Use a checklist to validate stock ideas

“No wise pilot, no matter how great his talent and experience, fails to use his checklist”

Charlie Munger

Checklists are a very powerful way of analysing stocks against strict sets of rules. They can help rapidly speed up stock analysis and ensure you add rigour to your investment process. By repeatedly applying a sound methodology to every purchase or sale you can also weed out the kind of emotional decision making that may damage returns.

We’ve created a simple to use checklist tool at Stockopedia that allows you to compare any stock against any set of fundamental or technical criteria.

Finding the Checklist tool

You can find the Checklist function by placing your cursor over the dropdown Tools tab (above the price chart of any StockReport) and selecting Run through a checklist.

Running a Checklist

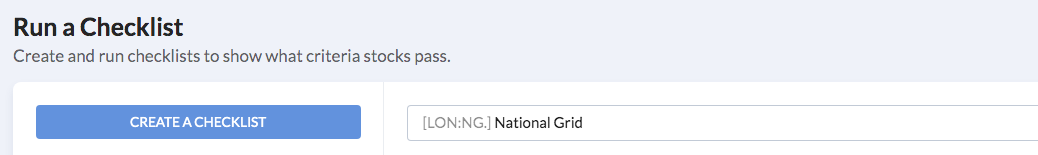

At the top of the Checklist page there is a text input box. You can load up any stock by typing its name or ticker and selecting it from the dropdown menu. Use the mouse or keypad to select the stock and press Enter.

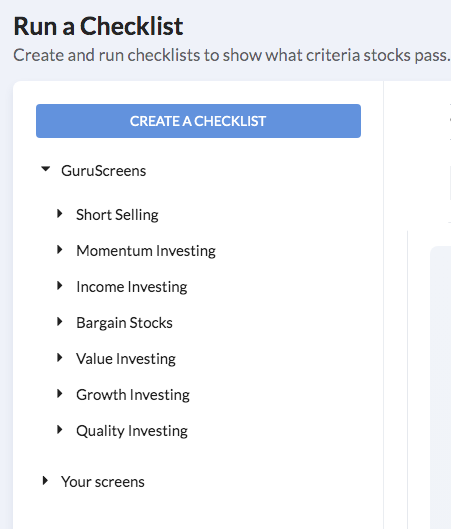

With a stock loaded into the Checklist tool you can check it against any of our 67 pre-loaded Guru Screen Checklists - or any of your own.

The strategies are listed down the left-hand side of the page and sub-divided into different categories depending on their investment style.

Checking the Rules

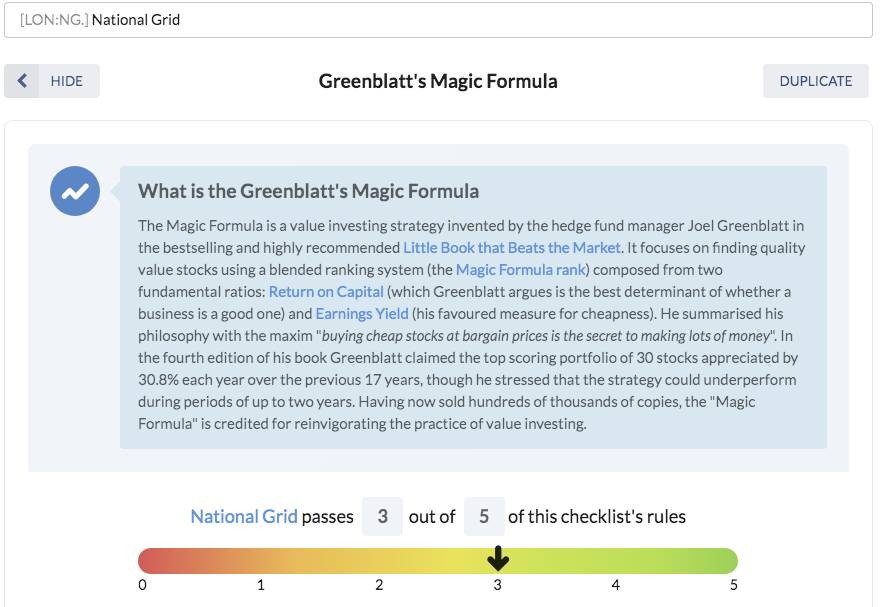

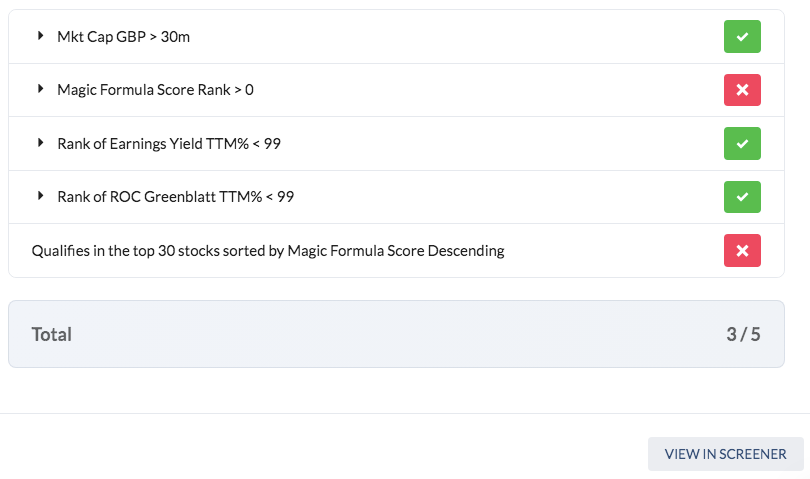

Once you have selected a strategy to test the stock against, you'll see brief description of the strategy itself and an instant assessment of how the stock scores against it.

Below this, you'll get a breakdown of which strategy rules the stock has passed, and which one that it hasn't passed.

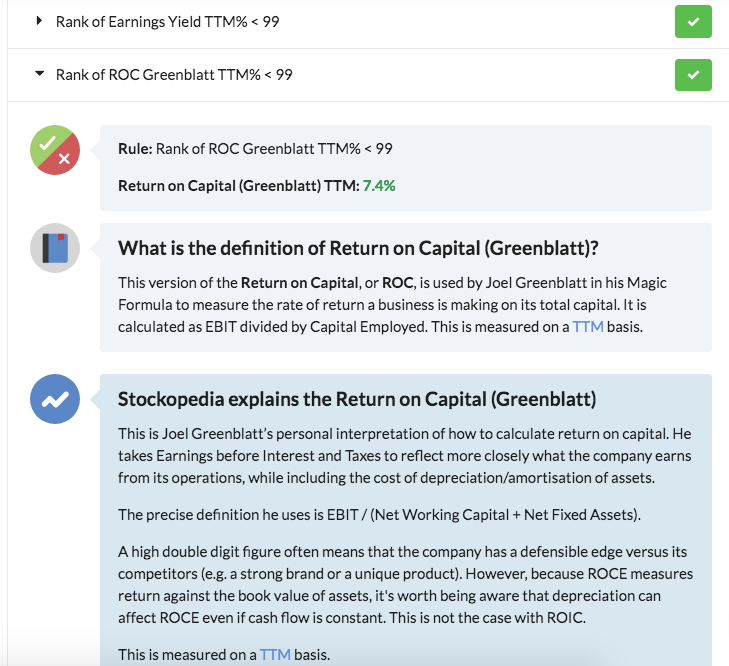

If you want to know why the stock has passed or failed a rule you can click on the "arrow" next to the rule. The list item will expand and reveal the exact fundamental or technical metric for the stock as well as a more detailed description of the data point.

These Pass/Fail items allow you to quickly isolate the strengths and weaknesses of the stock and follow it up with further research.

Creating your own Checklist

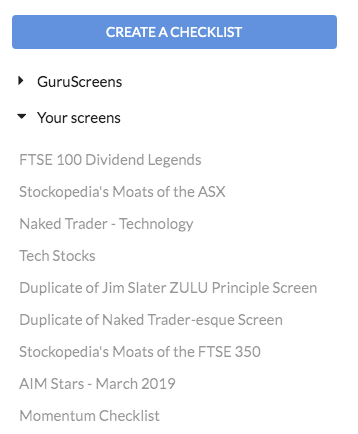

In addition to comparing companies against the rules of our pre-loaded strategies, you can also create your own. Checklists are essentially stock screens applied as a set of pass/fail rules to a single stock, so we make all your own custom stock screens available as checklists.

On the Checklist page, click the Create a checklist button at the top-left hand side of the page. This will take you to Stockopedia’s Screener, which allows you to choose from more than 350 ratios and measures to custom build a “custom screen”.

Once completed, the screen will automatically be saved to Your Screens and also be available as a Checklist in the menu on the left-hand side of the Checklist tool page.

Applying a Checklist as a Screen

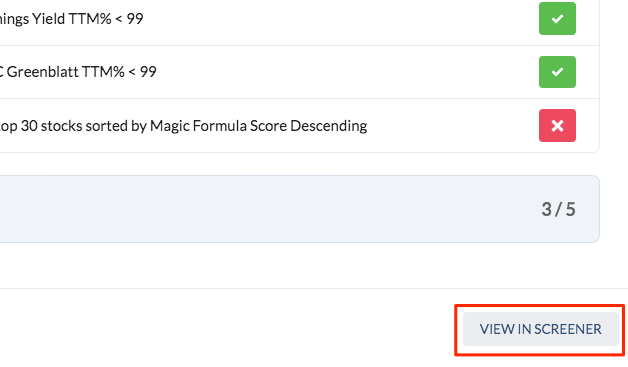

When using the Checklist tool, you can always go through and see how these rules of each strategy are applied to the market as a whole and find qualifying stocks. Do this by clicking the View in Screener button at the bottom of the page to instantly find stocks that qualify for that strategy.