Good morning!

Today we have interesting news from:

- Quartix Holdings (LON:QTX) - interim results

- Joules (LON:JOUL) - annual results

- Burford Capital (LON:BUR) - interim results

We have in-line-with-expectations updates from STM (LON:STM), Empresaria (LON:EMR), James Halstead (LON:JHD) and Norcros (LON:NXR) (which I will discuss further below).

Wealth manager Brewin Dolphin Holdings (LON:BRW) issued an update which did not specify performance relative to expectations but looks strong.

Walker Greenbank (LON:WGB)

- Share price: 75.5p (-8.5%)

- No. of shares: 71 million

- Market cap: £54 million

I'm detecting a lot of frustration from shareholders that the company saw fit to release this announcement at 16:27 yesterday afternoon, creating a bit of an intraday mess as far as the share price is concerned.

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, announces the following trading update in respect of the financial year ending 31 January 2019.

Paul has covered this company several times before (see the archives).

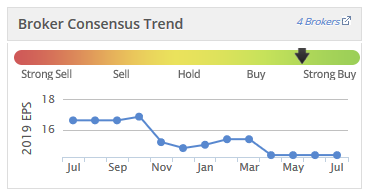

EPS expectations have been trending lower:

Yesterday, we learned the Board had materially revised down expectations for licensing income in the current year, after gaining "new information" on the potential profit from a recently signed licensing agreement.

Separately to this, ongoing trading has deteriorated, with orders below expectations.

Adjusted PBT will therefore be materially short of expectations.

At least we are given a new range to expect: adjusted PBT is likely to be £9.5 million - £10 million. It's very good to include this range in the RNS.

Anyway, the new estimate is not so terrible in comparison to last year's adjusted PBT of £12.5 million (2018), or the previous year's £10.4 million (2017).

And the financial adjustments the company makes don't look overly aggressive to me. Statutory PBT (what I call the "actual" PBT!) was £12.8 million (2018) and £7 million (2017).

So on the face of it, I don't see why the share price is down by another third after this profit warning, having already fallen massively over the past year. I must be missing something?

Checking the most recent results statement, the company is in a net debt position after making an acquisition but still had £12.2 million of headroom as of January 2018. The balance sheet is heavy with intangibles but still has NCAV of £13.9 million (i.e. it still has positive net assets even if you write all intangibles and PPE down to zero).

So it doesn't look like the company is in a doomsday situation to me. It remains profitable (assuming the adjustments haven't spiraled out of control) and I can't see any sign of immediate financial distress.

Being in an overdraft position, you could argue that it is at the mercy of its bank, but while it remains in the black, I don't see why the bank would want to pull the plug on it.

I haven't studied the company in detail before but my initial impressions are that this could be a legitimate value opportunity, despite the net debt position and a small pension deficit.

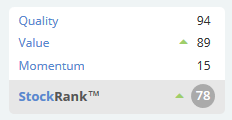

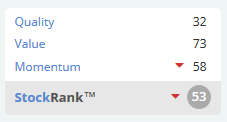

Stocko algorithms also think there is value, and this is before taking the latest share price plunge into account:

Quartix Holdings (LON:QTX)

- Share price: 367p (unch.)

- No. of shares: 48 million

- Market cap: £175 million

This is a telematics group, i.e. in the same space as Trakm8 Holdings (LON:TRAK). I previously used Stocko tools to compare the financial performance of the two companies (link).

Today's results are in line with expectations and broker estimates for the full year are unchanged.

The big-picture view is that growth expectations have gradually cooled down at Quartix, leading to a stabilisation in the share price. The shares haven't gone anywhere in a couple of years:

Selected highlights from today's results:

- revenue +7% to £12.9 million

- operating profit unchanged at £3.8 million, good conversion to cash

- unchanged interim dividend

- fleet recurring revenue up 11%, increasing faster than overall revenue growth

It's all a bit slow for a company on a P/E ratio of 31x, and broker forecasts indicate that results out to 2020 are likely to remain rather flat.

The stock does have some very attractive characteristics, which I've pointed to before. Management have done a great job at keeping things efficient and have turned down unwanted business, with the consequence that operating margins are high (almost 30%) and the company earns above-average returns on capital.

This translates to good free cash flow generation and the ability to pay a decent set of dividends (including a special dividend last year). Another special dividend is possible this year:

The Board will also consider distributing the excess of cash balances over £2m by way of supplementary dividends.

So we have a few reasons why an above-average multiple might be justified.

Ultimately, I suppose you have to take a view on the technology, both in the context of the wider telematics space and specifically in terms of what Quartix brings to the table.

I was speaking recently to someone who works for a company that makes advanced fleet management cameras, collecting footage of incidents in addition to telematics data. While hardly unbiased, he expressed the view that many telematics devices were becoming a little bit old-fashioned and that more advanced, multifunctional fleet management devices would be commonplace soon.

I'm not sure where exactly the truth lies, but I do think it is interesting that revenue growth at both Quartix Holdings (LON:QTX) and Trakm8 Holdings (LON:TRAK) has slowed.

Joules (LON:JOUL)

- Share price: 340p (-2%)

- No. of shares: 87.5 million

- Market cap: £298 million

Annual Results for the 52 weeks ended 27 May 2018

This is a highly-rated and high-performing fashion brand, operating 123 stores in the UK and Ireland and selling internationally.

It doesn't provoke much discussion, but it has done very well for investors since IPO'ing at 160p just two years ago.

I thought that the IPO looked overpriced. The doubling of the share price over the subsequent two years very strongly indicates that I was incorrect!

The company hasn't put a foot wrong, increasing underlying PBT by 28.5% to £13 million in FY 2018 and indicating "strong momentum" in the first few weeks of FY 2019.

Underlying PBT is forecast to reach £14.7 million in FY 2019 (note that the company has a track record of beating forecasts).

Some other positives:

- The founder, after whom the company is named, continues to own 33% of the company.

- The gross margin is firm and is approaching 56%.

- Joules has eliminated its net debt

My view

This is a high-performing brand that is worthy of a more detailed look, particularly for fashion and retail aficionados.

As someone who admires the company's progress, I'm a bit disappointed that the shares have never really been "on sale" (unless you consider the IPO price to have represented good value).

Those who have owned it since IPO will likely take a different view, as they are enjoying rich capital gains!

I think it's particularly impressive that the company has outperformed while so many others in the space have reported difficult conditions. This supports the company's claim to have "a distinctive brand with a strong connection to its customers".

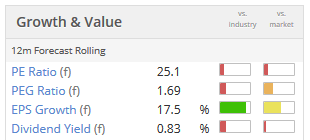

For those who buy into the story, I can understand why they might be willing to pay up at current levels to hold this for the long-term:

Burford Capital (LON:BUR)

- Share price: 1826p (+11%)

- No. of shares: 208 million

- Market cap: £3,802 million

Interim Results for six months ended 30 June 2018

This is a widely-followed litigation finance firm. It owns stakes in large lawsuits and manages funds investing in lawsuits.

I've covered it previously in this report. Here is the link to my commentary on its FY 2017 results.

It's still going gangbusters, reporting "another stellar half-year, setting new records for income and profit".

Operating profit is up 18% to $183.5 million. Net income is up 17% to $166 million.

These numbers are stated after some adjustments, but the adjustments aren't onerous. Statutory operating profit is $178 million, while statutory net income is $161 million.

Burford's extraordinary balance sheet is now officially worth $954 million, so the price to book value ratio edges higher to 5.2x (it was 5x the last time I checked).

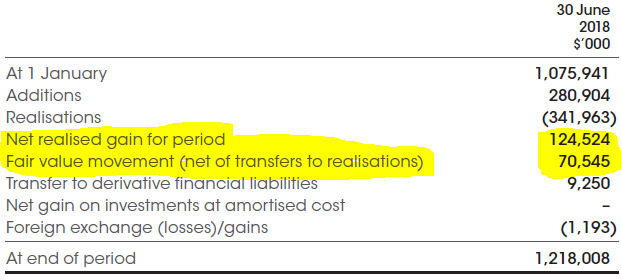

The key balance sheet entry is $1.2 billion of "Investments".

Big and wonderful things happen to this entry every period.

For the latest six months:

I've highlighted the net realised gain for the period and the fair value movement (the unrealised gain, in other words). These are the major contributors to Burford's Investment Income, which is the most important entry on its income statement.

The return Burford generates on its investments remains spectacular. We see a near-$200 million return in six months from a portfolio which stood at $1.075 billion at December 2017.

The commentary is always extremely crisp and clear, which is handy given that the underlying subject matter could be considered inscrutable.

One of the interesting snippets from today's report is that it hopes to disrupt the "oligopolistic" Australian market, which it considers "particularly litigious". Sounds promising!

Capital - given the success and growth of the business, it is likely to add more capital over the next twelve months. No hints yet as to whether this will be debt, equity or something else.

My view - it's still fascinating, it's still hugely impressive. The numbers back up the firm's claim to have a unique competitive position and to be the innovative first-mover in the new world of litigation finance.

I haven't found the courage to have a nibble at the shares yet (to my cost). But I don't mind watching from the sidelines.

Norcros (LON:NXR)

- Share price: 217p (+1%)

- No. of shares: 80 million

- Market cap: £174 million

This is the bathroom and kitchen products group operating in the UK and South Africa.

Q1 trading has been in line with expectations.

Like-for-like revenue growth is 0.9%, or 6.9% excluding Johnson Tiles.

CEO comment:

Whilst the UK retail sector continues to be challenging, strong performances at Triton and Merlyn, the benefits of the cost restructuring at Johnson Tiles and the sustained progress in South Africa gives the Board confidence that the Group will continue to make progress in line with its expectations for the current year."

My view: performance is in line with expectations, and the share price hasn't made any gains since last time I looked at it, so there is no change to the view I expressed last time (i.e. that the Norcros share price is probably too low).

APC Technology (LON:APC)

- Share price: 7.125p (+7.5%)

- No. of shares: 135 million

- Market cap: £10 million

I've only briefly looked at this company before. There is some reader interest in the stock, so I thought I'd quickly mention it.

APC describes itself as:

the provider of design-in, specification and distribution services for specialist electronic components and systems, lighting technologies and connectivity products

Its products and services are used in everything from aerospace to logistics and commercial real estate.

Today it announces the issuance of £3 million of new shares. Shares and cash totaling £2.2 million will then form the payment for Aspen Electronics, a distributor of electronic components. "Top line synergy opportunities" are sought, i.e. increased aggregate revenues.

The deal values Aspen at 4x historic EBITDA. That could turn out to be cheap, I reckon.

That's all for today. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.