Good morning, it's Paul here!

I'm up early today, to finish off the unfinished sections from yesterday. There seems to be so much going on at the moment, which sometimes distracts me from the task in hand here.

Here are a couple of interesting situations which I've been immersed in recently, GAME Digital (LON:GMD) , and Air Partner (LON:AIR);

GAME Digital (LON:GMD)

Share price: 38.7p (up 7.6% yesterday, at market close)

No. shares: 172.9m

Market cap: £66.9m

(at the time of writing, I hold a long position in this share)

Takeover bid speculation

NB. This is speculation on my part, but the reported trades yesterday do seem to suggest something might be going on.

I monitor all positions in my portfolio pretty much in real time, and when there's unusually large volume traded, I sit up and take notice. This can occasionally be a precursor to a takeover bid, if a potential acquirer is buying stock in the market. The trouble is, we don't know who is buying or selling, until the "holding in company" RNS(s) come out, day(s) later.

Sometimes though, very large volume goes through, and you can work out who is selling (but not necessarily who is buying).

In this case, with Game Digital, I noticed traded volume of over 60m shares early yesterday afternoon. Bear in mind that a more typical daily volume for this share is under 1m shares, so something unusual seems to be happening.

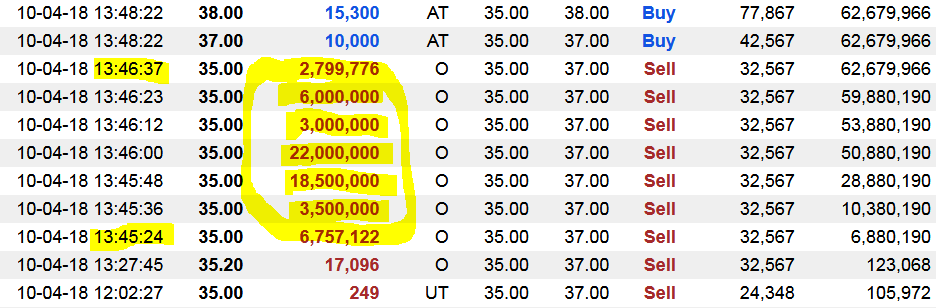

I got my broker to email me over the list of >3% shareholders, from his Bloomberg terminal, as I couldn't readily find that information on GMD's own website. Next, I looked at the reported trades for GMD yesterday (courtesy of MoneyAM), and noticed this block of very large trades;

The "buy" or "sell" indicator is meaningless, as by definition every trade in the market has to have both a buyer & a seller, otherwise the shares wouldn't change hands at all.

The trades I have highlighted above stand out like a sore thumb, because they are;

- very large

- at the same price of 35p

- bunched together, happening a few seconds apart, so are very likely to be the same seller (not necessarily the same buyer though)

Adding together the highlighted items, comes to 62,556,898 shares. So who is the seller?

There are 2 really big shareholders in GMD, namely;

- Duodi Investments SARL: 63,179,898 shares (36.5% of the company), and

- Sports Direct International: 44,000,000 shares (25.44% of the company)

So logically, the seller can only be Duodi Investments. We already knew (from reduced holding RNSs) that Duodi was selling, and that I think was probably the main reason that the share price had been very weak in Jan-Mar 2018.

Interestingly, if you deduct the 62,556,898 large trades from Duodi's holding of 63,179,898 shares, then the difference is a round number - 623,000. That suggests to me that the transactions are almost certainly linked to Duodi. There's no other shareholder with enough shares to have sold 62.557m shares, so it has to be Duodi.

Some quick googling shows that Duodi held the shares for Elliott Advisors, a hedge fund which originally owned GMD and floated it in 2014. It has been suggested in the press that Elliott is raising cash to fund its imminent acquisition of Waterstones, which is expected to complete later this month.

Now the interesting part. Who is the buyer of Duodi's stake? My money is guessing that it could be Sports Direct. There is an increasingly close relationship between GMD and Sports Direct. Not only does SD already own 25.44% of GMD, but it recently announced a joint venture to open new "Belong" format gaming shops within SD stores. This is such a close relationship now, that the logical next step would be for SD to buy out GMD completely. It also makes commercial sense, as the cost could be financed from GMD's own cash pile. Mike Ashley of SD has a long history of deals like this, so again the history fits my theory very well.

Therefore, putting 2 and 2 together, and hopefully arriving at 4, I think a takeover bid for GMD could be imminent. With the possible buyer being Sports Direct. It all seems to fit together, although I should emphasise that this is guesswork on my part - I do not have any inside information. If I did, I would keep schtum, because that's supposed to be the whole point of inside information - you don't disclose it to anyone.

The burning question is, if I'm right that GMD is now likely to be bought by SD, what price are they likely to pay? It's got to be 35p minimum, as a bid can't be below the market price paid for shares. The share price rose strongly yesterday, and bulletin board activity shows that plenty of other people have spotted the large trades, and joined up the dots that it must be Duodi selling.

I take the view that, at 39p, the downside scenario would be a bid at 35p, so I'm only risking 4p by buying/holding at the current price. My feeling (and again this is guesswork) is that a takeover bid between 50-80p is most likely. It depends what level the Board at GMD can negotiate with what is probably now its controlling shareholder i.e. Sports Direct.

It will be very interesting to see how this situation pans out. There's obvious value in GMD, because c.80% of its shop leases expire or can be broken this year. Therefore it has a unique opportunity to radically change its store portfolio, and reduce costs. The new Belong format has shown in trials that it has an excellent 16-month payback period on average, so should make a good roll-out. Plus GMD has a fantastic balance sheet, stuffed with cash. The period end cash balances are probably seasonal peaks, but even so, it has a strong net working capital position.

Let's hope GMD shareholders are in for a bumper payday soon. My portfolio could certainly do with a boost, as Q1 this year has been shockingly bad (although it's really only giving back some over-sized profits from last year, so isn't a cause for alarm in my view).

EDIT: Gromley puts forward (comment no.3 below, in the comments section) an alternative (and credible-sounding) theory. He reckons that the Duodi holding at GMD might have been broken up & placed with various as yet unknown institutions. That's a persuasive argument, as the holding was broken up into several trades, which might have been finding homes with various buyers. No doubt we'll find out soon whether my takeover theory, or Gromley's placing theory is correct. What we can agree on is that the seller has been cleared, one way or another.

End of edit

There are some very interesting special situations in retailing right now. The carnage in the sector generally has thrown up some interesting bargains, but also plenty of value traps to avoid - e.g. Mothercare (LON:MTC) , Debenhams (LON:DEB) , Carpetright (LON:CPR) , and plenty of others.

Amazingly, looking at my own portfolio, 9 out of 10 of my largest personal holdings are retail/hospitality special situations, namely (in size order);

£RBG (203p cash bid from Stonegate in Jul 2017, rejected as too low by RBG shareholders. We can now buy in the market at 145p - doesn't make sense! A self-funding roll-out, with good pipeline of low rented new sites. Virtually no debt, and paying a decent divi)

£NXT (forward PER of 11 for the best fashion retail business in the UK. Online now generates more profit than stores. Strong cash generation. Outlook improving)

£FCCN (excellent recent disposal of Toast boosts cash to about half mkt cap. Moving into profit this year, as loss-making sites close. Wholesale & licensing doing well & valuable. Company now "in play" as founder likely to sell in foreseeable future

£GMD (as above

£BWNG (dirt-cheap internet retailer. Excellent divi yield)

Sosandar (LON:SOS) (highly speculative, early stage)

Gear4Music - excellent international growth. Not cheap, but is rapidly becoming a significant player in its niche. Great entrepreneurial management, with big stake.

Airea (LON:AIEA) - company also in play. Pension fund is big, but now fully funded. Closure of heavily loss-making carpet division will leave a highly profitable commercial flooring business. J Halstead is considering a bid. Big special divi imminent.

Superdry (LON:SDRY) - a quality international fashion growth business. Looks cheap after recent sell-off, but I won't be surprised if it announces soft current trading.

Portmeirion (LON:PMP) - good quality pottery business. Trading well. Nice balance sheet. Good value.

So my portfolio has a huge concentration on consumer-related special situations, I didn't realise it was quite this concentrated. A little further down my portfolio list, I also hold;

Best Of The Best (LON:BOTB) - recent sell-off seems overdone, and Directors have been hoovering up recent sells. Good long term potential, but growth not as aggressive as it could be.

Headlam (LON:HEAD) - good quality carpet distributor, with lovely balance sheet, and looks very good value. Nice divis.

Boohoo.Com (LON:BOO) - I bought back in recently, but am worried that growth might disappoint, so only a smallish position right now.

Angling Direct (LON:ANG) - looks a good niche growth business. Buying small competitors cheaply, as well as online growth.

That's probably enough share ideas to be going on with. As always, I'm only giving an opinion on those shares, not recommending them. It's none of my business what shares you put in your own portfolios, that's entirely up to you. Doing your own research is what it's all about.

I do wonder if my concentration on consumer-related special situations is far too much? I'll give that some more thought. However, my reading of things is that the outlook for the consumer is beginning to improve, so that seems the logical place to look for bargains, given how bombed-out the sector is. It's also fairly easy to spot & avoid the banana skins (famous last words!)

Belvoir Lettings (LON:BLV)

Share price: 102.5p (unchanged yesterday)

No. shares: 34.9m

Market cap: 35.8m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Dec 2017.

... the UK's largest property franchise group

These results look pretty good to me.

Adjusted EPS of 11.3p (versus Stockopedia forecast of 10.5p) - looks like an earnings beat.

PER of 9.1, based on that 11.3p adj EPS

Total divis in line with forecast, up slightly at 6.9p (vs. 6.8p last year) - a great yield of 6.7%

Revenues up, but costs down, drove a big increase in profitability.

Weak balance sheet - NTAV is negative, at -£7.0m

My opinion - I like the profit growth, and the excellent yield. However, for me the weak balance sheet deters me from buying any more shares in this. I try to always either avoid companies with weak balance sheets, or only take small positions in them (as in this case).

Another issue is that the Government action to abolish lettings fees could harm future profits. I didn't find sufficient reassurance in the narrative to find comfort on this problem.

On balance then, I've decided to retain a modest position, for the divis, but decline to buy more shares for now.

Air Partner (LON:AIR)

Share price: 87.1p (up 17.7% today, at 09:16)

No. shares: 52.2m

Market cap: 45.5m

(at the time of writing, I hold a long position in this share)

Further update on accounting review

What an interesting situation this has been so far. After the recent Conviviality collapse, I think investors are (rightly) taking an extremely dim view of any share where the bean counters can't actually count. The initial announcement can be the thin end of the wedge, as I discovered to my cost with Conviviality. So catching the falling knife can be a big mistake, if undisclosed additional problems then begin to emerge.

I'm just re-reading my notes from 3 Apr 2018, when the accounting problems were first disclosed to the market. The situation looked very concerning, but not life threatening. For that reason, I picked up a little long position in the company yesterday, with incomplete information, as a bit of a punt. That was a stroke of luck, as today's update is generally reassuring, triggering an 18% rebound in the share price so far today. Key points;

- PWC & Rosenblatt solicitors have been providing independent support to the company's review - no doubt at a 6-figure cost, I imagine.

- Review is making "good progress", and is ongoing.

- Total cumulative impact (of presumably over-stated profits) is believed to be under £4m - not much more than the previously mentioned estimate of £3.3m.

- Results for y/e 31 Jan 2018 will be pushed back to 31 May 2018, just over a month late.

- Distributable reserves are sufficient to continue paying dividends.

- Intention to declare a 3.8p final dividend - this is a strong message of confidence, in my view. Although it's still subject to completion of the audit.

- Policy on dividend cover of 1.5 to 2.0 times underlying EPS is reaffirmed.

- Underlying PBT of £6.4m for y/e 31 Jan 2018 is also reaffirmed (excluding the costs of this review). Accounting corrections will go through as prior year adjustments.

- No customers, operators, or suppliers have been adversely affected.

- The company won't comment on rumours or speculation, but will update the market via RNS. Good - that's the right thing to do.

My opinion - I'm reassured by this update. We're still not in the clear, but I'd say that the risk of a meltdown has probably receded now, enough to probably make the shares investable again, for more risk tolerant people like myself.

For me, the crucial thing is that the balance sheet here is pretty solid. Yes, a lot of the cash pile is client money, but there's no reason to suspect clients would want to withdraw that money - as AIR's overall solvency looks fine.

Personally I only tend to make punts like this fairly small, so that if it does all go disastrously wrong, then the losses aren't too bad. The update today sounds reassuring to me, so I've topped up with a few more - but still only a smallish overall position.

I think the company should fire its FD. There's just no excuse for leaving large balance sheet accounts unreconciled for over 4 years. That's just plain sloppy. In my days as an FD for a larger company/group, I had every significant balance sheet account reconciled to the penny, at every month's management accounts. You have to do that, to maintain proper control, and to ensure there are no nasty surprises. All the debtor & creditor accounts should be controlled via spreadsheets, detailing precisely what is in there, and each one checked carefully every month. My mind simply boggles at the idea that AIR's FD just didn't know what was in the largest balance sheet account, deferred income.

Norcros (LON:NXR)

Share price: 182.5p (down 1.75% today, at 12:16)

No. shares: 80.14m

Market cap: £146.3m

Norcros calls itself the market leading supplier of innovative branded showers, shower enclosures and trays, taps, bathroom accessories, tiles and adhesives...

Today's update is for the year ended 31 Mar 2018.

Group underlying operating profit1 for the year is expected to be in line with the Board's expectations.

- There's more detail given, which I won't regurgitate here. Just a few key points;

- More restructuring needed at Johnson Tiles - exceptional cost of £2.1m, to deliver annualised savings of £2m p.a.

- Net debt of £48m is up sharply from prior year's £23.2m, due to acquisitions. This seems to be getting a bit high to me, but the company says it's only 1.3x EBITDA, which sounds reasonable.

- Merlyn (largest & most recent acquisition) is performing strongly.

- Challenging market conditions, but "well placed to make further progress".

My opinion - it's dirt cheap on a forward PER basis, of only 5.9.

Nothing is said today about the huge pension fund. If the pension deficit reduces, then that could trigger a re-rating, perhaps?

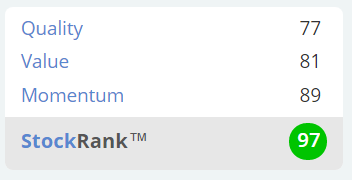

Management seem to be doing a good job of balancing growth by acquisitions, pension deficit funding, and paying divis (the yield is about 4.5% currently). StockRank is 97.

I like the company, and thought management seemed on the ball when I met them last year. What's going to trigger a re-rating though? That's the ongoing problem with this share - I think there are probably lots of stale bulls, who would like to sell, but can't due to lack of liquidity. So, a bit like Mission Marketing (LON:TMMG) yesterday, it just seems one of those shares that is always cheap, and trades sideways. Maybe that could change one day, I don't know.

Stockopedia really likes it - "Super Stock" style, and very high StockRank. Maybe this share might suit very patient investors, who might eventually be rewarded with a re-rating;

SRT Marine Systems (LON:SRT)

Share price: 24.5p (up 15.3% today, at 12:47)

No. shares: 127.7m

Market cap: £31.3m

Year end trading update - for the y/e 31 Mar 2018.

SRT, the global provider of maritime tracking, monitoring and management systems...

Subject to audit, for the year ended 31 March 2018 the company expects to report a 22% year on year increase in revenues to £13.5 million, and profit before tax and exceptional items of £1.3 million which is broadly in line with market expectations.

Stockopedia shows £15.0m forecast revenues. So I'm not quite sure how a £13.5m result can produce profits broadly in line. Maybe there are some adjusting factors? I'll have to look at the full figures when they come out.

At least the company is profitable though, and has delivered a reasonable increase on last year's revenues, although profit looks to be similar to last year.

My opinion - I've mostly lost interest in this company, because it's been promising a huge pipeline of work, and bulging order books for years now. Yet the breakthrough profits still haven't happened.

I hope to add sections on Universe (LON:UNG) (potential hit from Conviviality) and Epwin (LON:EPWN) later, but am having a rest first. So more sections may, or may not happen.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.