Calculating folio valuations

Portfolio holdings are valued by default at the last traded price, though you can edit this within your portfolio settings to calculate valuation at the bid price if preferred.

While the bid price is a better reflection of the realisable value of the portfolio, there are two issues that can cause confusion intraday. Firstly, there has been volatility during auction period at the end of the day which has made valuations occasionally erratic. Secondly, the change on day is improved when not compared versus bid price. Last price will give a more consistent valuation within portfolios.

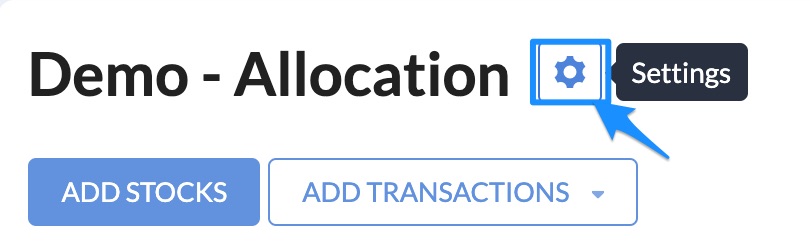

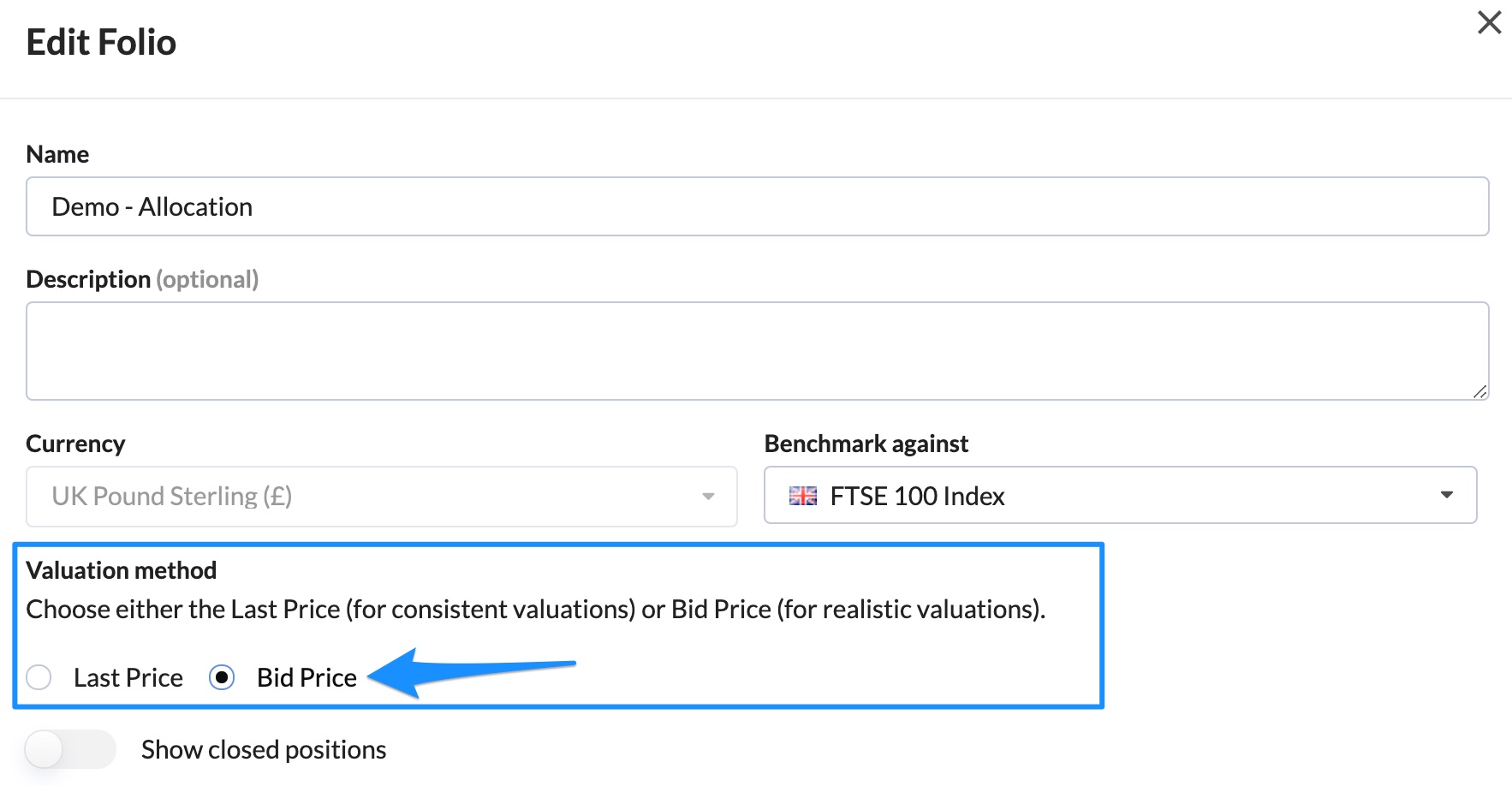

You can change your portfolio valuation to be based on Bid Price by going to Portfolio Settings and then choosing the 'Bid Price' option, as shown below:

Updating the table

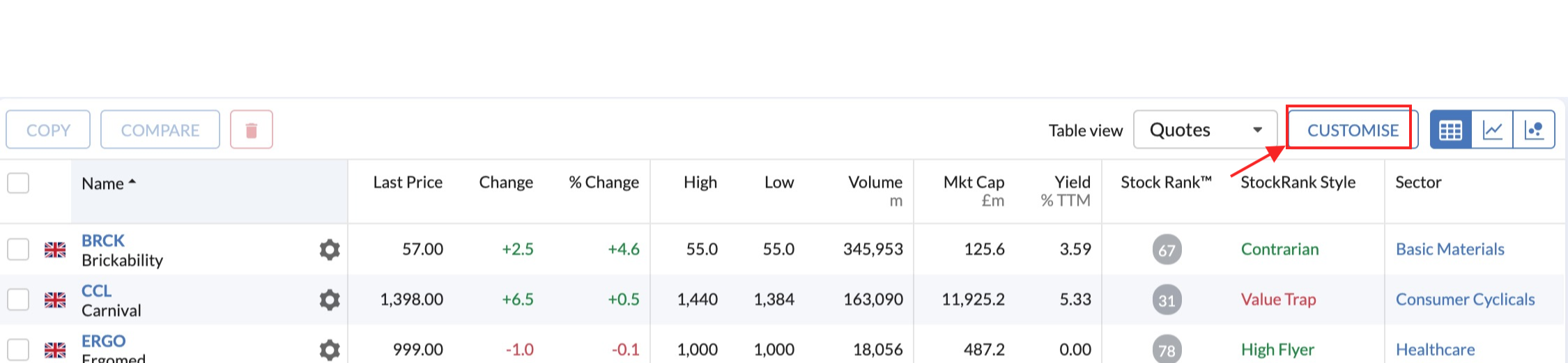

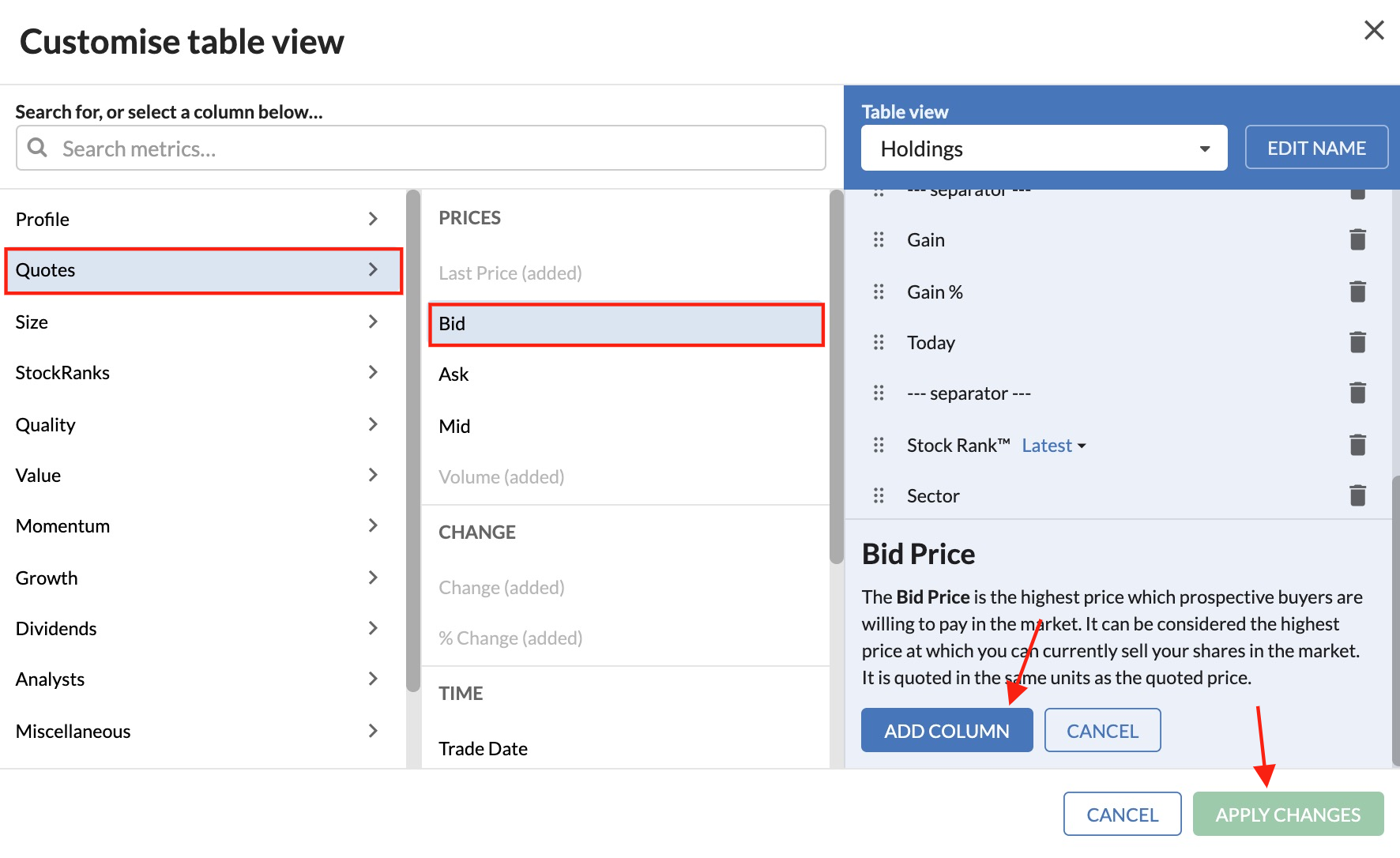

'Last Price' is added to your portfolio holdings view by default, but you can add the Bid Price as well by clicking 'Customise' at the top of the portfolio table:

In the pop up table that appears simply choose 'Quotes' and 'Bid' from the list of options.

Handling alternative currencies

As part of your portfolio setup, you will chose a base currency for your portfolio. Valuation, Total Returns and Breakdown will then be displayed in the base currency you selected.

You can however enter individual transactions in stocks trading in alternative currencies to your portfolio currency. Upon entering these transactions, the 'Holdings' table will show the quote price in the currency in which the security trades and calculate gains and losses incorporating the change in exchange rate.

The total valuation sums the last price of every symbol multiplied by the number of shares held in the position including the current value of Cash, converted into the selected portfolio currency at current exchange rates.

Calculating Cost Basis and Realised Gains

Imagine a portfolio has multiple purchase prices for the same security, when it comes to sell a choice must be made against which purchase price to match with.

e.g. Imagine you have bought

- 100 shares at 100p

- 100 shares at 150p

- 100 shares at 200p

And you sell 100 shares at 300p.

Your profit is the difference between the price you paid for the shares and the price received. In the UK for Capital Gains tax purposes, the law changed and all matching is done on a Section 104 'pooled' cost basis which averages the purchase price of all shares. In this case the price for matching would be 150p and the profit would be 100 * (£3-£1.5) = £150.

In Folios all gains and losses are calculated using the "average cost" method as described above. If you have any further queries about your gains and losses, please contact the support team.