Good morning!

Today is Fed decision day. President Trump has been tweeting unhappily about it, but it looks like US interest rates will increase toward 2.5%.

Away from macro, I have noticed the following RNS announcements:

- Begbies Traynor (LON:BEG) - half year report

- 888 (LON:888) - pre close trading update

- Cambridge Cognition Holdings (LON:COG) - trading update

- Yu (LON:YU.) - notice of appointment of FCA investigators

- Manolete Partners (LON:MANO) - maiden interim results are in line with expectations. What a relief - it has been listed since Friday!

Begbies Traynor (LON:BEG)

- Share price: 68.8p (pre-open)

- No. of shares: 110.5 million

- Market cap: £76 million

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, today announces its half year results for the six months ended 31 October 2018.

This company is useful as a barometer of financial distress in the economy.

The numbers show some modest progress against last year. There have been some acquisitions:

- revenue +£2 million to £28 million

- adjusted PBT +10% to £3.2 million

- after amortisation of acquired intangibles and transaction costs, actual PBT reduces from £1 million to £0.6 million (see the debate on my previous commentary)

- net down down, dividend up

Outlook

Careful wording: the company is "well placed to deliver up current market expectations for the full year". There is a second half weighting, relying on contingent fees and higher activity levels.

Insolvency Market

Corporate insolvencies are up 6% on a trailing 12-month basis, to September 2018.

After a couple of very lean years, this means that business looks to be getting back to normal for insolvency practitioners.

Begbies has been involved with the administrations of a music festival, an estate agency and a menswear retailer, and has advised House of Fraser landlords on the CVA process.

These individual cases give us a sense for how a full-blown consumer recession would (counter-cyclically) produce a boom in the demand for Begbies' services.

My view

For reasons previously discussed, this share doesn't interest me as a potential investment - I don't invest in professional services businesses.

Its announcements are useful, however, as confirmation of the state of the involvency market. It sounds like things are moving on that front, with momentum for continued growth in the demand for insolvency services. That's really healthy for the economy - freeing resources which have been tied up in failing businesses, so they can be allocated in a more rational way.

888 (LON:888)

- Share price: 182.6p (+7%)

- No. of shares: 364 million

- Market cap: £664 million

(Please note that I currently hold 888 shares.)

This international online gambling operator is a very recent addition to my portfolio.

It helps that I have played poker on 888 for a few years and also have some familiarity with its position in the US market - it is a smaller but highly-respected competitor against PokerStars.

Using its products is one of the best ways to deepen your understanding of any company - though you might want to be careful when it comes to gambling, tobacco, etc!

Poker has actually been one of the more difficult segments for 888. The other casino games tend to provide a much more straightforward route to profitability.

Today's update confirms that adjusted EBITDA will be in line with expectations.

888 shares have been massively de-rated over the past six months despite the prospect that US growth could be sparked through the legalisation of online sports betting and the spread of online poker to more and more States.

Investors have instead been focusing on the worrying situation in Europe, where the company has faced seemingly endless fines and legal problems.

The share price became overly pessimistic, in my view, since 888's broad geographic diversification means that it is likely to churn out decent results even if it continues to suffer bad luck in one or two jurisdictions.

It's a Gibraltar-registered company with Israeli roots, but is a truly international business.

For whatever it's worth, the Outlook comments today from the CEO are very positive.

888's forecast P/E ratio was 11x based on last night's close, with a forecast dividend yield of 7%.

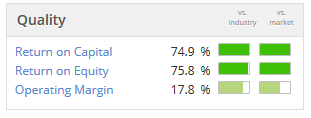

It enjoys a Quality Rank of 87, thanks to the following metrics which are indicative of a successful online business:

Where it falls down is in its Momentum, which is why Stockopedia classifies it as Contrarian.

I was brave enough to step in the way of the downtrend and buy some shares - I wouldn't be too upset if I had accidentally called the bottom. At the same, I also wouldn't mind continuing to accumulate them at cheap levels!

Cambridge Cognition Holdings (LON:COG)

- Share price: 81.5p (-19%)

- No. of shares: 21 million

- Market cap: £17 million

Trading Update and Notice of Results

I've been unpicking the logic in this trading update. Something strange is going on!

In a nutshell, the company is blaming IFRS 15 (the new accounting standard for revenue recognition) for a reduction in reported revenues this year.

That alone shouldn't cause a near-20% fall in the share price. Different accounting rules don't change the value of a business, after all! They only change how that value is presented to us.

So either investors are wrong to mark the shares down, or the company is wrong to blame IFRS 15 for its woes. I am leaning toward the latter.

Let's recap. In March, the company warned that IFRS 15 was coming. It said that this would result in smoother revenues through the life of its software contracts - revenues would be recognised over the life of a contract, rather than in a lumpy manner up front. The company seemed to be ok with that, at the time!

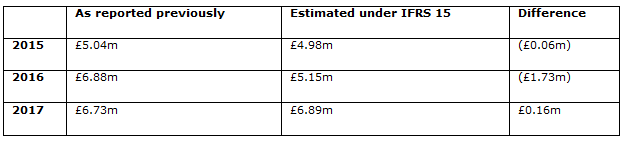

Very helpfully, we were given this table to show how the new rules would have changed historic revenue:

You can see that IFRS 15 revenue is smaller in the first two years, but is larger in the third year. Adding all years together (including 2018 and beyond), the total revenue should be unchanged. The only difference should be that some of the revenues are recognised later.

Which brings us to this morning. The key paragraph is:

For FY2018, the Company adopted IFRS15, the new financial standard on revenue recognition, which has had a short-term adverse impact on the financial performance of the Company. Under IFRS15, revenue for FY2018 is expected to be in the region of £6.0m. Had revenue been reported using the same standard adopted as in the year ending 31 December 2017 ("FY2017"), FY2018 revenue would have been approximately £7.0m. This compares with £6.7m in FY2017.

So the company is saying that under the old rules, it would have improved revenues from £6.7 million to £7 million in FY 2018.

But under the new rules, it is instead going to fall from £6.9 million (see the table above) to £6.0 million in FY 2018.

Stockopedia forecasts show that the consensus revenue forecast for FY 2018 was £6.9 million. I wonder is this under the new rules or the old rules? If it is under the new rules, then today's update represents a big sales miss, and it's unsurprising that the shares have fallen so much.

Whichever way you look at it - the new rules or the old rules - sales growth isn't growing terribly fast, at least not in FY 2018.

The company promises investors that marmalade will be coming soon:

Total sales order intake is expected to exceed £7.6m, compared with £5.1m in FY2017. In addition there are a number of materially significant contracts expected to be signed in Q1 2019. The order book is expected to be approximately £5.6m at 31 December 2018, an increase of 40% compared to the equivalent value of £4.0m at 31 December 2017.

Unfortunately, it has been around for quite a few years and hasn't yet made the big commercial breakthrough that would excite investors. Perhaps 2019 will be its year - but I would want to be very close to the story, to have the confidence to bet on that.

Yu (LON:YU.)

- Share price: 75p (-30%)

- No. of shares: 16 million

- Market cap: £12 million

Notice of Appointment of FCA Investigators

This company has suffered a shocking fall from grace, and in tandem with Patisserie Holdings, you might even go so far as to say that it has brought AIM into disrepute.

It launched at 200p in 2016 and reached a high at 1345p earlier this year, before admitting that its figures were, in a word, rubbish.

Income had been accrued (not invoiced) which would never be paid by customers. There were also significant additional amounts which had been invoiced but would never be paid by customers. The company was running at a loss instead of a large profit.

Today we learn:

The Financial Conduct Authority (the "FCA") has notified the Groupthat it intends to conduct an investigation into accuracy of the Group's announcements made between 6 March 2018 and 24 October 2018 and whether these announcements accurately reflected the Group's financial status.

I must be too simple-minded, but when a company admits that its accounts have "several areas of significant concern", resulting in £10 million of "adjustments" and a "substantial reduction in profitability", has it not already admitted that its announcements did not accurately reflect its financial status?

I wonder what the upshot of all this might be. It's not good for investor trust in AIM, that's for sure.

I studied Yu during its meteoric rise - I was impressed by its growth, but I did think that the share price had gotten ahead of itself by at least a few years.

A bit like Patisserie Holdings, it now turns out that the story was too good be true. It was surprising that a small gas and electricity supplier could do so well. On the other hand, it had peers who achieved similar success before it.

It now looks like the growth was a mirage. Hopefully, we will find out if there was a deliberate plot to mislead.

I wouldn't be tempted to buy shares in this company unless they were almost free.

Manolete Partners (LON:MANO)

- Share price: 195.5p (-0.3%)

- No. of shares: 43.6 million

- Market cap: £85 million

These are results to September 2018, i.e. for a period which had already ended long before its recent IPO.

Manolete is an insolvency litigation financing company, earning massive returns on its investments which would remind you of Burford Capital (LON:BUR).

These results, which are of course in line with expectations, show the success of the business model with an equity base of £8 - £10 million.

Its challenge now is to deploy NAV of £24 million, following a successful fundraise of almost £15 million, with a £20 million bank facility on top.

Returns

The "average money multiple" is 3.6x for cases completed during the period. How on earth can returns be so high?! It must be very painful for the customers (Insolvent Estates) to give away multiples like that to law firms. Although I suppose they don't have much of an alternative, and are better off than if they don't get the funding!

The pool of lawsuits seems to be reasonably well diversified, even before the fundraise: 76 live cases. I'd be curious to know how big were the top 5, as a percentage of the total value?

There is a big difference between the average case value (£180k) and the median case value (£60k). Mathematically, this hints at the existence of a small number of high-value cases.

One note of warning: about one third of recorded revenue for the period is to do with "unrealised gains on investments in cases". This must be tricky to measure. (Similarly, the true value of Burford's balance sheet is highly uncertain).

My view

I view this as a financial stock, trading at 3.5x book value - which might be justified, if the high returns continue to be achieved.

Perhaps I've been unduly sceptical towards this sector. My concern is simple enough: that it's impossible for an outsider to predict the outcome of legal cases with any certainty (so a concentrated set of legal cases would be dangerous). In addition, the extreme high returns make me suspicious that something strange is going on.

Good luck to anyone who is willing to give it a chance! I'll remain on the sidelines for now.

That's it from me this afternoon. Apologies for the slow production of this report - lots of preparations underway for Christmas. Life gets in the way sometimes!

Have a great evening.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.