Morning folks.

Today we have:

- Non-Standard Finance (LON:NSF) / Provident Financial (LON:PFG) investigation by CMA, as expected

- XLMedia (LON:XLM)

- 888 (LON:888)

- Air Partner (LON:AIR)

- CMC Markets (LON:CMCX) (from yesterday)

- Taptica International (LON:TAP) (from yesterday)

Non-Standard Finance (LON:NSF) / Provident Financial (LON:PFG) - the Competition and Markets Authority has started investigating the proposed merger.

XLMedia (LON:XLM)

- Share price: 53.6p (-31%)

- No. of shares: 217 million

- Market cap: £116 million

Isn't it remarkable how things nearly always seems to go wrong with these Israeli tech companies?

You can see my historic coverage of this "performance marketing" business in the archives. I've always found XLM to be worth reviewing, and have been encouraged by its share buybacks. But I never pulled the trigger and put it in my own portfolio, because the category it's in is just so dangerous.

Strategic Update

- more investment in its Publishing division (i.e. managing its own websites) going forward,

- reduction in "non-core" Media activities, so there will be a "substantial reduction" in Media revenues.

XLM has never to my knowledge used the phrase "non-core" in relation to some of its Media actitivities, until today.

But it has previously reported the regulatory pressure on its Media revenues in various markets (e.g. bans on gambling advertising), and that its main focus is on growing its Publishing revenues instead. Media revenues collapsed by 31% in H1 2018, and contributed just 22% of total gross profit for the group.

So today's strategic update is not really a change in direction - it's more like an acceleration in the direction it was already going, if that makes sense.

XLM's investment in Publishing will create a "short-term impact on Group EBITDA", as the $7 million of internal spending will not be capitalised.

Current trading

- 2019 has started in line with expectations

- expected $11 - $13 million impairment in acquired intangible assets as their associated activities cease.

- FY 2019 revenues expected down by c. $30 million and EBITDA down by $6-$7 million for FY 2019.

This suggests revenue of $88 million and EBITDA of c. $37 - $38 million. XLM's latest market cap is c. $153 million.

- The company remains committed to the $10 million buyback and a progressive dividend policy with 50% of adjusted net profit paid out in dividend.

My view

I must admit that I am sorely tempted to buy into the shares at current level. It's probably the most tempted that I've ever been, to own some XLM. The value on offer now is the best I remember seeing.

But I have to stick to my method and avoid buying something just because it is "value". There needs to be convincing evidence of quality, too. I don't really know if XLM's websites are going to be around for the long-term.

If quantitative value is what you're into, there is plenty of that on offer here. These metrics are from last night, before a 30% share price fall in response to a 15% EBITDA cut:

Personal Trading Update

I've finally made my first share trade of 2019 (excluding index trades), topping up my position in 888 (LON:888) and bringing it up to 4% of my portfolio.

Last night, I tried out its live casino for the first time in a couple of years (this is separate to its competitive poker offering). It was such an impressive, immersive experience - just like being in a real casino, with a fun and easy interface and great interaction with the dealers.

Of course it's not the only company offering this service, but I thought that they are doing such a super job, my level of confidence in the business increased quite a lot!

Combining that "due diligence" with today's temptation to pick up XLMedia (LON:XLM), I thought the best thing to do was to double down in the Israeli internet business where I do have confidence and feel that there is an element of safety. 888 isn't nearly as cheap as XLM, naturally, but the risk/reward at a PER of c. 12x and dividend yield greater than 6% seems to offer favourable odds.

Air Partner (LON:AIR)

- Share price: 83p (-2.6%)

- No. of shares: 52.2 million

- Market cap: £43 million

FY Trading Update and Notification of Results

Air Partner plc ('Air Partner' or 'Group'), the global aviation services group, today provides a trading update for the year ended 31 January 2019.

Key points:

- both divisions (Charter and Consulting & Training) reported to be doing well, though Private Jet flights are only flat on the prior year.

- underlying PBT at least £5.8 million for FY 2019 (ending January), the same as the prior year.. The RNS doesn't say it, but this is below consensus of £6.1 million.

Outlook:

- organic and acquisition-led growth opportunities being assessed

- headcount increases are planned

- global charter flight business to remain volatile

Worth noting that one of the company's brokers has made rather significant cuts to its underlying PBT estimates for FY 2020 (the current financial year) and FY 2021, reducing them by 12% and 13%, respectively. This is materially larger than the 7% miss for FY 2019. The broker gives "heightened economic uncertainty" as the reason for this large downgrade (you can find this on Research Tree).

I would normally expect the company's share price to be down by a similar percentage, in line with the reduction in its profit forecasts for the current year or next year.

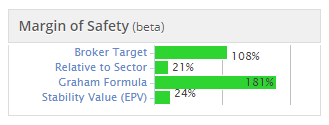

Perhaps the fact that the shares are already quite cheap on fundamentals is supporting the share price?

Indeed, the broker thinks that Air Partner shares are worth 145p on DCF fundamentals (cut from 160p), but its "target price" is only 115p. It applies a 21% discount to fair value "because of the lack of short-term catalysts".

I like the transparency of this: in my opinion, most brokers simply adjust their fair value estimates to come up with a number that they think is reasonable and tempting for their clients over the next 6-12 months. This means that their fair value estimates are worthless.

In this case, the broker reports fair value on fundamentals separately, and then applies a discretionary discount to come up with a number that it thinks is realistic in the short-term. Much more transparent and therefore much better research.

My view

Overall, I have positive impression of Air Partner.

You could argue that its adjustments to arrive at "underlying" PBT are a little generous, I suppose. There were £800k of after-tax adjustments to profits in FY 2018, and FY 2019's adjustments will be at least £1.4 million after large costs associated with its accounting review in H1.

Management should be judged not only on their ability to grow a business on an underlying basis, but also on their ability to manage and reduce exceptional costs. If £AIR's exceptional costs can reduce through FY 2020 and FY 2021, then I do suspect that the shares will turn out to look cheap at their current levels, in hindsight.

It's not a company I've looked at in great detail, however. Organic growth seems rather limited at present, but management have probably been distracted by the need to understand and resolve their accounting mishap. Perhaps now that the business has their full attention again, it can enjoy a few years of nice progress?

CMC Markets (LON:CMCX)

- Share price: 87.1p (-1%)

- No. of shares: 289 million

- Market cap: £252 million

(Please note that I bought some CMCX shares after writing this.)

This spreadbet and CFD provider issued a profit warning during market hours last Friday, and I've been meaning to catch up with it.

Readers will recall that EU ESMA measures restricting leverage for retail clients were enforced from August 2018.

CMC (and other providers) are still figuring out what the long-term impacts of these restrictions might be.

Besides regulatory issues, there is also the perennial volatility caused by market conditions to reckon with.

- Markets have been unexciting ("narrower daily ranges in major products"), meaning that client activity has reduced.

- Client performance has been "exceptionally strong".

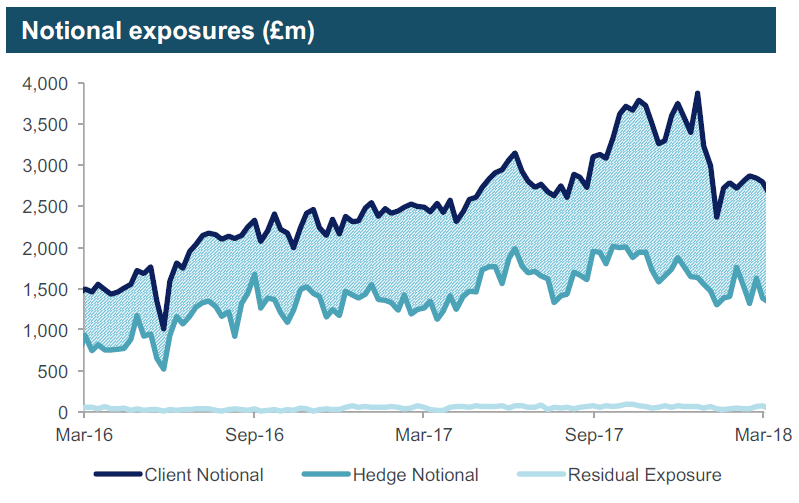

I've pulled out the CMC analyst presentation for FY 2018, to get a sense for the extent to which CMC hedges its clients' positions. Here's the relevant chart. The line at the bottom is what's left over after hedging:

While the number isn't given for client residual exposure, it is clear enough that nearly all of the client notional position size is hedged, with just a tiny fraction of it left in client residual exposure (as is the case at IG Group (LON:IGG), where I have a long position).

Relative to CFD and spreadbet revenues of c. £150 - £175 million annually, the net win or loss by clients on the residual exposure does not seem like it should be a major contributor to results.

But for FY March 2019, we have:

- exceptional client P&L losses

- reduced activity caused by low market volatility

- ESMA enforcement from August 2018 (including the ban on binary options)

As a consequence of all of the above, CFD and spreadbet revenue is now expected to come in 25% - 35% lower year-on-year for FY 2019, versus previous guidance for a 20% reduction (which was also below previous guidance - there have been multiple profit warnings).

According to my sums, the new forecast for CFD and spreadbet net revenue in FY 2019 is £114 million - £131 million, or £122 million at the midpoint.

Other revenue streams might be able to generate c. £20 million in the years ahead (stockbroking, etc.)

In a bear case scenario, if the revenue figure turns out to be just £114 million, and holding other items constant, then net operating income would reduce almost to breakeven (but we should note that other revenue items are in fact forecast to grow).

Indeed, the company is still officially forecast to make healthy profits this year and next year, and makes no change to forecasts for FY 2020 operating income. Strong performance by clients is unlikely to repeat and renewed market volatility would encourage more trading activity. This will be offset by the fact that it is the first full year in which ESMA regulations are enforced.

I am considering making a purchase, but haven't yet quite managed to convince myself that the forecasts make sense, given the annualisation of the ESMA impact. Nonetheless, a very interesting situation where a decent financial stock remains profitable and is available at a >60% discount to its IPO price.

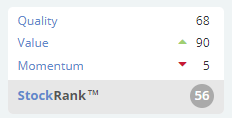

The StockRanks are impressed by the Quality and Value, but Momentum is diabolically poor. Perhaps there will be one or two more profit warnings in the works, if markets haven't become more favourable by Q1 FY 2020? Calling the bottom is never easy!

Edit: After playing with the numbers some more, I decided to open a starter position here for just 1% of my portfolio. Net tangible asset value per share is something like 71p, with a very liquid balance sheet, so I think there should be considerable downside protection even if profits continue to disappoint.

Taptica International (LON:TAP)

- Share price: 165p (-1%)

- No. of shares: 69 million

- Market cap: £113 million

Yesterday morning, the online advertising group Taptica said that FY 2019 had got off to a "varied" start. In the context, this seems like a nice way of saying that it got off to a poor start.

There are "anticipated industry headwinds across the supply chain", which are presumably worse than expected or else why would they have been mentioned in this update?

One of the goals of the proposed merger with RhythmOne/Blinkx is to smooth out the volatility in supply (which I think means the availability of advertising space at publishers).

Net cash is $54 million at year-end (December 2018).

My view - This Israeli tech company remains outside my investable universe and yesterday's update doesn't make me any more interested in it.

All done for today, thank you.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.