Morning all.

Many results statements are out this morning, plus a few AGM updates.

The most interesting ones for me are:

- Gooch & Housego (LON:GHH)

- QUIZ (LON:QUIZ)

- Carclo (LON:CAR)

- GB (LON:GBG)

- Altitude (LON:ALT)

- Vianet (LON:VNET)

3pm edit: Substituted Vianet into the list, in response to reader requests. Cheers!

Graham

Gooch & Housego (LON:GHH)

- Share price: 1367.5p (+2%)

- No. of shares: 24.5 million

- Market cap: £335 million

This is a high-quality AIM stock which I haven't been paying enough attention to in the last couple of years. It tends to fly under the radar because it generally performs well, doesn't attract controversy and pushes out decent results year in and year out.

It's in the field of photonics - lasers for industrial purposes, fiber optics components, and other light-related technologies and applications.

Today's headline results are as follows: revenues up 6.6%, PBT up 11.6%. Expectations for the full year are in line with management expectations.

Some acquisitions contributed to the revenue growth; a quick back-of-the-envelope calculation by me says that the organic revenue growth was 1.4%.

The company's long-term progress is illustrated by its dividend stream. Aside from taking a break in 2009/2010, it has paid a beautifully rising stream of dividends all the way back to 1998.

One particular metric from today's report which really jumps out at me is that on a constant currency basis, the order book is up 36% compared to a year ago. Probably not all of that is organic growth but even so, it strikes me that the outlook must be a rosy one, with that sort of growth rate in orders.

Overall group strategy is based on R&D, Diversification and "Moving up the Value Chain":

G&H seeks to move up the value chain to more complex sub-assemblies and systems through leveraging its excellence in materials and components, and by providing photonic design and engineering solutions for our customers. This will enable G&H to transition from a components supplier to a solutions provider. A significant proportion of our business in the Aerospace & Defence market now comes from the sale of sub-systems rather than discrete components.

And:

...continued strong focus is being placed on acquisition opportunities that enhance the Company's ability to wrap electronics and software around core photonic products to yield system-level solutions.

All of this strikes me as cutting-edge, if not downright futuristic!

Once you dig into the numbers, you see that operating profit margin could be a little higher: it's 10.2% for the most recent period. Not bad, but not spectacular.

And if you examine the company's long-term quality metrics, you find that it usually earns more than 10% return on capital employed. Again, this is not spectacular, but it's good enough to produce a fine shareholder return over the long run. The share price has trebled since 2012, along with the rising dividends.

Putting it all together, I'm tempted to have a small nibble at this one, the next time I'm deploying some capital. One for the bottom drawer, perhaps.

QUIZ (LON:QUIZ)

- Share price: 168p (-5.6%)

- No. of shares: 124 million

- Market cap: £208 million

Preliminary Results - year ended 31 March 2018

Paraic makes another strong comment today, in the comment thread below:

What I like about QUIZ (LON:QUIZ) is it has great BooHoo style marketing to drive online traffic - at least in London; it's adverts are everywhere!

He's bang on the money there.

I noticed the same on my last trip to London, and took a snap of one instance of this:

As you can see, QUIZ (LON:QUIZ) is competing for the exact same advertising space as Boohoo.Com (LON:BOO) on the underground.

On the same strip of adverts, we also can see the dark horse Bee Inspired, which describes itself as "the fastest growing streetwear brand in the UK". It can only be a matter of time before we are trading its shares, too!!

Anyway, back to Quiz.

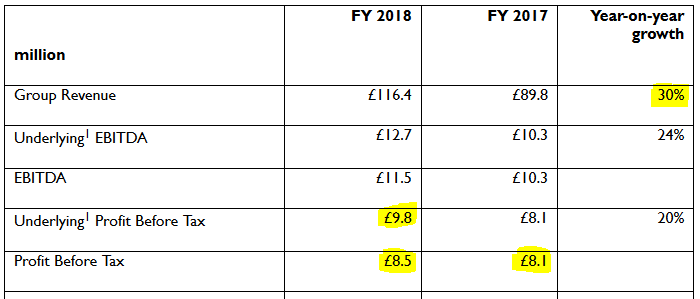

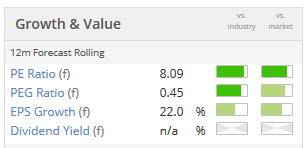

Top-line growth is good (30%). Everything is pointing up:

I suppose this table immediately leads to the question of why profit growth didn't improve by more. If revenues are up 30%, I'd like to see the profit measures improve by more than 30% (i.e. a positive impact from operating leverage).

The gross margin improved by 30 basis points to 63%, so there is no problem with that.

Quiz uses adjusted EBITDA margin as one its financial KPIs: this fell by 50bps.

If you scroll down to the Financial Review, you find that marketing spend increased by £1.5 million to £2.5 million, including digital spending and offline spending such as on the London Underground ads.

Distribution costs increased by a much larger amount, from £13.6 million to £21.4 million. Here's the explanation:

This increase reflects (i) the cost of carriage to stores, concessions and franchises as well as online customers and (ii) commission paid to third-parties who sell product on behalf of QUIZ. The uplift in these costs primarily reflects the higher commission costs incurred associated with a higher proportion of sales being made through third-parties which have a higher cost to serve than sales generated through our own websites.

This strikes me as important, because it's a key factor dragging on the operating/EBITDA margin and preventing a big uplift in profits during the year.

Depreciation and amortisation also increased faster than sales, but this is understandable given the recent capex spend.

The outlook for the full year is in line with expectations.

My opinion

An interesting stock, although I have to admit that I'm not too sure about the power of the brand. It says that its specialism is "occasion wear and dressy casual wear". Is it sufficiently unique to enjoy the same sort of cachet among consumers as the likes of Boohoo.Com (LON:BOO), which achieved sales 6x larger than QUIZ (LON:QUIZ) last year? At this stage, I can't tell.

The top-line numbers are all fine. Online sales jumped 158% and doubled as a percentage of total sales, reaching 26%.

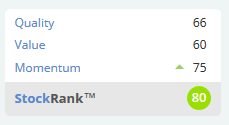

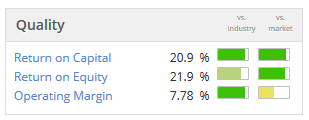

Overall, I see this as fairly priced at the moment (P/E ratio c. 22x). Despite having many positives, including the excellent quality metrics shown below, I think it's quite difficult to predict which of the "fast-fashion" stocks will be winners in the long-run. This is why I'm still holding Burberry (LON:BRBY), despite the P/E ratio approaching 27x, because I view it as (hopefully) an evergreen brand. Only time will tell!

Quiz quality metrics:

Carclo (LON:CAR)

- Share price: 87.5p (-3%)

- No. of shares: 73 million

- Market cap: £64 million

This manufacturing group had a nasty profit warning in January (covered here).

The Chairman describes these results as "disappointing". That's refreshing!

...delays in the placement of certain customer project awards and some weaknesses in operational performance, particularly within Carclo Technical Plastics ("CTP"), meant the Group did not achieve its profit targets.

Scrolling down to the CEO's report, he attributes the difficulties to labour shortages and increased resin prices not being immediately passed on to the customers of the plastics division.

All aspects of the plastics division have been reviewed. It sounds like the previous divisional management struggled to keep it working efficiently as revenues grew strongly over the past five years.

Notwithstanding these issues in FY 2018, Carclo still achieved a profit before tax of £8.2 million.

The balance sheet is a key issue: heavy capex has contributed to net debt increasing to £31.5 million. Headroom on the associated covenants was "comfortable" at March 2018.

There is also an accounting pension deficit of £24.7 million. (The pension position is heavily geared: £200 million in pre-tax liabilities versus £170 million in pre-tax assets.)

The shares are still a bit too risky for me, considering the balance sheet and the customer concentration. Excerpt from the 2017 annual report:

The proportion of revenues generated from the top five customers in the year was 47.5% (2016 – 47.4%). One medical customer accounted for 16.4% of revenues (2016 – 19.3%) and one supercar customer accounted for 14.7% of revenues (2016 – 14.5%). No other customer accounted for more than 10.0% of revenues in the year or prior year.

Investors who don't mind bearing these sorts of risks can buy the shares at 8x earnings, albeit without a dividend:

GB (LON:GBG)

- Share price: 518p (-0.4%)

- No. of shares: 152.7 million

- Market cap: £791 million

GB Group plc (AIM: GBG), the global identity data intelligence specialist, announces its annual results for the Year Ended 31 March 2018.

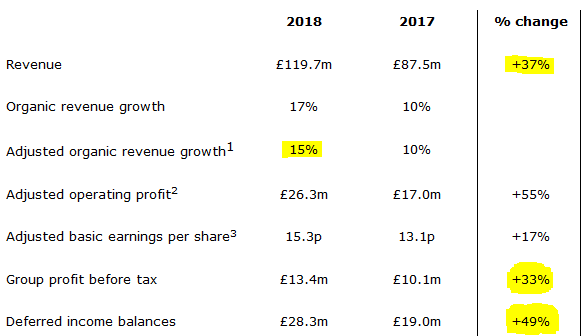

I have attempted to highlight the most important financial highlights for you in yellow below:

Outlook - the new financial year is trading in line with expectations.

Rather like the order book situation at Gooch & Housego (LON:GHH), I'm very impressed by the 49% growth in deferred income balances at GB (LON:GBG).

Deferred income is "the amount of invoiced business in excess of the amount recognised as revenue", i.e. the value of cash received from customers and outstanding trade receivables relating to work which hasn't been done yet (roughly speaking). This sort of metric, along with the order book, is often an excellent leading indicator for future revenue growth.

(Also note that GB has non-cancellable agreements with customers which haven't been invoiced yet, so GB's total sales visibility is larger than just its deferred income).

What it does

The company has a prestigious customer list and gives the impression that it is extremely busy, not least with GDPR-related work.

The two operating segments are:

Fraud, Risk & Compliance - which provides ID verification, ID Compliance and Fraud Solutions, ID trace & investigate and employment screening.

Customer & Location Intelligence - which provides ID Location Intelligence and ID engage solutions.

Reading through the specific definitions of each of the above lines of business, they are all engaged in helping companies keep track of the customers they are interacting with.

Here is an example of one of GBG's products. Some people might find this rather sinister:

GBG Connexus brings together the broadest range of identity data, all in one place. We have access to millions of records including names, addresses, dates of birth, telephone numbers, email addresses, 130 social networks to check for associated social IDs, and OSINT - our innovative Open Source Intelligence tool that aggregates social media data to provide you with valuable insights to aid your investigations.

All you need is a phone number or email address and you can build a profile on an individual. You can study their neighbours and cohabitees, too. I'm not surprised that big organisations are willing to pay up for tools like this, to develop detailed information on their customers, employees, etc.

Balance sheet

The balance sheet isn't too pretty, as GBG has grown via acquisition. There are £161 million of intangibles, mostly consisting of goodwill and customer relationships. And if you strip them out, the company is in negative equity. So there is no balance sheet value to fall back on in this case.

It does enjoy a net cash balance of £13.5 million, funded by customers paying in advance for GBG's products and services. So assuming continued profitability, it looks like it will probably be ok.

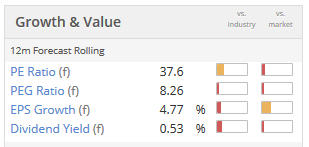

Conclusion - a very impressive company, growing strongly for many years.

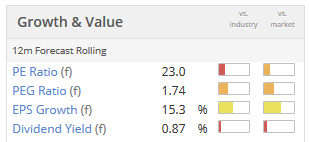

The valuation is sadly beyond the limits of where I could consider buying it, at nearly 40x forecast earnings:

Altitude (LON:ALT)

- Share price: 94p (+19%)

- No. of shares: 53 million

- Market cap: £50 million

Before I get into these results, bear in mind that they relate to the year ending December 2017. Very late.

Paul covered it last year, at the 2016 results, and called it "a complete punt".

It had a placing back then, for £2.5 million, and raised another £1.5 million this year.

The dilution hasn't been too awful - share count is up by 24% over the past five years.

Description of the company's technology services:

Altitude Group plc provide [sic] leading technology services, specialising in cloud and server based software that is catered to companies of any size and expertise. Whether you would like an end to end business management system to suit you [sic] company or access to product data from the industry’s most comprehensive sourcing portal, you’re in the right place.

The key focus for Altitude is something called the "AIMPro Tech Suite". I think this is its website. It serves US distributors (members of the "AIM Group") and as such, Altitude's new CEO will be US-based.

Altitude's e-commerce platform can be viewed at this link.

Results

Excluding the effects of an acquisition, revenues fell in 2017, from £4.3 million to £4 million.

The Chairman says he is pleased that PBT increased by 71.8% in 2017, but the increase was merely from £73k to £125k.

I'm not sure about how impressive this is:

AIMPro was formally launched to 200 attending AIM members at the national PPAI trade show in Las Vegas in January 2018 to an immediately positive reception. Indeed we are carefully managing demand within our current resources, as any marketing to the AIM members and suppliers prompts immediate response and excitement. Marketing email opening rates of 38.5% (industry average 14.2%), a click through rate of 8.9% (industry average 1.6%) and web site visits to the AIM info site doubled in May illustrating their enthusiasm for engagement.

My own mailing list is fairly small, but it's not very far from being the same size as the AIM Group membership. And my open rates are a lot higher than 38.5%!

The industry average open rates and click rates are more typical when you have mailing lists of commercial size, rather than tiny lists with less than 2,000 members.

I also find it a bit odd that investors should care very much that prospective clients are opening emails from Altitude.

Having said that, the opening levels of activity on AIMPro do seem encouraging:

More than 1.4 million items have been ordered through the platform on over 2,200 individual sales orders from the first 57 AIMPro members with total throughput of $2.8 million to date. 65% of active users have used the platform to place multiple orders.

I wonder how much revenue for Altitude is generated by $2.8 million of sales throughput on its platform? These are very early days.

Cash flow generation was ok, I'm happy to add back in the amortisation of intangible assets and depreciation so operating cash flow was somewhere around £550k for the period (from pre-existing publications and exhibitions businesses, plus six months of the new acquisition).

Conclusion: This is too early-stage for me. There are a few interesting things happening with it, but I don't see how it is worth more than its net book value or a modest earnings multiple, based on achievements to date.

It is trading at 5x 2018 forecast sales, and the StockRanks duly categorise it as Highly Speculative. As always, I'm happy to listen to arguments to the contrary!

Vianet (LON:VNET)

- Share price: 130p (+2%)

- No. of shares: 28 million

- Market cap: £37 million

If you go back in time, Vianet was known for providing vending solutions and performance management services for bars, petrol stations, gaming machines, etc.

It now describes itself as "having operated in the IoT enterprise level market since 1994". That's quite fair, I suppose!

Internet of Things (IoT) is a silly name but all it really means is that physical devices are able to communicate somehow (e.g. transmit to humans their location, condition, etc). Vianet has been in this space for a long time, before it became a huge investment theme.

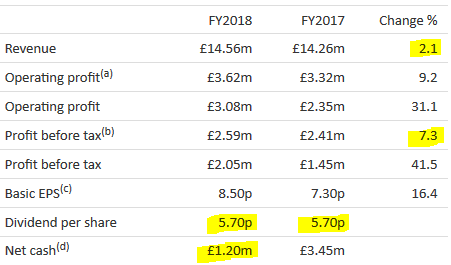

Unlike blue-sky companies lacking in sales and profits, Vianet has stable revenues (£14.6 million in FY 2018, up from £14.3 million), a decent pre-tax profit margin of 14%, and pays an attractive dividend yield of 4.5%.

The older part of business, primarily in drinks monitoring, is in a slow decline. However, it is still generating cash and enabling Vianet to invest in infrastructure and technology, to explore new ways to implement its solutions.

The numbers are all fine. Revenue is up only a little, but PBT improves 7%. The dividend is unchanged which looks prudent, as net cash has reduced following an acquisition:

The StockRank is a very healthy 80, giving rise to classification as a Super Stock.

So overall, I think things are looking nice for shareholders, and I don't see any immediate cause for concern (by Sod's Law, I am probably jinxing it by saying this!)

I'm out of time for today. I hope you found a few interesting nuggets in today's report.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.