Ranking data - percentiles and ordinals

In this article we explain how Stockopedia Ranks companies based on different financial ratios like the P/E, Yield and Earnings Growth. These rankings generate the unique TrafficLights on the Stock Reports. This is not to be confused with Stockopedia's proprietary StockRanks which are explained in this article.

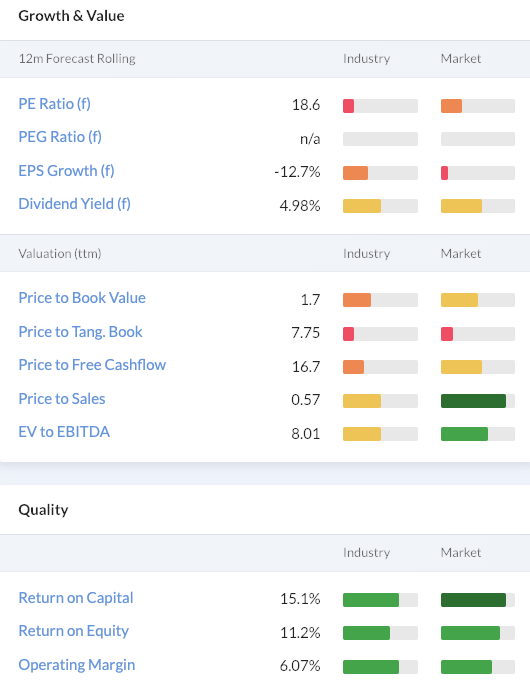

All Ratios can be ranked on Stockopedia so that it is quick to have a sense of where a company stacks up against its peer group or the market as a whole.

All ranks have both a position ranking and a percentile ranking. For consistency, we have standardised the direction of all ranks such that both the position of 1st, and the percentile of 100% signifies the top ranked company for that ratio in that ranking set. Some examples illustrate this point best:

- The highest growth company in the market (e.g. by forward EPS Growth) will rank position 1st in its set, and percentile score 100%.

- The cheapest company in the market (i.e. the lowest P/E ratio) will rank 1st in its set, and percentile score 100%.

- The most expensive company by P/B will rank last in its set and score 0%.

These ranks are used to generate the colour quintiles for our TrafficLights on each StockReport, which are discussed in more detail here. The 'Popover' tooltips when hovering over TrafficLights will show the position ranking, while the width of the TrafficLight is based on the percentile ranking.

In the screener, to screen for top ranked companies by percentile ranking simply use a Ranking criterion with the greater than operator '>' and an appropriate cutoff '80' e.g. Rank P/E > 80

What is the ranking set?

All stocks are ranked against a 'set' - which is either/or both the Market as a whole or their Industry or Sector Group within that Market. The Market set is dependent on what edition of Stockopedia you are using - for the UK Edition the 'market' includes all listed stocks (both primary and dual listed) on the London Stock Exchange, but for e.g. European subscribers it will include all the European component markets.

The Sector/Industry ranks are based on the company's peer group according to Refinitiv's TRBC classification schema. The sector will only include companies within the market area defined by the Stockopedia Edition (e.g. for UK Subscribers Vodafone will be ranked against UK Telecom stocks).