Good morning! There are lots of comment-worthy news stories today.

To get us started, we have an updated comment from Paul Scott on Victoria (LON:VCP).

I'd also like to mention:

- Crawshaw (LON:CRAW) - intention to appoint administrators

- Fastjet (LON:FJET) - funding update

- Next (LON:NXT) - trading update

- Computacenter (LON:CCC) - Q3 2018 trading update

This section written by Paul Scott.

Victoria (LON:VCP)

- Share price: 375p (-4%)

- No. of shares: 125 million

- Market cap: £470 million

Victoria (LON:VCP) has issued an update regarding its possible bond issue, here;

Credit rating and response to speculation

This carpet maker has given more details about its proposed bond issue, to replace the exiting bank borrowings. Summarising it, with my comments:

Credit rating - Fitch has given the rating BB(stable) for the intended bond issue. Using a table shown on Wikipedia, this doesn't look very good - it's in the bracket described as non-investment grade, and speculative. "Higher degree of default risk, speculative" are the description provided by Google for BB credit rating bonds. So not something to brag about, I would suggest. The interest rate would therefore tend to be higher than better quality bonds.

"Misleading rumour & speculation" - what does the company expect, if it drops a bombshell on the market, with no explanation? At the same time as issuing a profit warning, which is what happened here.

Banking relationships (with HSBC and Barclays) - Victoria says;

Firstly, the Company continues to have a close and positive relationship with its lending banks, HSBC and Barclays, and continues to operate with significant headroom with respect to its covenants under the existing 2-year facilities put in place in August 2018.

Our lending banks are acting as joint global coordinators and bookrunners on the potential Bond issue and have been working with us on the project since April of this year.

That's reassuring on the banking covenants.

What I don't understand is this. If the banks are happy with their existing lending to Victoria, then why have they been working with the company to get their lending repaid through a bond issue? That just doesn't make sense to me!

More detail is given about why the company thinks a bond issue makes sense for Victoria;

Long term (5 year) funding of a bond - but this could also be done via a term loan from the banks. Maybe the banks don't have the appetite for long term lending to Victoria?

Fixed rate funding - again, this could also be achieved through conventional bank borrowings, adding an interest rate swap or cap if needed.

Flexibility - but not specified why a bond is seen as more flexible than bank borrowings. I would have thought the opposite is the case. Bank borrowings can be easily amended, whereas bonds are usually set in stone.

Depth of the bond market - suggests perhaps that the banks are at or near the limit that they want, in terms of exposure to Victoria.

Discretionary nature of this bond exercise;

The potential Bond issue is an entirely discretionary exercise, and a final decision will be made at the Company's discretion in the coming days on whether to move ahead or retain the existing facilities;

The potential Bond issue is an entirely discretionary exercise, and a final decision will be made at the Company's discretion in the coming days on whether to move ahead or retain the existing facilities.

Paul's opinion - the proof of the pudding is in the eating. So let's see what terms (if any) are agreed for the bond issue. I cannot see the logic for replacing cheap bank borrowings with a (probably more expensive) junk bond. Whatever the company says, this suggests that the banks may not want continued exposure to Victoria. Why else would they be co-operating with the company to get all their debt repaid? I could understand if the banks wanted to lower their exposure, but it's perplexing as to why they are happy to see it all repaid.

The share price has fallen because of the profit warning a few days ago, and the bombshell announcement (with no explanation or detail) as to the bank borrowings being repaid through a bond issue.

Maybe the share price would go up again, once the refinancing has happened? That would depend on the terms of the refinancing. If the bonds are expensive, then that would reduce profits available to pay out in dividends.

I shall monitor things closely, but personally I remain of the view that this share looks too risky to hold unless/until the refinancing has completed.

Graham's view

I would take a slightly more positive stance toward this announcement than Paul does.

Credit rating: Firstly, I think it's a fine achievement to get a BB rating from Fitch. That's only one notch below investment grade.

Readers will be aware that I have invested heavily in US junk bonds in my personal portfolio. To put it bluntly, there is no shame in having a junk rating.

Companies whose junk bonds I own through a fund include Fiat Chrysler (automobiles), CenturyLink (telecoms), MGM Resorts (hotels and casinos), Symantec (software), Royal Bank of Scotland, Dell, Hertz, Avis, etc. They are all geared to varying extents but they are still decent businesses and most of them should have little difficulty in repaying their debts.

Based on my limited knowledge of Victoria, I would find it strange if it had secured an investment-grade credit rating. BB is, in my view, an impressive rating for it to have achieved.

Tesla's credit rating, for example, is only B.

You can of course make the argument that credit rating agencies aren't particularly good at their jobs, and frequently get it wrong. I have sympathy with that point of view, but statistically there is good evidence that credit ratings do help to predict default probabilities.

So overall I would view it as a very positive piece of news that a BB rating has been achieved from Fitch. They will have done their own due diligence on the company, and that's got to be worth something. It will be interesting to see what Standard & Poors thinks.

Flexibility/Duration/Depth of Bond Market: Again, I agree with the company's overall perspective on this. The bond market is enormous (greater depth) and is more suitable for a long-term funding solution than bank loans.

While it's true that you can have bank loans which are structured to be fixed-rate, long-term, and covenant-lite, these are features which are more commonly found with bonds.

Bond investors tend to put large amounts of capital into a company and then take a patient, hands-off approach for many years, whereas bankers usually want to engage in detailed monitoring of a company's short-term performance.

So if you're running a large, growing business and you have the choice, I'd say that you'd nearly always prefer to issue a bond rather than take out a bank loan. Then you can get on with running the business, without worrying about meeting your banker every couple of months. Bonds are just a more attractive way to borrow.

Interest Rate: This is a fair point from VCP bears. The interest rate of the bank loan is apparently c. 2.9%. Using very crude methods, I can estimate that a BB bond issue from Victoria would cost 4%. But there's no real way of knowing what the cost might be at this stage.

The angle from the company is that it would rather have the certainty of a fixed rate rather than a variable rate bank loan. That's sensible. So long as the fixed rate isn't so much higher that it's unaffordable.

Summary: I would still have no interest in buying VCP shares, since I try to avoid highly acquisitive companies. But I agree that it should consider issuing €450 million in bonds, rather than continuing to use bank loans for borrowings of this size.

Crawshaw (LON:CRAW)

- Share price: 2p (suspended)

- No. of shares: 113 million

- Market cap: £2 million

Intention to appoint administrators

This chain of butchers bites the dust.

Five days ago, Paul said he would be surprised if it succeeded in raising additional funding. Indeed, it has failed.

I wonder if there might be a little bit of equity value here? I accept that it's not very likely. But I noticed that cash was at £3.3 million in July, with a cash burn of £1.4 million over the previous six months. Maybe there is still some cash left?

Today, the company says:

"...in order to protect both shareholders and creditors, the Board has taken the decision to place the Company into administration and intends to appoint administrators shortly with the purpose of seeking buyers for the Group's business and assets on a going concern basis."

The administration isn't just for the protection of creditors - it's for the protection of shareholders, too. It's a hint that there could be a little bit of equity value left to preserve. Could more than one bidder emerge for what's left of the business?

Probably not. Commiserations to anyone still holding this one.

Fastjet (LON:FJET)

- Share price: 1.8p (-23%)

- No. of shares: 621 million

- Market cap: £11 million

I'm amazed that this African airline is still here. It should have died a long time ago.

Today's funding update has something new. Usually, the company is simply running out of money.

Today, we learn that it is also negotiating with its creditors "to reduce the outstanding balances due to be paid and reduce the burden of interest and capital repayments".

I imagine that such a conversation would go like this:

FJET: We can't pay you back, can you forget about the money we owe you please?

Creditor: No.

As of 24 October, the company had $0.7 million of cash that wasn't restricted. That's not enough with which to run an airline. If it can't raise fresh equity AND/OR reach agreement with its creditors in the coming days, it will be game over.

My view: the most shocking thing about Fastjet is how it was backed again and again with customer money by supposedly respectable fund managers. I'd rather not name them here but the shareholder register is public information, so feel free to look them up.

Next (LON:NXT)

- Share price: £51.72 (-2.5%)

- No. of shares: 140 million

- Market cap: £7,162 million

(Please note that I currently hold NXT shares.)

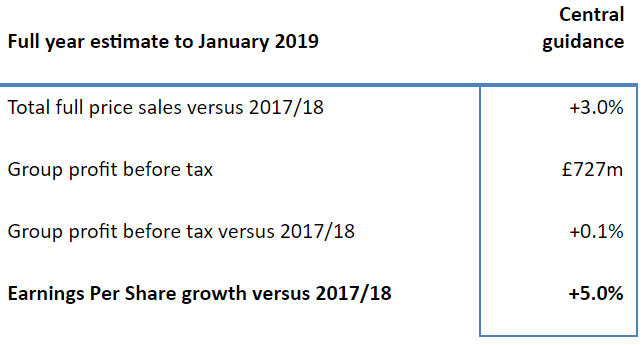

There is no change to Next's full-year sales and profit guidance:

Note the very slight expected increase in PBT for the year of just 0.1%. Essentially flat.

In Q3, online full-price sales continued to make great progress (+12.7%) at the expense of retail sales (-8%).

The overall Q3 full-price sales growth (+1.3%) was slow compared to the entire year-to-date performance (+3.1%).

This is another position where I could think about topping up, if the share price remains weak while business performance is stable.

My main concern is that I don't want my portfolio to be too heavy in retail. So I am most likely to do nothing for the time being.

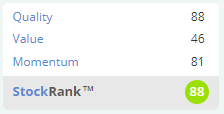

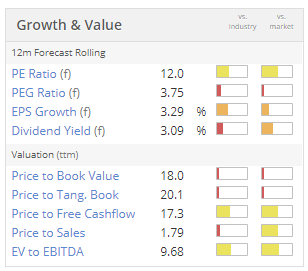

Stocko algorithms continue to love it:

I'm surprised the Value Rank isn't a little higher, given the P/E rating of just 12x. It looks to me as if one of the reasons it's being penalised is that its industry peers are quantitatively much cheaper.

But I think it's industry peers should be cheaper, because Next is better.

In an industry where uncompetitive businesses are prone to becoming worthless, I am happy to pay that little bit more for a company which is definitely much better-quality than most of its peers.

Computacenter (LON:CCC)

- Share price: 1100p (-12.4%)

- No. of shares: 114 million

- Market cap: £1,255 million

Covering this provider of IT infrastructure services in response to reader requests, much as I did in January.

I'm not an expert on this company but overall I've had a positive impression of it. It has also enjoyed a high StockRank (92 as of yesterday).

Key elements of today's Q3 update:

- revenue down 3%, blamed on tough comparisons. Q3 2017 had shown abnormally high growth against 2016.

- UK revenue down 9% with particular weakness in Technology Sourcing. Technology Sourcing is essentially a software distribution business.

- Germany +1%, France -6%, International +13%.

Outlook - improved growth in Q4, "but not to the levels seen in the first half of the year".

The anticipated trading result for the year as a whole is in line with expectations, but the share price reaction says to me that investors are doubtful that Q4 will produce the required growth.

There are also a few question marks over the drivers of the business:

As we look out further into the future our pipeline for Professional Services is building nicely while the Infrastructure Managed Services market place is somewhat more challenged which is making growth more difficult. However, we remain confident in our ability to gain Infrastructure Managed Services market share due to our focus on innovation and productivity improvements.

My view - I don't see any reason to change my overall positive view of the company, even with the loss of revenue momentum this quarter.

It's not something I personally would invest in, because it looks to me like a combination of IT managed services and technology distribution, and these don't seem like very attractive sectors. But within these sectors, Computacenter might be the best of the bunch. It has an excellent long-term track record of profitability.

That's it for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.