Explore the recent buy and sell sentiment in a security

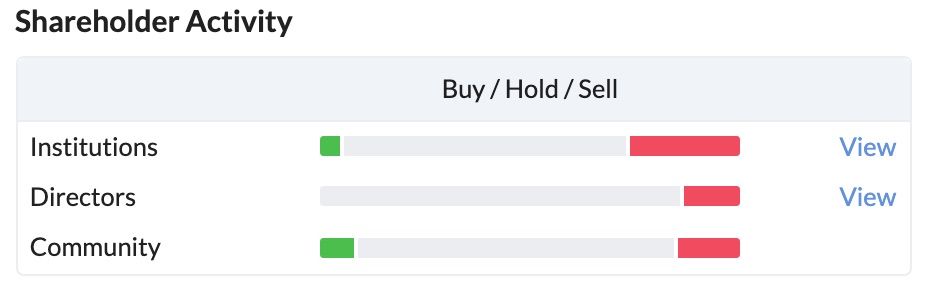

The Shareholder activity widget provides a snapshot of trading activity across institutions, directors and our very own community over the last 3 months.

The bar is split into buy, hold and sell percentages with ‘buys’ marked as green, ‘holds’ as grey and ‘sells’ as red.

A bar that is majority green indicates a large percentage of buys within that subset, whereas a bar that is majority red indicates a large percentage of sells. A largely grey bar implies that the subset are mostly holding and not adding or reducing from their position.

All trading activity is based on the last quarter.

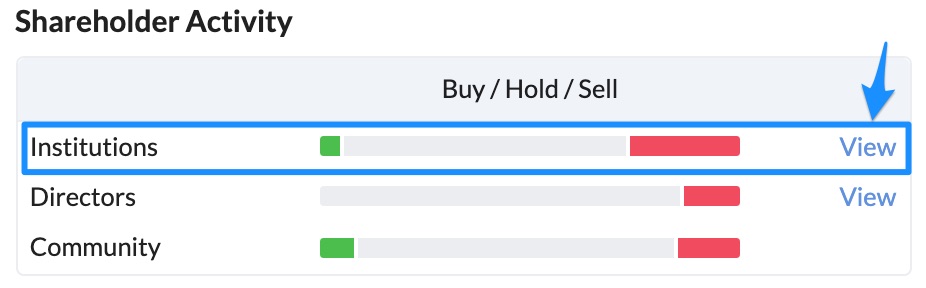

Institutional Activity

This bar shows the percentages of buys, holds and sells based on the number of institutional shares traded and held. As the volume of shares bought by institutions increases, we would expect the buy percentage to increase. This is sourced from our ownership data.

You can link to see Major Shareholders by clicking on ‘view’.

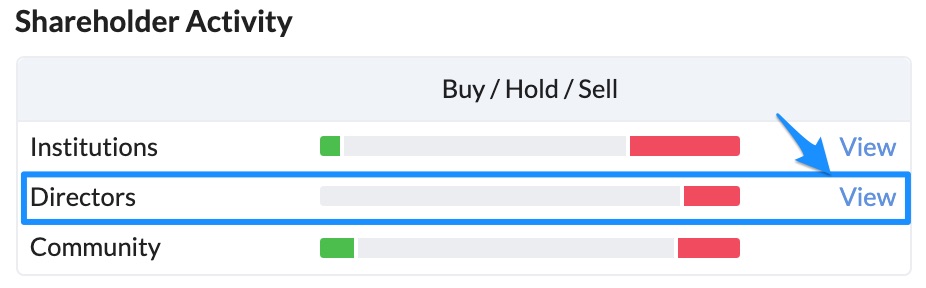

Insider Activity

This bar shows the percentages of buys, holds and sells based on the changes in percentage holdings reported by Directors over the time period. A director that is buying a large number of shares in comparison to total director holdings will cause an increase in the buy percentage, whereas a director that is selling a large number of shares in comparison to total director holding will cause an increase in the sell percentage.

The Shareholder Activity bar is based on holding changes, so a director exercising an option to create shares and then promptly selling them will not have an impact as their net holding will remain the same. Equally, if a director uses a holding company for any transaction of the shares then this may be excluded from the calculation.

Please note that there may also be cases where the Directors bar shows as green even though the recent director trades are sells (and vice versa). This can happen when a director sells at the same time as a company reduces its overall number of shares in issue (e.g. share buybacks). Conversely, the opposite may also take place.

Community Activity

This bar shows the percentage of our community that are buying, holding or selling the share. As more community members increase (/decrease) their shareholding, the buy (sell) percentage will increase. If the community is mostly passively holding , with no new transactions in the share then the bar will be mostly grey. Watchlists portfolios are not included in the calculation.

This data is completely anonymised. No data will be shown where we do not have a large enough sample such that an individual would have a significant impact on the percentages shown.