Good morning, it's Paul here.

To get you started today, I added some more sections to Tuesday's report in the evening - the full report is here. It covers updates from: Cenkos, Sprue Aegis, Gear4Music, Zytronic, Patisserie Valerie, Accrol, and Lookers.

Timing of these reports

I'd like to respond to a critical reader comment yesterday, which I think was a bit of a misunderstanding.

So this is just to clarify, re timing of these reports. We asked readers a while back whether they wanted a report out every day at a certain time (e.g. 1pm), or whether they were happy for me & Graham to take our time, and go into more detail. Much to my surprise, the reaction from readers was overwhelmingly that you are happy with us taking our time, and that people would rather see more detail & thought going into the articles, than us rushing to meet a deadline. So that's what we do.

People also need to bear in mind that (by far) my main living is from my own investment portfolio - capital gains, and dividends. So to a certain extent, these reports are a sideline, or a by-product of what I spend most of my time doing - researching individual companies, reading broker notes, etc.

There's a lot of background reading, fact checking & thought that goes into each report, each day. That takes time, and sometimes after a very intense 6 hours work from 7am, I'm mentally drained by lunchtime. So I tend to down tools, and have a long lunch, then resume working later in the afternoon, and often going right through into the evening. I finished yesterday's report after 10pm, for example.

As a reader pointed out in yesterday's comments, these reports are free to everyone, and are not part of the Stockopedia subscription. Therefore, whatever arrangements that Stockopedia & I have re remuneration, are nobody else's business really.

Sosandar (LON:SOS)

Share price: 16.5p (up 7.5% today, at 08:35)

No. shares: 106.8m

Market cap: £17.6m

(at the time of writing, I hold a long position in this share)

Sosandar is an online women's fashion brand - targeted at the under-served 35-55 year old demographic, who still want fashionable clothing. It's an early stage (hence loss-making) company, having only started trading in autumn 2016.

The company's previous updates have justifiably been criticised for too much waffle, but not enough facts & figures. Today's update seems much better;

- Revenue for y/e 31 March 2018: no less than £1.34m

- Like-for-like revenues for the 6 months to 31 March 2018: up 268% - impressive, but this is based on the prior year's low, start-up numbers

- Record monthly revenues achieved in March 2018 - this is good going, because seasonality would normally mean that March is a much softer month than December

- Substantial momentum has continued into the new year (April & May-to-date 2018)

- Successful marketing campaigns - perhaps surprisingly, direct mail has performed best. Maybe this is because of the older demographic?

- Significant improvement in gross margin - up from 37.8% last year to 49.3% this year, due to stock being ordered in larger quantities, and more sales being achieved at full price. I'm impressed that such a small business is capable of generating a decent gross margin. This should rise in time, to perhaps 55-60%, I reckon.

- Returns rate is said to be at industry average, but strikes me as too high, at 44.8%. It would be good to see some initiatives to reduce the returns rate.

- Repeat orders are good - this is a very important point, and is encouraging. The ideal scenario is to build a loyal customer base, not chase after one-off sales.

- Average order size of £94.18 is much higher than the fast fashion youth market, e.g. Boohoo.Com (LON:BOO)

- Customer database of 54,196 is only scratching the surface of the potential UK market. Being online, of course the market size is potentially global.

- Record sales achieved in March 2018, and then beaten by a further 32% growth in April 2018.

- No comment is made about full year market expectations, which is a pity.

My opinion - this is one of the highest risk shares in my portfolio, hence it won't appeal to many readers. Are the shares good value? No - they're very expensive, considering how early stage the company is, and loss-making. However, for me it's all about backing management (who I think are superb).

Management came across very well at the UK Investor Show, both in a presentation which I attended, and on their stand, which attracted a lot of interest from investors. Mind you, there wasn't a lot else to see on the company stands - c.90% of which were complete dross in my view! (junior resources sector junk, basically). Still, the rubbish companies pay for the event, and do fund some excellent main stage speakers.

In my view Sosandar is likely to be a much bigger business in several years' time. I cannot predict what the share price will do, so decided to just take a fairly big stake (relative to my portfolio) and then do nothing. Providing the growth remains strong, then I'm happy to hold indefinitely.

If the growth stalls, then I'll lose most of my money. If things go well, then this could be a multi-bagger, looking forward several years. So it's high risk, high potential reward.

The cash position is not mentioned today, which I think is another omission. Investors do notice these things, so it's not clever to avoid mentioning stuff that investors want to know. There should be enough cash in the bank to get the company through to maybe mid-2020, by my rough calculations. So cash burn isn't an issue for the time being. They planned heavy cash burn in 2018 & 2019, to grow the business. Hence why the fundraising to launch the company on AIM provided for several years' anticipated cash burn.

I think Sosandar has clearly demonstrated already that it has an excellent market position - serving an overlooked niche. The fashion magazine background of its founders gives it remarkable marketing & PR reach, with many celebrity endorsements, TV and magazine coverage. This is key - online businesses have few barriers to entry, but massive barriers to achieving scale - mainly marketing spend being the impediment. Thinking back to BooHoo's development, it was their clever marketing (using bloggers & vloggers, as influencers of their target market) which catapulted them into the big league. Sosandar is doing something similar, but with an older demographic.

I really like the fact that Sosandar is not chasing the overcrowded youth, fast fashion market, but is instead going for a much more affluent customer, with little direct competition.

So far so good. I think the share price is expensive for now, but I'm optimistic that the company should grow into the valuation over the medium to long term.

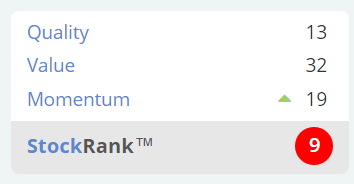

The Stockopedia computers remind us that it's high risk, with a "Sucker Stock" classification, and a terrible StockRank! (se below). I should point out though, that the company has not yet published any meaningful full year figures since listing, so the Stockopedia computers haven't actually got any sensible data to work on yet.

The Stockopedia system is very negative on early stage companies in general - which makes sense, as the disappointment/failure rate is so high.

BOTB (LON:BOTB)

Share price: 218p (unchanged today, at 09:44)

No. shares: 10.07m

Market cap: £22.0m

(at the time of writing, I hold a long position in this share)

Best of the Best PLC, (LSE: BOTB) the organiser of weekly competitions to win dream cars and other luxury prizes...

We all know it from the airports. However the business has since transitioned mainly online;

The Board is also pleased to report that revenue attributable to online sales continues to grow in accordance with the Company's stated strategy to move away from physical sites at airports and retail locations...

Trading seems to be going OK;

... trading for the 12 months ended 30 April 2018 has been encouraging, with profit before tax comfortably in line with management's expectations.

What does "comfortably in line" mean?! I assume it must mean slightly ahead.

The product offering has been enhanced recently, which I noticed from the company's regular emails to me. I imagine that its email list is likely to be hurt by GDPR. Although if non-players are deleted from its database, does that really matter?

To complement the well-established weekly Dream Car competition and to appeal to a wider audience, the Company has enhanced its weekly Lifestyle competition to include an extended range of watches, motorbikes and other items such as exclusive bicycles, water craft, consumer technology items and luxury holidays.

My opinion - I really like the long-term track record of this company, and hence that it's a trusted brand. That could potentially have a value much greater than the current market cap. Hence I'm hopeful that, at some stage, shareholders might have a bumper payday on an agreed takeover bid (it would have to be agreed, as management have such large personal shareholdings).

Management are very approachable, and are trustworthy, having treated minority shareholders well - e.g. Director remuneration is not excessive, and the company has been very generous with dividends, including several bumper special divis in recent years.

Growth has been rather lacklustre in recent years, hence why the share de-rated from a growth company, to a more pedestrian rating for an online business.

If management can find a way to turbocharge the growth, then the shares could have big upside. As things stand though, the forward PER of about 20 looks about right. I think GDPR could force many companies to think of novel ways of connecting with customers & potential customers.

The shares are very thinly traded, and the wide bid-offer spread discourages transactions. So this is very much a lobster pot share. I'm happy to hold for the foreseeable future. I've had spread bets running on this share for nearly 3 years, and also have some in my SIPP.

The special divis have been excellent, which I'm fairly sure would have funded my cost of carry over that timeframe. Although my average buy price was 223p, so am a little underwater on the P&L. Never mind. As Lord Lee says, investing is about 2 things - common sense, and patience. I'm perfectly happy to be very patient with this one, as it's not the sort of share you can nip in & out of. So let's hope I'm right about the common sense bit too!

Right, I'll move on to some more liquid shares now. Obviously each working day, I look first at companies in which I have a personal holding, as I'm sure everyone else does too.

LoopUp (LON:LOOP)

Share price: 458p (up 5.3% today, at 10:10)

No. shares: 42.23m

Market cap: £193.4m

Proposed acquisition & placing

LoopUp provides cloud-based conference calling software, which has numerous advantages over conventional offerings. The product is superb, I've tried it.

This is a noteworthy acquisition because it is classified as a reverse takeover - the acquiree being larger than the acquirer. As Jim Slater mentions in his excellent book, "Return To Go", which I mentioned earlier this week here, when your shares reach a very rich rating in a bull market, it makes sense to take advantage of that by issuing new shares for cash, and buying decent/cheap assets with that cash.

LoopUp is buying MeetingZone Group, another conferencing services provider, for £61.4m.

Placing - at 400p, to raise £50.0m

Bank loan - a new £17m term loan from Bank of Ireland (which will not initially be drawn)

Product transitioning - this bit really worries me. The plan seems to be to migrate MeetingZone's customers over to the LoopUp platform, if I have understood the RNS correctly. Surely that is fraught with risk? Customers often don't like being transitioned. Remember when Morningstar bought Hemscott? They moved subscribers over to their new platform, which was absolute rubbish, and a massive step backwards from the excellent Hemscott platform. So I cancelled my subscription.

So my worry with LoopUp is that a certain percentage of MeetingZone's customers might not want to be transitioned. That could undermine the whole point of the acquisition, and possibly negate anticipated cost synergies.

My opinion - for me, this share is one that "got away". I was keen on it soon after it floated, but then panic sold at about 150p when Amazon launched a competing service. As it turns out, the Amazon service doesn't seem to have made any inroads whatsoever into LoopUp's offering.

I'm not interested in revisiting it at the now sky-high valuation.

It is worth pointing out that, in this bull market, institutions are going crazy for recurring revenue SaaS type software/communications companies. The market seems to be happy to look through short term losses, and instead value these businesses on very racy valuations. There is also private equity activity in this area. Note that Cloudcall (LON:CALL) shares (in which I have a long position) have benefited from this trend, and could have further to go, I reckon. It's nice to see that one finally coming good.

I've looked at the group accounts for Warwick Holdco Ltd ("WHL"), which is the top group company of MeetingZone, and it appears to be PE backed - since it has massive balance sheet debt, in order to leverage the investment and avoid corporation tax.

I was concerned that WHL might be capitalising a lot of development spending, hence the EBITDA figure mentioned in today's RNS could be inflated. Although WHL's accounts show it as loss-making, this is caused by a large goodwill amortisation charge of £4.1m p.a. Once you add that back, it does seem to be genuinely profitable. Also, it only capitalised £243k in development costs in 03/2017 (the most recent published accounts at Companies House), with most development spending of £604k being expensed in the year.

Also note that the huge interest charges in WHL's historic accounts will disappear, because the PE debt will have been eliminated - the company is being acquired on a cash/debt-free basis.

All in all, LoopUp looks an interesting situation, but it's way too expensive for me to want to revisit it.

Moss Bros (LON:MOSB)

Share price: 51.5p (up 9.5% at 12:04 today)

No. shares: 100.8m

Market cap: £51.9m

Moss Bros Group PLC ("the Group") the first choice in men's tailoring, today issues the following trading update for the 15 week period from 28 January 2018 to 12 May 2018...

The company says today;

The Group's overall trading performance has improved since the Trading Update released on 21 March 2018. The anticipated recovery in stock availability is on track and the stock position much improved from the early weeks of the current financial year. Retail sales, including e-commerce, have underpinned this improvement in performance.

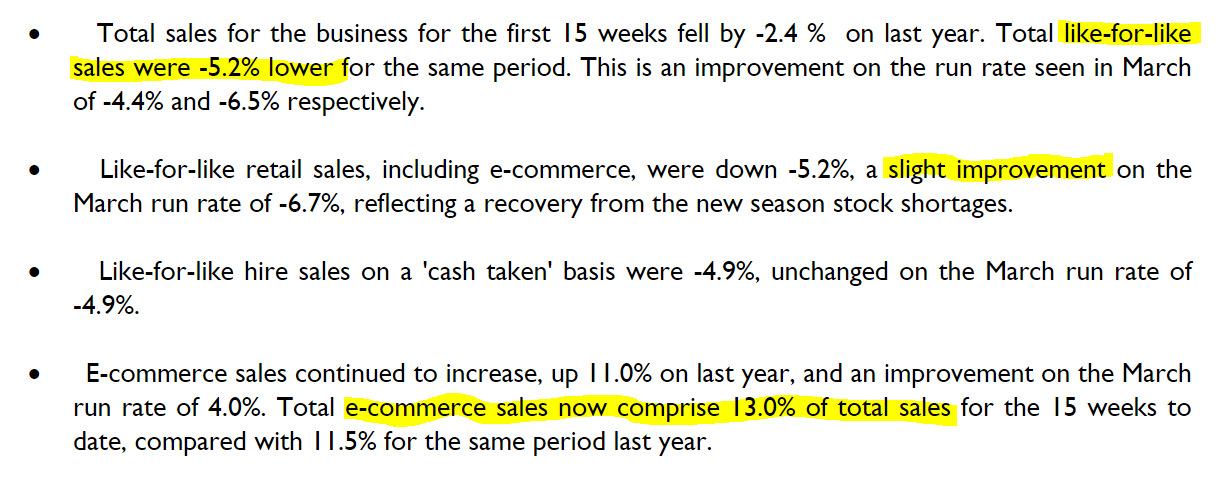

The detail shows that trading is still poor, but has improved slightly;

I certainly would not be rushing out to buy this share, on the basis that it's still reporting significant declines in LFL sales. Remember that the weather improved dramatically in mid-April, and Next (LON:NXT) reported a huge surge of about 27% in the first week of decent weather (week commencing 15 April 2018).

In contrast, MOSB is reporting only a slight improvement, and the figures are negative. I'm not impressed at all, and today's 9.5% share price rise looks spurious to me.

Outlook - the company says today that it's on track to meet expectations;

The business continues to recover from the stock related challenges experienced at the start of the current financial year, although a fragile and more volatile consumer environment continues.

Even so, the Board remains confident that the business is on track to meet market expectations for the year.

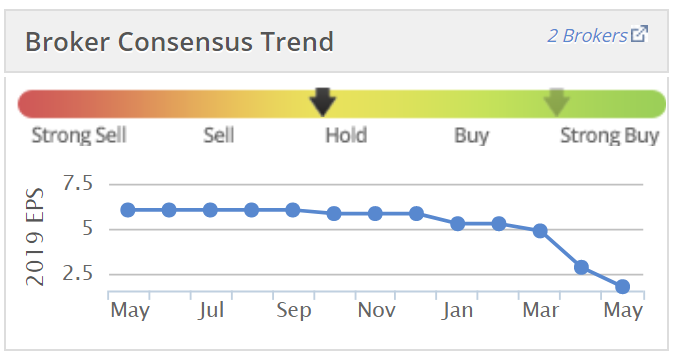

How can that be? Well, mainly because market expectations have been dramatically lowered, as you can see from the Stockopedia graph below;

My opinion - I'm kicking myself for not having shorted this share a while ago, as it looked over-valued (and still is).

The business is performing badly, with profits forecast to plunge this year. That leaves the dividends uncovered - so the very high dividend yield is actually a warning sign that such a yield is not sustainable. The company was running down its high cash reserves through divis, so it was never sustainable to pay out that much. Dividend policy was changed recently, as I reported here on 21 March 2018. It looks as if that hasn't flowed through to the broker forecasts on divis. Show the forecast yield looks wrong. I've asked Stockopedia HQ to challenge this data with Thomson Reuters, and get it corrected.

This just isn't a very good business, in my view. It's facing the same big structural problems that everyone else on the High Street faces - internet competition, and relentlessly rising costs. Why would any of those factors stop, let alone reverse?

I suspect that MOSB could easily become loss-making, and end up fighting for survival in the future, as so many other High Street retailers are. These are absolutely brutal conditions, where only the strongest will survive, and benefit from falling future rents. The BRC reported recently that 10% of High Street shops are now empty. So I certainly wouldn't want to be a landlord in these conditions. Rents are likely to plummet, in many towns.

Another factor is that MOSB is only doing 13% of its revenues online. That's nowhere near enough to offset the falling sales from its physical stores.

The company's wedding hire business is interesting, and a key point of difference. Although who cares, if overall the company hardly makes any profit now?

I cannot understand why anyone would find this share attractive. The only reasons I can come up with, are the strong balance sheet, and maybe that some investors might just be in denial about what's going on in High Streets up & down the UK?

Crest Nicholson Holdings (LON:CRST)

Share price: 441p (down 10.7% today, at 12:52)

No. shares: 256.9m

Market cap: £1,132.9m

The reason I want to report on this share today, is because I wonder if we might have reached peak housebuilder profits? That could have read-across for other housebuilders, and I'm wondering if now might be a good time to consider opening some short positions on housebuilders? (or at least getting out of longs).

CRST has dropped 10.7% today, because it warns that profit margins are beginning to fall;

The experience of generally flat pricing against a backdrop of continuing build cost inflation at 3-4% will mean that operating margins for the full year are expected to be around 18%, at the bottom end of our 18-20% guided range.

An operating margin of 18% is still spectacularly good. However, as we know, the housing market is very cyclical. Maybe the trend has now changed, in that unsustainably high profit margins for housebuilders could be starting to decline?

There are other signs of slowing transactions;

Whilst most of our sales outlets have been performing well, sales at higher price points have proved to be more difficult to achieve. This in part reflects the greater interdependency of higher-value sales with transactions in the second-hand market, where activity has been more subdued and property chains have been taking longer to complete.

My opinion - the UK housing market has been badly distorted by ultra-low interest rates. Also the British obsession with house prices shows no sign of abating, with a lot of artificial wealth having been created in several housing booms during my lifetime. The party has to end at some point - probably from the withdrawal of easy & cheap credit.

Imagine if a Corbyn Government had to defend against a collapse in sterling, by hiking base rates to say 5%, or more? The impact on the housing market would be devastating, as mortgages became unaffordable.

Maybe my recent reading of Jim Slater's book about the 1974 crash has coloured my judgement negatively? It has reminded me though that the health of the UK housing market is entirely dependent on the continued availability of cheap mortgages. If anything happens to change that, then we could see a big correction in house prices, which would devastate the profits of housebuilders.

So to my mind, this sector is looking high risk right now. Maybe CRST could be the canary in the mine, for tougher conditions ahead?

That's it for today. I didn't get round to looking at Speedy Hire (LON:SDY) in any detail, but the headlines looked very good, and above expectations. So that one might be worth a closer look.

See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.