Good morning everyone,

It feels a little less manic today in terms of news flow.

The following have caught my attention so far:

- Boohoo (LON:BOO)

- Minds Machines (LON:MMX)

- Crawshaw (LON:CRAW)

- Hornby (LON:HRN)

- Accrol Group (LON:ACRL)

- FairFX (LON:FFX)

Boohoo (LON:BOO)

- Share price: 208.6p (+9%)

- No. of shares: 1150 million

- Market cap: £2,398 million

A long-standing favourite of readers here, I don't think anybody will mind that we cover this big-cap (for the same reasons we covered Next (LON:NXT) yesterday).

Besides today's news, the company last week announced the appointment of a new CEO. He is currently the COO at Primark (owned by Associated British Foods (LON:ABF) ).

This means that the two co-founders of the business (currently the co-Chief Executives) are stepping back a little.

One of them will become Executive Chairman (working on "long-term strategic direction") while the other will become "Group Co-Founder and Executive Director" (working on brand positioning and product development).

This can be interpreted as a strengthening of the management team, as the two co-CEOs are remaining with the business and are being joined by another very senior executive.

It could also be seen as carrying some risks, as there will be no independent director who is more senior than the new Executive Chairman (who is, with his family, the largest shareholder in Boohoo and its subsidiary prettylittlething).

What I like best is a clear separation of powers between a CEO and Chairman, with the CEO being in charge of running the show while the Chairman sits back and provides oversight on behalf of shareholders. When you have an Executive Chairman and a CEO, you run the risk of having a frustrated CEO who doesn't feel like he can truly impose his vision on the company.

Based on the new roles being taken up by the co-Founders, it sounds to me as though John Lyttle will be limited when it comes to putting his own unique stamp on the company, at least at the beginning of his tenure.

The company is incentivising him with a "Growth Share Plan", such that he will make a £50 million pre-tax bonus if the boohoo share price increases by 23% p.a. during the five-year period from when he takes up the role.

This type of bonus scheme appears far from ideal to me. At least the time horizon is pretty long at five years!

Finally, on a point of strategy: while the incoming CEO is undoubtedly a very strong executive, does it really make all that much sense to hire someone from Primark to manage the growth of a pure-play online business? I would have thought that hiring from ASOS, Amazon or even Google would make more sense.

On the whole therefore, I have to feel that the CEO announcement contains more to worry about than to be pleased about.

The results - I haven't even looked at any of today's numbers yet! But I do think that management is such a key factor, it's definitely worth focusing on when there is a change.

As usual, I read these interim results side-by-side with last year's interim results, so that I can see how the growth rates are evolving.

- Group revenue +50%. Last year, revenues grew by 106% (boosted by acquisitions).

- Boohoo revenue +15%. Last year, boohoo revenue was +43%.

- PLT revenue +132%. Last year, PLT revenue was +289%.

- Nasty Gal revenue +111% but is immaterial at £18 million.

Margins have improved in the two major segments.

The company maintains a super-strong balance sheet with £155.6 million of net cash.

The share price is up today on a revenue upgrade:

Group revenue growth for the year to 28 February 2019 is expected to be 38% to 43%, up from our previous guidance of 35% to 40%, with adjusted EBITDA margin between 9% and 10%. We reiterate our medium term guidance to deliver sales growth of at least 25% per annum and EBITDA margin of 10%.

Scrolling through the KPIs, I don't see anything that stands out compared to what we would expect from the revenue trends.

Outlook - very positive. It's looking to build a distribution network capable of £3 billion in sales (for context, Next(LON:NXT), which I own shares in, generated £4 billion of sales last year).

My view - it's an amazing company, and an important company in the retail landscape.

I'm simply not willing to pay up for it, though I acknowledge its attractions.

Growth is very obviously slowing down as it grows, and I think that the valuation could possibly shrink back to a more "normal" rating when PLT revenue growth drops to normal (in the same way that boohoo's revenue growth has already dropped back).

And while online retailing is an efficient business, and boohoo has executed it extremely well, I don't think that it is the only company capable of generating good returns from it.

So I don't feel compelled to pay up for these shares, though I agree it is probably going to continue to do well.

One other governance factor I'd like to mention in closing, aside from the CEO appointment, is the large minority interest (held by one of the co-Founders) in prettylittlething.

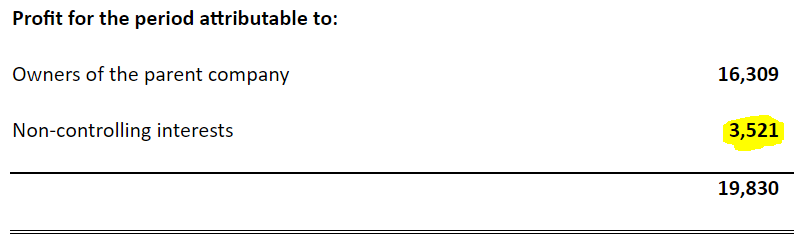

The success of PLT is not going to be fully enjoyed by BOO shareholders, and we can already see the impact of this minority shareholding in today's announcement:

It might not seem like a huge number at £3.5 million, but it represents 18% of group profit that is going to minority interests rather than BOO shareholders, mostly because BOO didn't acquire all of PLT. That would leave a sour taste in my mouth, if I was a BOO shareholder!

Minds Machines (LON:MMX)

- Share price: 6.65p (-10%)

- No. of shares: 797 million

- Market cap: £53 million

Minds + Machines Group Limited (AIM:MMX), one of the world's leading owners and operators of Internet Top-Level Domains ("TLDs"), today announces the Group's unaudited interim results for the six month period ended 30 June 2018 (the "period").

This is a small-cap I'm quite curious about. I've been tracking its progress in this report for a short while.

The idea is that it collects regular fees from website owners, via registrars, to maintain control of domains which have alternative endings such as .fashion, .garden, etc.

These alternative endings are still rather immature and only used by a small minority of websites. I do think they have a bright future.

Looking far ahead, it should eventually be affordable to have your own custom website ending (these days it costs $185,000!)

Anyway, let's check out these results:

- registrations within core portfolio up 38%

- revenues +22%, about a quarter of the growth coming from an acquisition

Revenues are based on a mix of initial domain set-up fees and then renewals. It's the renewals which have the potential to generate a really attractive revenue stream, but that critically depends on how many websites using alternative TLDs succeed. When a website fails, the owner can simply relinquish control and stop paying the fees.

The overall financial picture in H1 is an ugly one, I'm afraid. There is a loss of $15 million thanks to a very unfavourable contract agreed by MMX's previous management team.

Outlook - management are "cautiously optimistic about the full year operating EBITDA and the wider opportunities ahead. However, a slow-down in high value one-off sales is likely to impact top-line revenues."

My view - I still think this is potentially interesting. Top-level domains are valuable pieces of internet real estate and are impossible to steal or to replicate. So I do think MMX could mature into something which generates very nice cash flows.

Up until now, though, its financial performance has been disappointing, and it's likely going to remain poor in the short-term. Let's keep it under observation for now.

Crawshaw (LON:CRAW)

- Share price: 3.65p (+12%)

- No. of shares: 113 million

- Market cap: £4 million

A bleak picture at this chain of butchers. We have an H1 underlying operating loss of £1.7 million and the core business model is dead in the water.

Only the "Factory Shops" offer any hope. 12 of these are open so far and a further 23 are planned by the end of FY 2021.

It's also experimenting with franchising and online sales.

A new team of executives are implementing the new strategies.

Outlook - trading in H2 is in line with expectations. FY 2019 sales expected to be flat vs. FY 2018 with an underlying operating loss of £3 million.

My view - the balance sheet hasn't yet been ruined by losses, so it has a little bit of wiggle room. Cash ended the period at £3.3 million. But we should probably assume that this will be at c. £2 million or less by year-end. That won't leave much wiggle room as it presumably tries to shut down its High Street stores.

Not quite healthy enough for me to want to speculate in.

Hornby (LON:HRN)

- Share price: 35p (-2.5%)

- No. of shares: 125 million

- Market cap: £44 million

An update from this maker of model railways:

- Sales lower than expected due to the company abandoning its use of discounting and a buildup of stock in the supply chain (due to the previous use of discounting)

- Margins up thanks to this change in pricing. Costs controlled, so the operating loss is reduced.

- Net cash position.

Outlook is in line with expectations, subject to the key Christmas trading period.

My view - I want to research this more as a turnaround story at a famous old brand. Phoenix Asset Management are good investors and they own 75% of it, so I'd assume that a reasonable strategy will be pursued.

On the other hand, the company hasn't made a profit since 2012, and there is an awful lot of repair work to be done, based on my skimming of the results for FY 2018. Unlikely to be a conviction buy at this stage, then.

Accrol Group (LON:ACRL)

- Share price: 18.5p (-5%)

- No. of shares: 195 million

- Market cap: £36 million

Unaudited Final Results 2018 and Banking Update

This is the loo roll and kitchen roll cutter that turned out to be rather unfortunate for investors. It's already on its second CEO/CFO since listing.

Headcount has been reduced by 43% and fresh funds have been raised from investors after a series of calamities which included input prices rising and FX going the wrong way.

Some progress in the recovery plan is announced today. It may indeed be on a more stable footing now, from an operational point of view.

However, the shares are uninvestible to me for two reasons:

1) Lack of pricing power. It turns out that the ability cut paper into loo roll and kitchen roll offered little protection against commodity prices and FX rates. Even if profitability is restored following re-negotiations, how can investors have faith that profitability can be sustained, given this vulnerability?

2) The balance sheet. Even after raising fresh funds, net debt was £25 million at the end of August. That would be ok if profitability was at the previous high levels, but it offers little headroom now.

The directors draw attention to the material uncertainty as to whether the company can continue as a going concern, if it fails to achieve targets and breaks its revised banking covenants.

For these reasons, I don't find these shares remotely appealing.

My comments last year, when the share price was 149.5p and everything was rosy, make for interesting reading now.

FairFX (LON:FFX)

- Share price: 144.5p (+5%)

- No. of shares: 155.4 million

- Market cap: £225 million

This international payments group is targeting both the everyday consumer and SMEs/corporates. We discussed it in July at its half-year trading statement, which included some of today's numbers.

The historic numbers aren't too important. It's growing quickly and leveraging up its turnover against a cost base whose growth will hopefully be constrained.

There's been a strong start to H2 in July and August, turnover up 23% on a like-for-like basis. International payments and the corporate expense platform are both up 41% (like-for-like).

Outlook - in line with expectations.

Nice CEO comment:

Top line turnover growth has continued, and with the Group operationally geared revenue is increasingly flowing through to profit. This trend is expected to continue in the second half of the year as we grow further and rationalise the supply chain.

H1 sees an adjusted PBT of £2.6 million.

There are a lot of adjustments to get that number, but fortunately they don't add up to much. Actual PBT was £2.1 million.

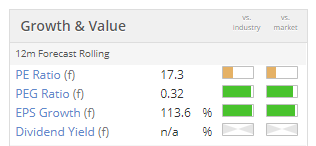

Forecasts suggest that we are going to get a great deal of profit growth over the next two years. So the P/E multiple is not unreasonable:

My view - my impression of this share hasn't changed, and is in line with the view expressed by Stocko's algorithms. It looks like an attractive combination of quality and growth momentum. Good luck to all holders!

All done for today, cheers everybody.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.