Sector classification

We use the Refinitiv Business Classifications (TRBC), an industry classification system that is owned and operated by Refinitiv. This is a market-based classification system whereby companies are assigned an industry on the basis of the market they serve rather than the products or services they offer.

This market-based classification emphasises the usage of a product rather than the materials used for the manufacturing process. This is done because the performance of companies is tied to the market that they serve and market based systems allow investors to group companies that share similar market characteristics. For example catering services to airlines are considered airport services rather than restaurants because their financial performance is dependent on the market for airline services.

Many investors are used to either the GICS or ICB industry classification schema, or local market schemas such as those offered by FTSE in the UK Market. For an excellent analysis of why the TRBC classification is more effective than these for investors please review this independent white paper. “TRBC uses the most objective, robust process to determine a company’s sector classification.”

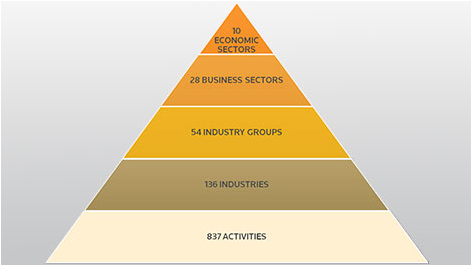

Classification Structure

TRBC consists of five levels of hierarchical structure, which are economic sector, business sector, industry group and industry, from top to bottom. We use the 2012 schema which consists of 10 economic sectors, 28 business sectors, 54 industry groups, 136 industries and 837 activities.

- 10 Economic sectors

- 28 Business sectors

- 45 Industry groups

- 136 Industries

- 837 Activities

At Stockopedia we currently publish the Economic Sector and Industry Group levels of the hierarchy (Levels 1 and 3).

How it works

TRBC is used to classify companies as a whole. Where organisations have multiple business segments a representative business is selected according the largest revenue contribution. The assignment process, detailed below, also considers factors such as profitability, asset utilisation and market perception when appropriate. Companies are assigned to an Industry, the lowest level. The Industry Group, Business Sector and Economic Sector assignments are derived from the classification hierarchy. Each company is represented by one primary TRBC Industry and companies cannot have multiple primary assignments.

Classification rules

- a) Dominant Segment

- b) Two Business Segments - A 60% of total revenue threshold is used to assign an industry to companies with two business segments. If neither segment meets the 60% revenue threshold, the criteria is applied first to assets then operating profit.

- c) Three or more Business Segments - A 51% of total revenue threshold is used to assign an industry to companies with three or more segments. If none of segments meets the 51% Revenue threshold, the criteria is applied to Assets then Operating Profits.

- d) 10% Significance- Business Segments must have 10% of Revenues or higher to be considered significant in the calculation process.

- e) Revenue, Assets and Profitability - Revenue is the preferred metric and is used in the majority of assignments. However there are types of company and situations where assets and profitability are taken into consideration when making assignments. Start-up and development phase companies may have little revenue, e.g. early stage biotechnology firms; therefore assets can be a used to determine the dominant sector. Profitability fluctuates from period to period, hence is not used as a primary method to classify companies as it would result in a high degree of volatility in assignment. However, long-term trends in profitability are a useful indicator of the importance of a sector in an entity. For example an industrial manufacturer may have large revenues in a low profitability OEM business and low revenue, highly profitable services business. Close analysis of business strategy together with profitability provides a classification that better reflects the company's sensitivity to its primary market.

- f) Market Perception - This is based on i) the business strategy of the company. A company may provide additional detail on the revenue drivers behind each business segment, have plans to divest or treat as non-strategic a particular business unit or simply group itself with peers, and ii) Local market perception.

- g) Growth Perspective - When a business segment is newly invested and its growth prospect indicates possible dominance within the next few years, (i.e. three) the new segment may be selected as the primary business. In this case, a company's growth prospect may be determined by a segment's revenue growth over the last 5 years.

Frequent review

Every company in the TRBC universe is reviewed at least annually to determine if the assignment remains valid or whether the company has changed business model and/or business segments have changed in importance either organically or through acquisition/divestment. Over 50,000 companies are therefore reviewed every year by Refinitiv's dedicated content operations. Their analysts review the detailed financials of each business segment, update company descriptions and review any corporate activity that may have impacted company operations.