Good morning!

Lots to digest today.

This list is final:

- DP Poland (LON:DPP) - final results

- Moss Bros (LON:MOSB) - preliminary results

- Quartix Holdings (LON:QTX) - trading statement

- Vianet (LON:VNET) - trading update

- Fevertree Drinks (LON:FEVR) - preliminary results

- S&U (LON:SUS) - final results

- XLMedia (LON:XLM) - final results

- MySale (LON:MYSL) - half year results

Cheers!

Graham

DP Poland (LON:DPP)

- Share price: 8p (-5%)

- No. of shares: 250 million

- Market cap: £20 million

Let's see how DP Poland is progressing.

Paul has written some very critical (but fair comments) in recent months - see the archives.

So far, the business model is taking a very long time to bear the fruit of profits.

Ongoing losses and the need for more marking spend created the need for a placing at 6p last month, raising almost £6 million before expenses.

Results

It sounds like 2018 was a miss in terms of store openings. According to my notes from last May, DPP was targeting 70 stores by the end of the year.

DPP currently has 66 stores, which includes 3 stores opened during 2019 year-to-date.

Revenues are up by 24% to £15 million.

The EBITDA loss for 2018 is £1.92 million, slightly bigger than the loss in 2017. The total loss, including share-based bonuses for staff, depreciation and amortisation, is £3.8 million. This is considerably bigger than the loss in 2017.

I also note that £200k of costs relating to software and other intangible assets were capitalised instead of expensed, so they are not included in the loss figuresabove.

We knew that losses were in the works. At its trading update last month, DPP said it was looking to achieve positive EBITDA and cash flow breakeven in 2022.

Like-for-like sales growth at stores was 6% (this figure is adjusted so that it doesn't include the cannibalisation effect of opening two stores in the same area).

Factors - the World Cup was a positive, but "exceptionally warm and dry weather" didn't help.

On top of that, advertising costs went up at "the two main delivery aggregators". I think the company is saying that it couldn't afford to spend as much as it wanted to on other advertising channels, because it had to spend so much at the delivery aggregators.

(This is an example of the pricing power at the likes of Just Eat (LON:JE.) ?)

Growing pains

There are more indications that things haven't been going to plan.

- A TV advertising trial failed to produce a good return on investment. The company says it needs a bigger store network to justify TV advertising in future.

- Some corporate stores are set for closure unless they can be sold to a franchisee.

The two commissaries (food factories) are doing ok, growing their gross profits by 21%.

Outlook - like-for-likes in January/February 2019 are negative since they don't have the benefit of TV advertising.

There are new sales tactics via social media and a new strategy with one of the delivery aggregators whereby DPP will deliver the orders received via this aggregator.

My view

These results make for grim reading. Revenue minus "direct costs" is barely positive, at c. £1 million.

That's before you deduct the SG&A (overhead expenses) of almost £3 million.

What this says to me is that DPP needs to be a lot bigger before it can make a positive adjusted EBITDA. It might need to be twice as large.

It depends on whether food margins can improve with increased scale. It also depends on the mix of stores between franchised and corporate.

Therefore, I wouldn't be surprised if DPP needed to raise funds again before it reaches profitability. Another few years of losses and store pre-opening costs could potentially use up the c. £7 million cash balance, before it can fund itself.

I take an interest in this because of my very small stake in DP Eurasia NV (LON:DPEU), which is active in Turkey and Russia.

DPEU is much bigger than DPP (about £100 million in sales last year at DPEU, versus £15 million at DPP) and it has been profitable, so it's a different story. But I do think that the troubles in Poland sound a major note of caution in relation to the prospects in Russia.

Moss Bros (LON:MOSB)

- Share price: 22p (-8%)

- No. of shares: 101 million

- Market cap: £22 million

You have to read through this results statement for a while before you get to the store like-for-like sales, which are down 7.4%. Store sales are 85% of the total, so I think that Moss should display this metric more prominently.

Additionaly, gross margins fell by 2.5%, affected by FX rates and "deeper discounting during the fourth quarter of the year to remain competitive in a highly promotional market".

And like-for-like hire sales continued their decline, down by 9.3%.

E-commerce sales, on the other hand, are up by 19.6% (the company includes VAT in this figure - anybody know why?).

The company highlights that the stores and the e-commerce channels support each other, which is a fair point. Next (LON:NXT) (in which I have a long position) says something similar. But Moss is still heavily weighted to physical stores rather than online sales.

Average lease length - 50 months, with an average of 33 months to next break option. Could b worse.

Recent trading - positive response to the Spring/Summer 2019 ranges.

For the first 8 weeks of FY 2020, the company reports every like-for-like number except the store like-for-likes. Total sales, including e-commerce, are up 3.6%. Hire sales are still falling.

Outlook - confident. Lots of initiatives being trialled to strengthen the customer proposition. Lots of investment in the e-commerce platform.

My view

Moss looks like yet another casualty of reduced footfall in traditional retail environments.

The balance sheet looks strong on an initial inspection, so at least it has that in its favour. And with the average lease length not being too long, it could hopefully shut down stores and/or renegotiate rents in due course.

It's not something I would want to bet my own funds on. E-commerce sales are still rather small as a percentage of the total (14.5%), and so I would be concerned that they might not be enough to carry the company through the difficult conditions which are likely to prevail for the foreseeable future.

Also, in my opinion, today's statement wasn't upfront about the terrible performance at the stores. And I think it downplayed the likelihood that difficult conditions at the stores are likely to continue for the foreseeable future, by blaming the results on a host of temporary and economic factors, rather than the overarching shift to online.

These warning signs would deter me from investing here, on top of the results themselves.

It took me a while to accept the extent to which retail was changing. Unfortunately, it sounds like some retailers themselves haven't quite accepted it, either.

Quartix Holdings (LON:QTX)

- Share price: 258p (+5%)

- No. of shares: 48 million

- Market cap: £123 million

Trading at this telematics business in January and February is consistent with meeting market expectations for the year.

There are very positive-sounding inceases in new installations in the UK, France and USA (watch out - this is the second derivative of sales).

New territories: expansion has begun in Poland and Spain. Ireland is next.

Insurance: continues its decline, as planned, but remains profitable. Quartix has been managing down its low-margin insurance-related activities.

CEO comment:

We are delighted with the progress made in our fleet business in the first quarter. Growth in new customer acquisition and new vehicle installations has accelerated and we have launched our telematics service in two new markets. We look forward to the rest of 2019 and beyond with confidence.

My view

Though I've never bought shares in Quartix, I admire its performance and its reporting style.

In today's statement, for example, Quartix includes consensus market expectations of sales, adjusted EBITDA and free cash flow as a footnote. It's a small thing, but it helps to keep everyone on the same page. Every company should do this.

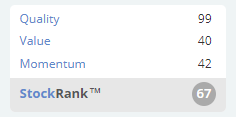

The StockRanks acknowledge the quality here, too, with a QualityRank of 99.

Vianet (LON:VNET)

- Share price: 121p (unch.)

- No. of shares: 29 million

- Market cap: £35 million

Trading Update and Notice of Results

The results for FY March 2019 are set to be in line with expectations.

As we've discussed before, it now calls itself an "Internet of Things" platform.

It has a track record of profitability, so it could probably attract good investors without using this buzzword. Whenever I hear "Internet of Things", "Machine Learning", etc., I tend to get very suspicious and want to move on to the next opportunity!

The StockRanks love it - scoring 90 out of 100, so it might be worth looking into.

Fevertree Drinks (LON:FEVR)

- Share price: 2615p (+3%)

- No. of shares: 116 million

- Market cap: £3,030 million

These results to December 2018 look like a small beat compared to the consensus forecasts.

- Revenues are £237.4 million (£236.2 million forecast)

- Adjusted EBITDA £78.6 million (£77.2 million forecast)

- Net income £61.8 million (£60.7 million forecast)

It was a great summer for gin, helped by the nice weather. Premiumisation of the drinks industry is real, along with the strong growth in spirits, and Fevertree taking market share within its category. It's the perfect growth story.

So far in 2019, trading is in line with expectations.

I've been sniffing around for a buying opportunity in this share, to see if I can open a starter position.

With the share price having achieved no net progress in 18 months, and the depressed mood in AIM, maybe now is as good a time as any?

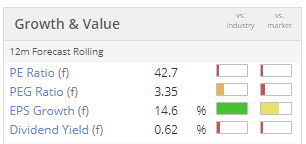

The ValueRank is 1 out of 100 (I can't remember if it's possible to get zero). So from a quantitative point of view, the value isn't there yet.

Looking ahead to 2020, the company is forecast to make net income of £83 million.

The current £3 billion valuation prices in net income within 5 years of, say, £150 million+ (for a foward P/E multiple of 20).

Future rapid growth depends mostly on the USA expansion, I think. In the UK, Fevertree's market share in retail reached 42%, and the CEO comments:

Looking ahead to 2019, we are now clear market leader in the Off-Trade and would naturally expect a moderation in growth rates compared to those of 2018 but remain excited about the opportunity ahead in the UK.

In the USA, the company has taken over the direct control of its sales, marketing and distribution efforts. It subsequently signed an exclusive agreement with the largest wine and spirits distributor in North America, covering 29 states.

There should also be plenty of runway in Continental Europe, where sales growth of 24% was achieved.

Conclusion - I want to build a position in FEVR, and need to spend more time considering whether now is the right time, i.e. whether I'm willing to accept the £3 billion valuation. Paying up a big multiple in anticipation of future growth isn't easy!

S&U (LON:SUS)

- Share price: £19.37p (+10%)

- No. of shares: 12 million

- Market cap: £232 million

This lender's share price has dropped back hugely over the past year. It feels like investors have partially priced in a recession already.

As a reminder, this is a family-controlled business (a big green flag in my book). It is primarily focused on subprime motor finance and also has a new property bridging division.

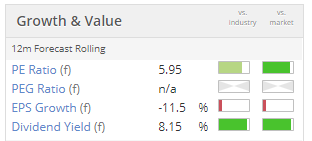

The P/E ratio was 7x and the dividend yield was 7% as of last night's close. There are some people who look for dividend yelds higher than the P/E ratio - this almost qualified!

It feels like the company has been managed conservatively over the past 12 months. Rather than chasing growth for the sake of it, the number of motor finance loans it advanced fell from 24,500 to 21,000.

Moderation in lending means that S&U can tighten its credit control and also de-risks the balance sheet to a certain extent. Balance sheet leverage reduces slightly to 1.7x (assets/equity). Group borrowings have increased only by £4 million to £108 million, with committed facilities of £160 million.

Careful lending makes sense in an environment where impairments have ticked up and the risk adjusted yield has reduced by around 200 basis points to 24.6%.

There are also some well-known issues in the car market presently: new cars are on the decline, though the market for used cars seems robust. S&U says that it doesn't have too much exposure to residual car values through its hire purchase products, but is nevertheless "encouraged by the good recent performance of of used car prices".

S&U's net assets are now £165 million, so the stock is trading at just 1.4x book value. This is a considerable discount to the likes of PCF (LON:PCF) (in which I have a long position), that trades at 2x.

Outlook - "realistic, but optimistic".

The combination of active markets, an expanded and dedicated team, a sound financial structure and responsible strategy, allows me to be confident of our continued success.

My view

Net asset value per share is officially recorded at £13.78p.

I might adjust this NAV lower to account for some preference shares which are recorded on the balance sheet as a financial liability worth £450k, but are probably worth a couple of million pounds in reality (they get paid dividends of £142k annually).

Even so, the valuation looks too cheap to me. I feel comfortable in this sector and I admire how this company is run with a strong emphasis on ROCE and long-term objectives, so I might add it to my portfolio.

I interviewed the Chairman back in November - here's the link.

XLMedia (LON:XLM)

- Share price: 60.3p (+8%)

- No. of shares: 213 million

- Market cap: £128 million ($169 million)

Results for the year ended 31 December 2018

XLMedia (AIM: XLM), a leading provider of digital performance marketing services, announces the Company's results for the year ended 31 December 2018.

As readers will know, this share price collapsed due to the anticipation of weak results, regulatory problems, and a loss of investor confidence. The company is registered in Jersey and operates primarily out of Israel.

I am one of those who wouldn't invest in it simply because of the category it falls into. It's too difficult for me to analyse its long-term prospects for shareholders.

Having said that, I find it one of the more attractive companies in this category. I've considered buying into it, from time to time.

The company is doing the right thing, I suspect, by buying back its shares at these levels. It spent £5 million buying them back from December to March, at an average price of 66p. The December cash balance was almost 30% of the current market cap.

Outlook - as had already been signalled, the company will focus on its publishing business from now on, where it owns its own websites and can earn high margins (and I think with fewer regulatory problems, too).

My view - Not for widows and orphans. Bravery could be well-rewarded from the current levels.

Note that the Value Rank is 96.

MySale (LON:MYSL)

- Share price: 12.95p (-26%)

- No. of shares: 154 million

- Market cap: £20 million

This feels like a busted flush. All metrics are now going in the wrong direction.

Significant change is being implemented, and this has disrupted the results.

Results will be materially below management's previous expectations.

As I said before, I don't understand what the opportunity is with this company. Not something I want to look at in more detail on a busy afternoon.

I've run out of time. Thanks for your suggestions - I would have covered Premier Technical Services (LON:PTSG), T Clarke (LON:CTO) and Pelatro (LON:PTRO) if there were more hours in the day.

Paul is due back tomorrow, while I make my way to London for a fresh set of meetings and events.

All the best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.