How we display faulty transactions

Our portfolio systems make a number of assumptions. Every transaction must be linked to a specific security, and the cashflow value of a buy, sell, or dividend transaction must not be zero. Unfortunately, portfolios that violate these assumptions may behave unpredictably. To help users get the most out of our tools, we highlight invalid transactions for review.

How do we define a faulty transaction?

A faulty transaction is a buy, sell or dividend transaction where at least one of the following criteria is met:

- The transaction is not associated with a specific stock or security;

- The total cashflow value of the transaction is zero.

How do we highlight faulty transactions?

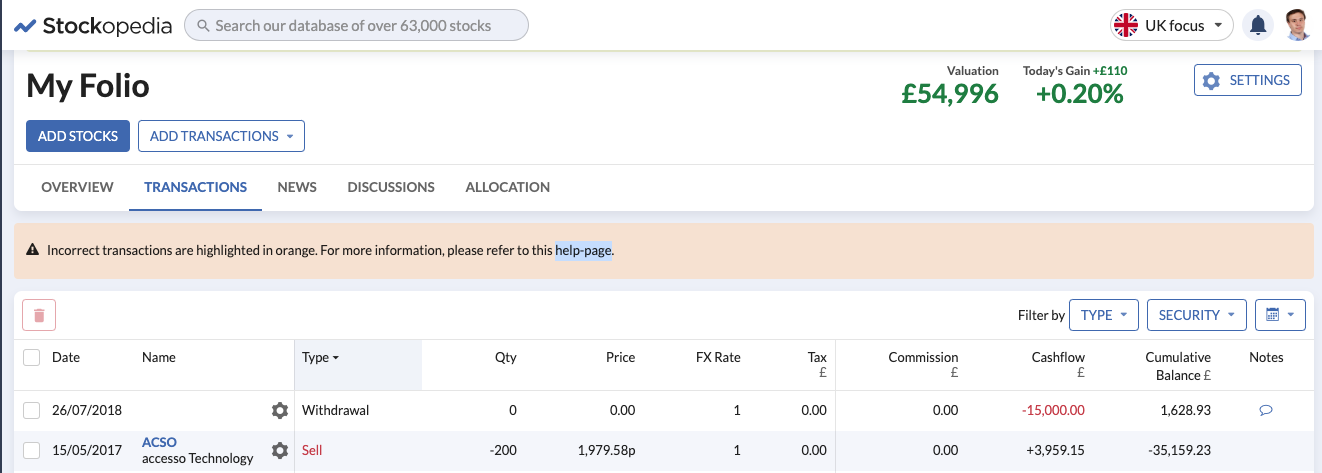

Portfolios with invalid transactions will display a banner.

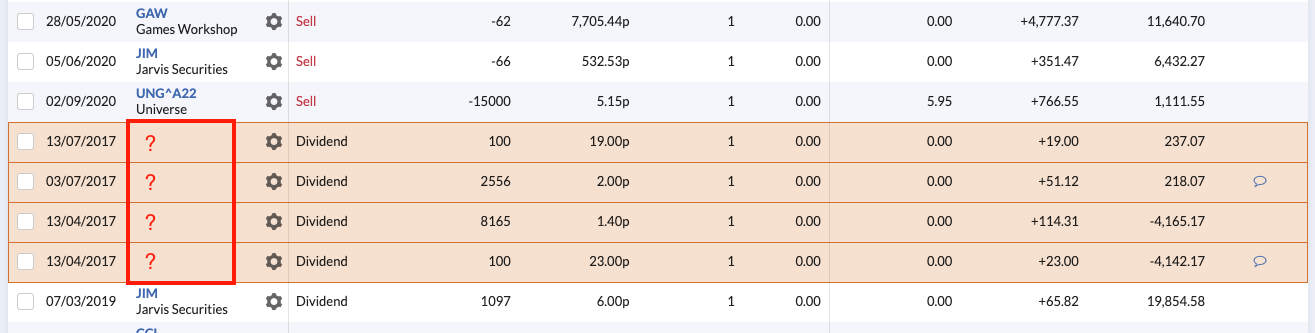

Case 1: No associated security

If a security is missing, there will be a blank space in the Name column.

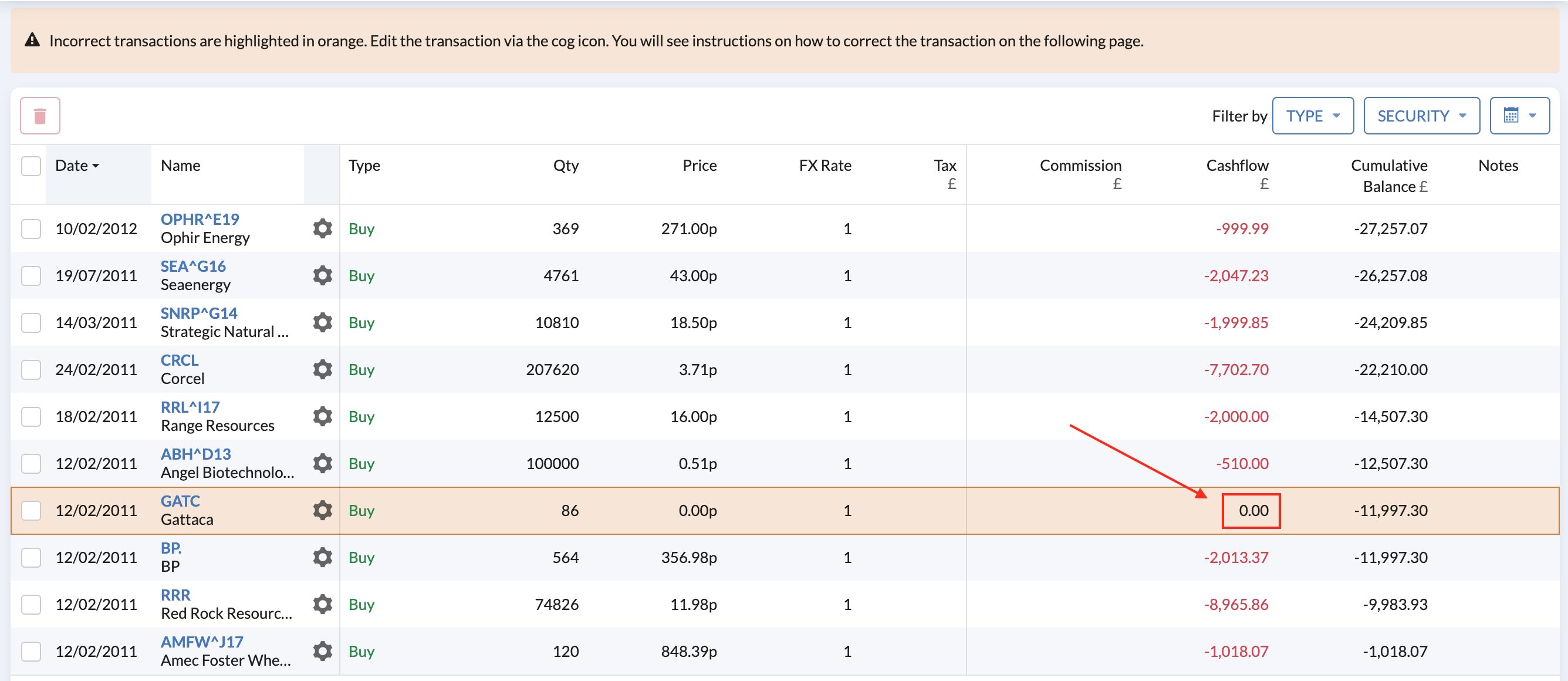

Case 2: Total cashflow value is zero

If the total cashflow value is recorded as zero, you will see 0.00 in the Cashflow column.

How can I correct my transactions?

Solution 1: Ensure trades are linked to a security

Unfortunately, it is not possible to edit the security via the website. You will need to create a new transaction, following these steps:

- Note down the transaction details. These are: Transaction date; Number of shares; Dividend per share; Commission; and Tax.

- Delete the transaction, as per this help-page;

- Add the exact same transaction, including the security, as per this help-page.

Solution 2: Ensure cashflow is not zero

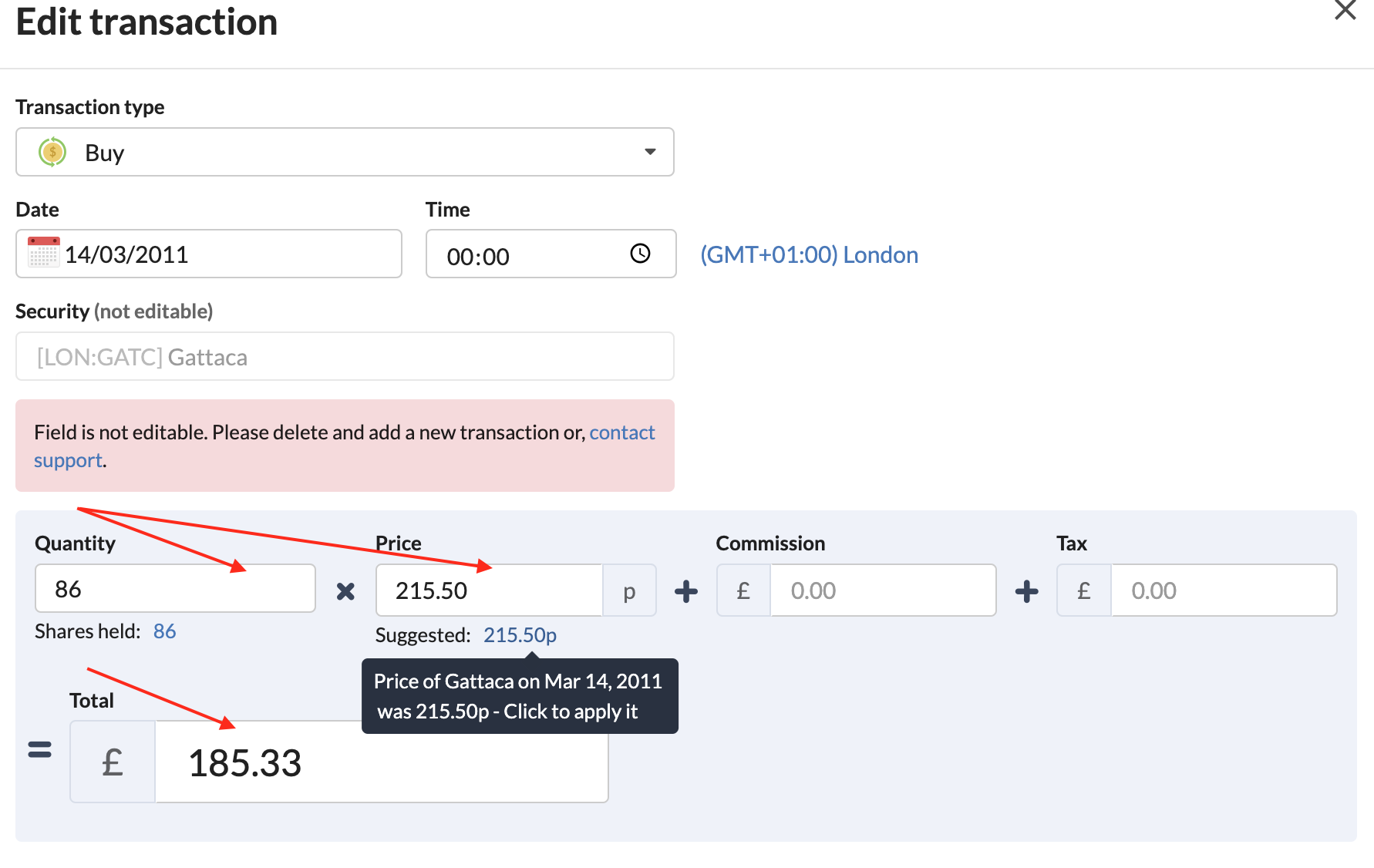

You can edit the cashflow by following these steps.

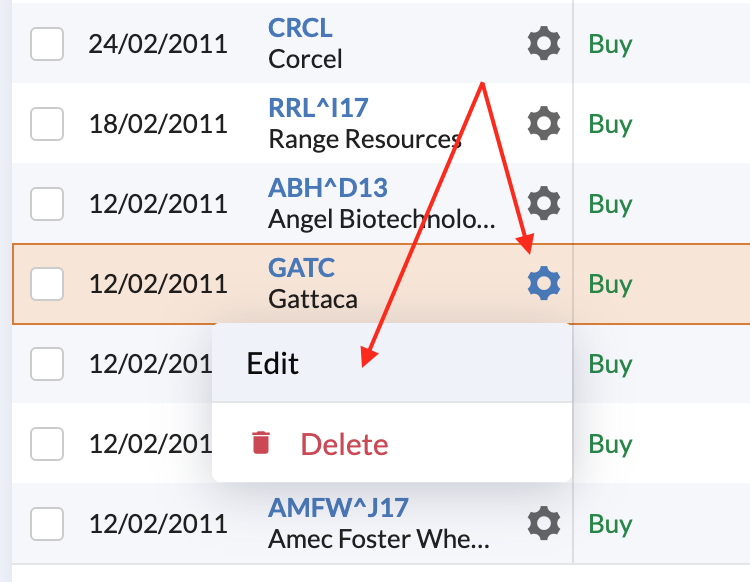

- Click on the cog icon and then click Edit.

- Ensure that the Quantity and Price fields are both populated.

- We suggest a price based on historical data;

- We suggest a number of share based on the prior transactions history;

- The Total should be computed automatically.

- Click ‘Update’.