Good morning!

Welcome back after the long weekend. The political noise in the background is very loud, but we will crack on with a look at companies:

- AFH Financial (OFEX:AFHP)

- Ramsdens Holdings (LON:RFX)

- Hipgnosis Songs Fund (LON:SONG)

- Goals Soccer Centres (LON:GOAL)

- Altitude (LON:ALT)

- Renold (LON:RNO)

- Albert Technologies (LON:ALB)

AFH Financial (OFEX:AFHP)

- Share price: 335.3p (+8%)

- No. of shares: 42.6 million

- Market cap: £143 million

This is an ambitious financial stock, looking to achieve funds under management (FuM) of £10 billion within a 3-5 year timeframe. FuM are currently £5.4 billion.

It has several hundred IFAs working for it, and describes itself as:

"an IFA business acting as gate keeper to the wealth management sector through its primary position in the client relationship"

Most of the gain in FuM in H1 was from acquisitions, with only about 20% representing organic inflows.

The main theme with this share seems to be consolidation in the IFA sector. AFH's strategy is to use its size to reduce platform and fund management charges, boosting margins (the target underlying EBITDA margin is 25%). Acquisition opportunities are found, for example, with retiring IFAs who are looking for an exit.

Balance sheet

Reading some of the small print, I note that AFH's receivables book has grown from £13.6 million to £22.1 million in six months. Its intangibles, naturally, have increased too, during the acquisition spree.

The company's financial KPIs are all about top-line growth and margins, which can sometimes be achieved at the expense of optimising the balance sheet. Just something to keep an eye on. This share's Quality metrics, according to Stocko, are just average (e.g. Return on Capital 9%).

The company has negative tangible equity (negative to the tune of almost £20 million). This isn't necessarily a problem. For AFH, most of the liabilities are contingent consideration, so I guess they can be paid out of future profits. While there is likely to be an element of financial risk, my initial impression is that it is modest. (I'd have a completely different view if the liabilities were bank overdrafts, for example!)

Profits/valuation

Net income for the period comes in at £4.5 million. AFH doesn't give a precise statement on trading against expectations, but the share price reaction tells me that the market is happy. The full-year profit figure according to Stocko is £13.8 million, although I'm guessing this is an adjusted measure.

Full-year revenues are forecast at £79 million, and this looks readily achievable versus £36.7 million in H1, given the timing of acquisitions.

Please note there is some dilution risk with this share, to fund the strategy, but cash balances ended the period at nearly £9 million which seems like a healthy figure. It has very little financial debt outstanding - most liabilities are contingent consideration, plus a mortgage on freehold property.

My view

I think this has potential, so thank you to readers for flagging it. I would like to see a little bit of emphasis in the KPIs on balance sheet management, but I can't argue with the company's track record of integrating IFA businesses. It also looks as if it is (and will be) cheap relative to earnings, if it continues to successfully execute the plan.

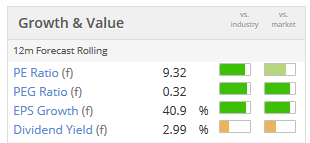

This box summarises the situation: reasonable earnings multiple, high EPS growth and low PEG ratio:

I've only just checked my comments on this share from last year, and it turns out that my thoughts at that time were remarkably similar to what I have written today. Interestingly, the company has upgraded its EBITDA margin target since then.

Ramsdens Holdings (LON:RFX)

- Share price: 170.75p (+1%)

- No. of shares: 31 million

- Market cap: £53 million

Ramsdens picks up four more The Money Shop stores and a small pawnbroking loan book.

The Money Shop was Britain's second-biggest payday lender, until government rules on short-term loans and mis-selling compensation claims caused its owner to abandon that product from August last year.

The owner, Dollar Financial, has already shut down or sold off hundreds of stores. The ones which are left now focus primarily on travel money, pawnbroking and cheque cashing.

This background helps to explain why the purchase price for Ramsdens is so low.

My instincts say that this is a good bit of business by Ramsdens: they are picking up four stores and a £0.3 million loan book for a very cheap price (£0.5m). The catch is that the sites are likely to require quite a lot of investment to upgrade them and incorporate them into the group. 18 stores were already acquired from The Money Shop in March.

Ramsdens now has 163 stores. I would start to get nervous if the estate grew very rapidly, because I am long H & T (LON:HAT), and I remember what happened the last time there was overcapacity in this industry! But for now, the expansion plans at Ramsdens seem very reasonable.

The Stock algorithms rate this as a SuperStock, with a StockRank of 92, P/E ratio of 9x and return on capital of 20%. I'm a fan, too, though I am loyal to H&T.

Hipgnosis Songs Fund (LON:SONG)

- Share price: 105p (+1%)

- No. of shares: 341 million

- Market cap: £358 million

Acquisition of Music Catalogue

I can't help checking the RNS announcements from this quirky fund. Its latest investment is in Ari Levine's catalogue - he has written songs for Bruno Mars, Ce Lo Green, etc.

Hipgnosis now owns:

"100% of Ari Levine's copyright ownership in his catalogue, which comprises 76 songs in total, including 100% of his writer share of performance income collected and distributed by the Performance Rights Organization GMR (Global Music Rights)"

From a diversification point of view, it strikes me that song royalties should be uncorrelated to lots of other things in our portfolios.

The Hipgnosis market cap is at a small (5%) premium to the amount of money it has raised, and it has already declared three dividends in its first year on the Main Market

Goals Soccer Centres (LON:GOAL)

- Share price: 27p (suspended)

- No. of shares: 75 million

- Market cap: £20 million

The accounts at Goals were a mirage and I'm afraid this looks like a potential zero for the equity holders.

There is an outstanding VAT liability of perhaps £12 million (value to be determined). And the 2018 and 2019 results will both be "materially below expectations and historically reported financial performance".

The CEO tendered his resignation two weeks ago and is working through his notice period.

I would assume that these shares are worthless without a big recapitalisation:

Discussions with our lenders are continuing, and remain positive as we seek to ensure that the Company is appropriately funded going forward.

Altitude (LON:ALT)

- Share price: 107p (-8%)

- No. of shares: 69 million

- Market cap: £74 million

Unaudited full year results and operational update

Altitude Group plc (AIM: ALT), the operator of a leading marketplace for personalised products, is pleased to announce its unaudited results for the year to 31 December 2018.

There's a lot to unpack with this. I note that the results are out five months after year-end. Feels very late to publish numbers.

Big-picture view: Altitude has purchased a US-based organisation for promotional products distributors. It had previously served the members of this organisation, without owning the entire network of relationships.

It uses its platform to connect buyers and suppliers of promotional products, sometimes collecting a percentage of the deals. Some investors think that the development of this network and marketplace will generate very large profits a couple of years from now.

What do I think? I have no idea, I'm afraid. I can see the logic in the argument - owning marketplaces and percentages of the deals which happen on them is a wonderful way to make money - but I can't map it to the real world.

I generally don't invest in US small-caps, because I am nervous about what I'm missing from this side of the Atlantic. I feel that way about this one.

The historical financial results don't indicate success, though net income of £5.1 million is forecast this year (Stocko data). The algorithms consider Altitude to be a Momentum Trap.

Renold (LON:RNO)

- Share price: 31.5p (+9%)

- No. of shares: 225 million

- Market cap: £71 million

Renold, a leading international supplier of industrial chains and related power transmission products, today announces its preliminary results for the year ended 31 March 2019

Big numbers produced today, as statutory operating profit explodes from £5.6 million to £16.2 million.

The big difference this year was a credit in relation to the pension fund.

Scrolling down, I see that there is a £102 million pension deficit. There are also net borrowings of £30 million.

This looks like a decent manufacturer and might represent "value" on a P/E basis but I suspect that it is fairly valued at a mid-single digit multiple. Leveraged, capital-intensive manufacturers tend to get that sort of rating (e.g. see the multiples attached car companies).

Albert Technologies (LON:ALB)

- Share price: 10.2p (-38%)

- No. of shares: 100 million

- Market cap: £10 million

I've not looked at this one before, it's an Israeli software company which supplies an "autonomous artificial intelligence marketing platform".

This announcement carries a profit warning, in the sixth and seventh paragraphs. Commiserations to holders:

Whilst the Company's management expects that the outcome for 2019 should show significant improvement over the performance achieved in 2018, it remains difficult to accurately predict short term revenue outcomes.

The cost base is being reduced to preserve cash. Management are still positive about the company's long-term prospects. Personally, I would give this share the bargepole treatment.Another reminder, if we needed one, that we need to be very selective when it comes to foreign companies listing on AIM.

That's it for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.