Parabolic SAR

The Parabolic SAR (stop and return) is a trading system devised by Welles Wilder that looks for changes in price trends.

When you apply this overlay to a chart, the first SAR point appears at the end of the previous price trend. From thereon, in an uptrend, new points are plotted as the price makes new highs. In the case of an uptrend, the Parabolic SAR line appears underneath the price line. But in a downtrend, the SAR line is above price line.

The maths behind the calculation for plotting the SAR line uses something called an Acceleration Factor.

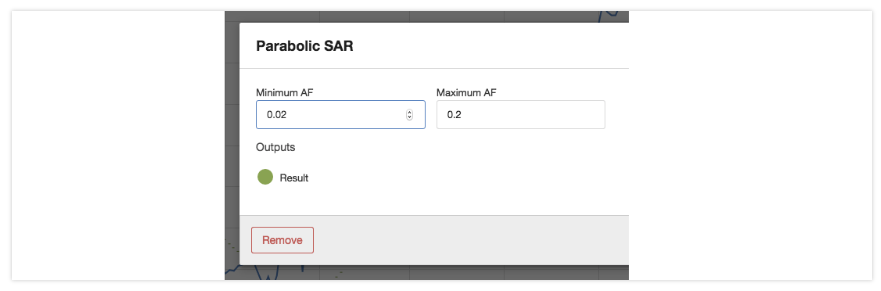

By default, the minimum Acceleration Factor is set at 0.02, which rises to a maximum of 0.2. Each time the price reaches a new high or low, the Acceleration Factor is increased by 0.02. That continues up to the maximum of 0.2, regardless of whether the trend carries on.

These settings can be adjusted in the Parabolic SAR settings modal.