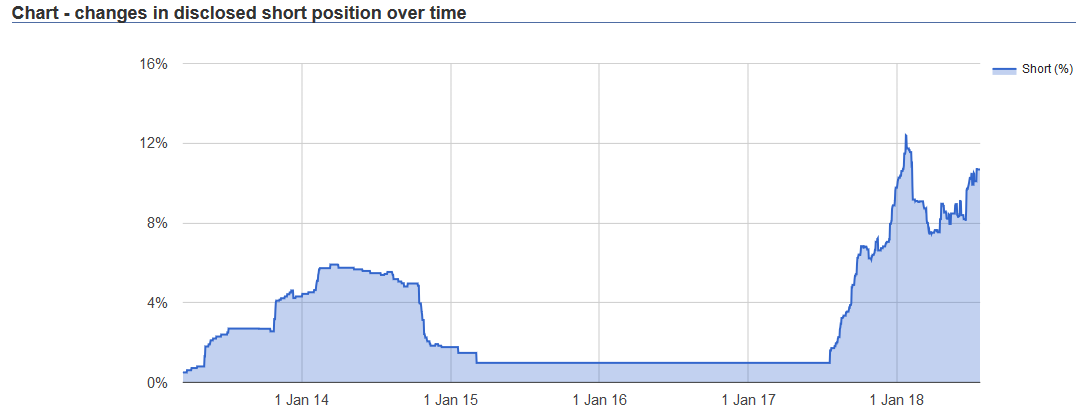

Readers may recall that this had a short attack launched against it last year.

The share price may not have collapsed yet but the shorters are sticking around. At least 10.7% of IQE's shares have been sold short across 8 funds, according to shorttracker.co.uk.

You can see that it's not the first time that IQE has come to the attention of the shorters. It also looked attractive to them back in 2013/2014.

Trading is reported in line with expectations, though I understand that the top-line performance of £73 million sales for H1 is materially below consensus. If it had not been for a currency headwind, it would have reported "strong double digit" sales growth.

IQE has been forecasting a 40:60 revenue split between H1 and H2. It will need about £106 million of sales in H2 to meet forecasts - this could be challenging.

Pre-tax profit is anticipated to more than double this year, to £33 million, if forecasts are met.

My view

I admit that I find this technology difficult to grasp, but I think it's fair to point out the obvious: this is a capital-intensive manufacturing business.

Assets grew to over £300 million by the end of last year, from which the company earned an adjusted profit before tax of £24 million (using its own calculations).

It is building 10 new reactors this year, and then plans to build more in 2019, so I expect the asset base will grow bigger and bigger.

That is a lot of shareholder wealth tied up in physical plant and intangibles.

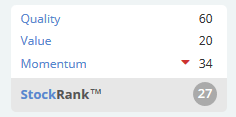

Stocko algorithms don't see what all the fuss is about, either. Maybe some IQE bulls could help explain it to me?

XLMedia (LON:XLM)

- Share price: 103.5p (-2%)

- No. of shares: 220 million

- Market cap: £228 million

This is trading in line with expectations. It's an online marketing group which owns some traffic-heavy websites and has developed clever systems to find customers for gambling and other services.

Last month, it had a serious profit warning due to regulatory issues in Australia and Europe. It is increasing its focus on the personal finance space (loans and credit cards, basically) as governments make it less attractive to target potential gamblers.

I'm not changing my stance on this. It's definitely in value territory, relative to cash generation and earnings. It may be of interest to those who are more adventurous than I am when it comes to investing in foreign companies.

I'm out of time for today. There were too many updates to cover them all, but I went as far as I could. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.