ADX/DMS

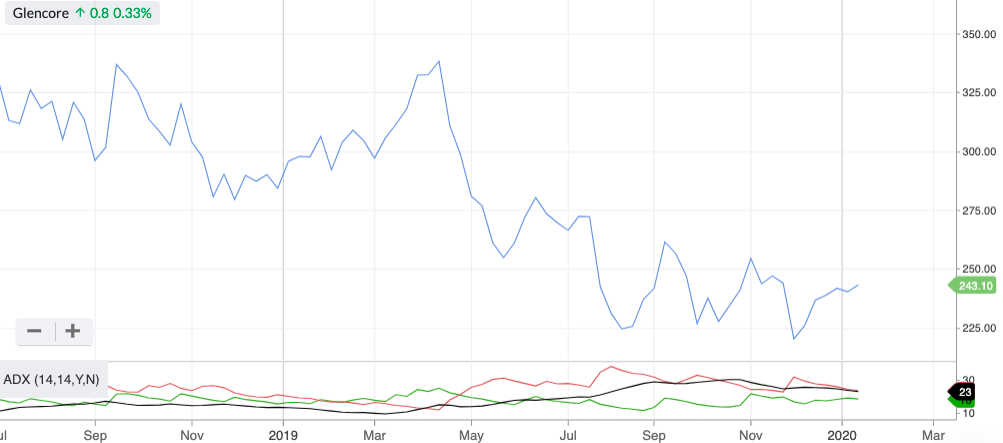

ADX/DMS is an indicator that uses three inputs to analyse the strength and direction of a price trend. It was originally devised by Welles Wilder.

The three inputs are the Average Directional Index (ADX), the Minus Directional Indicator (-DI) and the Plus Directional Indicator (+DI). The first of these measures the strength of a trend, regardless of direction. The second two measure the direction of the trend.

By default the ADX is calculated by taking the 14-day moving averages of the +DI and -DI values. ADX/DMS period length and line colours can be adjusted in the settings modal.