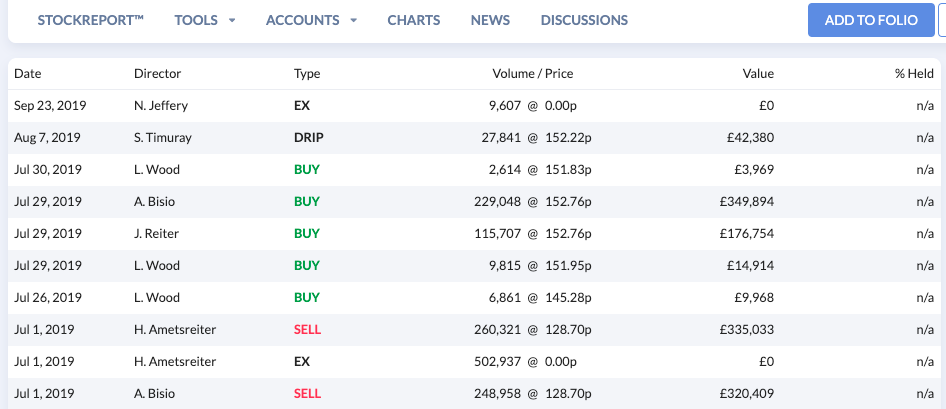

Director dealings data

We provide data on equity transactions by company directors and insiders. This data is available for all regions within our coverage universe (except Japan and Taiwan, where regulations do not require directors to disclose trades).

We display all trades that meet the following criteria:

- Trade is above £1000 in value;

- The trade was by a company insider or director. We do not display trades by a major shareholder who is not an insider (although this is available for US and Canadian stocks);

- The trade represents a change to the director's overall holding position - i.e. the director is not simply transferring their existing holding from one brokerage account to another.

Keeping on top of these dealings is an important due diligence step for many investors. It can be reassuring to know that management has 'skin in the game'. Large buys or sells from directors can send a powerful signal to the stock market, but the news can take a while to filter out.

You can read more on the value of Director's Dealings as a signal in our Smart Money Playbook.

How can I find the directors dealings data

You can access a company's directors deals page from its StockReport. We include this information on a sub-tab under the Accounts dropdown menu.

Types of trades

For any trade, you can see the date of transaction, the name of the insider in question, the type of transaction, the volume, price and value of the trade, and the percentage ownership of the insider. NB: We display n/a where the value of %Held is unavailable and/or below four decimal places.

You'll find a variety of different deal types on this page. Here's a quick overview of what they mean:

- BUY - Market purchase of shares

- CVRT - Conversion of loan, preferred, bonus issue stock etc.

- DRIP - Dividend Re-investment (SCRIP)

- DVRC - Divorce settlement

- EX - Exercise of shares options or warrants

- FEES - Director fees paid in shares

- GIFT - A gift of shares

- IHRT - Inheritance tax of shares

- ISA - Shares transacted within an ISA wrapper

- LOAN - Shares offset against a loan

- LTIP - Shares issued under a Long term incentive plan

- SELL - Shares sale

- SIPP - Shares bought or sold within a SIPP

- TAKE - Take-up of rights shares

- TRAN - Transfer of shares to a related entity

How we Process Director Dealings Data

It can be difficult to track trading activity when the same director places a large number of small trades within a very narrow timeframe. To reduce noise and increase signal, we display consolidated transactions - i.e. a single table row when trades happen within a 4-week window, in the same security, with the same transaction type. When we consolidate trades, we use a weighted average price alongside the latest trade date in the series of transactions. The %Held column will also reflect the holding on the date of the last transaction.