Good morning! This is my last small-cap report before I jet off for summer holidays at the end of this week.

Some RNS announcements to see me off:

- UP Global Sourcing Holdings (LON:UPGS) - trading ahead of expectations

- Koovs (LON:KOOV) - preliminary results

- Venture Life (LON:VLG) - commercial update

- Nichols (LON:NICL) - interim results

- Watches of Switzerland (LON:WOSG) - preliminary results

At Versarien (LON:VRS), "revenues [from graphene] of any material amount have yet to be achieved". It has received its first graphene orders post-period end.

APH

Readers have been having an excellent discussion in the comments on Alliance Pharma (LON:APH).

For better or for worse, I stay away from all pharmaceutical stocks on the grounds that my time is better spent focusing on industries where I have a little bit of experience and/or expertise. Sorry about that! I strongly recommend the comments section for anyone who is interested in this share.

Not taking profits

I've had an interesting chat this morning with a friend on the subject of taking profits. We are both long-term shareholders in Burberry (LON:BRBY), and it's a significant percentage of both of our portfolios (currently 13% of mine).

Pricing of Burberry (LON:BRBY) leaves us with a problem of sorts - a pleasant problem. Do we take profits at c. 27x earnings (pre-upgrades) or do we ride it out?

Regular readers will know that as a general principle, I don't sell shares. There are many reasons for this:

- frictional costs - commissions, the spread.

- taxes - to avoid capital gains tax liabilities, I need to hold on to shares (your tax situation may be different).

- the reinvestment problem - it creates more work for me, to find something else to invest in. This might sound lazy, but I think that minimising work is very smart!

- wasted research - related to the above, it is a waste of the work done on my existing portfolio and the comfort that I've built up with my existing holdings, if I get rid of them too quickly. Comfort with portfolio holdings has a real value.

- cash drag - selling out of shares on a regular basis probably means that I would end up holding more cash throughout the year. The expected return on cash is (usually) lower than the expected return on overvalued shares! So holding cash is a drag on returns.

For these reasons, I think my returns would be worse if I was a regular seller of shares.

To show that I practise what I preach: over the last twelve months, I have only sold two companies out of my portfolio, and it was because I realised that my investment thesis in each case was wrecked. The shares in question were United Carpets (LON:UCG) and Distil (LON:DIS). (For what it's worth, both shares are currently trading below my exit prices.)

But if I still think that my original investment thesis is floating, then I'm happy to carry on holding through minor disappointments and through temporary overvaluation.

When I look at Burberry (LON:BRBY), I see a share that might be overvalued. The market is clearly delighted with prospects under new designer Riccardo Tisci, after a postive consumer response to his initial range.

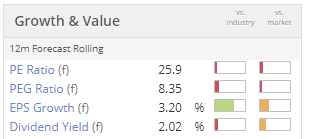

(Please note that the PER shown above does not take into account the further 3% gain today, or the EPS upgrades which will feed into the system.)

Upgraded EPS estimates for FY March 2021 and FY March 2022 from one particular investment bank are now 96p and 105p, respectively.

FY March 2022 starts quite soon: in eight months. So the PER for that year is now just over 22x.

For the patient investor, therefore, we can look forward a year or two and see that Burberry has the potential to grow into its current valuation quite quickly.

Since the company is performing well - indeed, especially because the company is performing well, and also because the valuation does not appear stretched to ludicrous levels, I don't see any need to trim my position.

Please note that this is not an argument in favour of buying Burberry at current levels. I have only ever bought Burberry shares when the market has been very scared of it - its shareholders are an extraordinarily nervous bunch, and tend to run away at the first sight of trouble. This provides plenty of trading opportunities for those who watch it closely and take a more active style.

The main investment thesis at Burberry has to do with the longevity of the brand, its exposure to attractive international growth opportunities, its strong quality metrics which flow from its luxury positioning, its very healthy cash generation, and its unlevered balance sheet. I've built up a lot of comfort with these characteristics, as I've been watching it, off and on, for the past seven years.

Now there is a good argument which takes a portfolio perspective and suggests taking profits to reinvest in similar companies. For example, Kering (KER) or LVMH (MC) are much larger and more diversified. I can't argue against the view that it would be much safer to own those two alongside Burberry, reducing the exposure to a single brand.

On the other hand, part of my investment thesis at Burberry has always been the potential for a takeover by LVMH. In that event, it will be the Burberry share price which enjoys a strong bid, not LVMH's.

American firms might take an interest, too: Tapestry (TPR) (formerly known as Coach) wanted to acquire Burberry back in 2016.

In summary, the investment thesis is intact and even if Burberry's share price is currently aggressive, it is not at levels which the company cannot grow into over the next two years.

Selling good companies is a move which successful investors often regret the most, and I'm determined to avoid replicating it.

As Jesse Livermore once said, in a completely different context:

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market.

UP Global Sourcing Holdings (LON:UPGS)

- Share price: 85.8p (+19%)

- No. of shares: 82 million

- Market cap: £70.5 million

A pleasing update from this IPO recovery stock. Underlying PBT this year will be above the market's current expectations.

"The Group has continued to trade strongly since its interim results, announced on 29 April 2019, and there has been better than expected revenue growth across each of its four strategic pillars - i.e. discounters, UK supermarkets, online platforms, and international customers."

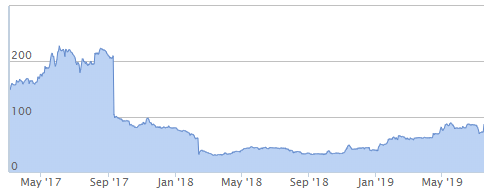

The chart tells the story: it floated on optimism, crashed shortly thereafter, and has been gradually recovering over the past year. See the archives for our previous comments - I last commented in April 2018, with the share price at 38p.

Commissioned research from Equity Development puts the latest EPS forecast for FY July 2020 at 8.3p.

As a reminder, UPGS is an importer of affordable consumer goods from the Far East. Based on its list of brands, I reckon that its products do enjoy some pricing power.

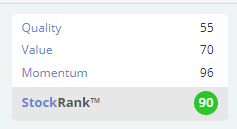

The StockRanks love it and the returns look excellent, however I would be surprised if this brand portfolio was able to support an above-average earnings multiple for the stock.

Koovs (LON:KOOV)

- Share price: 7.1p (-11%)

- No. of shares: 356 million

- Market cap: £25 million

This "Indian ASOS" says that current trading is in line with market expectations, and is very bullish about Q1 in the new financial year.

The results for FY 2018 are rubbish, so it's important that it has something to shout about.

In FY 2018, on sales of £6.4 million, it produced an adjusted EBITDA loss of £12.9 million. This is about as bad as it gets in terms of the companies that I cover.

The company has successfully raised lots of new money and is in partnership with Future Lifestyle Fashions, so you would think that there is no serious threat of insolvency. However, there is a rather lengthy going concern note.

Apologies for the extended excerpt, but I think this stuff is important:

"...the success of the business remains reliant on the Group achieving an adequate level of sales, driven by an appropriate level of marketing spend. During the next 12 months the forecast level of costs will be unlikely to be covered by the gross profit generated from sales. As such there is a risk that the Group's working capital may prove insufficient to cover such operating activities. In such circumstances, the Group could be obliged to seek additional funding through a placement of shares or source other funding. In the absence of additional funding the Group has the ability to reduce costs to ensure that existing cash resources together with the funding described below are sufficient to enable the Group to meet its liabilities for a minimum of 12 months from the date of this report....

The directors have concluded that the circumstances set forth above represent a material uncertainty, which may cast significant doubt about the Company's ability to continue as going concern. However, they believe that taken as a whole, the factors described above enable the Company to continue as a going concern for the foreseeable future."

It doesn't really matter to me how good Q1 at Koovs was. The risk of investing in an Indian business combined with the company's terrible financial record and the going concern note above make it uninvestable for me. Bargepole treatment.

Venture Life (LON:VLG)

- Share price: 50p (-1%)

- No. of shares: 84 million

- Market cap: £42 million

Venture Life Group plc (AIM: VLG), a leader in developing, manufacturing and commercialising products for the UK and international self-care market, announces a commercial update on business developments in H1 2019.

This is a detailed H1 update.

Noises sound positive re: Dentyl mouthwash but the UltraDEX brand strikes me as more differentiated versus the competition, so I find it a little bit more interesting. It's making progress with distribution arrangements with a variety of major retailers.

There is also some progress in VLG's manufacturing division, though there is a lack of financial detail given in this update.

The update includes no reference to market expectations, which are for EPS of 2.1p in the current financial year, rising to 2.8p next year.

I find this stock interesting but am in no particular rush to buy at current levels.

Nichols (LON:NICL)

- Share price: 1700p (+4%)

- No. of shares: 37 million

- Market cap: £629 million

2019 Interim Result & Board Changes

Running out of time now but I just want to mention this in the context of our analysis of Barr yesterday.

Nichols has seen UK revenue growth of >6% in H1, "against very strong prior year comparatives". It says UK soft drink sales in general are up by 4.1% year-to-date, using Nielsen data.

Outlook

While UK trading conditions are expected to remain challenging, as a result of the Group's diversified business model and sales momentum, the Board is confident that full year earnings will be delivered in line with its expectations.

My view

Firstly, I think this puts the horror show at Barr yesterday in an even worse light, since Nichols is having none of the same problems.

As for Nichols itself, it continues to look a very nice buy-and-hold candidate, as it always does. I am price-sensitive and leave it on my watchlist.

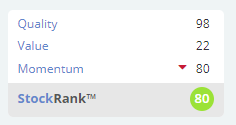

Stocko recognises the quality, calling it a High Flyer.

Watches of Switzerland (LON:WOSG)

- Share price: 293p (+1%)

- No. of shares: 240 million

- Market cap: £702 million

Slightly too big for a small-cap report. Possibly of interest to you, this is a new flotation (IPO in May) which has issued its maiden results.

There don't seem to be any nasty surprises. UK like-for-like sales are +10%, and PBT increases at a healthy rate to £20 million. Guidance for the current financial year is unchanged.

The likes of Rolex and Patek Philippe are picky about who gets to sell their watches. So in that sense, WOSG is not an ordinary retailer - it has valuable relationships with top-tier luxury brands.

So I'm interested to follow this story, watching out for the usual post-IPO wobble.

Addio! I will be somewhere that looks like this next week, checking my emails as infrequently as possible. Thanks for all your terrific feedback and comments, as always.

Cheers

Graham

(Source: ThomasCookairlines.com)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.