Good morning,

There isn't a whole lot in the RNS today but we do have:

- Duke Royalty (LON:DUKE)

- Lookers (LON:LOOK)

- Indigovision (LON:IND)

- Equals (LON:EQLS)

Negative Interest Rates

Since the RNS doesn't have too many stories which interest me, I thought I'd spend some time reflecting on the fact that 10-year fixed-rate mortgages are now being offered at negative interest rates in Denmark.

If you go to the source for this story, you'll find that there are disclaimers: due to set-up fees and other costs, the Danish bank which is offering this deal says that "you are not exactly going to make money borrowing".

Even so, this feels like an escalation of the "ZIRP/NIRP" phenomenon. It is almost certainly unprecedented.

(For context: the Danish krone is pegged to the euro and its official interest rate is -0.65%.)

Bank shares have achieved little for investors in recent years and when you read stories like this, it's not hard to understand why.

Until recently, many economists thought that negative interests rates weren't possible. Why bother giving money to someone, if they'll give you less back?

That logic is still quite sound, in my view! Low interest rate environments do have real effects on people's decisions. We are discouraged from saving and incentivised to spend the money on present-day consumption, instead.

But even with very low or negative interest rates, not everybody can consume all of their savings straight away. There are plenty of institutions and individuals who need to wait some period of time before consuming their savings, or who are forced to lend their money for some structural reason, and these are the ones forced to suffer negative interest rates.

Rediscovering Gold

These days, almost anything looks like a better investment than cash and bonds. Any real asset is inherently superior to paper assets.

But when you consider the negative interest rates and the unprecedented monetary conditions, there are strong reasons, at least in my mind, to focus on the prospects for gold.

The reason for this is gold's historical basis as a currency and as a foundation of currency strength.

This means that when central banks have stopped debasing their currencies and want to strengthen them again, they might rediscover a love of the yellow metal. Like a pendulum, we could have a massive reversal on our hands, when they change course.

Indeed, there are signs from some central banks that this has started to happen. According to a recent article by the FT, central banks have been buying gold at the fastest rate since 1971.

So I hope I don't sound like a stopped clock when I talk about gold - besides the fundamental reasons for bullishness, the price is currently breaking out when measured in many different currencies, and central banks are buying. So it's a current story!

Some investing ideas

For stock market investors who are bullish on gold, we have a problem. The problem is that gold bullion itself is unlikely to be a very good long-term investment, at least compared to equity investing. Gold simply sits there and shines, while companies actively create wealth for you. Warren Buffett is right about this!

So what I'm looking for are companies which actively create wealth in some way but which also enjoy levered gains from a rising gold price.

I recently asked the readership here for your thoughts. Unfortunately, I didn't phrase the question very well. I was looking for companies which can enjoy levered gains from a rising gold price, but which aren't in the mining sector.

One company which has been brought to my attention is the Toronto-listed Sandstorm Gold (SAND). While this is technically in the mining sector, it's really a financial stock which generates royalty income by financing the companies which do the digging.

Closer to home, readers will know that I am long H & T (LON:HAT) and have a positive view of Ramsdens Holdings (LON:RFX), too (though RFX is more diversified away from pawnbroking and gold-related activities).

There are also some large US stocks which might be worth a look - these are the American versions of H&T.

Firstly, we have the Texas-based EZCORP (EZPW). This was the biggest shareholder in the ill-fated British pawnbroker Albemarle & Bond (ABM), prior to that company's administration. Hopefully it learned a few lessons from that misadventure!

And there is the much larger FirstCash (FCFS), also headquartered in Texas.

For those of us who like H & T (LON:HAT) and Ramsdens Holdings (LON:RFX), and want more ideas in this sector, these stocks could be worth a look.

Duke Royalty (LON:DUKE)

- Share price: 45.1p (+3%)

- No. of shares: 200 million

- Market cap: £90 million

(I have a long position in DUKE.)

Duke's share price had slid quite far recently, from a high at 48.5p to a low at 42p. For a stock which is valued against its (contractually guaranteed) cash flows and which hadn't issued any news, this was unusual.

Today's RNS has evidently calmed a few nerves. The H1 results will be in line with expectations.

This is something I've noticed with a few stocks recently: they are selling off ahead of news, and then bouncing back when they issue an in-line-with-expectations update.

There is no doubt about it - investors are jittery at the moment!

(This is proven by the fact that the VIX, or "Fear Index", recently spiked up to 25. That index relates to the S&P but I've also noticed a significant uplift in volatility pricing on the FTSE.)

Key points from Duke today:

- Q1 of the new financial year (from April to June) saw continued momentum with record quarterly cash revenues.

- all Royalty Partners increasing their payments to Duke

- agreed new terms on debt facility to increase its size and "significantly" reduce its cost

- strong near-term pipeline of investment opportunities. "Late stage investigation" of new partners and negotiating follow-on investments in the current portfolio.

While all of this was baked in to forecast, it's still a great update from the company.

As highlighted by CEO Neil Johnson, shareholders can look forward to operating leverage from rising income and relatively fixed costs:

"...the Board believes the existing investment and operating infrastructure is now able to support the continued growth of the Company for the foreseeable future, which will stabilise group operating costs in FY 2020 and beyond."

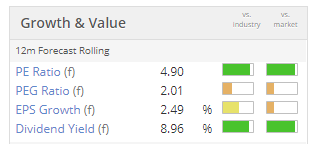

Forecasts

The company's broker, Cenkos, has published a note this morning (available on Research Tree). It leaves all the FY 2020 forecasts unchanged, including:

- income of £11.8 million

- operating profit £9.7 million

- adjusted, diluted EPS of 3.9p, with a payout of 3.6p. This implies an average quarterly dividend of 0.9p, rising from the current 0.7p.

My view

If I was happy to hold shares in Duke prior to this update, I'm hardly going to rush for the exits now! It hasn't put a foot wrong yet, which is all we can ask for.

Blackrock is also a happy holder, increasing its stake in the company last month to 10%. There are many institutions on the shareholder register.

To explain once again how it works, Duke is a halfway house between debt and equity investment. Its royalty payments are contractually guaranteed, and they also rise as the investees grow their revenue - so we get an element of inflation protection and we get to participate in the growth of the investees, too.

From time to time, we can expect that investees will suffer declining revenues and will default, but the overall return could still be quite good. One way of thinking about it is that Duke can get payback of its invested amount from an investee within about 7-8 years. And if the company survives and thrives for 30 years, Duke can get multiples of its initial investment back.

This share is currently about 5% of my portfolio, and I don't plan to buy any more. For now, I am simply monitoring its progress. A re-rating of the share price may depend on the company proving that it can get through another year or two with any major problem, and on more risk-reducing portfolio diversification. Thankfully, it sounds like that is on the cards.

Lookers (LON:LOOK)

- Share price: 44p (unch.)

- No. of shares: 389 million

- Market cap: £171 million

This auto retailer reports numbers in line with downgraded expectations and are undeniably rather poor: underlying PBT is down 27.5%,

The company talks about a "very challenging economic backdrop" and declining new car sales, problems which are facing all of the dealerships right now.

It also mentions weak margins in used cars - readers will remember this being a feature of results at Marshall Motor Holdings (LON:MMH), discussed yesterday.

I can't motivate myself to discuss this in more detail, as I don't want to get involved in any car dealership stocks. I'm not the only one who feels this way, so value opportunities could emerge in this sector for those who are willing to do the work to find them.

The ValueRank at Lookers is 97. Could this possibly already be in "deep value" territory? I will leave it up to you to decide.

For dividend hunters, watch out:

The Board intends to undertake a review of the current dividend policy in light of the Group's trading performance and future cash flows before the publication of the Group's Annual Report & Accounts.

Indigovision (LON:IND)

- Share price: 182.5p (+3%)

- No. of shares: 7.5 million

- Market cap: £14 million

There have been many false dawns at this Scottish CCTV business - too many to mention.

Today's H1 results show a small operating profit of $0.4 million, which is at least better than the loss it incurred last year. Sales are up by 8%.

Outlook:

The actions taken in 2018 to refocus the Company's strategy continue to drive improvements throughout the business. As in previous years, sales are expected to be weighted towards the second half of the year and the nature of IndigoVision's business is that the precise timing of customer orders is difficult to predict. Nevertheless, the current indicators continue to support the Board's target to return the Group to profitability in the current year and for the business to deliver an acceptable level of profitability from 2020.

My view

I've more or less given up on small, order-driven companies like these, as I think that even the managers are unable to predict the results.

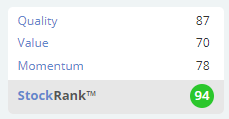

However, the StockRanks love it and categorise it as a Super Stock. If you can get past its lack of visibility, you might find a trading or investing opportunity here.

Equals (LON:EQLS)

- Share price: 111.1p (-5%)

- No. of shares: 164 million

- Market cap: £183 million

Statement re: press speculation

A brief statement:

The Company notes the recent press speculation and confirms that it is in the advanced stages of conducting a fundraising in the region of £14 million at a price of 110 pence per ordinary share in order to accelerate organic growth and to fund potential acquisitions.

An additional £2 million of new shares will be made available in an Open Offer - a nice gesture for small shareholders, although it's only really a gesture when the main fundraising is seven times larger.

According to my sums, we could have an extra 14.5 million new shares, increasing the share count by 9%. Not a terrible amount of dilution to suffer, then, for those who don't take part.

Cash performance - I've just checked the company's financial statements from last year, and they show that the company capitalised nearly £6 million of development spending. It spent a further £6.5 million on acquisitions.

The cash inflow from operations was quite limited, so the company's cash balance ended up declining by £10 million (leaving it with £8 million).

If you believe in the company's potential, this is probably fine: it is investing for its future opportunities. But it's clear that cash is mostly going out the door for now.

We also had an update from Xeros Technology (LON:XSG). This company has an exceptionally poor financial track record and is now attempting to raise money with the help of its Chairman's corporate finance business. Woodford Investment Management is the top shareholder.

Have a good evening, everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.