Good morning, it's Paul here.

UK & USA Futures showed some recovery overnight, after yesterday's sharp falls, so we should be in for a more calm start today.

Estimated timing - the workload is manageable today, so I'll be finished by 1pm (6 hours work).

EDIT at 13:17 - today's report is now finished.

Coronavirus

All eyes are still on China, with the coronavirus apparently spreading at what seems to me an alarming pace. For that reason I'm not planning on opening any new long positions in small caps until the situation is more clear. I'm happy with my existing positions anyway, so buying new things isn't a priority for me.

A contrarian view would be that, like all previous crises, this one will eventually pass. Therefore, for the brave, this type of situation can provide buying opportunities - not just lower share prices, but just as importantly more liquidity for buyers of small caps.

Looking back at some previous reports here, it seems almost laughable the macro things that we worried about at the time. Crises quickly pass, and are forgotten rapidly. That said, I am really worried about the coronavirus, as its economic impact seems potentially so much worse than previous similar outbreaks. Plus of course, fear of the unknown. With markets being so expensive, it seems to me that risk:reward looks unfavourable right now.

Incidentally, there have been a few cases reported in other countries. These victims are being quarantined obviously. However, what struck me is that those people will have presumably flown home, breathing out the virus - so how many of the other people on that plane will have become infected from breathing in the recirculated air during the flight? Has everyone on those flights been quarantined? I doubt it. This thing could conceivably spread around the world.

Thanks for the interesting reader comments yesterday on this topic. Some smashing posts, especially one from reader Howard Marx here, which got 99 thumbs ups from readers - well worth a read. Thanks for posting your thoughts, Howard, and everyone else. I feel that the reader comments are just as (if not more) important than the main articles, so keep them coming.

Volatile prices in small caps

There were some strange spikes down in some small caps yesterday. As readers noted in the comments yesterday, BEG shares spiked down 10% on the publication of its usual Q4 Red Flag report (here if you haven't already seen it). That was completely illogical, because being an insolvency practitioner, Begbies benefits from more companies being in financial distress, as it gets more jobs.

Some other small caps saw spikes down of up to 10% on no news (e.g. one of my large holdings, Revolution Bars (LON:RBG) ). I put this down to illiquidity, and nerves about coronavirus. It only takes 1 or 2 shareholders to start selling, on a day when there are no buyers (due to nerves about external factors, like coronavirus) and a small cap share price can easily drop significantly. The reason is because market makers like to run mostly neutral books, so they run for cover by marking the price down sharply, when a seller emerges, if there are no buyers around to soak up the shares.

We just have to live with this price volatility. Although it does reinforce the point that investors need to be very sure of the merits of a small cap, before taking the plunge and buying shares in decent size. After all, why take all the risk that comes with illiquidity, unless the upside is exceptionally good? Small portfolios have the advantage, as they can move in & out of small caps with ease.

SimplyBiz (LON:SBIZ)

Share price: 228p (down 2% today, at 08:47)

No. shares: 96.8m

Market cap: £220.7m

SimplyBiz (AIM: SBIZ), the independent provider of compliance, technology and business services to financial advisers and financial institutions in the UK, today issues a pre-close trading update for the year ended 31 December 2019.

This statement follows the current fashion for sounding terribly upbeat, quoting EBITDA instead of proper profits, but ultimately delivering a lacklustre overall result towards the end of the statement. This is annoying, and doesn't fool anyone.

PR companies please take note - are you really adding value, trying to pull the wool over peoples' eyes? No - it just makes investors cross, and undermines trust.

This is the most important bit of the update today;

The Directors are confident that the Group's overall performance is broadly in line with expectations and intend to propose a final dividend to Shareholders, in line with the stated dividend policy.

Slightly below expectations then. There's no footnote to explain what expectations are, so a thumbs down for that omission.

Another gripe is that the split of organic, and acquisition-led growth is not given.

Summary (with my comments in brackets);

- Revenues up 24% (but no figure given - why leave it to investors to work it out manually, wasting time?)

- Adjusted EBITDA up 50%, with a stronger margin of 27% vs 23% (EBITDA is not profit, so why omit real profit figures? I want to see adjusted profit before tax, not adjusted EBITDA - providing the adjustments are reasonable of course)

- Net debt at year end is £27m (slightly above expectations, and 1.6x EBITDA which the company thinks is comfortable. Looking at its last balance sheet, I think it looks over-geared, and has a very weak, negative, NTAV position of -£43.3m, caused by a debt-fuelled acquisition spree. Although given the recurring nature of revenues here, I can see the argument for it being safer to carry more bank debt).

- Acquisition going well - £7m of debt has been repaid since acquiring it

- Positive, but non-specific outlook comments that highlights recurring revenues

My opinion - I don't like the way this trading update was presented. However, it's a good business, with decent profit margins, and high level of recurring revenues.

The onerous extent, and constantly changing regulations that financial services companies are subjected to, makes it a no-brainer to outsource compliance work to an outfit like SimplyBiz. I like shares where I can see a clear commercial need for their goods or services, which is very much the case here.

The valuation looks about right to me, on a fwd PER of 15.7 times 2020 forecast earnings. Remember that there's a lot of debt on the balance sheet, which needs to be taken into account - after all, repaying debt soaks up cashflow that could otherwise be paid out in divis.

Overall then this company gets a thumbs up from me, although I can't see any particular reason to buy the shares now, with it being at the top end of the 150-250p share price range that we've seen since it floated in April 2018.

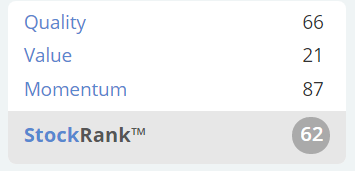

The StockRank is OK.

[please note that I accidentally copied in the wrong picture below, in error. Many thanks to member zaracrest for pointing out my mistake. I've now corrected the picture below to show the proper StockRank for SimplyBiz. Profuse apologies]

Sopheon (LON:SPE)

Share price: 815p (up 16% today, at 08:54)

No. shares: 10.17m

Market cap: £82.9m

Sopheon plc, the international provider of software, expertise, and best practices for Enterprise Innovation Management, is pleased to provide a further update on the Group's performance for the year ended 31 December 2019.

Background - there was a serious profit warning which I reported on here, on 11 Dec 2019. Forecast profitability for 2019 was slashed by 45% to $2.7m. There was considerable uncertainty over revenues & profits due to contract wins being difficult to predict - the bane of life for most small software companies. Like many of these, Sopheon is transitioning from a licence model to a SaaS model, which suppresses short term profits in return for a longer-term benefit of recurring revenues.

Quite a few of my investing friends hold this share. One of them explained to me the effect of the transition to SaaS, and made a convincing case that Sopheon's underlying performance was a lot better than the headline figures suggest, due to the SaaS effect. There are also discretionary increases in overheads underway at Sopheon, to grow the business faster - again this suppresses short term profitability, but is the right thing to do for the long-term.

Update today - this is the key paragraph;

Following on from our trading update of 11 December 2019, the Board now expects to deliver reported revenues for the year ended 31 December 2019 of approximately $30m (2018: $34m) which is in line with market expectations1.

[Paul: Hoorah, there's a footnote, which says....]

1Market expectations mean the current forecasts from analysts that cover Sopheon, being at this time finnCap and Progressive. Links to these forecasts are available in the investor section of www.sopheon.com.

[Paul: This is top notch stuff! I've just clicked through, gone to the investor relations section of Sopheon's website, and then clicked through to an updated FinnCap note (requires registration) published this morning. This is incredibly helpful, and raises the question - why can't all companies/brokers do this? No wonder Sopheon is popular with private investors, as the company has made it easy for us to access research and hence understand the business better]

EBITDA and pre-tax profits are also expected to be in line with market expectations1 for the year.

The year-end net cash position is expected to be $19.2m (2018: $16.7m) underlining the continued cash generative nature of the business.

I think this has all been handled very well by the company & its advisers. They came clean in December about profits being down, explained why, managed investor expectations well, and have now delivered on the revised numbers. That has been rewarded by a share price that has now recovered fully from the Nov 2019 profit warning. Although as you can see, it's still well down on the toppy levels achieved a year ago;

SaaS - more detail is given on the transition to a SaaS model, including this;

... we enter 2020 with a base of $15.9m in ARR (Annual Recurring Revenue) compared to $14.8m on entry to 2019.

As we have noted in recent communications, our strategic direction is to increase the proportion of recurring revenue and this is reflected in a growing sales pipeline that shows rising levels of SaaS opportunities...

That's all good, but 2020 forecast revenues total $36.0m, so recurring revenues are 44% of that, leaving more than half of 2020 revenues to be secured from other revenues. That leaves the company considerably exposed to the same problem of the past - difficulty in forecasting how it's going to perform, in both revenues and profits, and dependent on Q4 performance in particular. For this reason, I imagine shareholders should remain permanently braced for a bumpy ride.

My opinion - as mentioned in my last report on this company, I think it looks very interesting. Given that it's spending to grow, and that revenues are suppressed by moving from licences to SaaS (at least partially), then measuring it on a multiple of short term profits doesn't make a lot of sense. It also looks expensive on this valuation basis. At 815p per share, with forecast FY 12/2020 EPS of 16.5p (21.4c divided by 1.3 to convert dollars into sterling), the 2020 PER is 49 times.

Clearly at that valuation, investors are looking beyond the current year, anticipating much higher profits in future. I think that makes sense, given the above-mentioned factors. However, it also doesn't leave any headroom for anything to go wrong.

Overall, I can see why lots of private investors like this share. The company clearly must have a great product, as it's transformed itself in recent years from being a near-basket case, to a profitable & cash generative business with many (often large) organisations buying its software.

Potential investors need to understand that this is a volatile share, with limited liquidity, that is difficult to value due to erratic/unpredictable profitability. Therefore it better suits long-term investors who are prepared to ride out the peaks and troughs.

I'm tempted to buy a few as a long-term hold for my SIPP.

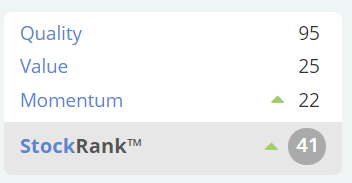

Stockopedia sums it up well - great quality scores, but not so good on value or momentum (which covers share price momentum and changes to forecast profits remember)

It wouldn't surprise me if someone bids for Sopheon, which could provide a profitable exit, as management probably wouldn't sell unless offered a full price. That's pure speculation on my part!

Luceco (LON:LUCE)

Share price: 146.3p (up 4.7% today, at 11:30)

No. shares: 160.8m

Market cap: £235.3m

Luceco is a leading manufacturer and distributor of high quality and innovative wiring accessories, LED lighting and portable power products for a global customer base... today announces its trading update for the year ended 31 December 2019.

Background - I'm not terribly familiar with this share, because Graham normally covers it. He wrote about the company's in line H1 trading update, here on 30 Jul 2019.

It floated in Oct 2016, and had a disastrous time afterwards, warning on profits. Then, look (below) at the stunning recovery in share price in 2019, to date.

This pattern reminds me very much of UP Global Sourcing Holdings (LON:UPGS) so just for fun, I've overlaid their charts, which look remarkably similar. Maybe there's something in this as a template for other companies which have a profit warning soon after floating? This suggests that we should hold off from buying for 12-15 months, until it has formed a base, and then start buying once it's stopped falling. It sounds so easy when I put it like that!

Blue/dark line is Luceco. feint/beige line is UPGS;

This also triggered my memory about Boohoo (LON:BOO) . That warned on profits after floating, and halved in price to sub-25p for a while (when I wrote super-bullish articles about it here, and lots of readers made collectively £millions from it). The key point being that expectations were set too high at the float, which was the main reason for the profit warning. Not that there was anything wrong with the business.

We should bear this in mind for future flotations - i.e. they could be good businesses, but just over-hyped to get the best price at flotation. Hence buying after a profit warning could (selectively) be a good strategy for that particular type of company - providing it's not a total crock of course, which so many AIM floats are.

Today's update - is headed up;

2019 & 2020 profits expected to be ahead of market expectations

This seems to have come from improved margins, and cost control, rather than sales growth (which was slower in H2).

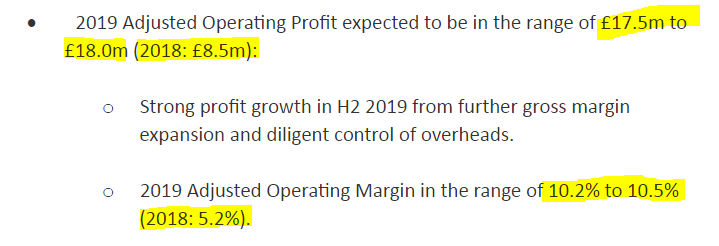

Margins - there seems to have been a remarkable rise in adj operating margin, doubling over the 2018 figure - not often you see that - I'd like to know what has caused that, and whether it's sustainable? This is certainly striking;

Net debt has dropped as a proportion of EBITDA, but I would expect that given that profit has doubled! So net debt might not have dropped in £ terms at all. I would have preferred the company to give actual figures, as well as the gearing ratio. Full disclosure is always better than cherry-picking the figures that look the best;

Closing net debt of approximately 1.0x Adjusted LTM EBITDA (2018: 2.21x), comfortably at the lower end of the Group's targeted range of 1.0 - 2.0x.

[LTM = Last Twelve Months - I do wish all companies would include a glossary of all abbreviations, and definitions of industry terms used, as not everyone will be familiar. Even experienced investors sometimes have to stop and think to remember what abbreviations are]

Guidance - very helpfully, the company gives us specific profit guidance for FY 12/2020;

Confident of further improvement in performance in 2020:

Expect 2020 Adjusted Operating Profit in the range of £20.5m to £21.5m.

I wish this could become the norm - wouldn't it be great if all companies issued specific profit guidance in a range, that is then tweaked and narrowed as the year progresses. Investors reward companies which provide clarity like this.

Directorspeak is also positive, and dangles before us the pleasant possibility of profit upgrades during the year;

... A more certain UK political environment should yield better market conditions in 2020, but we are not building this into our expectations for the year at this stage.

We are confident that the actions we are taking to expand our profitability will contribute to another improved performance in 2020."

Cherry on top - a helpful supporting footnote, bravo LUCE & its advisers MHP Communications, probably my favourite PR company for being so responsive & willing to engage, to give us the information that investors need;

Supporting note: The Board considers market expectations are best defined by taking the range of forecasts published by analysts who consistently follow the Group. The average of the Adjusted Operating Profit forecasts at 28 January 2020 is as follows: 2019: £17.3m and 2020: £19.4m.

This is great, as it removes all ambiguity, and we can clearly see that the revised guidance from LUCE for 2020 adj profit of £20.5m, is nearly 6% above the £19.4m current analyst consensus.

There is even a "Business summary" at the bottom of the RNS, to give more detail about the company, and its products. Can my day get any better?!

Valuation - well done & thanks to Liberum for making an update note available today via Research Tree, much appreciated. It's increased FY 12/2020 forecast EPS to 9.8p - that's a PER of 14.9, which sounds about right for the sector. Although the real rating could be lower, if the company exceeds expectations again, which it's hinting at.

Dividends - miserly at only 1.5% yield

Balance sheet - the last (interims 30 June 2019) balance sheet looks adequate, although net debt strikes me as a tad too high at £36.4m. That must have come down quite a bit in H2, to achieve 1* EBITDA. Although it strikes me that the year end figure might be a seasonal low for debt, and/or window-dressed? We'll be able to ascertain that from the next set of figures, when they come out

My opinion - this looks good, worthy of a closer look I'd say.

It's good to see a company recovering from previous under-performance, and doubling profits. However that does make me wonder why profits fell previously, and whether that could happen again?

With this type of business, we have to be careful to spot one-off surges in demand for particular products, which then subside. So I'd need to much better understand the detail of the business before wanting to take a position here. Well done to people who rode out (or bought) a year ago - who would now be sitting on excellent profits.

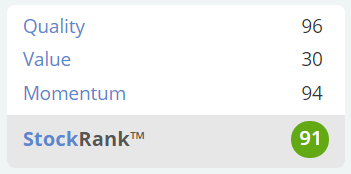

Stockopedia loves it, with a "High Flyer" classification, and excellent StockRank. I think the low Value score can be tolerated since the company is clearly hinting today at further forecast increases, which would make it better value if/when they happen;

I'm almost out of time, so quick comments to finish off with:

Eagle Eye Solutions (LON:EYE) - up 3% today to 232p, for a market cap of almost £59m - looking pricey for a company that's never made a profit, but it does have strong organic revenue growth, and recurring revenues. Plus a great & growing client list of supermarkets. It's international too. "Very low" level of customer churn - suggests the product is good. Trading in line with expectations.

My view - I think this is a promising growth company. Worth a closer look. No idea how to value it though!

Tribal (LON:TRB) - trading sounds OK here. The key information is that agreement has been reached on a legal dispute, which is costing c.£9m - a hefty cost for the company's size/profitability. Looking at the disclosures in the last interim results, it looks as if the company has not made a provision for this cost on its balance sheet. Therefore if I'm right, this would stretch the balance sheet further, and might require an equity fundraising.

If a company has to tell you that it has a strong balance sheet, then often it doesn't! That's the case here, with a weak balance sheet with negative NTAV of -£6.6m

For those reasons, I'm not keen on this share.

LSL Property Services (LON:LSL) - surprisingly, this estate agent has reached a new 12-month high today, up 10%. I thought the sector was supposed to be struggling?!

This sounds good;

We anticipate full year Group Underlying Operating Profit(1) for the year ended 31st December 2019 will be slightly ahead of the Board's prior expectations and slightly ahead of last year which is a highly resilient performance in the context of challenging residential market conditions during 2019.

Revenue is well down, due to branch closures, so maybe eliminating loss-making branches has helped the overall result, that would make sense.

Surveying went well, due to a new contract with Lloyds Bank.

Haha it has a heading, "Strong balance sheet" - as I suspected, the balance sheet is actually terrible! NTAV is negative at -£61.3m. That includes £57m in a bank revolving credit facility. Note there is an £8.2m contingent consideration liability.

Overall - this is too precariously financed to interest me. So only for investors who ignore balance sheets. Sometimes that can work, but it's high risk.

Frenkel Topping (LON:FEN) - Harwood Capital are it again. They have a history of putting in lowball takeover bids for good quality small caps. That's probably why FRE has only risen 6% today on news that it's received an initial bid approach from Harwood. Although it notes the recent rise in share price. Surely that is prima facie evidence of possible insider dealing, if people were buying because they knew a bid approach was coming?

That's it for today, see you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.