Good morning!

Today, after the introductory comment on Thalassa Holdings (LON:THAL) / Local Shopping REIT (LON:LSR), we have:

- Burford Capital (LON:BUR)

- Somero Enterprises Inc (LON:SOM)

- Franchise Brands (LON:FRAN)

Thalassa Holdings (LON:THAL)

- Share price: 81p (unch.)

- No. of shares: 17.6 million

- Market cap: £14 million

You could be forgiven for not knowing much about Thalassa. It's a small investment vehicle with a chequered history in terms of its track record and corporate governance.

I have written about it quite a bit, both here and elsewhere.

What's interesting about it at the moment is that it owns over 25% of Local Shopping REIT (LON:LSR), and has blocked, at least temporarily, that company's plans to liquidate. Almost all LSR shareholders, except for Thalassa, wanted to liquidate when it was put to a vote.

Instead, Thalassa wants to take over LSR and has offered its fellow LSR shareholders a mixture of cash and THAL shares.

Well, this has led to a war of words. The LSR Board has hit back at Thalassa's offer document, writing up a comprehensive analysis of Thalassa's corporate governance failings and explaining why LSR shareholders should reject the deal.

In my opinion, the LSR directors have done a good job of handling this situation so far. From an ethical point of view, I hope that that they succeed in fighting off Thalassa and finding a way to liquidate.

If you're interested to see what happens when Boards of Directors of small companies go to war, this is a fine case study.

Here are the links to the respective circulars:

Burford Capital (LON:BUR)

- Share price: 1914p (+5%)

- No. of shares: 219 million

- Market cap: £4.2 billion

Not a small-cap but a well-followed share among readers. It has been a big winner so far - well done to holders.

It is a litigation finance house, financing lawsuits and owning parts of the claims. It also manages 3rd party funds, collecting investment management fees.

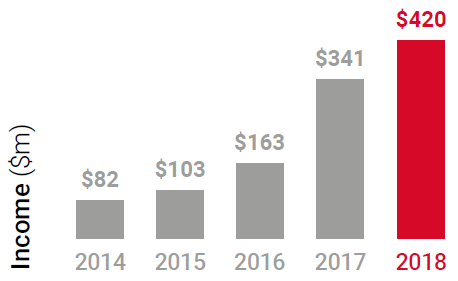

Here is the growth profile for income to 2018, most of which is converted to net income. Total income, operating profit and net income are all up by around 23-24% in today's results.

The lion's share (over 90%) of the above derives from investment income.

Most income is unrealised each year, i.e. based on changes in the perceived value of Burford's assets.

Diversification has improved from 20 to 26 investments contributing to performance - I will need to check what the biggest ones are worth.

The company reports ROE of 30%, a decline from 37% in 2017, resulting from the increase in net assets.

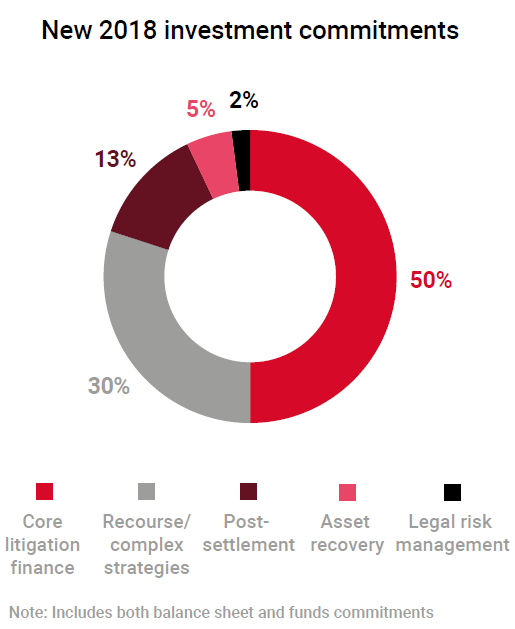

Evolution - Burford is branching out from "core litigation finance". It describes itself as "the legal industry's investment bank", and needs to cater to more of its clients' needs than just the most lucrative deals.

I'm excited by the discussion of Burford becoming a "specialty finance company", rather than just a litigation funder. It sees itself as the investment bank for law, providing a wide range of related services to clients.

Some of these will be less profitable than "core litigation finance", but they will help Burford to become a one-stop shop for its clients and strengthen its competitive position.

Volatility - the company warns that earnings volatility is likely, and that some shareholders may have become complacent after several good years. Great that they are managing expectations in this way.

Competition - why hasn't Burford suffered from increased competition in the space?

The company answers this head on by saying that it has always battled against competition, and has outperformed them.

And it says that the scale it has achieved makes it very difficult for others to compete with it now, as it enjoys economies of scale (see above).

It mentions IMF Bentham as a listed competitor. It has 16 lawyers compared to 55 at Burford. It has net assets of AUD $368 million.

There are private competitors too. They are generally much smaller, lacking the access to the capital markets that Burford enjoys.

Burford says that it rarely loses an attractive deal to the competition.

There is also the point that law is a closed shop, so that margins can remain robust for this kind of activity. (I sort of feel the same way about traditional fund managers - it's not easy to set up without a lot of capital to start with and regulatory approval).

My view

I feel like I've only read about one fifth of the report, but I need to write up some initial thoughts!

If you read the archives, you'll see that my views on litigation finance and Burford have evolved from scepticism to gradual acceptance.

The main things that bothered me about it before were that 1) litigation finance in this format was still very new, 2) Burford's wins seemed too heavily weighted towards a few large successful cases, 3) its valuation.

Based on its track record, exceptionally clear reporting style, the evidence it has shown that litigation finance is widely accepted, and its diversification into different types of activities, I think the first objection is no longer valid.

Diversification also seems to have improved a lot, helping me to look past objection number 2.

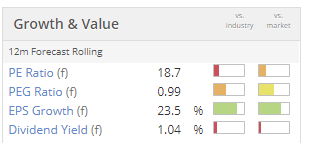

All that leaves is the question of valuation. Net assets are $1.36 billion at December 2018 (about £1 billion). So it's trading at about 4.2x book value.

When I looked at it a year ago, it was trading at 5x book value.

The way that I value companies like this is I relate their long-term return on equity to a "fair" book value.

If Burford continues earning ROE in the region of 30%, for a considerable period of time, then it is certainly worth at least 4x book value today.

I might have to capitulate and add this to my portfolio! I will look at it some more.

Somero Enterprises Inc (LON:SOM)

- Share price: 382.5p (+2%)

- No. of shares: 56 million

- Market cap: £215 million

Good numbers from the US-based Somero for 2018.

- revenue +10% to $94 million

- PBT +13% to $29 million

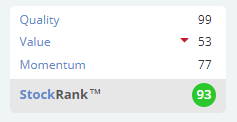

This is a high-margin, high ROCE business with a Quality Rank of 99 according to Stocko.

As we have discussed before, its concrete screeding (flattening) equipment enjoys an apparent lack of competition.

Its long-standing CEO has treated shareholders well with plenty of dividends while also keeping a safe and secure balance sheet.

Capex has been modest over the years, e.g. $2 million in 2017, and then just $800k in 2018. This helps to explain how it generates such high returns and free cash flow.

It has managed to grow and innovate despite the higher free cash flow generation, and this looks set to continue. Since the start of 2019, it has made a $2 million (plus bonuses) bolt-on acquisition, and launched a fresh product.

Outlook - more profitable growth.

My view - no change to my stance on this. It's a very good business with a few specific risks and challenges that we've discussed before.

Somero's Chinese sales fell slightly in 2018, consistent with my view that the Chinese are reluctant buyers of these types of products from a US manufacturer. I don't see why this should change.

Overall, it's a great performer. I'd even consider breaking my rule about avoiding foreign shares for it. It looks like it could fit nicely within a diversified, high-StockRank portfolio.

Franchise Brands (LON:FRAN)

- Share price: 73.5p (+8%)

- No. of shares: 77.5 million

- Market cap: £60 million

Franchise Brands plc (AIM: FRAN), an international multi-brand franchisor, is pleased to announce its full year audited results for the year ended 31 December 2018.

The 2017 numbers aren't directly comparable, as there was a big acquisition in April 2017.

On a pro-forma basis, the aquired company - Metro Rod, a provider of drain clearance and maintenance - did well, growing system sales by 10%.

System sales means sales to customers. This doesn’t correspond to FRAN revenues, because of the franchise system.

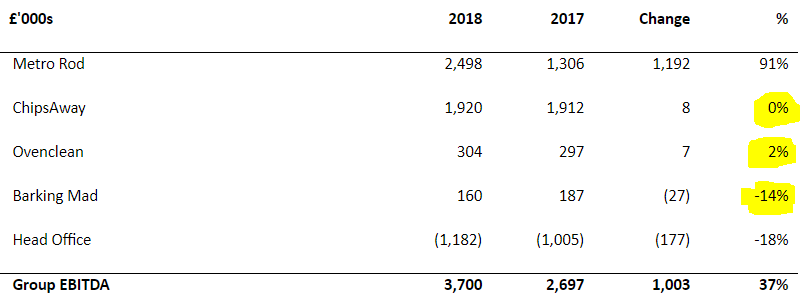

The mood at the other brands sounds less upbeat:

ChipsAway, Ovenclean and Barking Mad have all suffered a slow-down in relation to franchisee recruitment, due to the external environment.

This is confirmed by the small or negative percentage changes in EBITDA at these other brands:

On a pro-forma basis, if it had been owned for the entire year in 2017, EBITDA growth at Metro Road would have been 38%.

Outlook - much more positive than the 2018 commentary, the outlook statement says that 2019 has started "encouragingly". Franchise enquires are said to be up significantly at ChipsAway, Ovenclean and Barking Mad.

My view - I have a positive impression of this group, but am leaning toward the view that it is fully valued.

I have run out of time, not helped by losing half of my Burford article this morning and needing to rewrite it. Sorry about that.

Paul is back tomorrow.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.