Identify major shareholders of any share

Major Shareholders

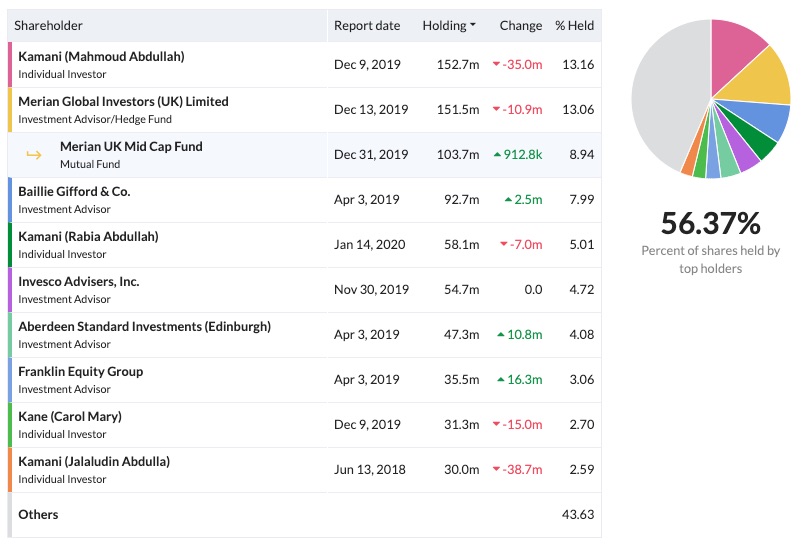

The major shareholders pages shows the holding of (up to) the top 10 holders of each security, plus the change in holding since the holder’s previous reporting date. The pie chart provides an insight into the concentration of the shareholder ownership.

How to access the major shareholder data

You can access a company's major shareholder’s page from its StockReport. This information can be found on a sub-tab under the ‘Accounts’ dropdown menu.

Asset Managers and their sub-funds

In order to provide as much detail in the major shareholder breakdown, we show both the individual funds that appear in the top holdings (such as Schroder UK Dynamic Fund) as well as the 'parent' Asset Manager that encompasses these funds (e.g. Schroder Investment Management). This is so you can see the actual fund manager that has conviction in the position rather than the aggregated high level parent group.

The relationship is shown in the table with sub-funds appearing indented below the parent, as shown below. Only sub-funds which appear in the top holders list are included:

To prevent duplicate values from distorting the value of percentage of shares held by top owners, only the holdings of the Asset Manager is included in the calculation where both an Asset Manager and their sub-funds are shown.

Please note that because the reporting frequency between sub-fund and the Asset Manager may be different, there may be occasions where the aggregate of the sub funds appear to hold more than the Asset Manager. This could occur if the sub fund reports more frequently and has bought more shares since the Asset Manager last reported its holdings.