Good morning, it's Paul here.

Apologies, for my running late today. This report will gradually emerge throughout the afternoon.

Falling knives

Some confidence seems to be returning to the market at the moment. As alluded to in yesterday's report, this is creating some attractive buying opportunities. The general sell-off in H2 of last year seemed to take most small caps down with it, regardless of how companies are performing. In particular I'm seeing good profits being made on small caps, in 2 specific situations right now;

Potentially profitable situations

1) Shares which relentlessly drifted down last year, on low volumes of selling, for no apparent reason.

When companies like this put out a positive trading update now, there's lots of scope for share price upside, in some cases. Eagle Eye Solutions (LON:EYE) is an example of this, which I'll cover below. Also Cloudcall (LON:CALL) (in which I hold a long position) springs to mind - with a very upbeat recent CMD and positive trading update, starting to claw back some of the unjustified share price losses of H2 2018.

2) Shares which fell heavily last year, in anticipation of poor trading, then got whacked a second time on issuing poor trading updates.

This resulted in some pretty crazy market over-reactions on the downside. Good examples of this are Superdry (LON:SDRY) and QUIZ (LON:QUIZ) (in which I have a long position) - which have both bounced about 50% from the lows on their recent profit warnings.

Therefore, I'm wondering if this might be an interesting time to look closely at (very selectively) catching some falling knives, on a profit warning?

My checklist for possible falling knife catching

1) Financially secure - so a decent balance sheet, preferably with net cash, which protects the downside.

2) Reason for the profit warning falls into the temporary, fixable problem(s) category - Zoo Digital (LON:ZOO) yesterday looked like an example of a one-off profit warning, and I note it's started rising today.

3) Share price has already fallen a lot in 2018, and has a further, deep drop on the profit warning - so an over-sold situation.

4) A fundamentally decent quality company, whose shares are now cheap on fundamentals.

That seems to me a good, simple checklist to apply to profit warnings. There seem to be some unusually good opportunities out there at the moment.

Eagle Eye Solutions (LON:EYE)

Share price: 172.5p (unchanged today, at 12:42)

No. shares: 25.4m

Market cap: £43.8m

Eagle Eye, the SaaS technology company that allows businesses to create a real-time connection to attract and retain their customers through digital promotions and loyalty services, is pleased to provide an update on the Group's trading for the 6 months ended 31 December 2018 ("the Period")

Checking back through my notes here, I flagged the company as potentially interesting, here on 16 Nov 2018, on a solid AGM statement.

I reported again, here on 7 Jan 2019, on an inline trading update & a contract win with Waitrose (extending its existing relationship with John Lewis Partnership - good evidence that its service is liked by a big customer).

Shortly after that, there were some large Director buys announced. For me, that put all the ducks in a row, so I bought a few shares shortly afterwards at about 110p. I really didn't expect the share price to shoot up as much as it has (a rise of over 50% in just a fortnight), and have already sold them, for a small, but worthwhile profit. It wasn't intended as a short term trade, but if something hits my price target early, in a few days, even if it was intended as a longer term position, then that's fine by me.

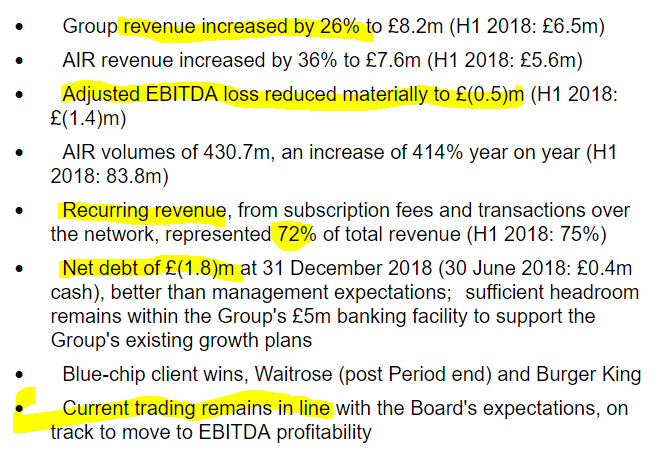

To save re-typing it, here is a picture of today's highlights, with my highlighting the key points;

Comments;

- Good, organic revenue growth - justifies a premium rating on the shares

- Big fall in EBITDA - this is positive, but caution: it's always important to check the cashflow statement when tech companies in particular refer to EBITDA, as they often capitalise a lot of their payroll into intangible assets. Sure enough, EYE capitalised nearly £2m of costs into intangibles last year, so EBITDA is inflated & meaningless in this case, and is NOT a good proxy for cash burn

- Recurring revenues - high, which is very good - giving strong visibility. Banks are willing to lend against recurring revenues too, as I learned at the recent CALL CMD

- On track towards EBITDA profitability - good, but as mentioned above, that's not real profitability!

My opinion - I like this growth company. The litmus test is the growing blue chip client list - that proves the product is very good, and must work reliably at high volumes.

My main concern is the cash burn, combined with a net debt position. Clearly EYE will need to do another fundraising at some point, probably in the not-too-distant-future. That said, to raise say £4m in extra cash, would only be around 10% dilution, which isn't a worry.

I was discussing placings with a pal the other day. His view is that he'll avoid all companies which may need to raise more cash. Generally that's sensible, but personally I will make exceptions - where (here's another checklist! I like checklists);

When possible placings are acceptable

- Newsflow is positive, with strong organic growth being achieved

- Recurring revenues a high proportion of overall revenues - as this gives visibility & stickiness

- High gross margins, so profits geared nicely to top line growth

- Approaching breakeven (within roughly a year)

- Annual cash burn relatively low compared with market cap - say below 10%

- Only needs a final, top-up placing, before reaching breakeven

- Modest dilution only needed - anything up to 10% is fine by me

- Supportive institutions who want to buy more stock - this can be gauged by looking back at previous placings & the resultant "Holding in company" RNSs. In particular, what level of discount to the market price (if any) was given in previous placings?

Overall with EYE, I'm happy to sit on the sidelines for now, given the big recent share price rise. The current price looks about right to me, rather than looking cheap any more. I'll be looking to buy back on any weakness in future (the price moves around a lot, on little volume), and ideally after the next placing has completed.

Longer term, the company's prospects look bright, providing it can continue growing enough to move into profit.

Patisserie Holdings (LON:CAKE)

Sadly, it's all over for shareholders now. It's gone into administration, so the shares are now worthless. Presumably, the profitable shops are likely to be snapped up for a song, in a quick deal to be done with the administrator - that's what usually happens in this type of situation. No doubt the planning has already been done for that.

The BBC news is reporting today that 70 of the 200 shops have been closed, because they are loss-making. If that many shops were losing money, then it's abundantly clear the published accounts were not just a bit wrong. They were massively wrong. So far out, that a lot of people within the business, particularly at senior levels, must have known what was going on.

It also raises the question as to whether the IPO in May 2014 was fraudulent? I've taken the precaution of downloading a copy of the Admission Document, before it disappears from the website, for further analysis when time permits.

Let's hope the perpetrators go to prison for this. Haha, only joking - this is of course the UK, where white collar crime pays very nicely indeed.

eve Sleep (LON:EVE)

More evidence emerges today that Woodford has totally lost the plot.

Eve is raising £12m in a 10p placing, with Woodford's clients being stuffed with two thirds of that.

Eve has one of the worst business models I've ever seen. It's trying to build a European brand (think, vast advertising spend), to sell memory foam mattresses direct to the public. Given that for most people, mattresses are a one-off spend, maybe every 10 years, or longer, then what's the point in spending all that money on building the brand?

In any case, memory foam mattresses are two a penny online. I've bought several in recent years, and have found that generic ones for about a quarter of the cost of an Eve mattress are very comfortable indeed. There's absolutely no point in spending more, in my view.

Why would any investor (let alone a former star fund manager) throw good money after bad? Financial results from Eve have been absolutely dire. It just hasn't worked. So for most rational investors, it would simply be a case of saying never mind, sell the shares for whatever you can get, and put it down to experience.

Refinancing a basket case, seems an act of pure folly.

It made a £12m loss in H1, so the new money raised is only enough to keep it going for another 6 months, at previous levels of cash burn. Unless new management slashes cash burn, which would mean slashing advertising, which would presumably cause sales growth to stall.

Product reviews on Argos are not particularly impressive.

Reading today's RNS in more detail, the company is scaling back its ambitions to the UK, Ireland, and France, because it was costing too much to expand into other European markets.

The company reckons this fundraise should see it through to late 2020 - so costs are indeed being reduced.

In my experience, blue sky business models which fail on first attempt, very rarely succeed on the second attempt. Woodford's just prolonging the agony, maybe so as to avoid egg on his face with an insolvency at an investee company? I would want any fund manager controlling my money to make tough decisions on poorly performing companies, not throw more money at them.

Hotel Chocolat (LON:HOTC)

Share price:

No. shares:

Market cap:

(work-in-progress - am popping out for an all-day breakfast now - 14:22)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.